Late final 12 months, Zillow stated residence costs wanted to come down about 25% to develop into reasonably priced once more.

Round that very same time, mortgage charges hit their highest level in 20 years, with the 30-year mounted surging above 7%.

That led many to attract the conclusion that aid was in sight, a minimum of should you have been a potential residence purchaser.

And certainly, residence costs did fall shortly after, coming down 3.3% in March, per Redfin, the biggest year-over-year decline since 2012.

However that was then, and that is now. In Could, residence costs hit a brand new all-time report excessive. What on Earth is happening?

After a Transient Pause, Dwelling Costs Are Reaccelerating

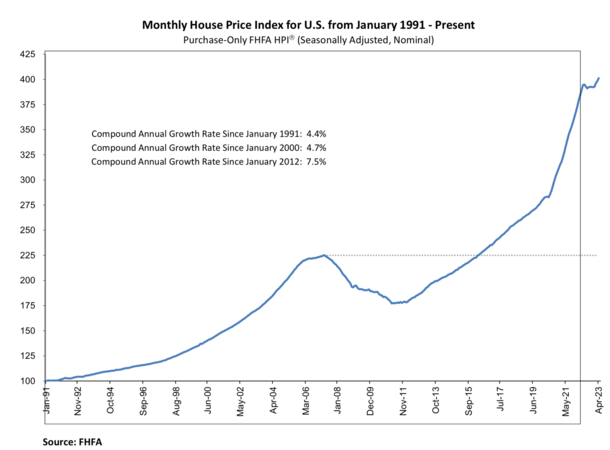

The pandemic-fueled housing market is the stuff of legends. Simply have a look at this chart from the FHFA, which oversees Fannie Mae and Freddie Mac.

Dwelling costs had already surpassed the prior housing bubble peak earlier than COVID-19 reared its ugly head.

However simply look how a lot larger they climbed from 2020 onward. This explosive progress nervous the Fed, which was additionally coping with out-of-control inflation.

And led to Federal Reserve Chairman Jerome Powell calling for a housing market “reset,” which he believed may very well be achieved through numerous rate of interest will increase.

As famous, it did certainly lead to an enormous spike in mortgage charges, with the 30-year mounted greater than doubling from the low-3% vary to over 7% by late 2022.

Ultimately, that did dampen residence costs, with some reporting it as the second largest residence value correction of the post-WWII period.

Downside is, it was short-lived, and should you take into account how a lot residence costs went up previous to the correction, it was a drop within the bucket.

Sure, some areas of the nation have fared worse than others, however most markets nationwide have confirmed to be fairly resilient.

This has lots of housing bears, renters, potential consumers, and economists basically scratching their heads, questioning why residence costs aren’t dropping.

There’s Nonetheless No Housing Provide Out There

One of many main themes within the housing market since costs bottomed in 2012 has been an absence of provide.

And it actually hasn’t modified a lot since then. In reality, by some measures housing stock has worsened.

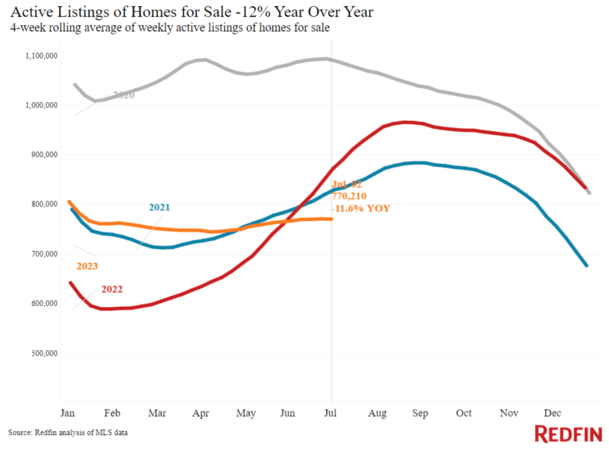

For instance, Redfin reported final week that months of provide was a mere 2.6 months, near its lowest stage in a 12 months.

Equally, Black Knight famous that for-sale stock has improved “modestly,” however stays 51% off pre-pandemic ranges.

Usually, 4 to 5 months is taken into account a balanced market, with much less provide tipped in favor of sellers versus consumers.

As to why, there’s been a scarcity of houses on the market for the reason that 2010s, typically attributable to underbuilding. Additional exacerbating that scarcity has been the so-called mortgage price lock-in impact.

Merely put, most owners have 30-year fixed-rate mortgages set at 2-3% (and even sub-2%), successfully locking them into their houses.

