Don’t make the error of paying on your revenue taxes through GIRO, as a result of that earns you completely NOTHING in your funds. Right here’s what I’ve been utilizing to earn miles on funds that my bank cards wouldn’t in any other case give me rewards for.

Now that you just’ve efficiently filed your revenue taxes to IRAS, it received’t be lengthy earlier than you obtain your tax invoice. Whether or not you select to go for month-to-month repayments or a one-time yearly invoice, the larger query can be HOW to make cost – particularly, what mode of cost must you use to be able to nonetheless earn miles from this?

We already know that most bank cards reward you primarily based in your discretionary spending i.e. services or products that you just need to purchase as an alternative of the stuff that you just want. And that’s precisely why you see classes like eating and purchasing get such beneficiant rewards (e.g. 10X for eating!), since you might technically reside with out consuming out and shopping for new stuff.

The tougher piece to resolve is normally earn rewards on our non-discretionary spend i.e. common funds that you just HAVE to make and can’t keep away from, comparable to once you pay on your insurance coverage premiums, revenue taxes, or electrical energy.

Enter CardUp, which has been fixing this drawback for Singaporeans since 2016.

If you happen to haven’t already heard of them / began utilizing them, then that’s since you haven’t been following this weblog intently 😛 I’ve raved about them a number of instances since discovering the service in 2017, and assembly the founders in individual (at an occasion) who helped me actually perceive what they do and the way it works.

Merely put, service suppliers like CardUp cost your bank card for the cost plus an administrative price (1.9% – 3.3%), which they then make the funds in your behalf utilizing financial institution transfers.

This manner, you’ll be able to get pleasure from cashback, miles or reward factors on these funds that bank card corporations usually exclude.

