As I wrote in No FDIC Insurance coverage – Why a Brokerage Account Is Protected, if you hold your money in a cash market fund at a dealer, the protection of your cash doesn’t rely upon the monetary well being of the dealer. The security comes straight from the protection of the holdings within the cash market fund. Your cash market fund is protected when the fund’s underlying holdings are protected.

Why Cash Market Fund

The explanation to maintain your money in a cash market fund, versus a excessive yield financial savings account, is that you just’re not relying on any financial institution to set their price competitively. You mechanically get the market yield minus the fund supervisor’s minimize, no extra, no much less, type of like if you spend money on an index fund. You’re not transferring to a different financial institution as a result of it’s providing a promotional price. You’re not transferring once more when that financial institution decides to lag behind. See my Information to Cash Market Funds & Excessive Yield Financial savings Accounts.

Why Vanguard

As a result of all cash market funds of the identical sort fish in the identical pond, how a lot the fund supervisor costs to run the fund (the “expense ratio”) straight impacts how a lot yield you’ll obtain. Among the many main brokers, Vanguard costs the bottom expense ratio on its cash market funds. Even when you do your investing elsewhere, you may nonetheless open a Vanguard account simply to make use of its cash market fund in the identical means you utilize a excessive yield financial savings account — switch cash into it when you’ve extra money and switch cash out if you want money.

When you favor to maintain your money and investments at Constancy or Charles Schwab, please learn Which Constancy Cash Market Fund Is the Finest at Your Tax Charges or Which Schwab Cash Market Fund Is the Finest at Your Tax Charges.

Vanguard gives six cash market funds of three differing types. They differ of their underlying holdings and tax remedy at each the federal and the state ranges. Which one shall be barely higher for you than one other depends upon your desire for comfort and your federal and state tax brackets.

Taxable Cash Market Funds

Three of the six Vanguard cash market funds are taxable cash market funds. You pay federal earnings tax on the earnings earned from these funds. A portion of the earnings earned is exempt from state earnings tax.

The yield from any of those three funds could be very shut to one another. The quoted yield on any cash market fund is all the time a internet yield after the expense ratio is already deducted. You don’t have to deduct it once more.

Vanguard Federal Cash Market Fund

Vanguard Federal Cash Market Fund (VMFXX) is the settlement fund in a Vanguard brokerage account. You don’t should do something further to purchase or promote this fund. It requires no minimal funding. Any money you switch into your Vanguard brokerage account will mechanically land on this fund. Any money you switch out of your Vanguard brokerage account will come out of this fund by default.

The earnings earned is totally taxable on the federal degree. A proportion of the earnings is exempt from state earnings tax. That proportion varies from 12 months to 12 months. It was 38% in 2022 (0% for CA, NY, and CT residents).

This fund invests in authorities securities and repurchase agreements which might be collateralized by authorities securities. Consider repurchase agreements (“repo”) as a cope with a pawn store. Entities give authorities securities to the cash market fund as collateral for short-term money. They’ll come again later to purchase again (“repurchase”) their authorities securities at the next value. In the event that they don’t fulfill the repurchase settlement, the cash market fund will promote these authorities securities. Repurchase agreements themselves aren’t assured by the federal government however their security comes from the protected collateral.

Vanguard Treasury Cash Market Fund

Vanguard Treasury Cash Market Fund (VUSXX) invests primarily in Treasuries. It’s the most secure cash market fund at Vanguard. It’s a must to enter a purchase or promote order to get cash into or out of this fund. It has a $3,000 minimal funding. The $3,000 minimal is barely required to get began. You possibly can switch out and in lower than $3,000 after you’ve the fund.

The earnings earned from the Treasury Cash Market Fund is totally taxable on the federal degree. A proportion of the earnings is exempt from state earnings tax. That proportion varies from 12 months to 12 months. It was 100% in 2022 however it’s going to possible be within the 70% vary in 2023 as a result of the fund began investing a large portion in repurchase agreements. Repurchase agreements pay greater than Treasuries (and are nonetheless protected) however they don’t have state tax exemption. If the fund will increase the share invested in repurchase agreements, the state tax exemption might go decrease than 70%.

Vanguard Money Reserves Federal Cash Market Fund

Vanguard Money Reserves Federal Cash Market Fund (VMRXX) is someplace in between the Federal Cash Market Fund and the Treasury Cash Market Fund. As within the Treasury Cash Market Fund, you must enter a purchase or promote order to get cash into or out of this fund. It additionally has a $3,000 minimal funding.

