Publish Views:

6,590

In my a number of conversations with buyers throughout the bull-run since 2014, there was nobody who stated that I can’t reap the benefits of investing in fairness when the market will crash. In good occasions i.e. when the market valuations are often very excessive, everybody agrees to the logic of shopping for low and promoting excessive. However apparently, only a few implement this technique. As an alternative, the bulk have a tendency to take a position when markets are going increased and better, getting costly and creates a possible for important draw back threat. They comply with the herd, take selections based mostly on feelings and throw logic out of the window by succumbing to the psychological stress of witnessing rising market ranges and from the actions taken by their friends.

Investing is straightforward however not simple. A number of the main errors which individuals commit in an overvalued market are:

1. Investing with out understanding the market cycle. Click on right here to learn our weblog on market cycles

2. Not figuring out how one can worth belongings. You’ll be able to examine Worth vs. Worth by clicking right here. Shopping for the very best of companies at flawed costs may develop into a nasty funding.

3. Not understanding the function & significance of tactical asset allocation (obese debt in euphoric occasions and obese fairness in a time of acute pessimism) in creating superior returns over the long run.

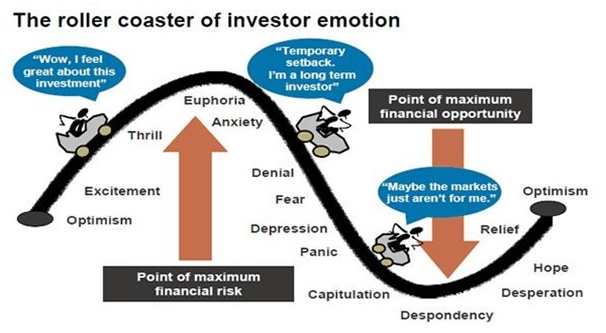

I’m a pupil of the market cycles. One factor could be very clear to me. Like we expertise good days and dangerous days in our lives, markets additionally expertise good occasions and dangerous occasions. Market value actions are the apt manifestation of collective human feelings. I wish to reproduce one in every of my favorite diagrams – market sentiment cycle.

There had been many market cycles of increase and bust up to now and plenty of will comply with sooner or later. Each time the explanations for the flip in market cycles are completely different and are surprising however comply with the identical behavioral template. These cycles are inevitable and no mortal on earth has the facility to completely cease it from occurring. Though, that may be delayed because it was performed by the International Central banks by pumping within the big sum of money at any time when markets gave the impression to be on the brink of correction. Folks in energy may delay the larger stability sheet drawback by flooding the market with low-cost cash however didn’t know that the unseen micro enemy will assault the revenue assertion by paralyzing the financial actions. Regardless of pondering that every thing is underneath our management, repeatedly we’re jolted by such occasions that remind us that we’re simply fallible people and weak in entrance of the desire of nature. It’s nature’s manner of humbling us down.

Now a few of chances are you’ll say that no person predicted {that a} virus named Covid-19 will create havoc all around the globe, so it was not attainable to be ready for such a threat. Precisely my level – the true threat is one thing that we can’t foresee a lot upfront, all of the identified dangers get already discounted and provisioned for. That’s why the margin of security precept ought to by no means be forgotten. It merely states that the long run is unsure and unknown, due to this fact, the investments needs to be made on the costs equal to or decrease than the long run honest valuations. This precept, which is on the coronary heart of worth investing, ensures that any unexpected threat that would set off a meltdown is not going to lead to a major draw back to the portfolio. Those that had adopted the precept of the margin of security, like us, are sitting fairly on money and equivalents. Having short-sightedness whereas investing or enjoying the momentum recreation may develop into a really harmful proposition.

Google Search tendencies for the Coronavirus. No person noticed it coming in an enormous manner until January-February 2020:

We’re, nevertheless, lucky to have shoppers who understood our worth investing strategy, saved their belief in our technique, understood the advantage of endurance and follow us once we remained conservative whereas the markets had been exhibiting indicators of euphoria. We had been sustaining 0-35% large-cap fairness allocation (relying on threat urge for food and time of funding) in all of the portfolios underneath our administration over the past two years on account of our evaluation of being within the late stage of the market cycle that was additionally mirrored within the costly fairness costs. We efficiently averted the carnage in mid & small cap in 2018-19 by exiting from all such schemes at the start of 2018 and likewise bought benefitted from taking respectable publicity in gold a yr in the past when it was buying and selling at INR 32,000-34,000 unit costs. Whereas benchmark Sensex is down by greater than 25% in the final one yr, our portfolios returns are within the vary of 0% to five%.

After a pointy fall, the margin of security has considerably gone up i.e. draw back threat potential has drastically decreased. Benchmark PE ratios have additionally come nearer to their long run averages. Now’s the time to make use of the supply created in debt mutual funds to regularly shift to fairness. The utmost draw back available in the market on account of Corona and the anticipated affect on the economic system could possibly be as a lot as 25%-30% from the present ranges. Please notice, it’s the most draw back in our evaluation and never very sure to occur. Since, no person can catch the underside, we have to regularly and strategically take increased fairness publicity, inside a restrict of most tactical allocation based mostly on our respective threat profile, because the market goes via a downward (sentimental) cyclical development. It will be certain that our common shopping for is at cheaper costs (with a excessive margin of security). So when the market cycle will inevitably flip up once more, which may take a couple of months to some years, we’d have set a powerful basis for excellent returns sooner or later.

By mere memorizing what Warren Buffet stated, “Be grasping when others are fearful and be fearful when others are grasping” received’t make you wealthier except you implement this saying in spirit. In occasions (and alternatives) like these which come as soon as in a decade, it takes braveness, sanity of thoughts and endurance to generate excellent returns in the long run.

Please take all mandatory precautions to remain secure and wholesome. We as a human race have come out of the tough occasions attributable to world wars, international pandemics and main monetary crises up to now and have solely progressed in the long run. This unlucky time upon us shall cross too.

Truemind Capital is a SEBI Registered Funding Administration & Private Finance Advisory platform. You’ll be able to write to us at join@truemindcapital.com or name us on 9999505324.