Regardless of an extended listing of issues that Constancy’s retirement planning device doesn’t do, I nonetheless use it as a high-level mannequin. The planning train I did on the finish of final yr revealed two elementary drivers of monetary success in retirement.

Baseline Spending

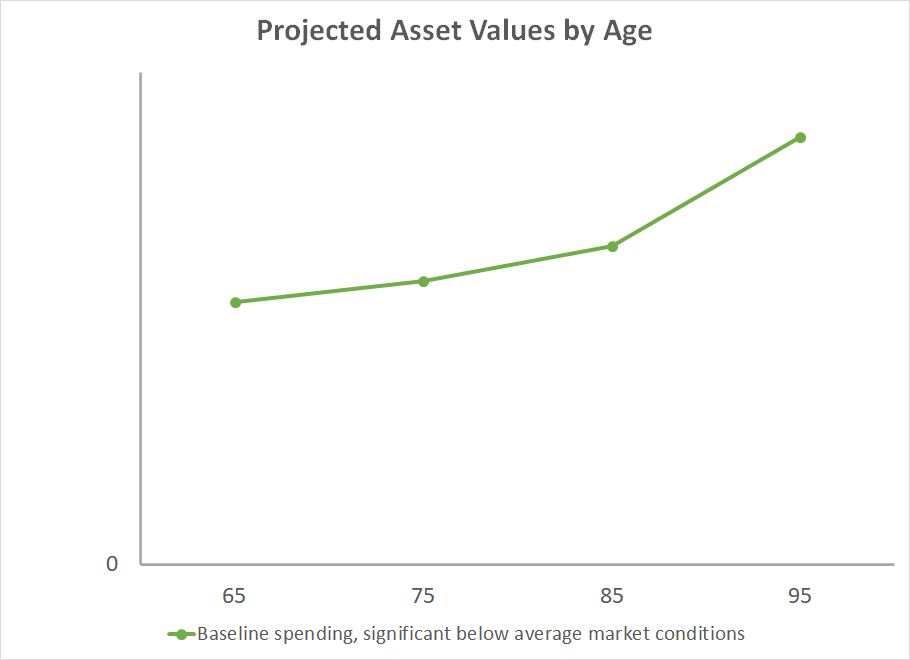

First, I created a baseline annual spending. The planning device confirmed a desk of the projected values of our investments at totally different ages when the funding returns are “considerably under common.” Considerably under common means “a state of affairs during which your consequence was profitable 90% of the time” utilizing historic knowledge. I created this chart by sampling a number of age milestones from the desk:

All values are in at present’s {dollars}. I’m not exhibiting numbers on the vertical axis for apparent causes.

Our funding portfolio is projected to extend whereas we take withdrawals to assist the deliberate annual spending. That’s each good and dangerous. It’s good as a result of it reveals we now have sufficient for our retirement. It’s dangerous as a result of we don’t want or need 60% more cash at age 95 than at age 65.

Greater Spending

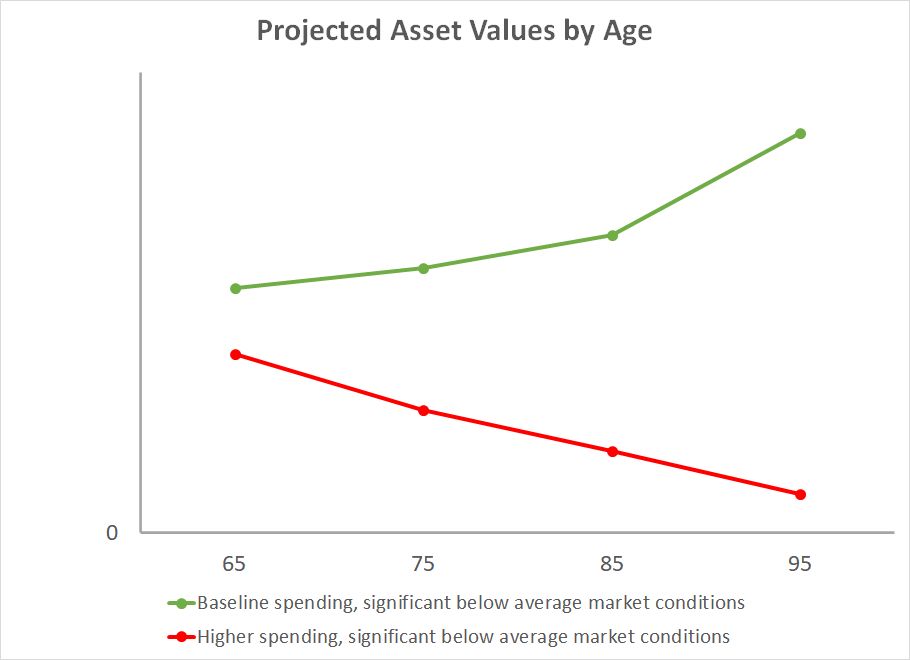

Subsequent, I elevated the annual spending by 20%. The planning device confirmed a unique set of projected values:

Now the projected values go down with age. It will get dangerously near zero at age 95. Because of this our sustainable spending is someplace between these two ranges. If the long run market returns are under 90% of returns previously, we will nonetheless spend slightly greater than the baseline plan however not 20% extra.

