Keep in mind all of the hype from central bankers final yr and earlier this yr about how they needed to get ‘forward of the curve’ with their rate of interest hikes simply in case wage calls for escalated and inflationary expectatinos turned ‘unanchored’. Over the past 18 months, I persistently famous in numerous weblog posts that this was all a ruse to create a smokescreen to justify the unjustifiable price rises – on condition that the inflationary pressures had been virtually all coming from the availability facet and people forces had been short-term and abating. Nicely now, the mainstream, having pushed for the speed rises and obtained their method are actually backtracking to take care of their credibility by claiming there are not any wage-price dynamics in sight. It’s a dystopia.

The frenzy of the rate of interest hike lemmings

The pressures for the rate of interest hikes had been mounting even earlier than the inflationary pressures emerged.

I’ve famous earlier than that the cheer leaders for the hikes had been the economists in funding banks or tutorial economists within the thrall of the monetary markets.

These characters are frequently wheeled out on monetary stories on TV and within the written media and held out as ‘professional commentators’.

The general public hasn’t a clue and thinks a swimsuit is a swimsuit – somebody to be listened to as a result of clearly they know what they’re on about.

Most listeners or readers fail to work out that these fits are, in truth, simply boosters for his or her companies – who acquire extra income in an surroundings of accelerating rates of interest.

The central bankers, a lot of who’ve the revolving door aspiration to maneuver into the non-public monetary markets on spectacular salaries when their time period within the public establishments ends, had been underneath fixed strain from these boosters and finally succumbed.

Solely the Financial institution of Japan, among the many giant, superior nations have resisted the pressures – to their credit score.

And you’ll be aware that the mainstream press hardly check with what’s going on in Japan on this regard, on condition that it’s diametrically against the rate of interest hike lot.

After all, the central bankers needed to create a smokescreen for the rate of interest hikes.

They may hardly inform the general public that they had been succumbing to the gamblers and rewarding their short-selling bets with huge income.

So, the New Keynesian framework is completely suited to this operate.

In any case, it says that:

1. Low unemployment will result in nominal wage pressures that may instigate a wage-price spiral and so unemployment have to be pushed up till the inflation is quelled (the hoary previous NAIRU story).

2. Worth expectations will begin accelerating and develop into self-fulfilling and drive the inflationary course of unbiased of the state of the financial system (the hoardy previous ‘unachoring’ story).

So final yr and into this yr, statements from central bankers frequently claimed that they had been shifting quick on rates of interest to make sure that wage pressures and/or inflationary expectations didn’t develop into issues.

After all, there was no strong information proof to help these fears as I’ve persistently identified.

However it’s a case of say the identical factor sufficient instances in sufficient locations and other people begin to suppose there’s something there.

The opposite level is that central bankers have egos and solely a restricted set of instruments with which they will show their ‘worth’.

So after a interval of low charges and a reemergence of fiscal dominance, folks needed to be asking – what do central bankers do to justify their big salaries?

Pushing up rates of interest allowed these characters to renew the centre of consideration and big their egos.

Nicely, now the charges are up the narrative is altering

In his weblog publish, which accompanied the discharge of the Spring IMF World Financial Outlook (April 11, 2023) – International Financial Restoration Endures however the Street Is Getting Rocky – the IMF boss wrote:

Ought to we fear concerning the danger of an uncontrolled wage-price spiral? At this level, I stay unconvinced. Nominal wage positive factors proceed to lag worth will increase, implying a decline in actual wages. Considerably paradoxically, that is taking place whereas labor demand could be very robust, with companies posting many vacancies, and whereas labor provide stays weak — many employees haven’t totally rejoined the labor drive after the pandemic.

So, no wage-price spiral.

The opposite fascinating facet of this quote was his virtually disbelief that there wouldn’t be such a spiral – “considerably paradoxically”!

There is no such thing as a paradox to an Trendy Financial Principle (MMT) economist as a result of what the mainstream interpret as being a labour market that’s under the NAIRU – that’s, past full employment – is in our eyes a market that continues to function with extra provide – that’s, not near full employment.

They maintain claiming Australia is past full employment however presently there are 9.7 per cent of prepared and accessible employees both unemployed or underemployed.

