When you desire particular person shares and ETFs for brief or long-term buying and selling, funding analysis instruments like Ziggma will help you discover the very best shares on your portfolio.

Ziggma gives in-depth analysis by way of a free inventory screener and portfolio tracker. The platform additionally has a number of premium instruments, together with proprietary inventory rankings, a portfolio simulator, and backtests.

Our Ziggma overview checks out the varied options of this inventory evaluation device so you may determine if it deserves a spot in your funding toolkit.

Desk of Contents

- What Is Ziggma?

- How To Use Ziggma

- Ziggma Inventory Screener

- Portfolio Tracker

- Portfolio Analyzer

- Inventory Evaluation

- Ziggma Rating

- Portfolio Simulator

- Portfolio Again Check

- Funding Concepts

- Large Board

- How A lot Does Ziggma Price?

- Ziggma Professionals and Cons

- Ziggma Alternate options

- Ought to Traders Use Ziggma?

What Is Ziggma?

Ziggma is a multi-faceted inventory and ETF analysis device with over 20,000 customers and $1 billion in linked accounts.

Informal buyers will recognize the free inventory screening and portfolio monitoring instruments that may present extra particulars than a fundamental on-line search, to not point out most on-line brokers. The free membership additionally doles out the propriety Ziggma Rating for shares, Local weather Scores, and a dividend tracker.

Whereas this service doesn’t present month-to-month inventory picks like an funding e-newsletter, a paid membership ($9.90/month or $89/yr, after a 7-day free trial) consists of the Prime 50 Inventory Checklist, guru, and mannequin portfolios you glean funding concepts from. There may be additionally a hands-on portfolio simulator and backtesting to attempt completely different methods.

How To Use Ziggma

Ziggma’s analysis platform is straightforward to make use of and gives in-depth basic and technical information. You’ll be able to hyperlink your funding accounts utilizing Plaid to view your each day stability, historic efficiency, and scores on your present holdings.

You’ll be able to create a digital portfolio if you happen to don’t need to hyperlink your accounts or desire to paper commerce. There are numerous tabs and drop-down menus to entry the varied analysis instruments we’re highlighting under.

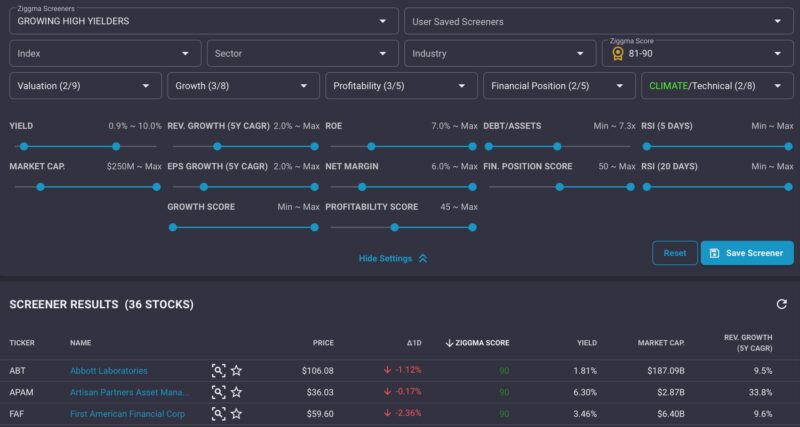

Ziggma Inventory Screener

All customers can make the most of the in-depth inventory screener to filter by way of an expansive listing of shares and ETFs. There are a number of customizable filters you may make use of to slim down your search outcomes. It’s additionally attainable to make use of premade screens and save DIY screens.

The screener filters embrace the next:

- Index

- Sector

- Trade

- Ziggma Rating

- Valuation (9 metrics)

- Progress (8 metrics)

- Profitability (5 metrics)

- Monetary Place (5 metrics)

- Local weather/Technical (8 metrics)

Premium members also can kind outcomes through general rating for a selected class, similar to progress or valuation.

There’s a slider bar to decide on the minimal and most standards for the varied progress, profitability, valuation, monetary place, and technical indicators. Any securities that go the display screen seem in a listing under.

Different inventory screeners present extra filters, however this one is detailed sufficient to fulfill most merchants.

