And on we go after a brief break with one other contemporary 15 Norwegian shares, chosen by the Google Sheets random generator. This time, I’ve recognized six firms that go onto the preliminary watch listing. Let’s go:

106. Instabank

Instabank is a 50 mn EUR market cap “absolutely digital financial institution that provides mortgage merchandise, financial savings and insurance coverage to shoppers in Norway, Sweden and Finland.” The corporate was IPOed in 2022 and surprisingly trades barely above its IPO worth, a transparent exception for the 2020/2021 IPO classic.

Equally stunning is the truth that a comparatively younger “digital financial institution” makes a revenue. They appear to lend to extra “excessive yielding” prospects however general, they present respectable development and the inventory appears to be like low-cost at 8x trailing earnings and ~6,5x 2023 earnings.

Though I’m not a giant fan of Nordic banks, I believe this one is value to doubtlessly “watch”.

107. GNP Power

GNP Power is a 19 mn EUR market cap Power firm that has misplaced greater than 50% since its IPO in 2020. I additionally discovered little or no tangible info on this one. “Go”.

108. Wilh. Wilhelmsen

Wilh. Wilhelmsen is a 1 bn EUR market cap “world maritime industrial group providing ocean transportation and built-in logistics companies for automobile and ro-ro cargo. It additionally occupies a number one place within the world maritime service trade, delivering companies to some 200 shipyards and 20 000 vessels yearly.”.

the long run chart, it appears that there’s important cyclicality in Wilhelmsen’s enterprise:

The shares at present commerce at a historic excessive and on avery low P/E a number of. The P&L will not be simple to learn as the vast majority of internet earnings comes from non-consolidated JVs. My intestine feeling tells me that getting into on the prime of the cycle may not be a wise concept, nevertheless they appear to be very energetic in supporting the offshore wind trade. Due to this fact I’ll put them on “watch”.

109. Austevoll Seafood

Austevoll is a 1,6 bn EUR fish farmer, which in comparison with the opposite fish gamers to this point, is a really established participant. the long run chart we see a comparatively good worth creation, however fairly some volatility:

The inventory appears to be like fairly low-cost at 8x 2023 earnings, however they make use of fairly some leverage. I believe they had been additionally hit by the suprse Norwegian Particular tax for Salmon fsih farmers. Total, this could possibly be one of many fish farms the place one may study one thing, subsequently they go on the preliminary “watch” listing.

110. Tysnes Sparebank

Tysnes is a 20 mn EUR native financial savings financial institution, which, not surprisingly is positioned in Tysnes close to Bergen. The inventory appears to be like low-cost, however regional financial savings banks should not my specialty, subsequently I’ll “go”.

111. Salmar

Salmar, with 5,5 bn EUR market cap appears to be one of many “bigger fish” among the many Norwegian fish farms. The long run share chart appears to be like spectacular, regardless of the plain hit from the particular tax:

Nonetheless, the valuation at 17,5x 2023 earnings appears to mirror this already to a sure extent. Curiously, Salmar holds a 71% curiosity in one other listed Norwegian firm referred to as Froy which appears to be a specialist in servicing fish farms. In response to the This fall report, they appear to ponder promoting Froy

Total, Salmar can be an organization which could possibly be attention-grabbing to “watch” as their monitor file appears to be actually god.

112. Froy

As a one time excepion, I comply with up with Froy, a 475 mn market cap inventory through which Salmar holds a 72% stake. Froy was IPOed in 2021 and its share worth went on a fairly wild journey:

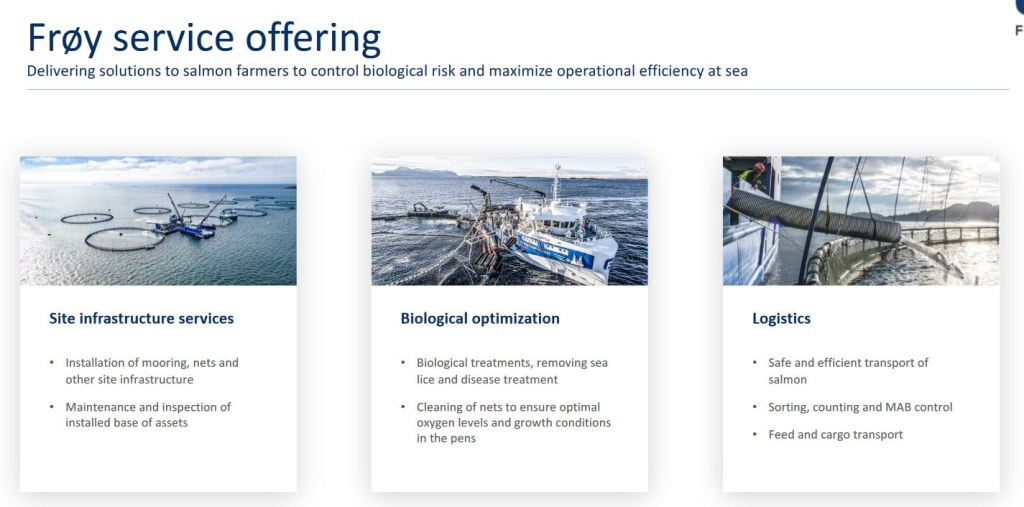

In response to their preliminary investor presentation, Froy appears to be an important service supplier to the fish farming trade, offering all sort of important companies with a deal with Norway:

I assume that their deal with Norway led to the numerous loss within the share worth follwoing the surpise tax on Norwegian Slamon farming final years.

