True or false: As an employer, you may pay workers any quantity you need. False. It’s 100% false. Why? Due to minimal wage legal guidelines.

However, what’s minimal wage? Relying on what you are promoting’s location, you might have differing federal, state, and native minimal wage charges. To make sure what you are promoting is compliant with labor legal guidelines, get to know minimal wage.

What’s minimal wage?

The minimal wage is the lowest quantity you may legally pay an worker per hour of labor. You possibly can pay greater than the minimal wage if you happen to’d like, however you can not pay lower than the minimal wage.

Minimal wage legal guidelines don’t apply to impartial contractors, so it’s essential to just be sure you classify your workers appropriately.

Who units the minimal wage?

The federal authorities units a normal minimal wage that applies to all workers in the USA. Nonetheless, states and localities can set their very own minimal wage charges, too.

So, which price do you want to observe? Federal, state, or native?

Federal minimal wage vs. state vs. native

What occurs if a state’s minimal wage is decrease than the federal minimal wage? What about if the native minimal wage is decrease than the federal?

If the state or native minimal wage is decrease than the federal minimal wage, you have to pay your workers at the least the federal minimal wage price.

What about if the state or native minimal wage is increased? If the state or native minimal wage is increased than the federal price, pay your workers the state or native price, whichever is increased.

Professional tip: When selecting between federal, state, and native minimal wage legal guidelines, all the time pay your workers the very best price.

What’s the federal minimal wage?

The federal minimal wage is ready by the Honest Labor Requirements Act (FLSA) and enforced by the U.S. Division of Labor (DOL).

Though the federal minimal wage price is topic to alter, it has not elevated since 2009.

So, what’s the nationwide minimal wage? The present federal minimal wage is $7.25 per hour. Nonetheless, the federal minimal wage may probably improve in upcoming years.

Minimal wage by state

Every state can set its personal minimal wage. If a state’s minimal wage is larger than the federal minimal, pay workers at the least the state’s minimal wage.

For instance, the minimal price in Ohio is $10.10 per hour for 2023. In case you have workers in Ohio, you have to pay them at the least the state’s minimal since it’s larger than the federal minimal wage of $7.25.

Quite a few states handed laws to extend the state’s minimal wage to $15.00 by a selected yr. For instance, Connecticut’s Public Act No. 19-4 required the state’s minimal wage to extend yearly over a five-year interval. As a result of Connecticut has been following this minimal wage improve schedule, the state’s minimal wage reached $15.00 per hour in 2023.