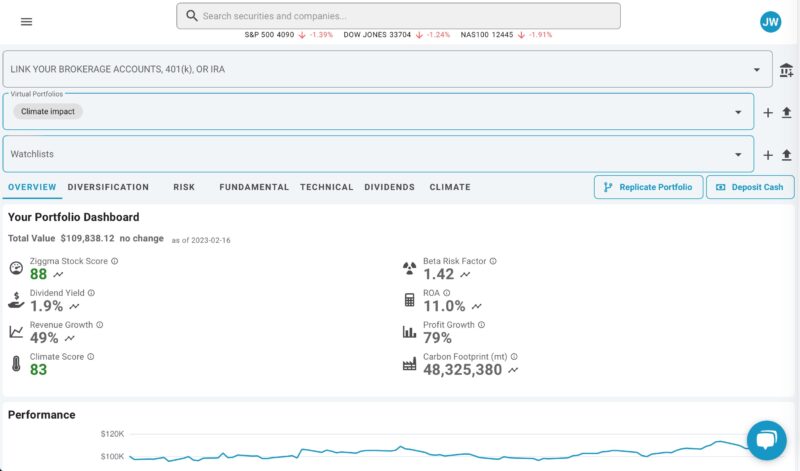

Portfolio Tracker

The portfolio tracker makes it straightforward to trace the efficiency and key efficiency indicators (KPIs) of your holdings. As well as, it’s attainable to hyperlink a number of brokerage accounts to see your asset efficiency and portfolio weight in a single place.

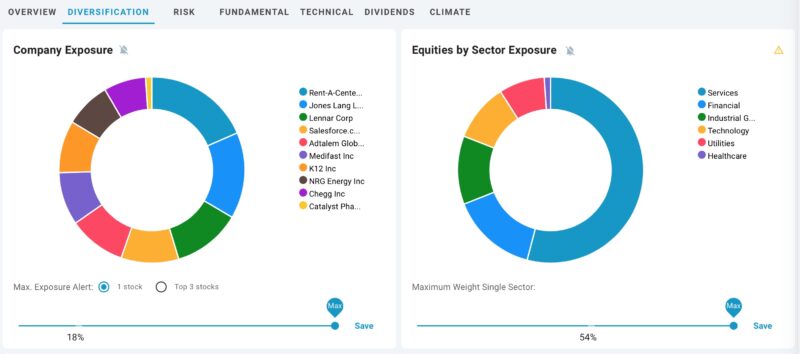

You may as well view in-depth scores for these components:

- Diversification

- Danger

- Elementary

- Technical

- Dividends

- Local weather

Ziggma goes into considerably extra depth than a barebones free investing app like Robinhood, M1 Finance, or Public, which make it straightforward to take a position however are restricted with regards to analysis and account monitoring.

Traders preferring fundamentals over technical information ought to discover this platform fascinating. Dividend buyers will recognize the colourful graphs, which make it simpler to challenge your portfolio dividend yield and monitor current funds.

Portfolio Analyzer

Along with monitoring your funding efficiency, Ziggma will help consider your asset allocation and portfolio threat. You gained’t obtain personalised insights as with another analyzers, however you may examine your portfolio from a number of completely different viewpoints.

The platform gives observations, and you may hover your mouse icon over a yellow triangle to view the potential warning. For instance, Ziggma will let you recognize which sectors your portfolio doesn’t have publicity to.

Premium members can schedule Sensible Alerts for conditions like:

- A single place exceeds a selected proportion of your portfolio allocation

- Portfolio drift from a sector or asset class

- A inventory trades at a selected worth

- An asset’s PE ratio or dividend yield adjustments

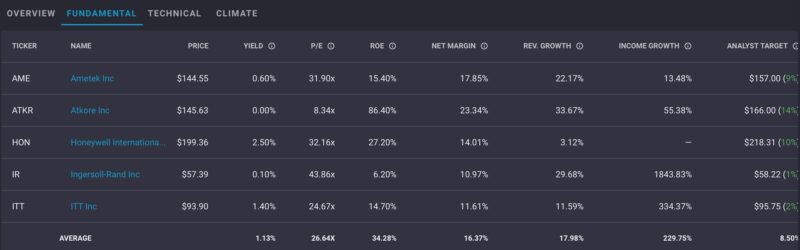

Elementary Metrics

You’ll be able to rapidly consider an organization’s monetary well being utilizing the basic KPIs. These readings will help you establish how the share worth pertains to the P/E ratio and profitability metrics.