As talked about within the Salmar write-up, Salmar appears to be contemplating “strategic choices” for Froy no matter which means. In any case, I discover Froy attention-grabbing, even though it isn’t low-cost at 18,5x 2022 earnings. “Watch”.

113. Okea

Okea is a 250 mn EUR market cap firm that owns minority curiosity in a number of Norwegian off shore oil fields.

They appear to specialize on mature oil fields and attempt to prolong the life of those fields.

The corporate was IPOed in 2020 and the share worth has been fluctuation widly between 10 andf 70 NOKs:

As many oil shares, the inventory appears to be like ridicuolosly low-cost at round 2,4x trailing P/E and a giant juicy dividend. Nonetheless there appears to be clearly a powerful leverage to grease costs which are actually declining for some months. Someway I nonetheless discover them attention-grabbing bexause of their foucs on Norway, subsequently they go on “watch”.

114. Techstep

Techstep is a 37 mn EUR market cap firm that appears to hav had its finest time within the early 2000s, though the present enterprise mannequin appears to have impmented solely in 2016. The corporate appears to supply some cellular companies, however solely achieved to have a optimistic working end in 2 out of the final 6 years. “Go”.

115. Sparebanken 1 Helgeland

It is a 324 mn EUR market cap regional financial savings financial institution that appears fairly profitable- The inventory has carried out fairly welll because the GFC and isn’t too costly (P/E ~10,5). Nonetheless. native banks are out of scope for me, “go”.

116. Agilyx

Agilyx is a 228 mn EUR market cap firm that’s energetic in chemical plastics recycling. As a 2020 IPO, the inventory trades across the IPO worth, which will be thought-about a succes for this classic.

As one can anticipate from a younger cleantech firm, they’re loss making, though they do have gross sales, at present a run charge of 15-20 mn EUR. Nonetheless gross margins are detrimental in the meanwhile and they’re burning money.

The principle shareholder is a fund referred to as “Saphron Hill Ventures” and as many such firms they’ve a powerful listing of strategic companions (Exxon and so on.). They appear to function a JV with Exxon within the US referred to as Cyclix, that recycles plasticand one other venture appears to be in building in Japan

Plastic recycling is an attention-grabbing matter, nevertheless a negativ gross margin actually turns me off, subsequently I’ll “go”.

117. Aurskog Sparebanken

Aurskog is a small, 89 mn EUR market cap native financial savings banklocated in Aurskog close to Oslo with no particular elements at a primary look. “Go”.

118. SATS

SATS is a 110 mn EUR market cap health chain that’s energetic throughout Scandinavia. The corporate IPOed in 2020 and misplaced round -75% since then, indicating that not all is nice.

The principle motive may be that since their IPO, they haven’t been capable of genrate a revenue. The corporate has important debt, though they managed to decrease the debt burden over the previous 3 years.

Due to mortgage covenants, the corporate will not be allowed to distribute dividends and This fall 2022 was not nice, almost certainly resulting from electricty and heating prices.

At an EV/EBITDA of ~5,5 this may be attention-grabbing for turnaround specialists, however for me the chance is way too excessive, therfore I’ll “go”.

119. Nykode Therapeutic

Nykode is 570 mn EUR market cap “clinical-stage biopharmaceutical firm, devoted to the invention and growth of vaccines and novel immunotherapies for the remedy most cancers and infectious illnesses. Nykode’s modular platform know-how particularly targets antigens to Antigen Presenting Cells.” Nykode was solely worthwhile in its IPO 12 months 2020 and has been making losses in 2021 and 2022.

So far as I perceive, they’re utilizing a special know-how to MRNA, however they’ve some attention-grabbing cooperations and Money ought to final for a few years. Nonetheless, Biotech is way out of my circle of competence, subsequently I’ll “go”.

120. Wallenius Wilhelmson

By coincidence, this 3 bn EUR market cap firm has been chosen in the identical a part of the sequence as Wilhelm Wilhemsen. And certainly, the businesses are associated as Wallenius Wilhelmsen appears to be a JV between Wallenius and Wilhelmsen, specialising in proudly owning and working ships that transport automobiles.

As different delivery firms, the inventory did fairly nicely, doing ~11x because the backside in MArch/April 2020. The inventory appears to be like actually low-cost at a P/E < 5, however shopping for cyclical shares on the margin peak is never a great entry level. As I’ve Wilhelm Wilhelmson already on watch, I’ll “go” right here.