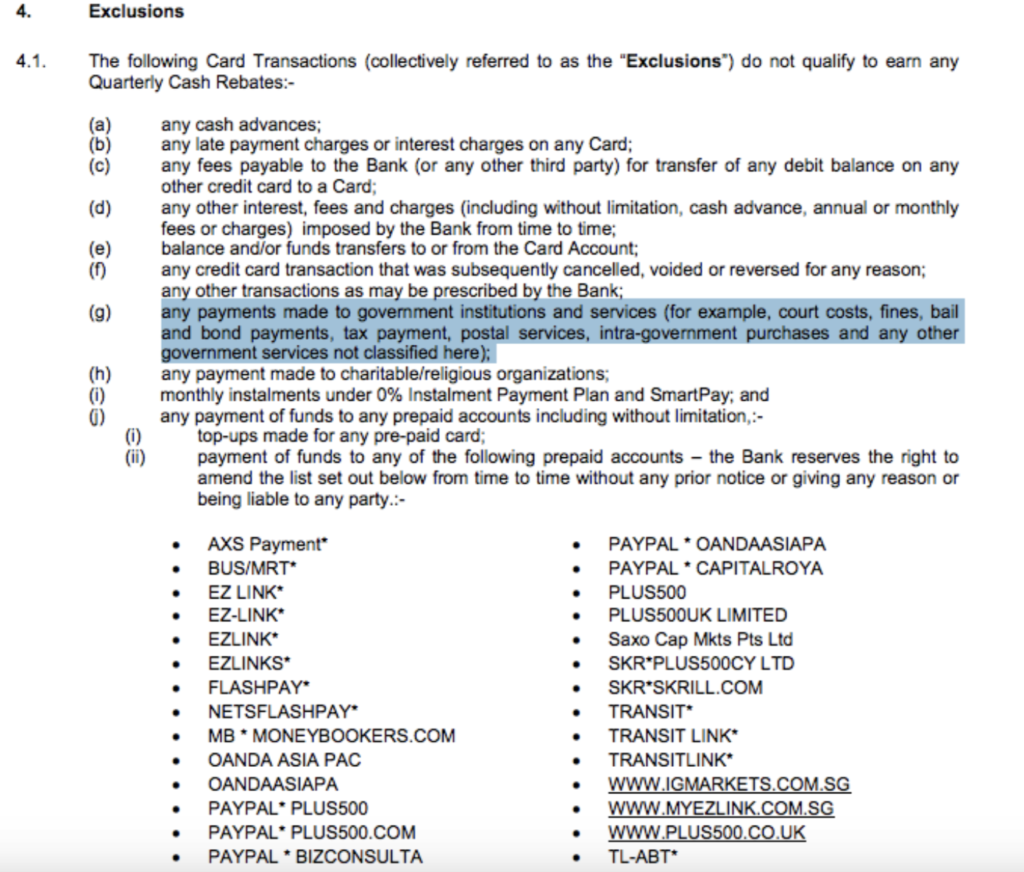

In fact, this was a shocker to the monetary business, and within the years that adopted, I’ve watched as some banks proceeded to exclude CardUp transactions. Nonetheless, 7 years on, CardUp is now typically accepted for the base mile / cashback earn price, whereas being excluded for the excessive on-line spend class or any bonus programmes.

Which means if you happen to’re utilizing a card that rewards you generously for on-line spending e.g. DBS Lady’s Card (5X) or DBS Lady’s World (10X), you’ll solely earn the bottom price of 1X DBS Factors in case your on-line transaction is thru CardUp.

So the trick with utilizing CardUp is to discover a card that provides you a good base reward price, which you’ll be able to test right here. In my case, as an example, I’ve been utilizing my UOB PRVI Miles card to pay for all CardUp transactions prior to now 6 years.

Ought to I exploit miles or cashback playing cards with CardUp?

To start with, I used a cashback bank card to pay through CardUp.

However because the banks saved altering their T&Cs, it turned an excessive amount of of a problem to maintain up, so I switched to a far card as an alternative and settled for the bottom reward price. Right this moment, I wouldn’t actually suggest utilizing a cashback bank card with CardUp, as a result of the admin price of two.6% signifies that you’ll need to discover a cashback bank card that rewards you a better earn price than that – that’s a tricky name.

It has turn out to be far simpler – and fewer of a headache – to simply stick to a great miles card on CardUp.

Is it actually value paying for the admin price?

This can be a query that solely you’ll be able to reply for your self.