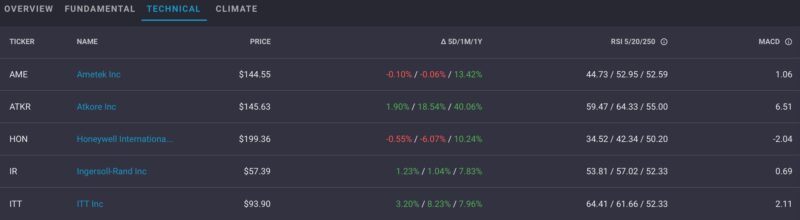

Technical Evaluation

The upfront technical indicators allow you to rapidly see the current worth efficiency, RSI studying, and MACD. These metrics will help you determine if the inventory is overbought, oversold, or market impartial and whether or not it may be in an uptrend or downtrend.

You may as well use interactive inventory charts for in-depth technical evaluation when inspecting a single inventory.

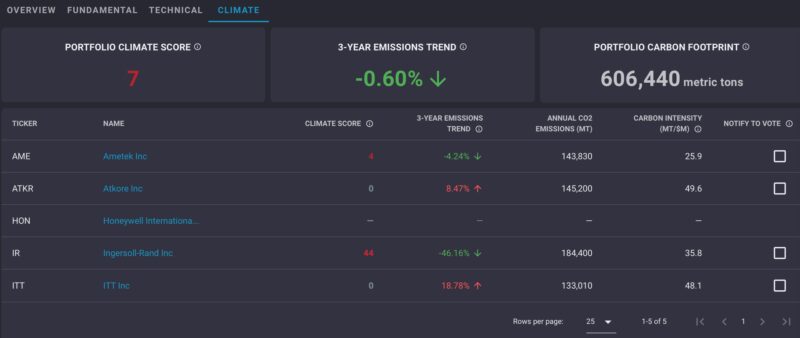

Local weather Rating

Ziggma locations a noticeable emphasis on an organization’s environmental influence. You’ll be able to view the present rating and three-year emissions development on your portfolio and particular person shares.

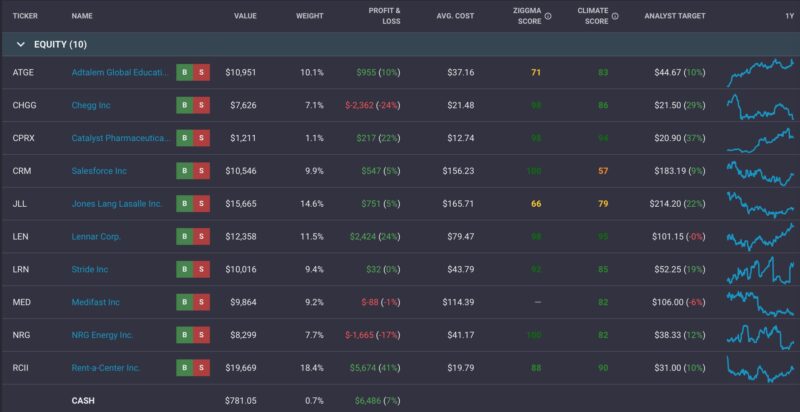

Inventory Evaluation

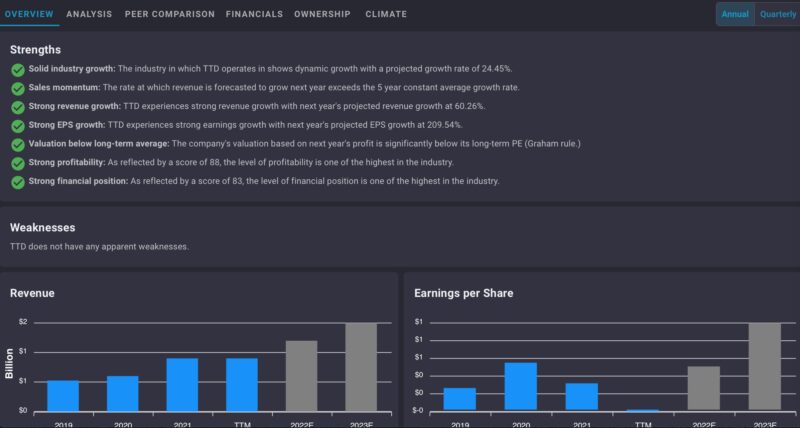

You’ll be able to dig deeper into any publicly-traded inventory or ETF to view its historic efficiency and key efficiency indicators. Most equities have a Ziggma Rating that may rapidly summarize the way it compares towards their friends, however you can even view the underlying information.