This fund invests extra in Treasuries than the Federal Cash Market Fund however lower than the Treasury Cash Market Fund. The earnings earned is totally taxable on the federal degree. A proportion of the earnings is exempt from state earnings tax. That proportion varies from 12 months to 12 months. It was 53% in 2022 (0% for CA, NY, and CT residents).

| Should Purchase/Promote | State Tax Exemption in 2022 | |

|---|---|---|

| Federal Cash Market (VMFXX) | no | 38% (0% in CA, NY, CT) |

| Treasury Cash Market (VUSXX) | sure | 100% (possible ~70% in 2023) |

| Money Reserves (VMRXX) | sure | 53% (0% in CA, NY, CT) |

Amongst these three taxable cash market funds, If I worth the comfort of no further step to purchase or promote or if I stay in a no-tax state, I might select the Federal Cash Market Fund (VMFXX). If I don’t thoughts the additional step to purchase or promote and I stay in a high-tax state, I might select the Treasury Cash Market Fund (VUSXX) for further security and the extra state earnings tax financial savings.

Keep in mind to say the state tax exemption if you do your taxes. See State Tax-Exempt Treasury Curiosity from Mutual Funds and ETFs.

Single State Tax-Exempt Cash Market Funds

Vanguard gives a tax-exempt cash market fund particularly for California and New York residents in greater tax brackets. These two funds make investments solely in high-quality, short-term municipal securities issued by entities throughout the state. Revenue from these funds is tax-exempt from each the federal earnings tax and the California and New York state earnings tax respectively. They’re typically known as “double tax-free” funds.

Each Vanguard California Municipal Cash Market Fund (VCTXX) and Vanguard New York Municipal Cash Market Fund (VYFXX) require a purchase or promote order to get cash into and out of the fund. Each require a $3,000 minimal funding.

The yield on these funds is decrease than the yield on the three taxable cash market funds however the federal and state tax exemption makes up for it if you’re in a excessive tax bracket.

Keep in mind to say the state tax exemption if you do your taxes. See State Tax-Exempt Muni Bond Curiosity from Mutual Funds and ETFs.

Nationwide Tax-Exempt Cash Market Fund

Vanguard Municipal Cash Market Fund (VMSXX) is for buyers in greater tax brackets exterior of California and New York. This fund is extra diversified than the California and New York funds as a result of it invests in short-term, high-quality municipal securities from many states. Revenue from this fund is tax-exempt from the federal earnings tax however solely a small proportion is exempt from state earnings tax.

It additionally requires a $3,000 minimal funding and a purchase or promote order to get cash into and out of the fund. The yield on this fund is decrease than the yield on the three taxable cash market funds however the federal earnings tax exemption makes up for it if you’re in a excessive tax bracket.

Keep in mind to say the small state tax exemption if you do your taxes. See State Tax-Exempt Muni Bond Curiosity from Mutual Funds and ETFs.

Taxable or Tax-Exempt?

A tax-exempt cash market fund gives tax financial savings however it pays much less. Select a tax-exempt fund when you’re in a excessive tax bracket. Select a taxable fund when you’re in a low tax bracket. When you’re unsure whether or not your federal and state tax brackets are thought of excessive or low, you should utilize a calculator to see which fund gives a greater yield after taxes.

I created such a calculator again in 2007. I used to be going to replace it however I got here throughout a way more elaborate one created by the person retiringwhen on the Bogleheads discussion board. It’s a Google Sheet known as MM Optimizer.

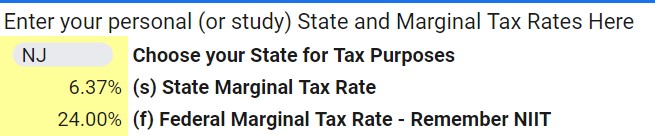

Your Tax Charges

MM Optimizer is shared as View Solely. After you make a replica of it to your Google account, you alter the tax charges on the My Parameters tab to your tax charges.

Finest Proper Now

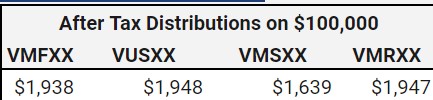

MM Optimizer mechanically pulls within the newest yield numbers. The My Finest Now tab reveals you which ones fund has the very best after-tax yield proper now for the tax charges you entered.

