The Federal Reserve’s financial coverage committee raised the federal funds goal fee by 25 foundation factors on the conclusion of its Could assembly. Though the communication from the Fed didn’t explicitly point out that they’re finished tightening, language used of their assertion alerts the Fed is transferring towards a extra data-dependent posture, albeit one which retains a hawkish bias. The Fed faces competing dangers: elevated however trending decrease inflation mixed with rising dangers to the banking system and macroeconomic slowing. Chair Powell has beforehand famous that near-term uncertainty is excessive on account of these dangers.

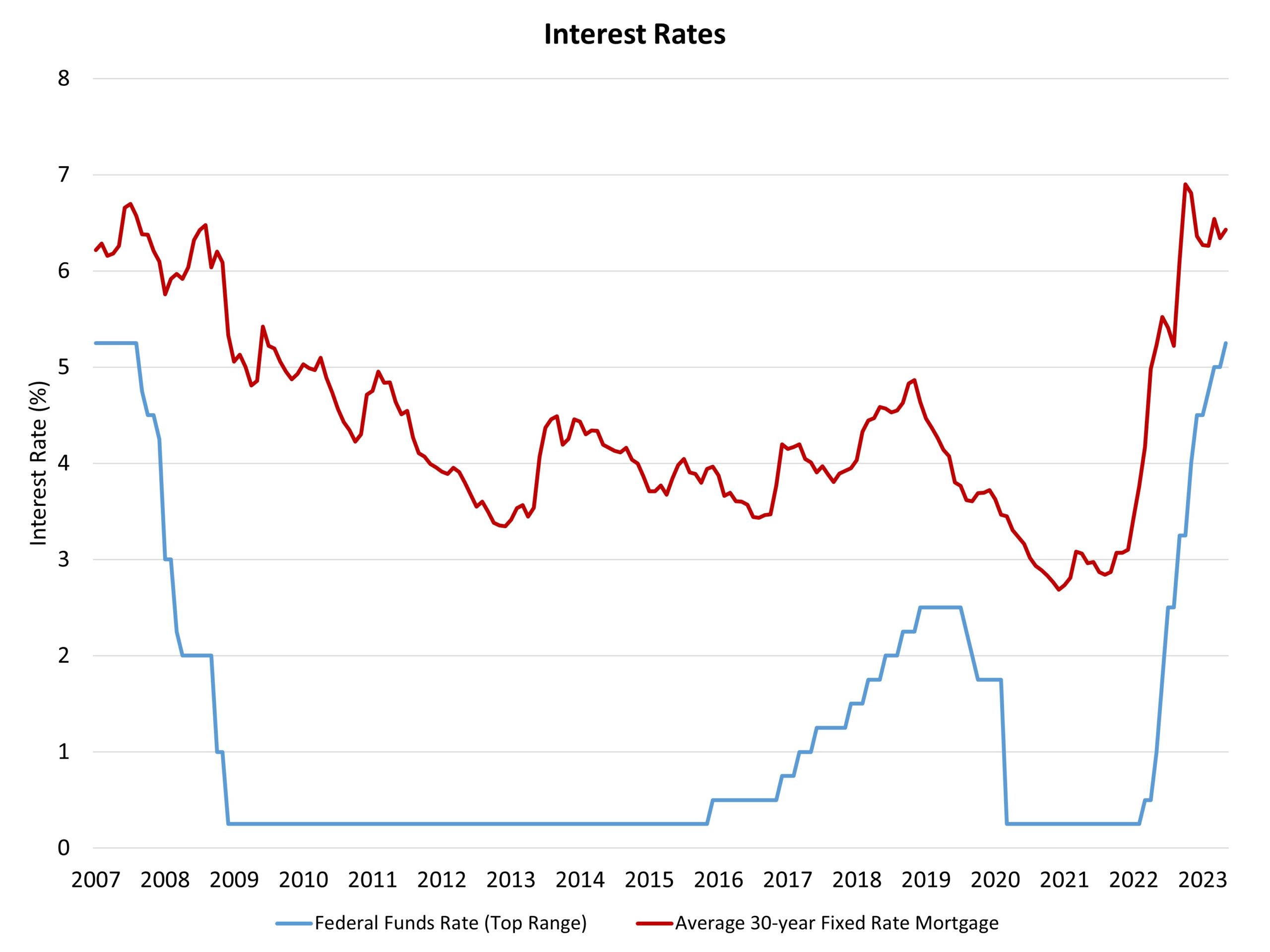

Immediately’s improve of the fed funds fee moved that concentrate on to an higher fee of 5.25%, the quickest improve for charges in many years. The Fed famous: “The Committee will carefully monitor incoming data and assess the implications for financial coverage. In figuring out the extent to which further coverage firming could also be acceptable to return inflation to 2 p.c over time, the Committee will consider the cumulative tightening of financial coverage, the lags with which financial coverage impacts financial exercise and inflation, and financial and monetary developments.” Whereas not express, this language represents a pivot to a extra data-dependent stance. Beforehand, the Fed had asserted that further fee hikes can be required, it was solely a matter of how massive.

Nonetheless, the Fed left room to proceed fee hikes, if wanted. The Fed asserted: “The Committee is strongly dedicated to returning inflation to its 2 p.c goal.” In addition they acknowledged: “The Committee can be ready to regulate the stance of financial coverage as acceptable if dangers emerge that might impede the attainment of the Committee’s targets.” This implies the bias for the Fed leans to the hawkish aspect if information counsel that inflation isn’t persevering with to pattern decrease.

Nonetheless, ongoing challenges for regional banks, in addition to sector weak spot in actual property and manufacturing symbolize warning alerts for the Fed. Actually, the dangers for smaller banks will end in tighter credit score situations, which can gradual the financial system and scale back inflation. Thus, these monetary challenges act as further surrogate fee hikes by way of tightening credit score availability, doing a few of the work for the Fed.

Warning would counsel the Fed pause and consider situations within the coming months. As we famous with the discharge of the March NAHB/Wells Fargo Housing Market Index, the well being of the regional and neighborhood financial institution system is essential to the provision of builder and developer financing, for for-sale, for-rent and reasonably priced housing development. We anticipate these situations to tighten and can proceed to observe lending situations by way of NAHB trade surveys.

Understand that roughly 40% of total inflation is generated from shelter inflation, which might solely be tamed by further reasonably priced attainable housing provide. Greater charges for developer and development loans transfer the ball within the fallacious route with respect to this goal. Furthermore, monetary market stress has elevated the unfold between the 10-year Treasury fee and the standard 30-year mounted fee mortgage. Final week, the unfold widened to virtually 300 foundation factors once more, which is nicely above normalized ranges.

Trying ahead, the bond market seems to expect the Fed to chop charges throughout the second half of the 12 months. Nonetheless, this runs counter to communication from Fed management, who’ve recommended that increased charges want to stay in place over an extended time period to efficiently convey inflation decrease. Certainly, the NAHB forecast doesn’t embody any Fed fee cuts till 2024.

Associated