For the longest time pundits predicted rates of interest would go greater but they did nothing however go decrease yr after yr.

Then when charges hit 0% it appeared like everybody assumed we’d expertise decrease charges perpetually…simply in time for charges to rise greater than anybody thought was attainable in such a brief time frame.

So it goes in relation to the markets.

When charges first started going up it appeared prefer it was solely a matter of time earlier than the Fed would break one thing and ZIRP could be again in our lives very quickly.

However a humorous factor occurred — charges went up a unprecedented quantity and nothing actually broke. Not but anyway.

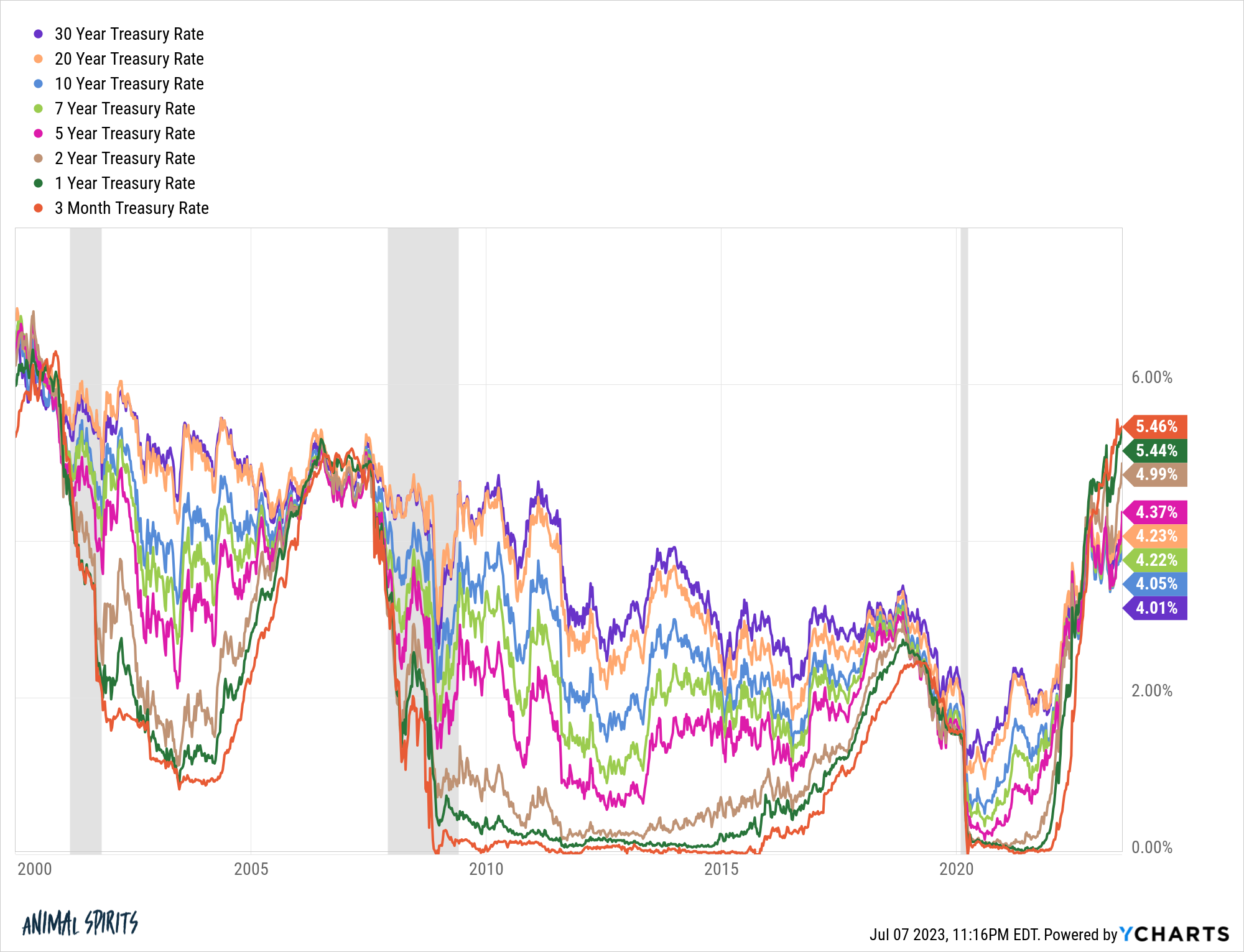

Right here’s a have a look at present U.S. authorities bond yields:

There are all kinds of loopy issues happening right here when you think about how inverted the yield curve is, the pace of the rise in charges and absolutely the stage of yields that we haven’t seen — at the least on the brief finish of the curve — in many years.

So when is all of it going to matter?

There are three areas of the markets and economic system that I’ve this exact same query for:

When do charges start to matter to the inventory market? There was a narrative within the Wall Road Journal this week in regards to the substantial enhance in fairness allocations by older buyers:

Practically half of Vanguard 401(okay) buyers actively managing their cash and over age 55 held greater than 70% of their portfolios in shares. In 2011, 38% did so. At Constancy Investments, practically 4 in 10 buyers ages 65 to 69 maintain about two-thirds or extra of their portfolios in shares.

And it isn’t simply child boomers. In taxable brokerage accounts at Vanguard, one-fifth of buyers 85 or older have practically all their cash in shares, up from 16% in 2012. The identical is true of virtually 1 / 4 of these ages 75 to 84.

There are a couple of completely different causes for this drift greater in inventory possession.

Older buyers have been by means of extra bear markets and have seen the advantages of investing in shares over the long term.

Some folks doubtless wanted to take extra threat as a result of they didn’t save sufficient.

However we additionally went by means of a prolonged interval of low rates of interest within the 2010s the place folks have been pressured out on the chance curve.

Immediately it’s the alternative.

You possibly can earn practically 5.5% in 3-month T-bills proper now. That’s the best stage since early-2001. Brief-term yields haven’t been above 5% since 2007.

Conservative buyers of the world ought to rejoice, particularly if the Fed is ready to hold charges greater for longer.

However when will we begin to see buyers change into extra conservative with their allocations now that risk-free charges are so excessive?

And the way will this impression the inventory market?

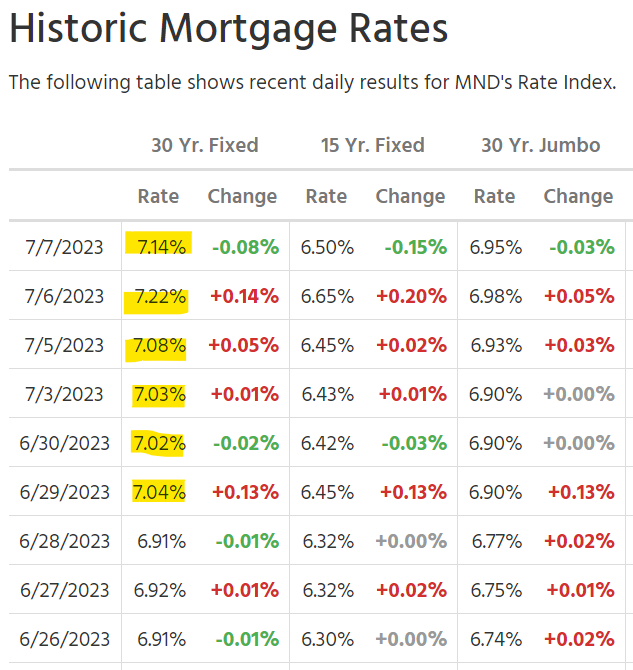

When do charges start to matter to the housing market? Mortgage charges have shot again over 7% previously couple of weeks:

However these greater charges haven’t deterred sure components of the housing market.

