A extra vital decline in USD/JPY is hampered by the extra-soft financial coverage pursued by the Financial institution of Japan. The Financial institution of Japan presently stays the one financial institution among the many world’s largest central banks that retains rates of interest in damaging territory.

This issue alone contributes to purchasing the greenback on the expense of a less expensive yen, in response to the so-called carry-trade technique.

Given the weak macro statistics coming from Japan and the comparatively low inflationary stress, one mustn’t depend on a change in the midst of the super-soft financial coverage of the Financial institution of Japan.

Nonetheless, the Financial institution of Japan doesn’t rule out the opportunity of overseas alternate interventions to stabilize the alternate price of the nationwide foreign money in case of its extreme weakening. Nonetheless, this is not going to be of cardinal significance for altering or breaking the bullish development of the USD/JPY pair.

Almost certainly, it’s going to proceed, not excluding short-term durations of correction, which we are actually observing.

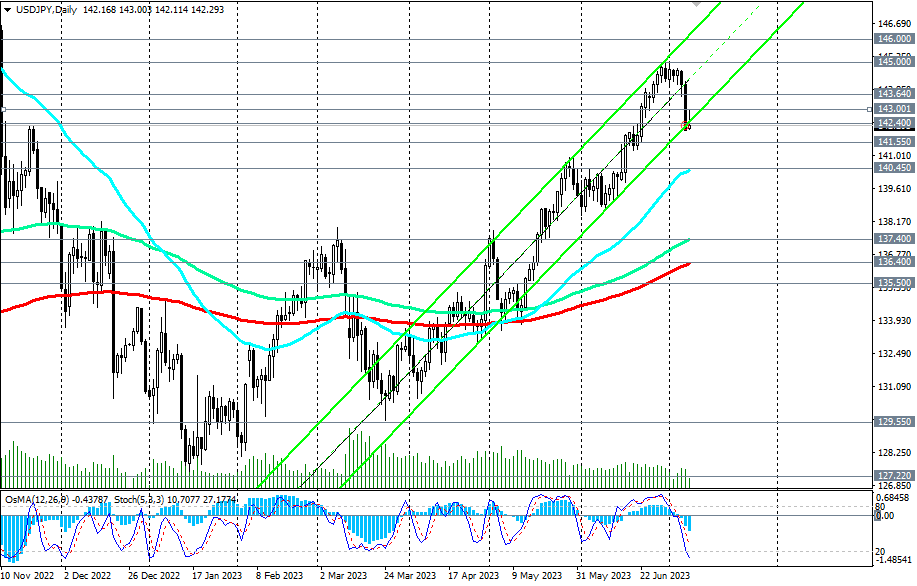

Subsequently, in our opinion, it will be applicable to open new lengthy positions close to the help degree of 142.40, in addition to when the worth drops to the help ranges of 141.55, 141.00, 140.45. An alternate state of affairs of a stronger strengthening of the yen is being constructed amid expectations of a doable change in financial coverage parameters by the Financial institution of Japan at its assembly on July 28 relating to the management of the YCC yield curve.

The Financial institution of Japan in December 2022 doubled the cap price on 10-year Japanese authorities bonds from 0.25% to 0.5%, increasing the vary from zero in each instructions by 0.5% and accelerated bond purchases to guard the (yield) ceiling. Then this precipitated a pointy strengthening of the yen and the autumn of the USD/JPY pair.

If the Financial institution of Japan on the assembly on July 28 as soon as once more expands the yield vary of the JGB, because it was on the assembly in December, then we will anticipate a brand new spherical of the strengthening of the yen and the autumn of the USD/JPY pair.

On this, in actual fact, the calculation of the sellers of the USD/JPY pair is predicated. And the nearer this date is, the stronger, in our opinion, the volatility within the pair will develop. By the way in which, some economists consider that the Financial institution of Japan might utterly abandon the yield management program this yr. It’s simple to imagine that even within the situations of a low rate of interest of the Financial institution of Japan, this might result in a critical strengthening of the yen.

Assist ranges: 102.20, 102.00, 101.50, 101.00, 100.75, 100.00, 99.50

Resistance ranges: 102.50, 102.87, 102.92, 103.00, 103.40, 103.55, 104.00, 104.65, 105.00, 105.85, 106.00, 107.00, 107.80

§ extra particulars -> https://www.instaforex.com/forex_analysis/348309?x=PKEZZ