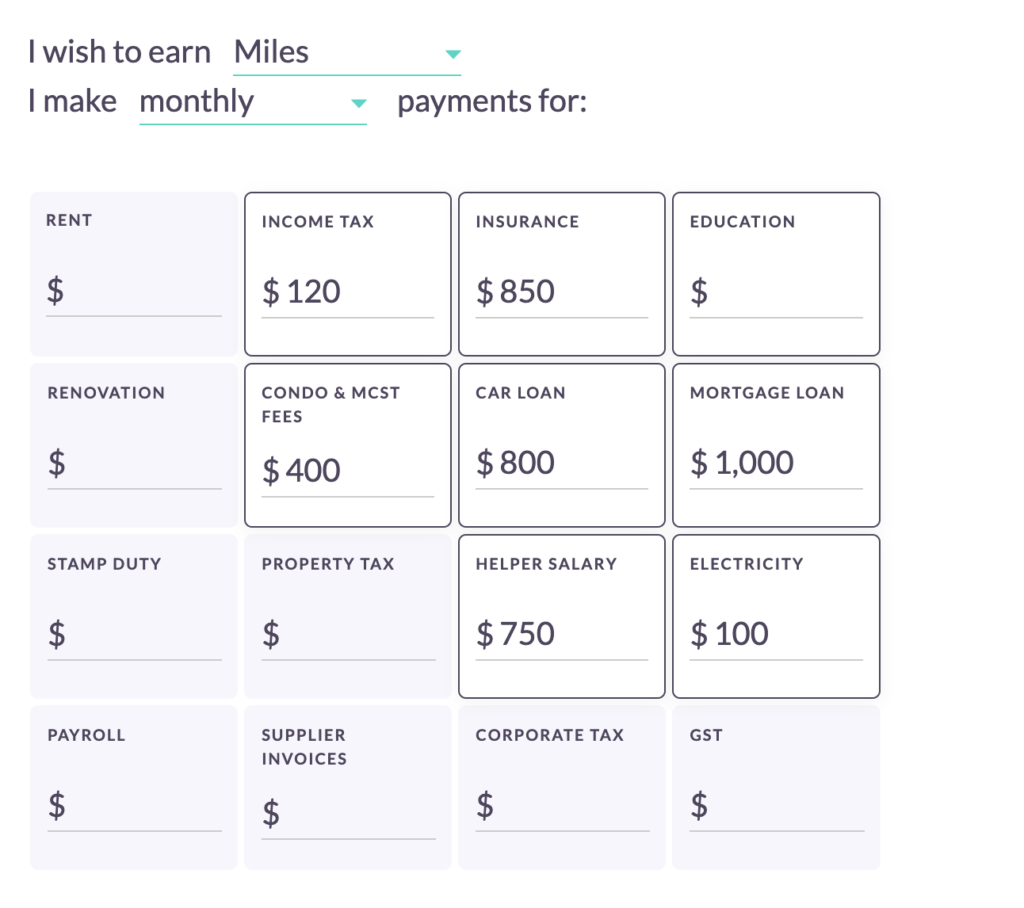

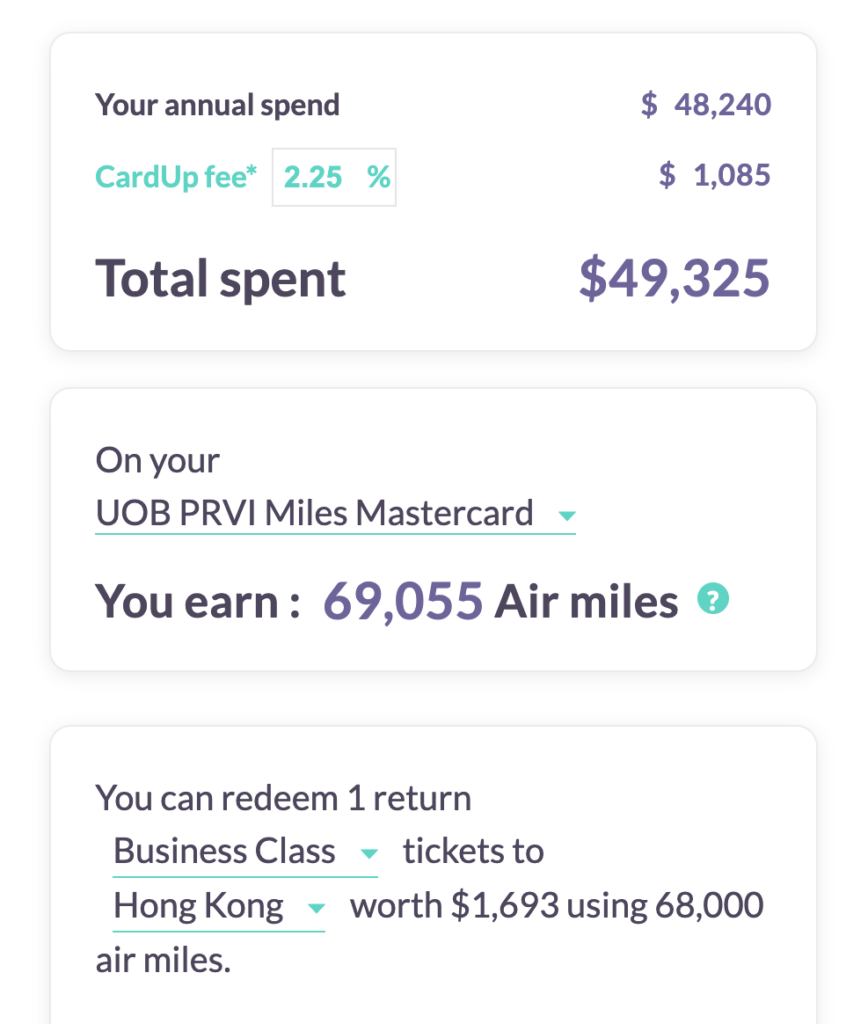

You’ll have to weigh the prices vs. rewards and determine if this is sensible for you. Right here’s an instance of how I do it:

First, go into CardUp’s web site right here and key in your estimated bills to learn the way a lot the service will price you:

Subsequent, choose your bank card from the listing and test how a lot rewards you’ll be capable of earn if you happen to have been to route your non-discretionary bills by CardUp:

So within the above state of affairs, the query to ask is whether or not you’ll be keen to pay $1k+ for the related miles. My reply is sure, as a result of doing so nonetheless permits me to save lots of ~$600.