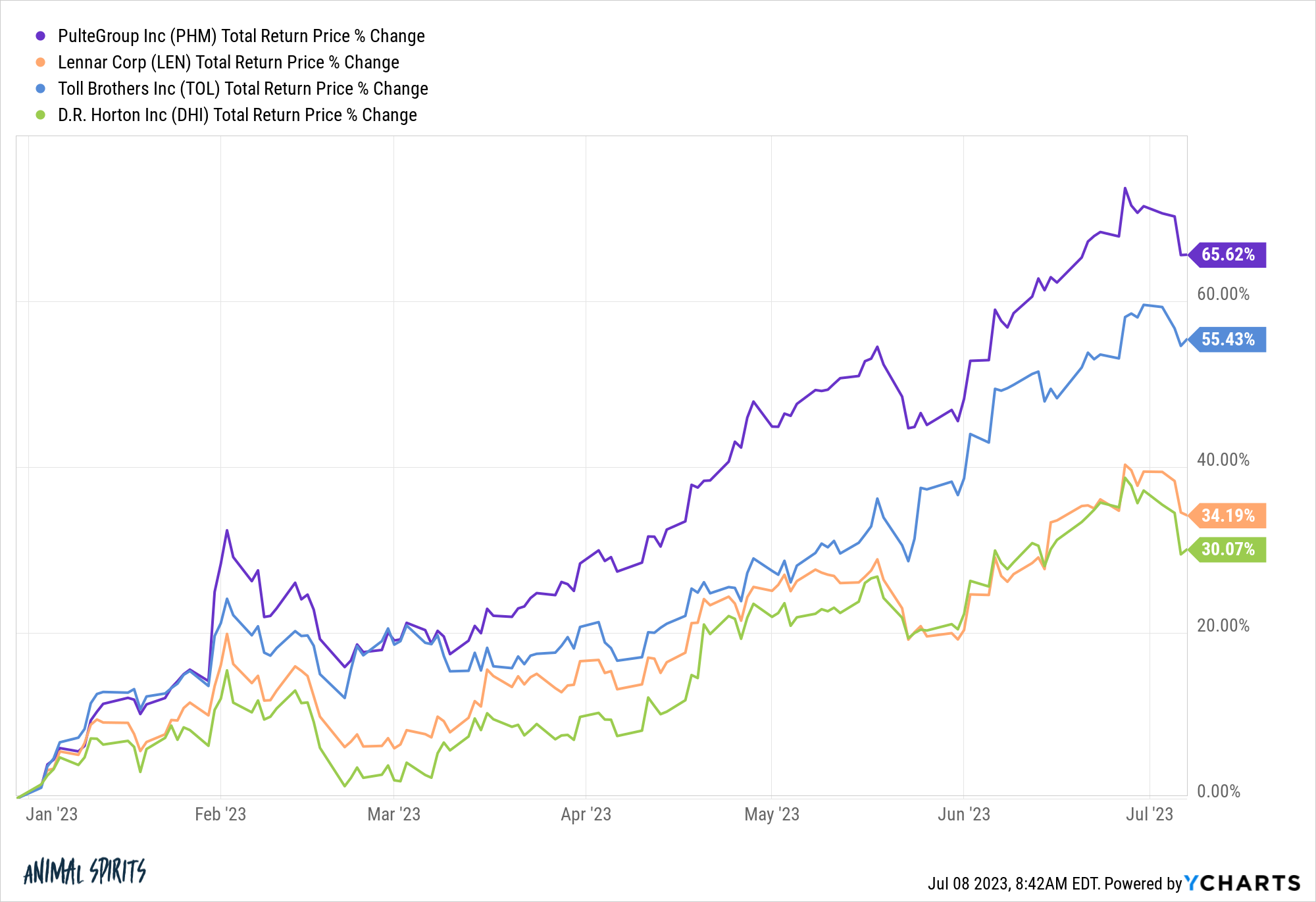

Homebuilder shares are rocketing greater this yr:

Pulte, Lennar, Toll Brothers and D.R. Horton have all hit new all-time highs this yr regardless of mortgage charges going again above 7%.

There are so few present properties available on the market that homebuilders have change into the one sport on the town for a lot of patrons.

