Why PPF rate of interest not elevated from 1st April 2020 onwards? Regardless that from 1st April 2023, all of the small financial savings schemes’ rates of interest have been elevated, why did PPF curiosity stay unchanged?

The PPF charge is similar at 7.1% from 1st April 2020 to 1st April 2023. It’s nearly 3 years!! What will be the causes?

When yesterday authorities introduced the rates of interest for all small financial savings rates of interest relevant from 1st April 2023 to thirtieth June 2023, the vast majority of PPF buyers are offended. As a result of the PPF rate of interest was not modified for nearly 3 years.

Why it’s so? Why authorities not performing to vary the PPF rate of interest?

Why PPF rate of interest not elevated?

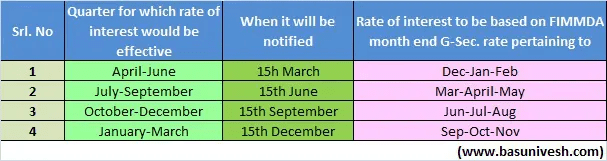

You could remember that earlier than 2016, the PPF charge was modified quarterly. Nonetheless, efficient from 1st April 2016, the change in rate of interest will likely be as soon as 1 / 4. I’ve written an in depth submit on this “Put up Workplace Financial savings Schemes -Modifications efficient from 1st, April 2016“. In line with this, the timetable as beneath was set to announce the rates of interest.

You seen that it was talked about within the notification that the Govt agreed and determined to recalibrate the rates of interest of all small financial savings schemes “each quarter to align the small saving rates of interest with the market charges of the related Authorities securities.”

However what is that this FIMMDA month-end G-Sec charge?

FIMMDA (Fastened Earnings Cash Market and Derivatives Affiliation of India) is a voluntary market physique for the bond, cash, and derivatives markets. They publish the Authorities Safety charge. Primarily based on these charges, the following quarter’s rate of interest on numerous Put up Workplace Financial savings Schemes is taken into account.

The ten-year G-Sec bond is taken into account the benchmark for PPF and the Sukanya Samriddhi Yojana (SSY). Sukanya Samriddhi Yojana (SSY) is to have a charge of 0.75% greater than over “prevailing 10Y bond market charges” and PPF a 0.25% greater return.

These are the principles set in 2016. Nonetheless, with regards to authorities schemes like PPF, SSY, SCSS, or EPF, there may be a number of strain from the general public to have the next charge at all times. We as buyers really feel a breach of belief if the rate of interest begins to fall. Nonetheless, if any authorities begins to extend it (though due to inflation and the falling bond market), we really feel it’s the BEST technique.

All these socially associated schemes’ rates of interest are generally retained as typical or elevated contemplating the general public anger, political advantages, or another conditions that are past financial implications.

That is what occurred with PPF additionally. When the brand new course of was launched on 1st April 2016, the common yield of 10 Years G-Sec was 7.7%. As per the above rule, it ought to be 7.95%. Nonetheless, the speed was set at 8.1%. Primarily as a result of the earlier PPF charge for FY2015-16 was 8.7%. If somebody lowered it to 7.95%, then the federal government has to face the anger as it’s nearly round 0.75% charge drop!!

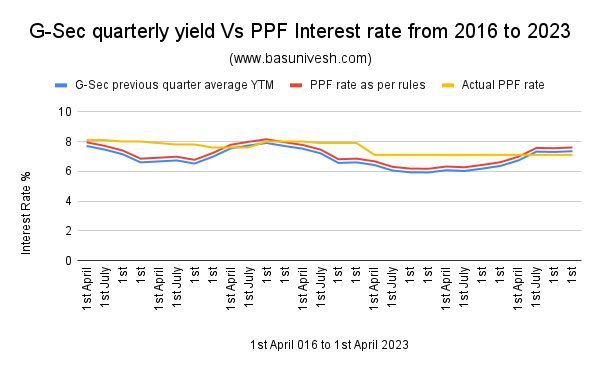

The pattern of getting the next charge than the precise earlier quarter’s G-Sec common YTM continued from that interval onwards. You may seek advice from the beneath chart for that objective.

Within the above chart, I’ve taken the earlier quarter’s common G-Sec yield and what ought to be the PPF charge Vs the precise charge.

You seen that from 1st April 2016 itself, the precise PPF charge was greater than the common G-Sec yield, and likewise the PPF charge ought to be as per the principles the federal government set.

We loved the upper PPF charge through the decrease rate of interest regime. Now you seen {that a} yr attributable to a rise in inflation and rate of interest, the bond markets have fallen drastically. Due to this, the yield of the bonds additionally elevated.

The yield on bonds is inversely proportional to their value. Elevate in rates of interest will lead to a fall in bond costs. This may elevate the yield. The reverse will occur when the rate of interest begins to fall.

Allow us to say you’ve a bond with a face worth of Rs.1, 000 and the curiosity (coupon) on this bond will likely be 10%. Subsequently, for those who purchased it at face worth and the return from this bond is 10%, then the yield on the such bond will likely be 10% (100/1000).

Now allow us to say RBI elevated the speed of curiosity to 11%, then whether or not anybody tries to purchase such bonds, which supply lower than the present market rate of interest? Clearly, no, in that case, the worth of such a bond, which bears a face worth of Rs.1,000, and coupon or yearly curiosity of 10% must fall. Allow us to say it fell to Rs.900. Then the yield will likely be 11.1% (100/900).

Why yield raised? As a result of the one that buys the bond which bears the face worth of Rs.1,000, however is at the moment priced at Rs.900, and the rate of interest (coupon) on such bond is mounted i.e. 10%. Subsequently, by investing Rs.900 one can get a ten% return. Earlier it’s a must to purchase this bond at Rs.1,000 (face worth) and the return is 10%. Now, attributable to a rise within the rate of interest and a fall in bond value, the yield on such funding will improve. Therefore, the autumn in value resulted in the next yield.

We’re at the moment dealing with the above scenario for round a yr. We as buyers assume that as financial institution FD charges and different debt devices are providing the upper charge then why is PPF curiosity not elevated?

In my opinion, the reason being that as PPF has an enormous AUM, I feel the federal government is compensating for what loss they made earlier attributable to providing greater charges through the decrease rate of interest regime. How lengthy they’ll proceed we don’t know.

At this time morning once I tweeted about the identical as beneath.

Somebody replied saying “No, the actual cause just isn’t compensating however the finance secretary says because the tax-free yield is greater (greater than 10% for the one falling within the highest tax bracket) due to this fact there isn’t a want of accelerating the speed”.

I cannot settle for this cause. If that’s the case, then the identical rule should additionally apply to SSY. Nonetheless, on this quarter (1st April 2023 onwards), they elevated the SSY charge however retained the PPF charge unchanged.

Contemplating all these eventualities, what I assume is that asking why the PPF rate of interest has not elevated just isn’t beneath our management. Regardless that Authorities and politicians with bureaucrats float the principles, they hardly adopted them. Primarily as a result of such schemes contain a number of political repercussions quite than financial ones.

Therefore, quite than discussing or displaying anger on why the federal government not altering the rate of interest of PPF, allow us to think about what we are able to management (i.e investing).

You could add yet another danger to your funding journey i.e POLITICAL POLICIES PARALYSIS RISK!!