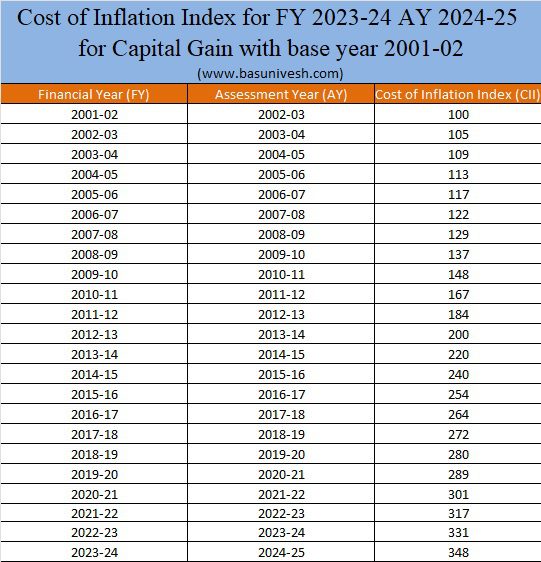

What’s the CII or price of inflation Index for FY 2023-24? CBDT notified the Value of Inflation Index for FY 2023-24 AY 2024-25 for Capital Acquire on tenth April 2023. You might remember that the bottom 12 months was modified from the sooner FY 1981-82 to FY 2001-02.

Change within the Base 12 months for Capital Acquire Indexation

In Finances 2017, the Authorities proposed to vary the bottom 12 months to calculate the indexation profit from 1981 to 2001. Do keep in mind that the change within the base 12 months is throughout all asset lessons however the affect would differ throughout belongings that take pleasure in indexation advantages on long-term capital features—actual property, unlisted shares, gold, and bond funds. As much as thirty first March 2017, the capital achieve was calculated with 1981 as the bottom 12 months. Because of this the acquisition worth of an asset purchased earlier than 1 April 1981 may very well be calculated on the idea of the honest market worth of 1981. Nevertheless, from 1st Apr 2017, the acquisition worth will probably be calculated primarily based on the honest market worth of 2001. Accordingly, capital features on belongings acquired earlier than 1 April 2001 will even be calculated utilizing honest market worth as of 2001.

What’s the Value of Inflation Index (CII)?

It is a measure of inflation that’s used for computing Lengthy Time period Capital Positive aspects (LTCG) on the sale of capital belongings as per IT Part.48.

It’s introduced for every Monetary 12 months however not primarily based on Evaluation 12 months. Therefore, the relevant fee of CII will probably be for that exact monetary 12 months.

To reach at a capital achieve, it is extremely a lot essential to calculate the LTCG. For this goal Value of Inflation Index is a should.

Take an instance of how the listed price of acquisition will probably be calculated utilizing Value of Inflation Index or CII.

The method is as under.

Listed Value of Acquisition=(Value of Acquisition/Value of Inflation Index (CII) for the 12 months through which the asset was first held by the assessee OR FY 2001-02, whichever is later)* Value of the Inflation Index (CII) for the 12 months through which the asset was offered or transferred.

Allow us to assume that you just bought the property in FY 2005-06 at Rs.50 lakh and offered the identical in FY 2017-18 at Rs.1.5 Cr. Now the listed price of acquisition will probably be as per the above method i.e.

Listed Value of Acquisition=(Rs.50 lakh/117)*272=Rs.1,16,23,931. So the Lengthy Time period Capital Acquire=Promoting Worth-Listed Value of shopping for property=Rs.33,76,069.

(Word-As per the under Value of Inflation Index (CII), the CII fee for FY 2017-18 is 272 and for FY 2005-06, it’s 117).

Nevertheless, if you don’t contemplate the listed price, then in plain the achieve could also be mentioned as Rs.1 Cr lakh (Rs.1.5 Cr-Rs.50 Lakh). However within the case of taxation, the LTCG on capital belongings will probably be after adjusting the price of shopping for to inflation or the Value of Inflation Index (CII).

Value of Inflation Index for FY 2023-24

Allow us to now look into the price of inflation index for FY 2023-24 and likewise what was the historic price of inflation index from FY 2001-02.

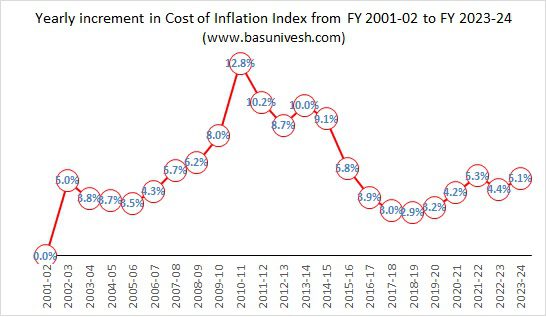

Now allow us to see how this price of inflation index is growing 12 months on 12 months from the bottom 12 months to the newest FY 2023-24.

You observed that from final 12 months to this 12 months, the increment is round 5.1%.

Hope this info will assist you to in arriving at your capital achieve tax.

Check with our newest posts –