I’ve been in search of indicators that the concerted efforts by most central banks (bar the eminently extra smart Financial institution of Japan) to kill progress and pressure unemployment up have truly been efficient. My prior, in fact, is that the rates of interest is not going to considerably cut back progress within the brief run, however might in the event that they go excessive sufficient begin to influence on spending patterns of low revenue households. The subsequent knowledge that can assist us affiliate the rate of interest results on spending by revenue quintile within the US comes out in September 2023, so I’ll be careful for that. The latest nationwide accounts knowledge from the US, nevertheless, doesn’t assist the mainstream perception that financial coverage is the best software for suppressing expenditure. Removed from it.

The ineffectiveness of financial coverage – US financial system

On June 29, 2023, the US Bureau of Financial Evaluation revealed the most recent US Nationwide Accounts figures – Gross Home Product (Third Estimate), Company Earnings (Revised Estimate), and GDP by Trade, First Quarter 2023 – which confirmed that “Actual gross home product (GDP) elevated at an annual fee of two.0 % within the first quarter of 2023”.

The December-quarter 2022 progress fee was 2.6 per cent.

The ‘third estimate’ 2 per cent determine is a revision on the sooner announcement of 1.3 per cent and displays the receipt of “extra full knowledge” being accessible.

The US Bureau of Financial Evaluation mentioned that:

The rise in actual GDP within the first quarter mirrored will increase in shopper spending, exports, state and native authorities spending, federal authorities spending, and nonresidential fastened funding that have been partly offset by decreases in personal stock funding and residential fastened funding. Imports elevated.

Be aware that the BEA is utilizing the annualised quarterly determine right here (multiplying the March-quarter progress of 0.5 per cent by 4) reasonably than the precise annual (year-on-year) progress fee which is the proportion shift from the March-quarter 2019 to the March-quarter 2020.

That combination was 1.8 per cent up from 0.88 per cent within the December-quarter 2022.

The next sequence of graphs captures the story.

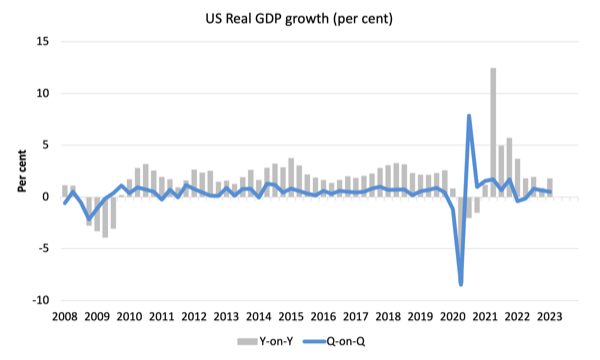

The primary graph reveals the annual actual GDP progress fee (year-to-year) from the height of the final cycle (December-quarter 2007) to the March-quarter 2020 (gray bars) and the quarterly progress fee (blue line). Be aware the date line begins at March-quarter 2008.

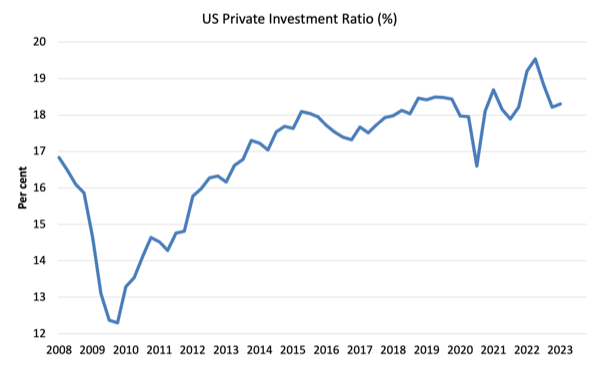

The subsequent graph reveals the evolution of the Personal Funding to GDP ratio from the March-quarter 2008 (actual GDP peak previous to GFC downturn) to the March-quarter 2023.

Enterprise funding is likely one of the nationwide accounting aggregates that mainstream economists imagine can be extremely delicate to rate of interest actions.

The information doesn’t counsel that.

The chaos brought on by the pandemic is clear as is the stalling efficiency after the preliminary GFC restoration.

However the funding fee is across the pre-pandemic worth now and now exhibiting something like a dramatic ‘fall of the cliff’ dynamic.