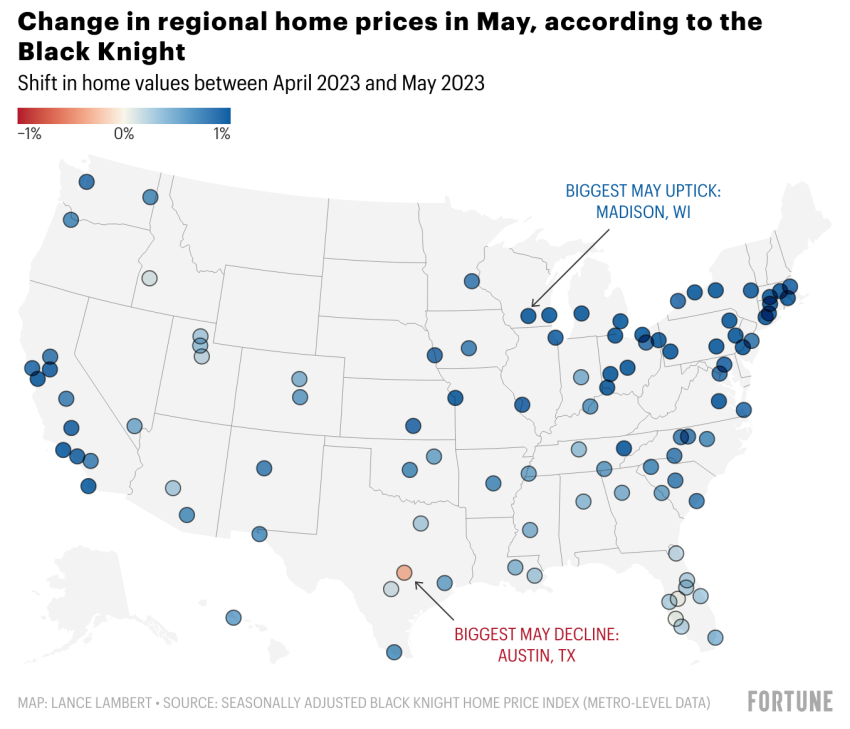

Housing costs are rising once more too. Fortune’s Lance Lambert appeared on the adjustments in regional residence costs in Could:

Ninety-nine of the nation’s largest housing markets noticed value will increase in Could. The lone decliner was Austin, TX.

Ever because the pandemic we’ve lived by means of one of many strangest housing market cycles in historical past.

Sooner or later, you’d assume mortgage charges going from 3% to 7% would have an effect past a shrinking provide of properties on the market.

Housing costs and homebuilder shares have been resilient (thus far).

How lengthy do mortgage charges have to remain elevated earlier than the housing market lastly will get dinged in a giant method?

When do charges start to matter to the labor market? Most economists and policymakers assumed we wanted a lot greater unemployment to include inflation.

Right here’s what Larry Summers stated wanted to occur in a speech he delivered a bit of greater than a yr in the past:

We’d like 5 years of unemployment above 5 p.c to include inflation–in different phrases, we want two years of seven.5 p.c unemployment or 5 years of 6 p.c unemployment or one yr of 10 p.c unemployment.