On this instance, it reveals that the nationwide tax-exempt fund has the very best after-tax yield, though not by a lot over the Treasury cash market fund (3.57% versus 3.49%, or 5.25% versus 5.13% pre-tax).

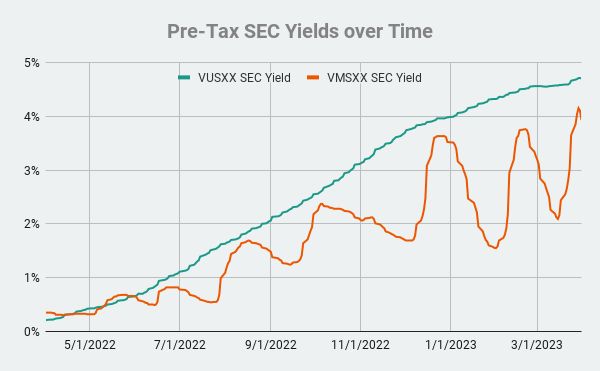

Finest Final 12 Months

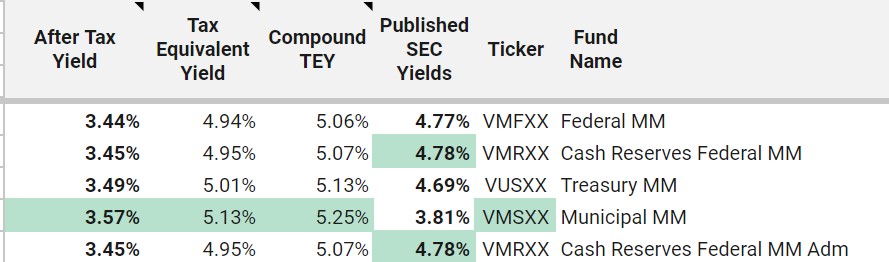

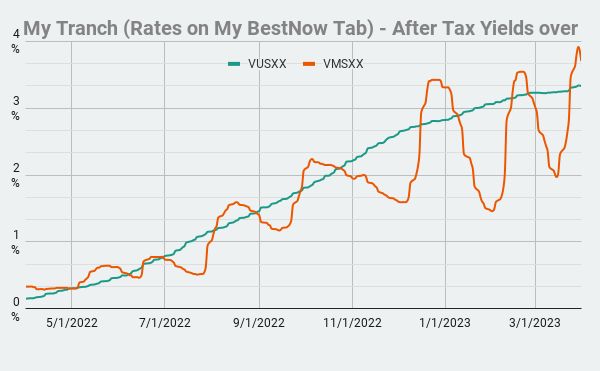

A wrinkle in evaluating taxable and tax-exempt cash market funds is that the yield on tax-exempt cash market funds swings wildly all year long. This chart reveals the yield on a taxable cash market fund and the yield on a tax-exempt cash market fund over the past 12 months:

Whereas the yield on the taxable fund (inexperienced line) rose steadily over time because the Fed raised rates of interest, the yield on the tax-exempt fund (orange line) swung wildly up and down. When you occur to match the after-tax yields when the yield on the tax-exempt fund is close to a prime, it could present that the tax-exempt fund is best even in a low tax bracket. When you occur to match them when the yield on the tax-exempt fund is close to a backside, it could present that the taxable fund is best even in a excessive tax bracket.

MM Optimizer reveals which fund was higher at your tax charges when you caught to it over a full 12 months.

On this case, the Treasury cash market fund was higher for the complete 12 months although the tax-exempt fund is barely higher at this second solely as a result of the yield on the tax-exempt fund is close to a prime.

Switching Again and Forth

You possibly can watch the yields and swap backwards and forwards between a taxable fund and a tax-exempt fund however I wouldn’t trouble. The My Charts tab reveals what number of occasions you’ll’ve needed to swap to catch the momentary swings and the way short-lived every swap was. When you’re late getting into and late popping out, you negate a big a part of the acquire from switching.

I might check out this chart and see which line is on prime more often than not. Select that fund and stick with it. On this instance, it’s the Treasury cash market fund (inexperienced line).

MM Optimizer has much more options however you don’t should get into these. It’s easy to make use of when you solely take a look at the locations I’m displaying right here. The writer continues to be including new options to MM Optimizer. You’ll discover the hyperlink to the most recent model in this publish on the Bogleheads discussion board.

Say No To Administration Charges

In case you are paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.