There may be additionally an interactive worth chart powered by TradingView, so you may add indicators if you happen to like studying inventory charts.

In-Depth Evaluation

Ziggma’s evaluation device permits you to analysis in-depth statistics for these classes:

- Overview: Firm strengths and weaknesses and monetary charts

- Evaluation: Ziggma Rating metrics of progress, valuation, profitability, stability sheet liquidity

- Valuation: Steadiness sheet metrics similar to revenue assertion and money move assertion

- Possession: Insider shopping for and promoting transactions

- Local weather: Local weather Rating, carbon depth, and comparability to friends

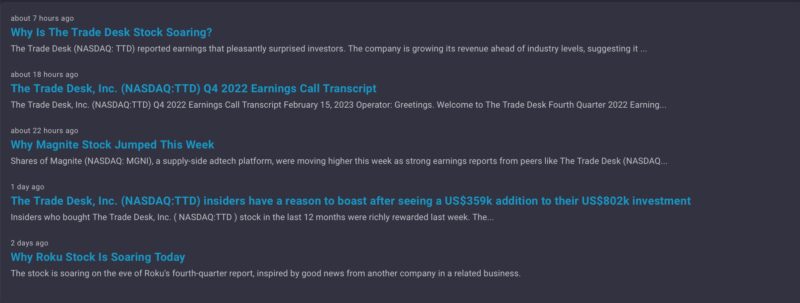

Funding Information

Ziggma additionally aggregates information article hyperlinks for the belongings you’re researching. It’s a useful device however isn’t as strong as the opposite evaluation instruments. As well as, you don’t obtain entry to analyst studies.

Ziggma Rating

A number of inventory analysis instruments have a proprietary rating to charge an fairness’s present funding potential. The Ziggma Inventory Rating makes use of institutional-grade metrics in these classes to generate a score:

- Progress

- Profitability

- Valuation

- Monetary well being

A rating nearer to 100 signifies a more healthy inventory.

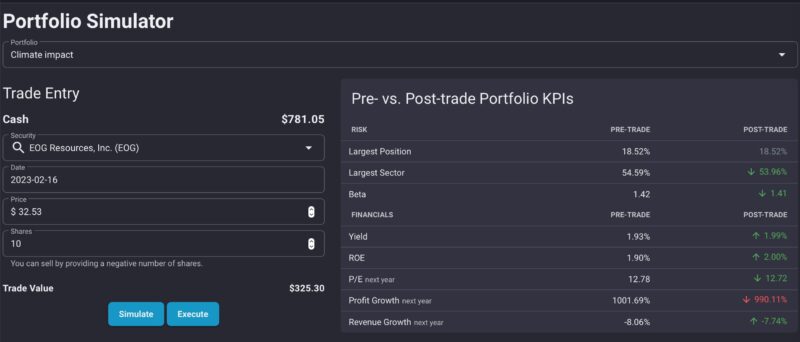

Portfolio Simulator

Earlier than shopping for inventory, you may see how the commerce will change your portfolio make-up. The fast comparability enables you to view your publicity to the biggest place and sector. You’re capable of estimate the yield and different financials too.