Final week (April 20, 2023), the ECB launched the minutes for the – Assembly of 15-16 March 2023 – the place we learn the next:

Though pipeline pressures had been weakening, they remained substantial. Wage pressures had strengthened, supported by strong labour markets and staff aiming to recoup a few of the buying energy misplaced owing to excessive inflation. Furthermore, many companies had been capable of increase their revenue margins in sectors confronted with constrained provide and resurgent demand. The evolution of income in contrast with that of wages urged that wages had had solely a restricted affect on inflation over the previous two years and that the rise in income had been considerably extra dynamic than that in wages. An vital query for the forecasting of inflation was whether or not companies would proceed with the identical pricing technique or would settle for decrease revenue margins within the interval forward.

So:

1. Revenue gouging – “increase their revenue margins” … “improve in income had been considerably extra dynamic that that in wages”.

2. Wages progress not driving the inflationary pressures.

The purpose that’s not appreciated by the financial commentariat is that rising nominal wages in an inflationary surroundings shouldn’t be

taken as an indicator of an rising wage-spiral.

I’ve famous many instances that it’s arduous to envisage a wage-price spiral turning into a driving drive after an inflationary provide shock if actual wages are being systematically reduce, which is the state of affairs everywhere in the world at current.

See under for the IMF tackle that time.

When you settle for these findings then it turns into even tougher to justify rising rates of interest within the present surroundings.

I’ve defined beforehand that the logic of rate of interest hikes is partly primarily based on the necessity to transfer unemployment as much as quell wage pressures.

If there are not any wage pressures driving the inflation then that justification lapses and the intent to create unemployment is simply malicious irresponsibility.

Relatedly, the prioritisation of financial coverage modifications in an inflationary surroundings relies on assessments that spending in the true financial system is outstripping the availability capability, normally in a progress surroundings.

It’s troublesome to use that logic to a state of affairs the place the availability capability is artificially and quickly constrained (by Covid and many others) and is more likely to restore to pre-pandemic ranges quickly sufficient.

However that time apart, central financial institution economists assemble all types of financial indicators to evaluate the state of the true financial system – capability utilisation charges, unemployment and underemployment charges, wage actions, and many others.

Usually their interpretation of those indicators is colored by the ideological biases within the lens they use.

However that additionally apart, economists know that actions in share markets should not significantly ‘related’ to actions in the true financial system.

The character of economic hypothesis creates a disconnect it that regard.

So it’s slightly extraordinary that the ECB cites an statement that “broad inventory indices had remained rather more resilient than financial institution shares, because the share costs of non-financial companies had been affected solely reasonably” as an indicator of the stae of the euro macro financial system.

That is the final word sop.

IMF finds wage-price spirals are uncommon and unlikely within the present state of affairs

On November 11, 2022, the IMF launched a working paper – Wage-Worth Spirals: What’s the Historic Proof? – which sought to find out the frequency of wage-price spirals previously.

They had been motivated by claims by the likes of Olivier Blanchard and others about:

… a possible wage-price spiral, with rising inflation and tight labor markets prompting employees to demand nominal wage will increase that catch-up to and even exceed inflation.

Blanchard, Summers and their ilk get a disproportionate privilege within the public debate but are not often appropriate.

They’ve been monumentally incorrect previously and the errors have price unusual folks jobs, incomes and worse.

Keep in mind the fiasco in regards to the IMF’s horrible errors within the crafting of the austerity program accompanying the Greek bailouts in the course of the GFC, which elicited a uncommon ‘mea culpa’ from them when Blanchard was the chief economist.

With all of the scaremongering concerning the probability of a wage-price spiral being unleashed, the researchers sought to see how typically they’ve truly occurred previously.

The conclusion: not typically.

Whereas the precise idea is slightly imprecise, they discovered that:

1. “the good majority of the episodes recognized on this method are not adopted by a sustained acceleration in wages and costs, with just a few exceptions. As an alternative, inflation and nominal wage progress tended to stabilize within the following quarters, leaving actual wage progress broadly unchanged.”

2. On the uncommon events they do happen, Wage-price spiraling dynamics seem to have brief lives”.

3. When it comes to historic episodes just like the “present macroeconomic state of affairs” the inflation declined “whereas nominal wage progress elevated thus permitting actual wages to catch up … Acceleration of nominal wages ought to subsequently not be seen as an indication {that a} sustained wage-price spiral is essentially taking maintain. Certainly, historical past signifies that nominal wages can speed up whereas inflation recedes from its excessive ranges.”

Expectations

On April 10, 2023, the Federal Reserve Financial institution of New York printed their newest – Survey of Shopper Expectations (March 2023) – which exhibits that whereas there was a small uptick in short-term inflationary expectations in March, whereas on the 5-year horizon, they’ve “decreased barely”.

The pattern throughout the horizons is firmly downwards.