Contributions to progress

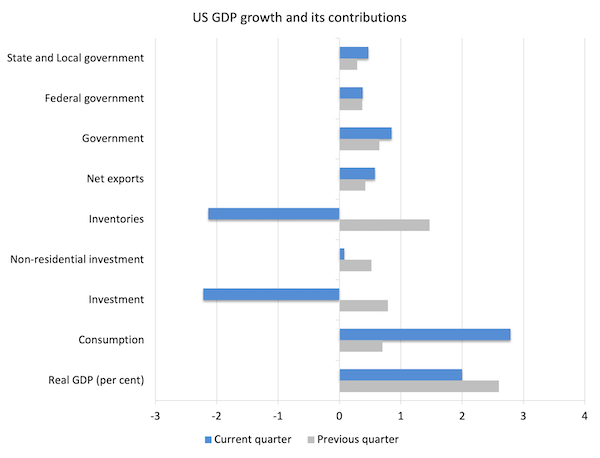

The subsequent graph compares the December-quarter 2022 (gray bars) contributions to actual GDP progress on the degree of the broad spending aggregates with the March-quarter 2023 (blue bars).

The foremost driver of the GDP rebound has been the strengthening private consumption spending, which can be most likely pushed the run down in retail commerce inventories.

The US authorities in any respect ranges can be driving progress as is web exports.

Enterprise funding undermined progress within the March-quarter – which is likely to be taken as an indication that the rate of interest hikes have began to influence (see beneath).

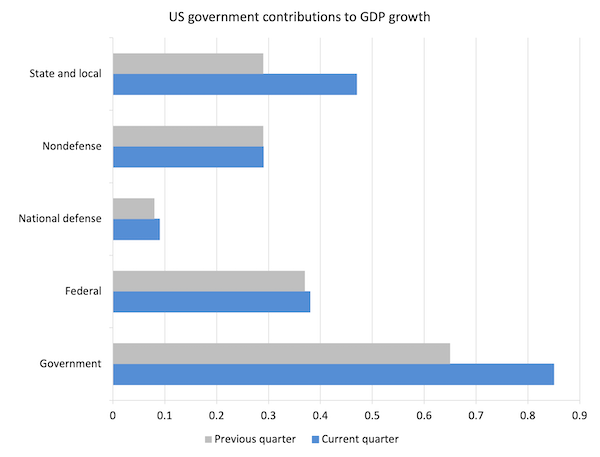

The subsequent graph decomposes the federal government sector and reveals that Federal non-defense spending has dominated.

There have been robust progress contributions from all ranges of presidency.

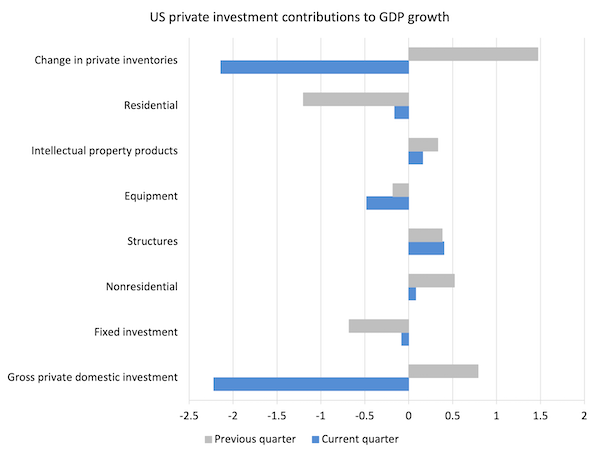

To raised perceive what is occurring with funding expenditure, the following graph breaks down the contributions to actual GDP progress of the assorted elements of funding.

The general decline was pushed by the stock reductions, whereas different capital formation expenditure elements have been principally optimistic and contributed to manufacturing.

Spending on tools was a brake on total GDP progress.

My tentative evaluation is that the stock cycle is usually driving the detrimental contribution of funding expenditure to GDP progress.

However we have now to watch out to grasp what meaning.

There was a robust uplift in family consumption expenditure, which I believe has caught the producers without warning considerably and led to the decline in unsold inventories.

FIrms will probably search to replenish their shares within the June-quarter reinforcing the optimistic sentiment within the different funding classes.

The purpose is that I can not see any substantial detrimental rate of interest impact on this knowledge.

US Family consumption and debt

The Federal Reserve Financial institution of New York publication – Family Debt and Credit score Report – was final up to date for the March-quarter 2023 (revealed Might 2023) – (PDF Obtain).