Higher Market Situations

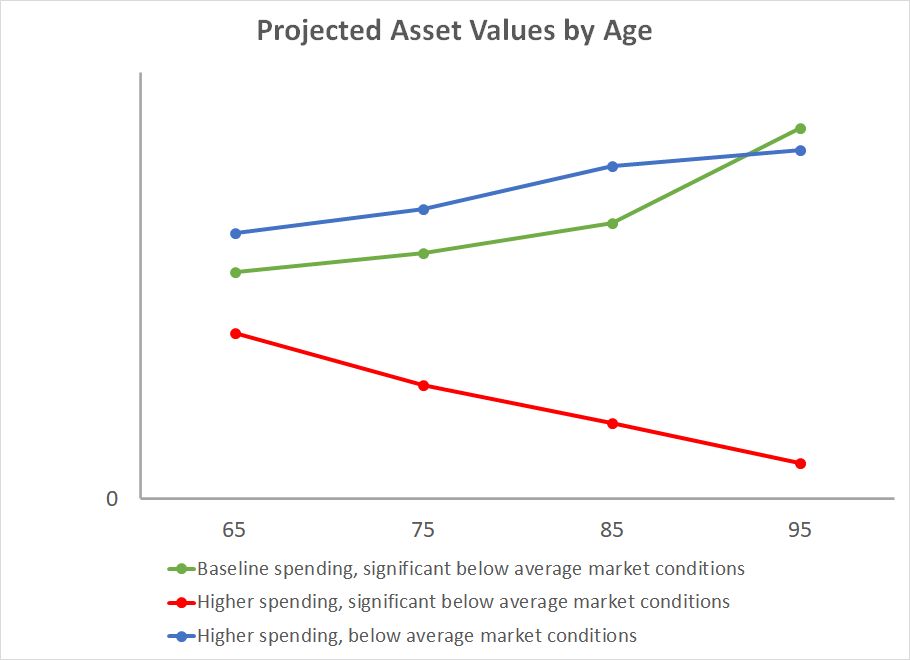

The planning device additionally produced a desk of projected values for returns merely under common however not considerably under common. Under common means “a state of affairs during which your consequence was profitable 75% of the time” versus 90%. The projected asset values below these higher market circumstances whereas supporting the upper spending appears to be like just like the blue line on this chart:

It reveals that if the returns are solely under common — not considerably under common — our belongings could be increased than the baseline state of affairs via age 90 whereas supporting 20% increased spending yearly.

Basic Drivers

After I offered these three situations to my spouse, she identified that it was solely too apparent.

“You didn’t should run a elaborate device to inform me that increased spending will drain our investments sooner and higher returns will assist.”

She advised me the identical factor after I stated I found the secrets and techniques to a fats 401k 11 years in the past.

It’s apparent as a result of it’s true. Spending and funding returns are certainly the 2 elementary drivers of monetary success in retirement as a result of they compound. We are able to deal with low returns (the inexperienced line) or increased spending (the blue line) however not each yr after yr if we reside lengthy (the purple line).

After we consider the same old consternations in retirement planning — when to say Social Safety, which accounts to withdraw from first, when and the way a lot to transform to Roth, buckets technique or proportional withdrawals, purchase an annuity or not, … — all the things added collectively can’t alter our retirement trajectory as a lot as our annual spending and funding returns.

If we’re on the purple line as a result of our annual spending is just too excessive relative to the funding returns, probably the most optimum techniques in Social Safety claiming, Roth conversion, and withdrawal sequencing gained’t yank us again to the inexperienced line. We’ll want to scale back spending. If we’re on the blue line as a result of we aren’t so unfortunate with funding returns, we’ll do exactly nice even when we aren’t so intelligent in retirement planning techniques.

You don’t have to make use of Constancy’s retirement planning device to see this impact. Some other device will present the identical two elementary drivers.

Make It Strong

Retirement planning techniques are helpful however we should always make our plan NOT depend on them. If optimum executions of Social Safety claiming, Roth conversion, and withdrawal sequencing make or break our retirement, it means our plan is too fragile. It isn’t strong sufficient when a slip in execution, a miscalculation, or a change of legal guidelines will knock us off observe.

The objective must be to make our retirement profitable regardless. After we get our spending proper for the market circumstances, any optimization techniques will solely be icing on the cake, and suboptimal executions gained’t jeopardize our retirement. If we get our spending fallacious for the market circumstances, no quantity of optimization will rescue our retirement.

***

We’ll be watching the trajectory of our investments. If we see we’re vulnerable to occurring the purple line when we now have a mixture of excessive spending and low returns, we’ll cut back spending and attempt to transfer towards the inexperienced line. If we see that the market returns aren’t too dangerous, we’ll know we now have extra leeway in our spending. That’s how we’ll maintain our eyes on the 2 elementary drivers of monetary success in retirement.

I advised my spouse that’s all she must do if one thing occurs to me. Every part else is non-obligatory. How does SECURE Act 2.0 alter the monetary success of our retirement? It doesn’t, as a result of it doesn’t change the 2 elementary drivers.

Say No To Administration Charges

In case you are paying an advisor a share of your belongings, you’re paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.