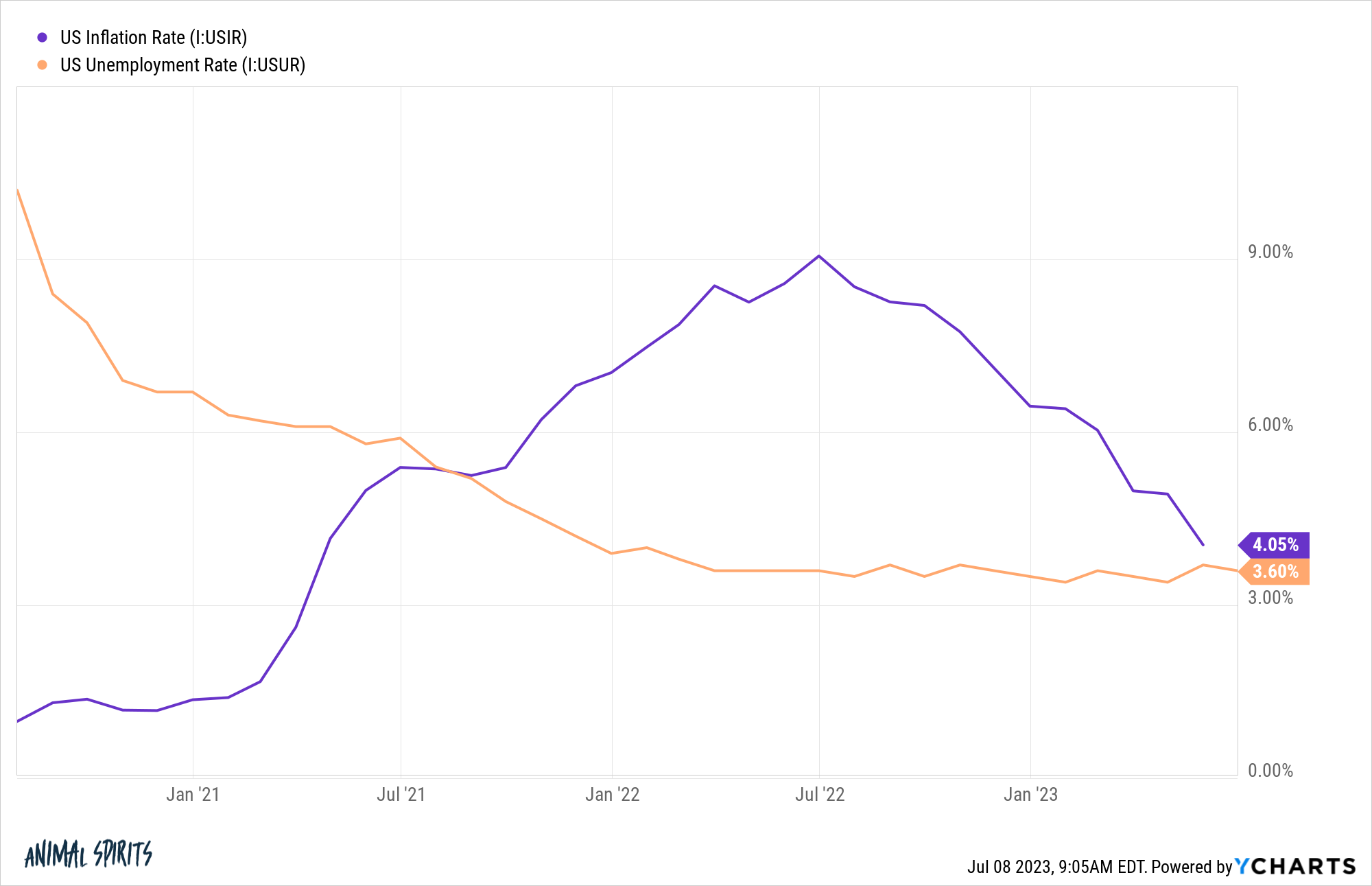

Since Summers made these remarks the U.S. economic system has added greater than 3.7 million jobs. The inflation charge has fallen whereas the unemployment charge hasn’t budged:

We’re residing by means of one of many strongest labor markets in historical past and it doesn’t appear to care what economists or the Fed says or does.