That is both as a result of they’ll’t go away (attributable to an absence of affordability) or as a result of they select to not (they don’t wish to purchase a substitute residence with a 7% mortgage).

Taken collectively, there are merely not sufficient houses in the marketplace, regardless of decreased demand from consumers.

Sure, demand can also be down, because the Fed anticipated it to be, attributable to a lot larger mortgage charges. And still-high residence costs.

However as a result of provide can also be so low, with lively listings down 12% year-over-year, low demand isn’t sufficient to push down residence costs.

That’s an vital factor to spotlight as a result of the housing market isn’t notably sizzling. It’s only a lack of provide that’s protecting issues collectively.

However Affordability Has By no means Been Worse!

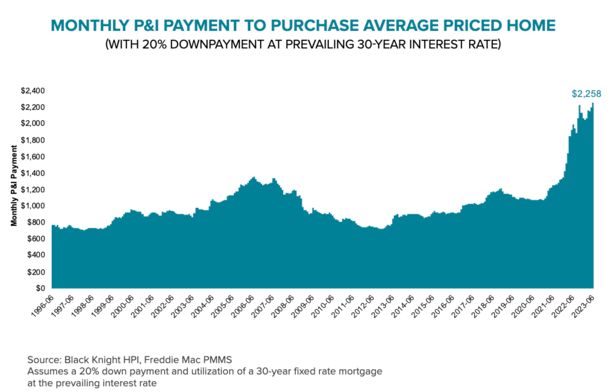

These rightfully vital of sky-high residence costs have pointed to traditionally dangerous affordability.

Lofty asking costs and far larger mortgage charges require a $2,258 month-to-month principal and curiosity cost on a median-priced residence with 20% down and a 30-year mortgage set at 6.67%.

That is the best cost on report, per Black Knight, and up markedly from ranges seen only a few years prior.

In Los Angeles, 68% of median revenue is required to purchase the common residence, which is clearly an excessive amount of.

Black Knight identified that we’d want a 30% drop in residence costs to get again to “regular affordability.”

The choice is nineteen% revenue progress if residence costs stay flat and mortgage charges fall to five%.

Within the meantime, residence costs are just too excessive from an affordability standpoint, which explains weak demand.

However as a result of provide stays constrained, residence costs defied expectations and chalked a powerful 0.7% month-over-month acquire in Could.

That might put annual appreciation near 9% once more, which might be seemingly ridiculous given the excessive mortgage charges at present on provide.

Nevertheless, we have to keep in mind that residence costs and mortgage charges aren’t negatively correlated. Each can rise or fall collectively.

For instance, the economic system may fall right into a recession, pushing mortgage charges down whereas additionally driving property values decrease.

Or the reverse may occur. A sturdy economic system, just like the one we’re in now, may push rates of interest up and residential costs together with it.

In different phrases, you want a catalyst to tank residence costs, similar to large unemployment, which has but to materialize.

Some Housing Markets Faring Worse Than Others

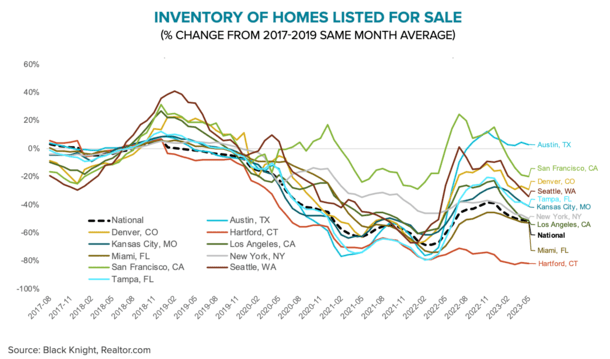

Whereas nationwide residence costs seem to have resumed their upward trajectory, after a really transient pause, not all housing markets are performing the identical.

The worst in the mean time is once-hot Austin, Texas, the place costs are off a large 13.8% from their peak.

Apparently, “stock there continues to run above pre-pandemic ranges,” which could sort of sum up the state of affairs nationally.

In locations the place stock hasn’t declined (or worse, risen), residence costs are below stress, which is logical given affordability points.

However per Black Knight, to this point this 12 months lively listings have fallen in 95% of main metros and stay 50% decrease than pre-pandemic ranges.

So different markets that have been struggling, similar to Seattle and San Francisco, have bounced again as their stock has swung from oversupply again to undersupply.

This would possibly clarify why residence costs aren’t dropping, even with 7% mortgage charges.

Keep watch over stock, and fewer on mortgage charges, to find out the place residence costs go subsequent.