KEY

TAKEAWAYS

- Bearish momentum divergences recommend exhaustion for consumers after a protracted bullish section.

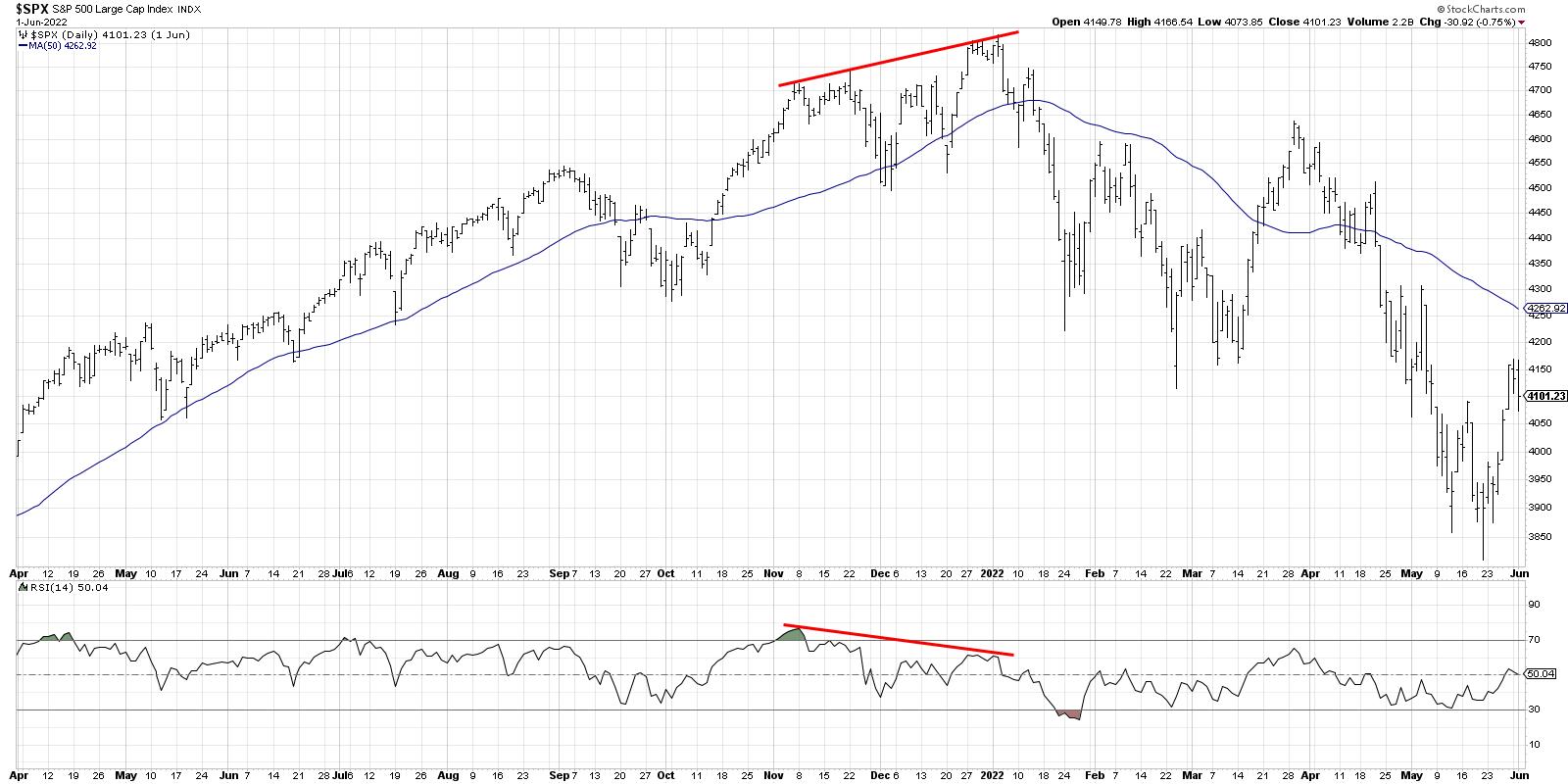

- The 2021 market prime was marked by a bearish momentum divergence for the S&P 500.