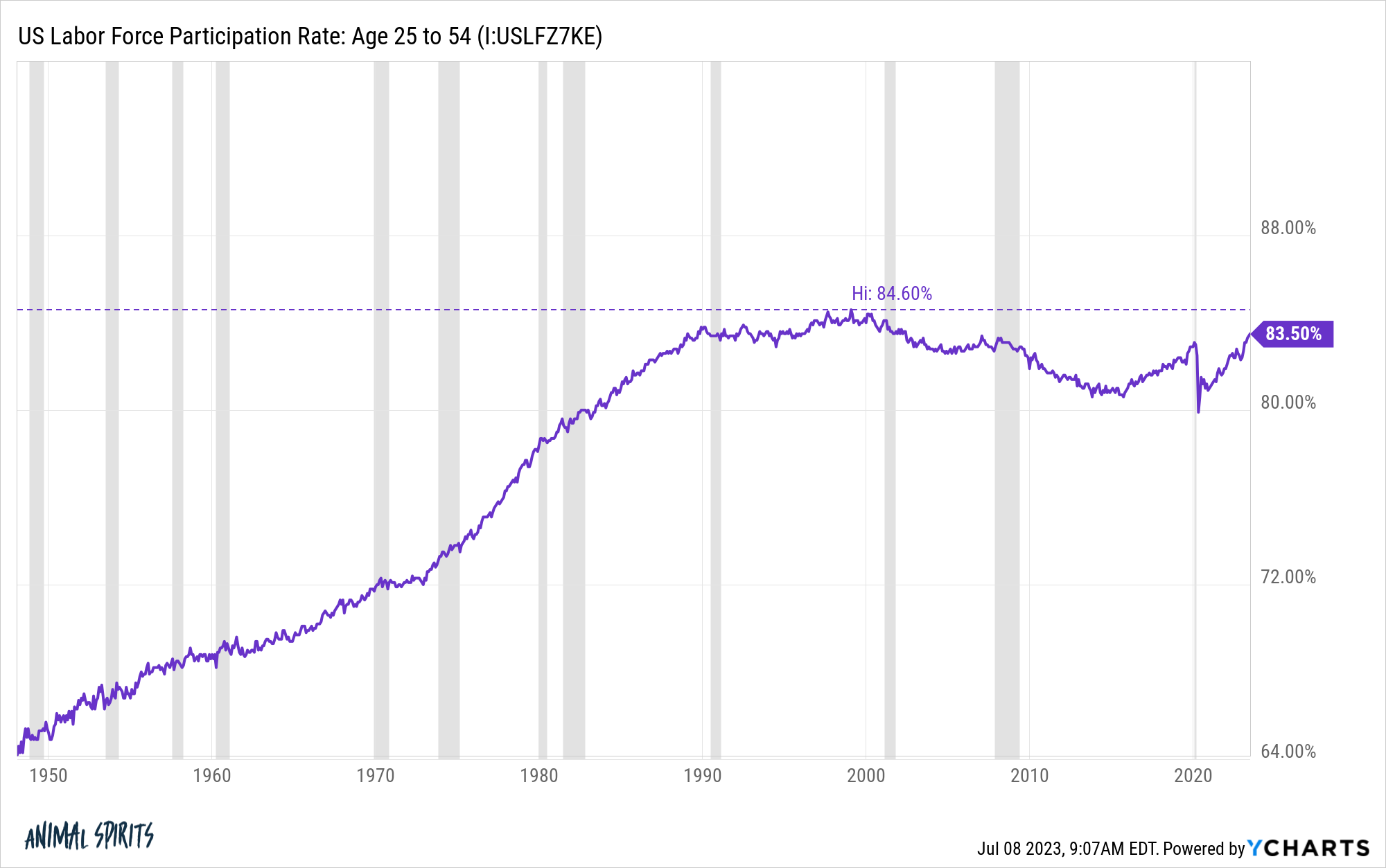

The prime age labor power participation ratio continues to rise, closing in on the all-time highs final seen in 2000:

Jerome Powell explicitly stated he needed folks to lose their jobs to assist with the inflation drawback.

Effectively inflation has come down whereas the labor market fees on.

Can this final?

I truthfully don’t know.

Many individuals assume financial coverage works on a lag. If charges keep excessive, finally customers will blow by means of their extra pandemic financial savings, borrowing prices will change into too prohibitive and the economic system and inventory market will falter.

You possibly can’t rule out the potential for a lag if charges keep greater for longer. Ultimately, you’d assume 7% mortgage charges and 9% auto mortgage charges and 27% bank card charges would decelerate the economic system.

We’ve already delay a slowdown in financial exercise for for much longer than most specialists assumed was attainable.

I agree greater charges ought to have an effect in some unspecified time in the future.

I simply don’t know what the tipping level will probably be if folks simply hold spending cash.

Additional Studying:

What Occurred to the Recession?