It reveals:

… Mixture family debt balances elevated by $148 billion within the first quarter of 2023, a 0.9% rise from 2022Q4. Balances now stand at $17.05 trillion and have elevated by $2.9 trillion because the finish of 2019, simply earlier than the pandemic recession …

Mortgage balances proven on shopper credit score stories elevated by $121 billion throughout the first quarter of 2023 and stood at $12.04 trillion on the finish of March, a modest improve …

Bank card balances have been flat within the first quarter, at $986 billion, bucking the standard development of stability declines in first quarters. Auto mortgage balances elevated by $10 billion within the first quarter, persevering with the upward trajectory that has been in place since 2011.

So whereas there was a “slow-down in dwelling gross sales” there doesn’t look like a large hit on shopper borrowing.

The information additionally reveals that:

Mixture delinquency charges have been roughly flat within the first quarter of 2023 and remained low, after declining sharply via the start of the pandemic.

As soon as once more no signal of a meltdown.

Housing scarcity in Australia – from unhealthy to worse

There’s a big housing scandal in Australia at current – summarised by not sufficient of it.

However it’s extra complicated than that.

It additionally considerations the full inadequacy of a lot of the brand new housing and house inventory for the environmental challenges forward.

There are a lot of massive house developments now which can be demonstrating main development flaws – some already completed, some already completed and now deserted, and a few in development section.

The NSW State authorities constructing requirements boss was in Newcastle lately and shut down two development websites for main breaches of the constructing code.

I conjecture that in 20 years many buildings which have been erected over the past 20 years might be deserted as a result of they’re unsafe and falling aside.

A number of excessive profile house towers in Sydney, for instance, are already in that state they usually haven’t even been occupied after development, regardless of the builders making off with thousands and thousands in earnings after which declaring chapter.

The issue right here is that governments privatised the constructing inspection position that was once completed by public sector officers.

Now we have now all these profit-seeking characters doing the checks and there may be robust proof that they get paybacks from the builders to show a blind eye.

Some inspections of complicated constructions are apparently completed by way of Facetime, with the builder holding up a cell phone whereas the inspector sits in his/her comfy workplace kilometers away.

The opposite downside is that the constructions aren’t match for objective – extremely vitality inefficient.

Now we have hectares of farming land now being taken over by concrete and roofs with little inexperienced house left for suburbs to breathe.

The homes leak and are typically too massive to be environment friendly.

However how is that related to the housing scarcity?

Nicely, the scarcity arose as a result of neoliberal economists took over authorities infrastructure departments and all of the ‘fiscal’ KPIs demanded surpluses.

pursue them?

Nicely, simply in the reduction of on social housing funding, which has been a significant duty of state governments since day 1.

Because the states in the reduction of the inventory of social housing – that’s, housing for decrease revenue households – has fallen method behind the demand for it.

There’s an estimated hole of some 800,000 models – that’s, provide shortfall relative to demand.

That’s inflicting big points – rental demand may be very excessive and the landlords are reaping large returns, thereby reinforcing the revenue inequalities.

And extra folks are actually sleeping in vehicles, tents and underneath bridges – in one of many wealthiest nations on Earth (in materials phrases).

So the answer is to desert the austerity pursuit and really begin taking good care of those that want our collective assist.

However that might be too straight foreward for the neoliberals.

Their resolution is to decontrol zoning, development requirements and all the remainder of the restrictions that try to make sure buildings truly keep up and don’t swarm in all places and eat up inexperienced areas and many others.

The neoliberal resolution that the builders are actually demanding be launched will simply make issues worse and line the pockets of the builders and depart extra city blight and horrific streetscapes.

Unhealthy selections resulting in additional unhealthy selections.

Neoliberalism.

Music – Max Richter – The Younger Mariner

That is what I’ve been listening to whereas working this morning.

It’s off the soundtrack launched by Deutsche Grammophone for the movie Henry Might Lengthy OST, which was launched on October 27, 2017 and recorded in Berlin.

The movie was launched in 2008 and the music scored in 2007.

This observe – The Younger Mariner – was quantity 13 of 14 on the album.

Submit minimalist composer and pianist – Max Richter – is joined by:

1. Chris Worsey – cello.

2. Ian Burdge – cello.

3. John Metcalfe – viola.

4. Natalie Fuller – violin.

That’s sufficient for as we speak!

(c) Copyright 2023 William Mitchell. All Rights Reserved.