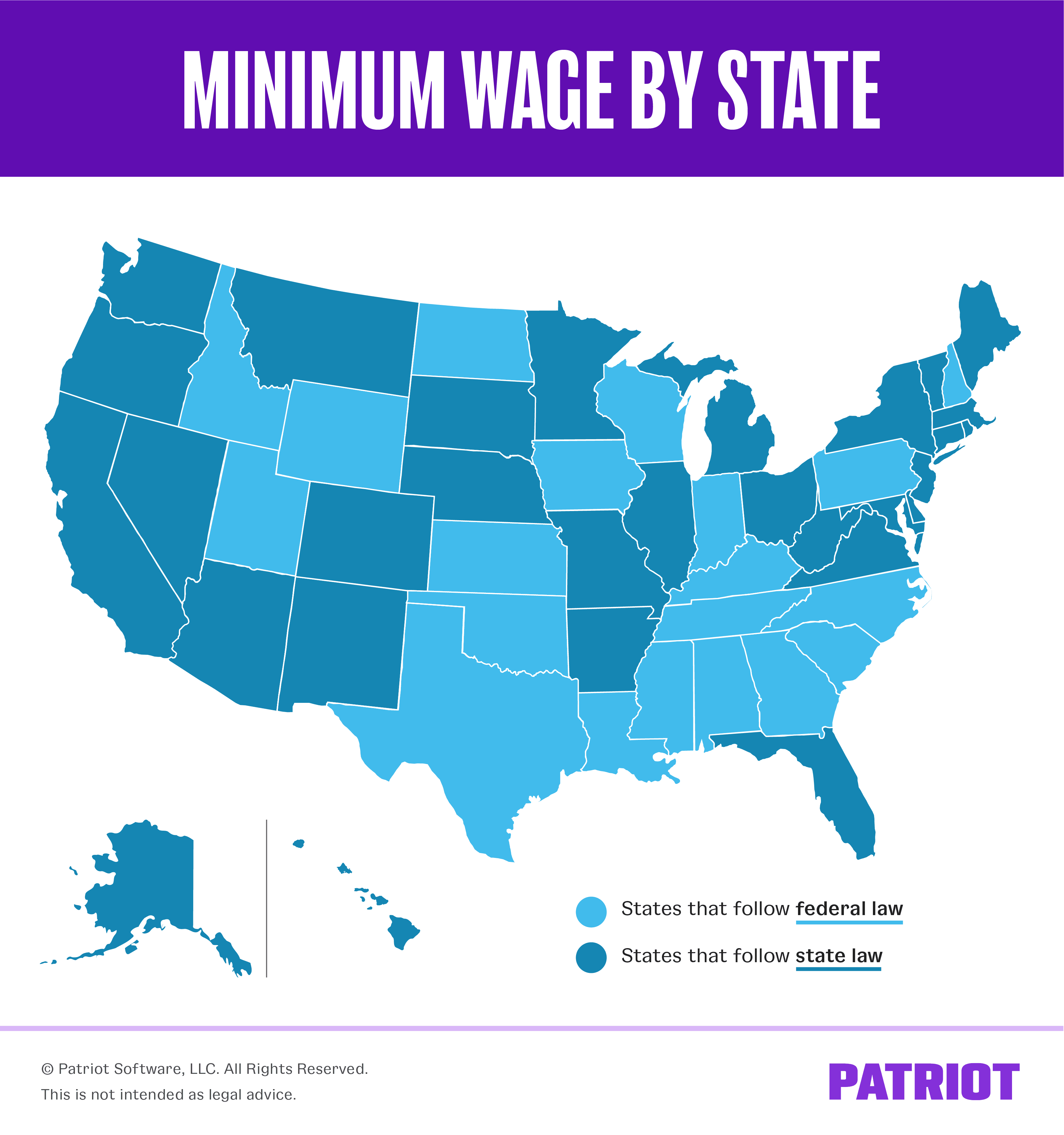

Use the map beneath to see which states observe the federal minimal wage price and which set their very own minimal.

You could be questioning how a lot minimal wage is in your state. Take a look at our state-by-state minimal wage price chart beneath to search out out. Needless to say the states with $7.25 observe the federal minimal wage base.

[State minimum wages as of July 1, 2023]

*These states would not have a state-mandated minimal wage. As an alternative, most employers should pay the federal minimal wage.

**These states have a minimal wage of $5.15 for any employers who aren’t lined by the Honest Labor Requirements Act. Most employers are lined by the FLSA and should pay the federal minimal wage of $7.25.

Heads up! State minimal wage legal guidelines are ever-changing. Keep up-to-date along with your state’s minimal wage necessities by periodically checking your state’s web site.

Native minimal wage

Some cities and counties create a neighborhood minimal wage that differs from state or federal charges. Native wages are most typical in greater cities. Employers should pay the increased of the 2 charges if the native minimal wage is totally different from the state minimal wage.

For instance, the minimal wage in San Francisco is $18.07 per hour. Employers in San Francisco should pay workers at the least the native base wage as a result of it’s larger than each the state and federal minimums.

Use the chart beneath to get began. Nonetheless, verify your metropolis’s legal guidelines, as this is probably not an all-inclusive checklist.

[Local minimum wages as of July 1, 2023]

| Metropolis / State | Native Minimal Wage |

|---|---|

| Alameda, California | $16.52 |

| Albuquerque, New Mexico | $12.00 |

| Belmont, California | $16.75 |

| Berkeley, California | $18.07 |

| Bernalillo County, New Mexico | $9.45 (be aware the state minimal wage of $12.00 is increased) |

| Burlingame, California | $16.47 |

| Chicago, Illinois | $15.00 (employers with 4 to twenty staff) $15.80 (employers with 21 or extra staff) |

| Prepare dinner County, Illinois | $13.70 (some municipalities decide out of the county minimal wage) |

| Cupertino, California | $17.20 |

| Daly Metropolis, California | $16.07 |

| East Palo Alto | $16.50 |

| El Cerrito, California | $17.35 |

| Emeryville, California | $18.67 |

| Flagstaff, Arizona | $16.80 |

| Foster Metropolis, California | $16.50 |

| Fremont, California | $16.80 |

| Half Moon Bay, California | $16.45 |

| Hayward, California | $15.50 (small employers) $16.34 (giant employers) |

| Las Cruces, New Mexico | $12.00 |

| Los Altos, California | $17.20 |

| Los Angeles, California | $16.78 |

| Los Angeles County (unincorporated) | $16.90 |

| Malibu, California | $16.90 |

| Menlo Park, California | $16.20 |

| Milpitas, California | $17.20 |

| Minneapolis, Minnesota | $14.50 (employers with 100 or fewer workers) $15.19 (employers with greater than 100 workers) |