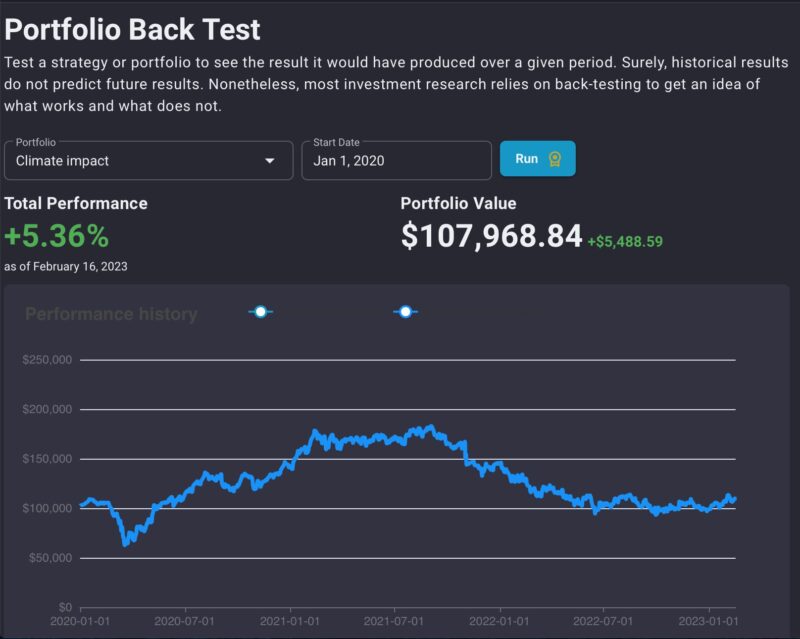

Portfolio Again Check

You’ll be able to consider how your digital portfolio would have carried out over a selected interval utilizing Ziggma’s Portfolio Again Check function. It gained’t predict future efficiency, however you may see how a technique would fare had you pursued it sooner or throughout a selected market state of affairs.

Funding Concepts

As talked about, Ziggma doesn’t present inventory picks like a inventory e-newsletter, however premium members can entry mannequin portfolios and guru portfolios to search out many funding concepts at an reasonably priced worth.

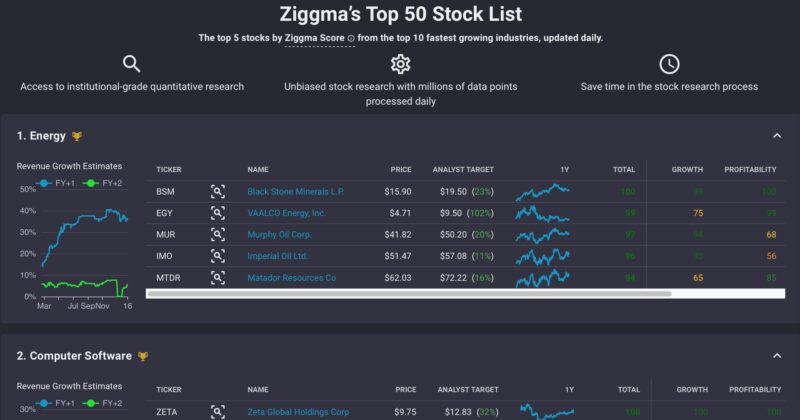

Prime 50 Inventory Checklist

The Ziggma Prime 50 Inventory Checklist ranks 5 shares within the ten fastest-growing industries each day. This device generally is a time-saving sidekick to the inventory screener whenever you’re on the lookout for the very best shares to purchase now.

Mannequin Portfolios

Ziggma has a number of thematic portfolios that monitor shares and funds for a selected technique. A few of them embrace:

- 60/40 Local weather Impression Portfolio

- Greatest-In-Class REITs

- Progress on Excessive Margins

- Sustainable Excessive Yield

- Extremely-Worthwhile and Fortress Steadiness Sheet

You may as well use the inventory screener to search out firms inside a portfolio to analysis additional.

Guru Portfolios

You may as well monitor the efficiency and create a portfolio based mostly on in style hedge funds, similar to:

- Berkshire Hathaway (Warren Buffett)

- Bridgewater (Ray Dalio)

- Greenlight (David Einhorn)

- Pershing Sq. (Invoice Ackman)

- Trian (Nelson Peltz)

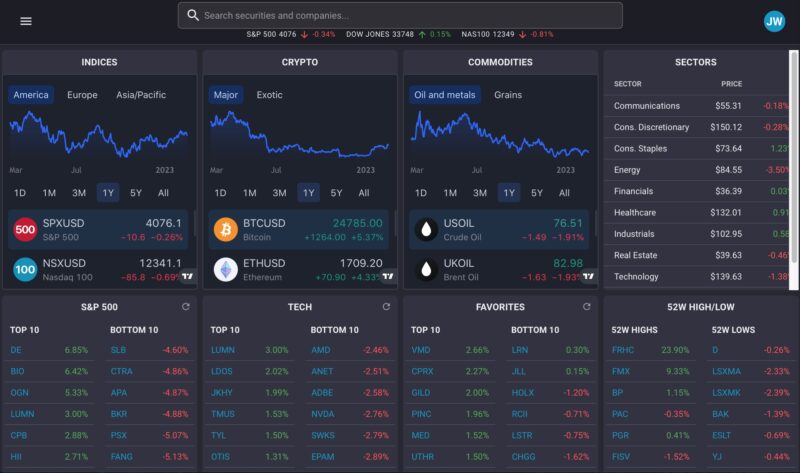

Large Board

The Large Board function shows the highest 10 and worst 10 performing shares by index and sector. This function is obtainable to all members and is a sensible various to warmth maps that some screeners use.

