I’ve been following certificates of deposit for some time now. Sure, I’m a weirdo.

Individuals love 12-month CDs and 60-month CDs (5 years) as a result of they’re simple to consider. We just like the 3-month, 6-month, and 9-month phrases as a result of they’re properly spaced out.

Typically individuals will contemplate a 24-month CD too.

However these days banks have been doing one thing completely different – they’re providing phrases which might be a month or two roughly than “typical.”

I’m speaking about these 11-month and 13-month CDs. Or the 15-month CD.

Why do banks supply this?

Desk of Contents

It’s Principally Advertising and marketing

There isn’t a giant distinction between a 12-month CD and a 13-month CD.

There could be a enterprise main someplace that may make the enterprise case for the financial institution’s traders however for the buyer, they’re the identical(ish).

On the degree of tens or tons of of tens of millions of {dollars} in deposits, which is what banks care about, there’s most likely some recreation you may play with rates of interest to get make traders completely satisfied. However for you, it doesn’t matter.

Many of the worth is in the way it simply seems bizarre.

We’re used to spherical numbers.

With CDs, it’s each three months (1 / 4 of the 12 months) whenever you’re shorter than a month. Then you could have the 12-month, 18-month, and 24-month CDs. Then it begins to go yearly.

Listed below are the excessive yield CD phrases from Ally Financial institution:

All typical phrases lengths. However then try their no-penalty CD – it’s a 11-month time period.

They may do a 12-month time period on a no-penalty CD however by making it 11-months, it seems just a little extra completely different than their normal choices.

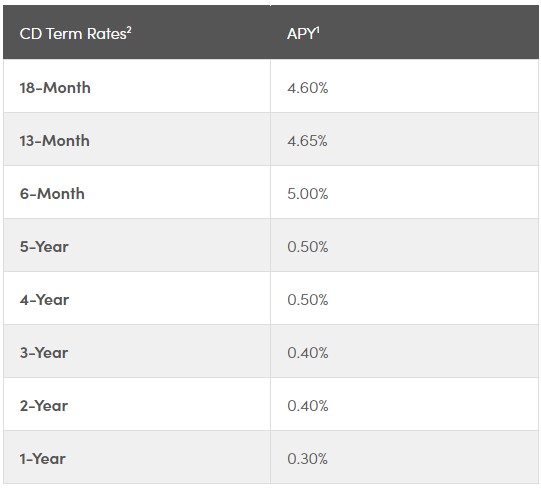

Then you could have a fee desk like what we see at CIT Financial institution:

The charges on the desk aren’t as necessary because the development – you could have tremendous low charges for all of the “normal” phrases. However for 6-month, 13-month, and 18-month, you see aggressive charges.

6- and 18-month phrases aren’t bizarre however their 13-month is certainly off “schedule.” Additionally they have an 11-Month no penalty CD that yields 4.80% APY.

It’s simply to catch your eye after they put it on the market.

1-Month CDs!?

Yep.

Then you could have conditions like Ponce Financial institution, by means of SaveBetter, with their 1-Month CD with a yield of 5.10% APY.

I suppose they get some certainty that they come up with the money for a month whereas paying the next rate of interest. Additionally they aren’t locked into that fee in case broader rates of interest drop whereas nonetheless with the ability to promote towards different certificates of deposit.

Nevertheless it’s largely simply eye-catching – when’s the final time you noticed a 1-Month CD? I can’t even consider one.

🤔 In case you aren’t conversant in SaveBetter, they’re a fintech firm that works with banks to assist them get deposits. Your account is managed by means of SaveBetter and so they have partnerships with a variety of small regional banks that wish to get deposits however don’t have the nationwide attain (or finances). You’ll be able to be taught extra about SaveBetter right here.

Keep in mind When It Matures

For these oddball CD phrases, the one “gotcha” is to recollect when the CD matures. Many banks will default to rolling over the CD into a brand new CD of the identical time period (or no matter is closest on the time it matures).

It’s not intentional, it’s simply how CDs work.

In case you’re used to your CDs maturing each 12 months and also you selected an 11 month CD, you may neglect and have it locked into one other 11 month time period. The financial institution will e mail you however you may miss it.

Most banks will allow you to decide what you need them to do with the CD when it matures. Try this at arrange, or someday shortly thereafter, and also you gained’t be shocked.

It’s a minor factor however nonetheless one thing to pay attention to.

Ought to You Get These Odd Time period CDs?

Positive – why not? There’s nothing inherently good or unhealthy in regards to the extra generally see phrases.

With CDs, you’re placing in cash you want within the close to time period. And also you need that money to be 100% secure.

The distinction between a 11-month CD and a 13-month CD is miniscule. Decide the very best fee for no matter you suppose might be a cushty time interval and don’t spend an excessive amount of time on it.

Or get a no-penalty CD for so long as you may and it’s basically a financial savings account with a brilliant excessive fee. You’ll have to press just a few buttons to entry the funds however you get the next fee.

For instance, Ally Financial institution is my major financial institution and the web financial savings account at present provides 3.75% APY whereas the 11-Month no-penalty CD is at 4.35% APY. I can open a no penalty CD in only a few button clicks and get a barely larger yield (my solely restriction is I can’t shut it inside 6 days).

That unfold isn’t value opening a brand new account, transferring funds by way of ACH (which takes 3-5 days), and the effort of a further tax kind. However for just a few button clicks? Completely value it.

The large takeaway is don’t suppose an excessive amount of about these – there are larger fish to fry. 😉