| Montgomery County, Maryland | $14.50 (employers with 10 or fewer workers) $15.00 (employers with 11 – 50 workers) $16.70 (employers with 51 or extra workers) |

| Mountain View, California | $18.15 |

| Nassau County, New York | $15.73 (if the employer does supply well being advantages) $18.26 (if the employer doesn’t supply well being advantages) (Minimal wage might be adjusted July 31, 2023) |

| New York Metropolis, New York | $15.00 |

| Novato, California | $15.53 (small employers with 1 – 25 workers) $16.07 (giant employers with 26 – 99 workers) $16.32 (employers with 100+ workers) |

| Oakland, California | $15.97 |

| Palo Alto, California | $17.25 |

| Pasadena, California | $16.93 |

| Petaluma, California | $17.06 |

| Portland, Maine | $14.00 |

| Prince George’s County, Maryland | $16.60 |

| Redwood Metropolis, California | $17.00 |

| Richmond, California | $16.17 |

| Rockland, Maine | $14.00 |

| Saint Paul, Minnesota | $15.19 (macro companies) $15.00 (giant companies with 101 – 10,000 workers) $13.00 (small companies 6 – 100 workers) $11.50 (micro companies with 5 or fewer workers) |

| San Carlos, California | $16.32 |

| San Diego, California | $16.30 |

| San Francisco, California | $18.07 |

| San Jose, California | $17.00 |

| San Mateo, California | $16.75 |

| San Mateo County, California (unincorporated | $16.50 |

| Santa Clara, California | $17.20 |

| Santa Fe Metropolis, New Mexico | $14.03 |

| Santa Fe County, New Mexico | $12.95 |

| Santa Monica, California | $16.90 |

| Santa Rosa, California | $17.06 |

| SeaTac, Washington | $19.06 (for workers in hospitality and transportation industries) |

| Seattle, Washington | $16.50 (employers with 500 or fewer workers who pay $2.19 per hour towards medical advantages and/or workers earn $2.19 per hour in suggestions) $18.69 (employers with 500 or fewer workers who don’t pay $2.19 per hour towards medical advantages and/or workers earn $2.19 per hour in suggestions) $18.69 (employers with 501 or extra workers) |

| Sonoma, California | $16.00 (employers with 25 or fewer workers) $17.00 (employers with 26 or extra workers) |

| South San Francisco, California | $16.70 |

| Suffolk County (Lengthy Island), New York | $15.00 |

| Sunnyvale, California | $17.95 |

| West Hollywood, California | $19.08 |

| Westchester County, New York | $15.00 |

Like state minimal wage charges, native charges are topic to alter. Verify along with your native authorities for extra info.

Exceptions to minimal wage

There are some exceptions to paying your workers minimal wage. Minimal wage varies for:

Minimal wage for tipped workers

The FLSA at present permits a tip credit score, which reduces the federal minimal wage for tipped workers. Tipped workers can have a decrease base wage as a result of their suggestions ought to make up the remainder of their wages.

The federal tipped minimal wage is at present $2.13. This is applicable to workers who earn greater than $30 in suggestions per 30 days.

Particular person states may also have minimal wage legal guidelines for tipped workers. Verify your state’s tipped minimal wage legal guidelines to be taught extra.

Youth minimal wage

The FLSA additionally permits a particular youth minimal wage. You possibly can pay workers beneath age 20 a wage of $4.25 for the primary 90 days of employment. After 90 consecutive days of employment or the worker reaches 20 years of age (whichever comes first), the worker should obtain the minimal wage.

Some states have a youth minimal that’s larger than the federal youth minimal wage. For extra info, try the U.S. Division of Labor’s web site.

Dwelling wage vs. minimal wage

When wanting via state and native minimal wage legal guidelines, you might even see the time period “residing wage.” For instance, Nassau County, NY makes use of residing wage instead of minimal wage. So, what’s a residing wage?

A residing wage is a state or native minimal wage that’s increased than the federal or state minimal wage. Lawmakers could set these wages to fulfill or exceed federal poverty tips for a household of 4. Or, they might select the residing wage to accommodate the value of residing in a selected geographic area. The purpose of residing wage legal guidelines is to lower poverty via elevated earnings.

Some residing wage legal guidelines may additionally mandate paid break day, medical health insurance protection, or different advantages for workers.

Minimal wage and residing wage legal guidelines could overlap. Or, residing wage legal guidelines could also be enacted instead of efforts to extend minimal wage charges.

This text has been up to date from its unique publication date of March 22, 2012.

This isn’t supposed as authorized recommendation; for extra info, please click on right here.