- Bearish divergences between value and RSI point out potential draw back for main development shares, together with AMZN and LRCX.

- The S&P 500 is now displaying a bearish momentum divergence, much like the market prime in This autumn 2021.

I take into account the objective of the pattern follower to be threefold: establish tendencies, comply with these tendencies, and anticipate when these tendencies could also be exhausted. Day by day, each week, each month, I am attempting to do these three issues in a constant and repeatable vogue.

That third piece is probably a very powerful. In spite of everything, it is pretty simple to establish new uptrends, and it is fairly easy to comply with these tendencies utilizing a fundamental stop-loss method. However anticipating when the pattern is over? That is the place issues can get fairly difficult, as a result of tendencies typically appear actually bullish proper up till they are not.

Bearish momentum divergences have turn out to be one among my favourite methods to establish potential pattern exhaustion factors, as a result of they characterize a shift in momentum. As a substitute of the value transferring greater on stronger momentum, that optimistic “mo” is starting to dissipate.

Here is a traditional instance, the place the S&P 500 moved greater by means of the tip of 2021 whereas the RSI sloped decrease. A traditional bearish divergence occurred, implying that the bull section of 2021 was nearing its endpoint.

What issues me right here as we start the third quarter of 2023 is that I am seeing a rising variety of bearish divergences on key development shares, in addition to with a few of our main benchmarks!

Let’s begin with the semiconductor group, which was one of many prime performers within the first half of 2023.

Whereas so many traders are centered on the upside potential for shares like NVDA (which is additionally displaying a bearish divergence, by the best way), I am considering Lam Analysis (LRCX) offers an ideal illustration of this bearish technical sign.

Observe the upper highs in Might and June and the downward-sloping RSI over the identical time interval. Once more, this means a probable upside exhaustion level, as there’s much less bullish momentum behind each time the value has moved greater in current weeks.

Amazon.com (AMZN) offers one other nice instance, as a result of this chart reveals each the bullish and bearish momentum divergences within the final 12 months.

Whereas the S&P 500 and Nasdaq made their lows in October of final 12 months, AMZN truly made a brand new low into year-end 2022. Right here, you may see that the RSI truly sloped greater from November by means of December, whereas the value was making its new low into January. That is an ideal illustration of draw back pattern exhaustion within the type of a bullish momentum divergence.

Now, look to the appropriate of the chart and you may see the bearish model of this divergence enjoying out. Larger costs with a decrease momentum studying recommend probably upward exhaustion and draw back rotation for AMZN.

Remember the fact that, in each circumstances, these shares are in well-established uptrends. As my visitor Mary Ann Bartels shared on The Last Bar this week, these shares have room to drag again, however nonetheless be thought of in a long-term uptrend. I do not disagree with that evaluation, and I might argue there’s loads of room for draw back within the 10-15% vary on many main names. I might additionally say that I do not essentially really feel the necessity to take part in that draw back transfer if I can keep away from it!

That brings me to probably the most regarding chart of all, the S&P 500 index itself.

The S&P 500 made greater highs in mid-June by means of the 4th of July vacation, though it trended decrease over this timeframe. It’s possible you’ll discover the same sample in November 2021, which supplied a key warning season main into the tip of 2021.

In 2021, in fact, the S&P 500 made one last gasp greater, which created a bigger bearish momentum divergence utilizing the November 2021 and January 2022 highs.

Might July 2023 find yourself being similar to December 2021, with a pullback to an ascending 50-day transferring common earlier than a push to new swing highs? Completely. And it is value noting that, with all of those divergences, there are upward-sloping 50-day transferring averages that might function a perfect help degree in a pullback section.

However my key takeaway, for now, is that the uptrend section is most probably exhausted, and to arrange for draw back assessments of key help ranges.

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any means characterize the views or opinions of every other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders reduce behavioral biases by means of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor resolution making in his weblog, The Conscious Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing danger by means of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to establish funding alternatives and enrich relationships between advisors and shoppers.

Study Extra