by Vicky Monroe

Lately I’ve seen plenty of movies on my social media feed in regards to the psychological load that ladies usually carry. Many ladies grow to be the family supervisor nearly by default, whether or not they wish to be or not.

Fortunately I take pleasure in housekeeping, as a result of my associate is fairly dangerous at cleansing! Again after I labored full-time, the home fell into chaos as a result of I couldn’t sustain with all of the chores whereas working my enterprise. As my associate’s profession has grown, I’ve been capable of work fewer hours and commit extra time to sustaining and working our dwelling, which I really feel is a good association.

I don’t thoughts chores and discover them fairly stress-free and meditative. However one thing I do want I had extra assist with is monetary planning. I haven’t seen many individuals discuss in regards to the psychological burden of being answerable for family cash administration. As a result of I’m a private finance author, the monetary planning primarily falls to me. Though I run the whole lot by my associate, I’m positively the first resolution maker, which could be a bit demanding at occasions.

If I make a giant monetary mistake, it might have an effect on our high quality of life or skill to retire. That’s why I discover being answerable for our cash extra demanding than managing our dwelling. Fundamental chores are fairly laborious to mess up, and there aren’t actually any penalties after I do. If I burn dinner, we are able to simply warmth up a frozen meal or go get a pizza. Dangerous monetary selections are a lot tougher to rectify.

Too Many Choices

Since I write about private finance for a dwelling, you’d assume it could be simple for me to handle our cash. Data is energy, proper? I really discover monetary planning troublesome generally as a result of I’m aware of too many various cash administration methods.

I nearly really feel like I’ve info overload in relation to funds. I second guess myself and marvel if I’m making the fitting cash strikes, or if totally different methods could be higher. Homemaking is less complicated for me as a result of I by no means must marvel if I’m loading the dishwasher proper or mopping accurately. And nothing catastrophic will occur if I do it flawed.

As a result of I’ve to be a cash professional at work and at dwelling, it’s laborious to modify off and cease serious about funds. I additionally dislike being the “dangerous cop” who has to inform my associate we are able to’t do or purchase one thing if we wish to meet our monetary targets.

Relieving the Psychological Load

I’m not sharing this to whine or complain. The psychological load of dealing with funds is one thing I believed is likely to be relatable. I see many insightful feedback from the women who learn this weblog, and I get the sensation at the least a few of you’re primarily answerable for your loved ones’s funds too. Discussions about psychological load normally deal with family chores, caretaking, and appointment setting, so I wished to shine a light-weight on this side of it.

Who’s primarily answerable for cash administration in your relationship? Does monetary planning stress you out or do you take pleasure in it? I’d love to listen to your ideas on this matter within the feedback.

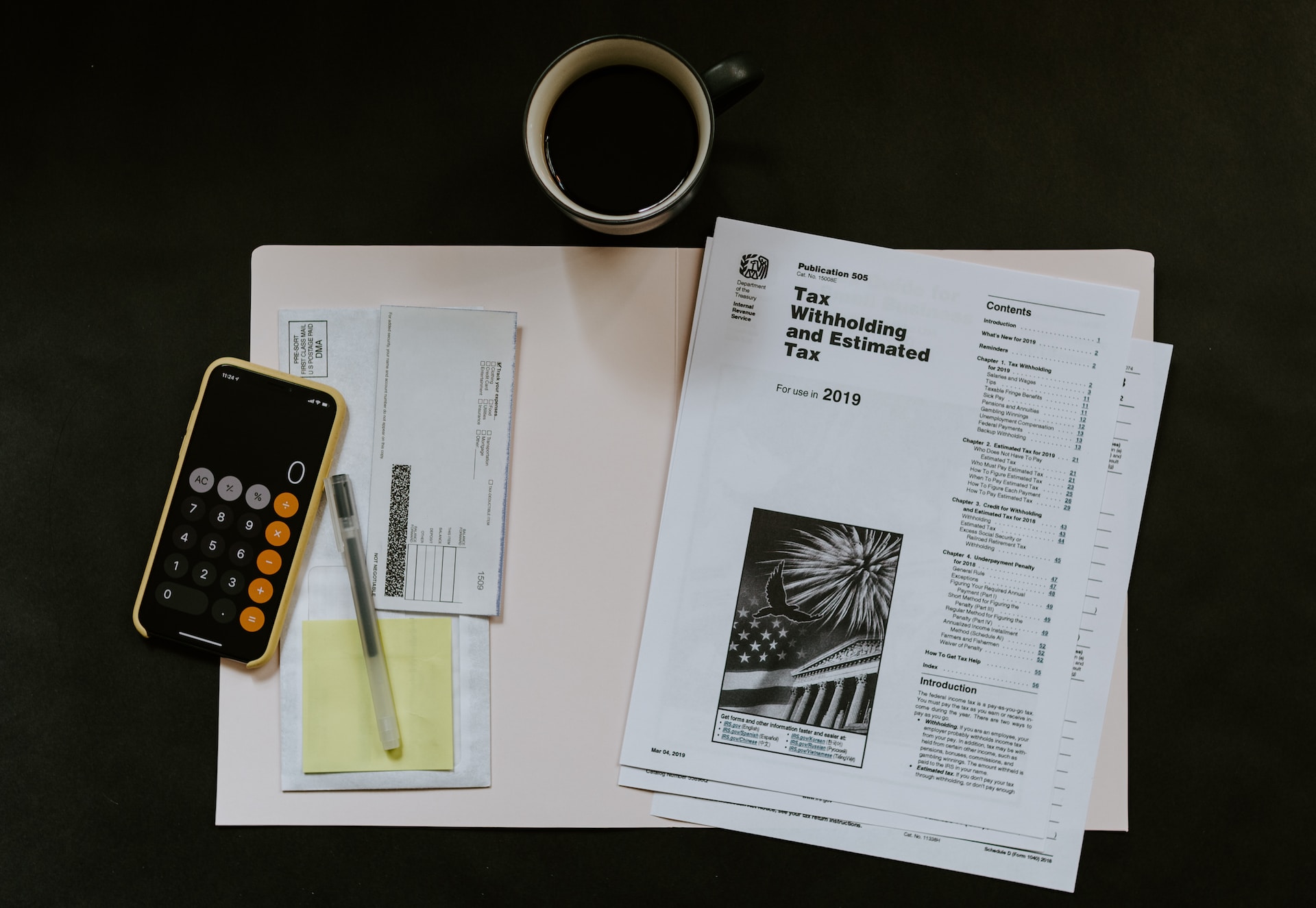

To alleviate among the psychological load, I’m attempting to redistribute sure monetary duties. For instance, I let my associate deal with our taxes this yr. Though it was nerve-wracking to surrender management of one thing so necessary, it turned out okay and we bought a $600 return.

We would’ve missed out on some deductions as a result of I didn’t double examine something. However I’m studying that generally achieved is healthier than excellent, even in relation to funds.

Learn Extra

Creating A Private Finance Calendar

Our 4th Marriage ceremony Anniversary Reflections

Vicky Monroe is a contract private finance and way of life author. When she’s not busy writing about her favourite cash saving hacks or tinkering together with her finances spreadsheets, she likes to journey, backyard, and prepare dinner wholesome vegetarian meals.