How A lot Does Ziggma Price?

Most Ziggma options are free, however a paid subscription is required to entry each indicator and portfolio analyzer device. Additional, the Prime 50 inventory listing and premade portfolios are unique to premium members.

Ziggma Free

The free plan is adequate if you need a screener and funding tracker and don’t want all the additional information or mannequin portfolios.

All customers can entry these options:

- Portfolio tracker

- Inventory and ETF screener

- Inventory scores

- Local weather scores

- Monetary information

- Large Board

- Market information

Ziggma Premium

A paid subscription prices $9.90 month-to-month or $89 when billed yearly ($7.42/month). You’ll be able to take pleasure in a seven-day free trial earlier than paying for the service.

The Premium options embrace:

- Full entry to Ziggma Rating

- Prime 50 Inventory Checklist

- Mannequin portfolios

- Guru portfolios

- Portfolio simulator

- Again-testing

- Sensible Alerts

- Save search screens

Ziggma Professionals and Cons

When you’re unhappy with the analysis instruments provided by your on-line brokerage account, Ziggma affords loads of useful free instruments. Right here is my listing of Ziggma’s execs and cons.

Professionals

- Loads of free analysis and monitoring instruments

- Portfolio simulator and backtesting

- Hyperlinks to most brokerage accounts

- Plenty of basic information

- Prime 50 inventory listing and mannequin portfolios

Cons

- Can not immediately commerce throughout the platform

- Doesn’t present inventory picks or personalised steerage

- Different inventory screeners might have extra filters

Ziggma Alternate options

Earlier than signing up with Ziggma, it doesn’t damage to take a look at the competitors. The next inventory analysis platforms can be efficient find funding concepts and monitoring your portfolio efficiency.

Inventory Rover

Inventory Rover is without doubt one of the greatest inventory screeners because it covers most shares and ETFs with thorough basic evaluation. Its free plan is nice for fundamental screens, and a number of other completely different paid plans unlock numerous analysis instruments and mannequin portfolios. For extra particulars, learn our Inventory Rover Evaluate.

Study Extra About Inventory Rover

Looking for Alpha

Take into account Looking for Alpha if you happen to desire studying analyst commentary, as most shares and funds have bullish and bearish articles. You may as well entry comparable basic and technical information in the course of the analysis course of. The Looking for Alpha score is much like the Ziggma Rating system for proprietary rankings much like what funding establishments apply to shares.

Looking for Alpha additionally has a sturdy portfolio tracker and inventory screener. Nevertheless, the free model is considerably restricted and solely good if you happen to plan to analysis a few month-to-month shares. For extra data, try our full Looking for Alpha Evaluate.

Study Extra About Looking for Alpha

TipRanks

Whereas Ziggma gives a lot of information, TipRanks gives extra and is a greater match for merchants and people counting on technical evaluation. You’ll be able to observe shares and obtain updates when analysis corporations alter their purchase, promote, or maintain rankings.

Sadly, there isn’t a free plan, though there are two paid plans. The entry-level Premium plan prices $30 monthly, which is expensive, however you may entry extra skilled opinions and information metrics. Study extra in our TipRanks Evaluate.

Ought to Traders Use Ziggma?

Ziggma affords the most effective free inventory screeners, and its analysis instruments are additionally beneficial in case your on-line brokerage doesn’t supply in-depth basic and technical metrics. This service can be useful you probably have a number of funding accounts and need to monitor your general efficiency and asset allocation simply.

Upgrading to the paid plan is value it whenever you need to dig deeper into the Ziggma Rating components, entry the Prime 50 Inventory Checklist and mannequin portfolios, or save your inventory screens. The premium plan can be needed for the portfolio simulator and back-tests.

This service isn’t the very best match if you happen to like studying analyst studies for bullish and bearish viewpoints, as Ziggma solely presents the analysis information. That mentioned, you will discover out about firms’ strengths and weaknesses, and the Ziggma Rating will help you determine if a inventory or ETF is trending in the suitable path.

Ziggma

Strengths

- Loads of free analysis and monitoring instruments

- Portfolio simulator and again testing

- Hyperlinks to most brokerage accounts

- Plenty of basic information

- Prime 50 inventory listing and mannequin portfolios

Weaknesses

- Can not immediately commerce throughout the platform

- Doesn’t present inventory picks or personalised steerage

- Different inventory screeners might have extra filters