Right here is the graph for the one- and three-year forward inflation expectations collection.

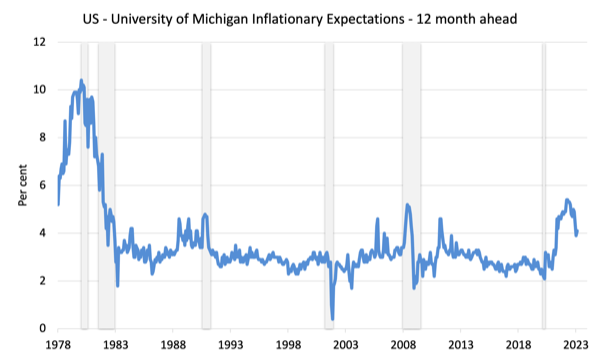

And what concerning the College of Michigan Inflation Expectation – information, which is proven within the following graph?

The gray bars are the NBER recession dates.

The Michigan information exhibits that that the one-year forward expectation peaked at 5.4 per cent in April 2022 and has been in pattern decline ever since.

This was the month that the Federal Reserve began climbing as a result of it mentioned it feared these expectations would rise.

Additionally examine the present state of affairs with the expertise of the late Nineteen Seventies, simply after the second OPEC oil worth shock,

The decline again to the decrease regular anticipated inflation within the 1979s took a number of years not months, as seems to be taking place this time round as provide constraints ease.

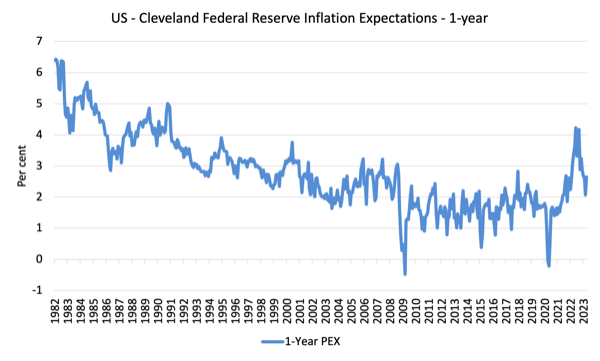

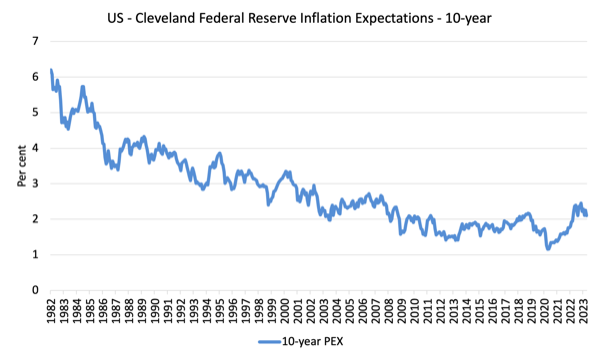

The Federal Reserve Financial institution of Cleveland additionally gives an inflationary expectations collection again to January 1982.

The latest Cleveland Federal Reserve – Inflation Expectations – information, launched April 12, 2023, exhibits that inflationary expectations throughout all time horizons are in decline.

1. The 1-year forward anticipated inflation price peaked at 4.23 per cent in June 2022 and is now at 2.64 per cent.

2. The ten-year anticipated inflation price peaked at 2.4 per cent in June 2022 and is now at 2.10 per cent.

Listed below are graphs for the 1-year and 10-year expectations from the Cleveland mannequin, respectively.

The information exhibits that inflationary expectations throughout all time horizons are in decline.

The query you must ask is with all this data pointing fairly definitively to the absence of a wage-price spiral and/or an de-anchoring of worth expectations, why have central bankers in continued to hike rates of interest, particularly when essentially the most direct measure of the state of affairs – the precise inflation price – has been abating for months in most jurisdictions.

New Podcast – Episode 5, April 21, 2023

I’ve simply launched a brand new podcast episode – Episode 5 – the place I invite listeners to get a pencil and paper out and do some arithmetic with me.

I assume the function of the federal government and the listener represents the non-government or residents.

The train demonstrates that the imposition of a binding tax legal responsibility motivates the residents to provide their labour to the federal government in return for its forex.

And, in doing so, the residents clear up the issue that the tax legal responsibility presents – that’s, the place do they get the forex from!

The corollary that arises is that it’s the spending that creates the capability to pay taxes slightly than the fictional view that it’s the taxes that fund the federal government spending.

That’s sufficient for at present!

(c) Copyright 2023 William Mitchell. All Rights Reserved.