Are there different choices to CardUp?

In fact, CardUp isn’t the one service supplier of its sort – you might additionally decide to make use of different related companies by ipaymy, or through the banks i.e. Citi PayAll, Commonplace Chartered EasyBill and UOB Cost Facility.

| Cardup | ipaymy | Citi PayAll | SC EasyBill | UOB Cost Facility |

| 2.6% | 1.99% – 3.30% | Varies | As much as 1.99% | 1.9% – 2.3% |

Unsurprisingly, the banks restrict this service solely to their cardholders, which suggests Citi PayAll solely advantages a Citi-cardholder, whereas SC EasyBill is just for Commonplace Chartered members and UOB Cost Facility for simply UOB playing cards.

For these of you who want recurring (month-to-month) funds, then SC EasyBill is out because it at the moment doesn’t provide this operate.

UOB cardholders who want to earn miles through UOB Cost Facility are restricted to utilizing solely the Krisflyer UOB card, which at the moment awards a low base price of 1.2 miles per greenback.

Why select CardUp?

Personally, I selected and have stayed with CardUp for the next causes:

- It has the widest vary of supported cost classes.

e.g. CardUp was restricted solely to 10 varieties of funds again in 2018, however they’ve been quietly increasing the listing (now 16) through the years. - It helps the widest variety of bank cards.

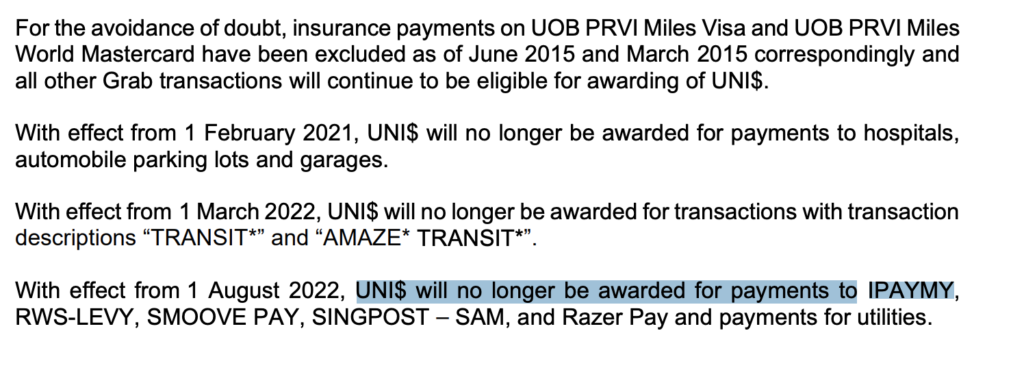

Together with AMEX and UnionPay. If you happen to use multiple bank card (or must you change bank cards attributable to technique within the coming years), CardUp has the least exclusions vs. the others. - ipaymy has since been excluded from some playing cards.

Significantly UOB, which is what I’m on.

Another good miles playing cards to pair with CardUp can be:

- Citi Premier – 1.2 mpd

- DBS Altitude – 1.2 mpd

This excludes premium playing cards like DBS Insignia (1.6 mpd) and DBS Vantage (1.5 mpd), that are usually not accessible to the mass market who aren’t excessive revenue earners.

Like this hack? Keep in mind to share it together with your family members to allow them to cease shortchanging themselves of miles they might have in any other case earned!

Save in your CardUp funds once you use my affiliate promo code SGBUDGETBABE

With love,

Funds Babe