The tax season is over for most individuals however in case you used TurboTax downloaded software program, don’t uninstall it simply but.

I confirmed in earlier posts some unwelcoming options in TurboTax that you could be wish to decide out of — underpayment penalty and estimated tax cost vouchers. Mockingly, TurboTax downloaded software program additionally has a really helpful function hidden deep inside. You must know methods to dig it out.

Undertaking Taxes for Present Yr

It’s known as the What-If Worksheet. After you’re performed along with your earlier yr’s taxes, you utilize the What-If Worksheet to undertaking your taxes for the present yr. It additionally makes it simple to match totally different eventualities.

The concept of the What-If Worksheet is that you could create various eventualities and see how your taxes will change.

What in case you earn extra earnings?

What in case your earnings drops?

What in case you tackle a mortgage?

What in case you promote some investments and notice capital features?

What in case you convert some IRA cash to Roth AND you promote some investments with a capital loss?

The What-If Worksheet is just accessible in TurboTax downloaded software program. It’s not in its on-line software program. It’s another excuse to use TurboTax downloaded software program, not the web software program. So far as I do know, solely TurboTax has it. H&R Block doesn’t have it. Neither does FreeTaxUSA.

Plan for Roth Conversion

I’ll present you methods to plan for Roth conversion with this Work-If Worksheet in TurboTax by the identical instance I used within the earlier submit Roth Conversion with Social Safety and Medicare IRMAA.

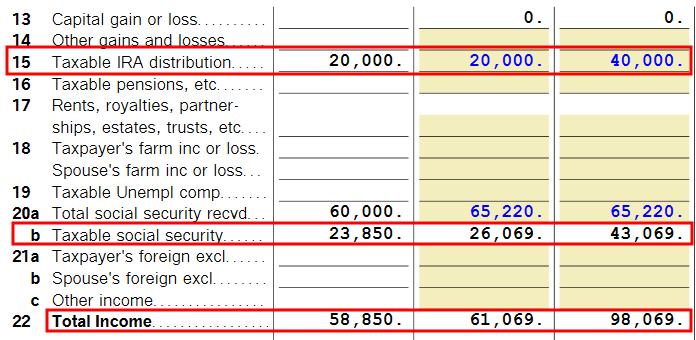

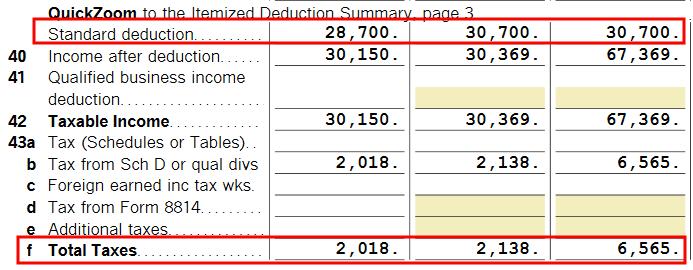

A retired couple, each age 66, Florida residents, married submitting collectively with no dependents. They stay on $60,000 of Social Safety advantages, $20,000 of Conventional IRA withdrawals, $5,000 of curiosity earnings, and $10,000 of certified dividends. They haven’t any different earnings or deductions. Each of them enrolled in Medicare Half B and Half D.

TurboTax reveals that this couple with $95,000 of earnings paid $2,018 in federal earnings tax. That’s solely 2% of their earnings. They’re taken with doing a Roth conversion subsequent yr to make the most of their low tax fee.

Discover What-If Worksheet

For some odd causes, TurboTax doesn’t promote this vastly helpful What-If Worksheet. You’ll must know that it exists and actually search for it.

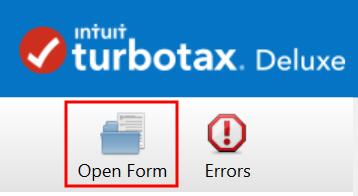

Click on on Types on the highest proper in TurboTax downloaded software program after which click on on the Open Kind button.

This opens a pop-up window. Sort “what” or “what-if” within the search field. Double-click on the “What-If Worksheet” within the search outcomes to open it.

Create a Baseline

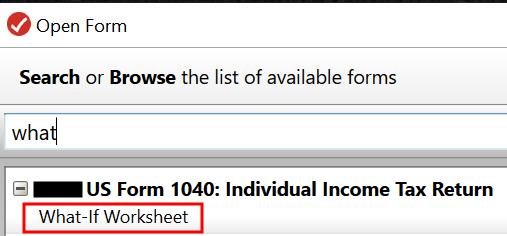

The What-If Worksheet has 4 columns. Column 1 is auto-populated with information out of your tax return. Columns 2 to 4 are used for tax planning.

First, you create a baseline for the present yr. Checking the field “Copy column 1 to column 2” beneath “Copy columns” copies your tax return for final yr to Column 2. Checking the field “Verify field to make use of XXXX tax charges” beneath Column 2 applies the present yr’s tax brackets. You can provide it a brief identify equivalent to “Baseline.”

Change the numbers beneath Column 2 with what you already know can be totally different this yr. For instance, you realize you’ll earn extra curiosity as a result of rates of interest have gone up, you realize you’ll have much less in dividends since you offered some investments final yr, your Social Safety advantages will go up due to COLA, and many others.

Column 2 is your greatest guess of your present yr’s taxes earlier than you’re taking any deliberate actions.

Take a look at Alternate options

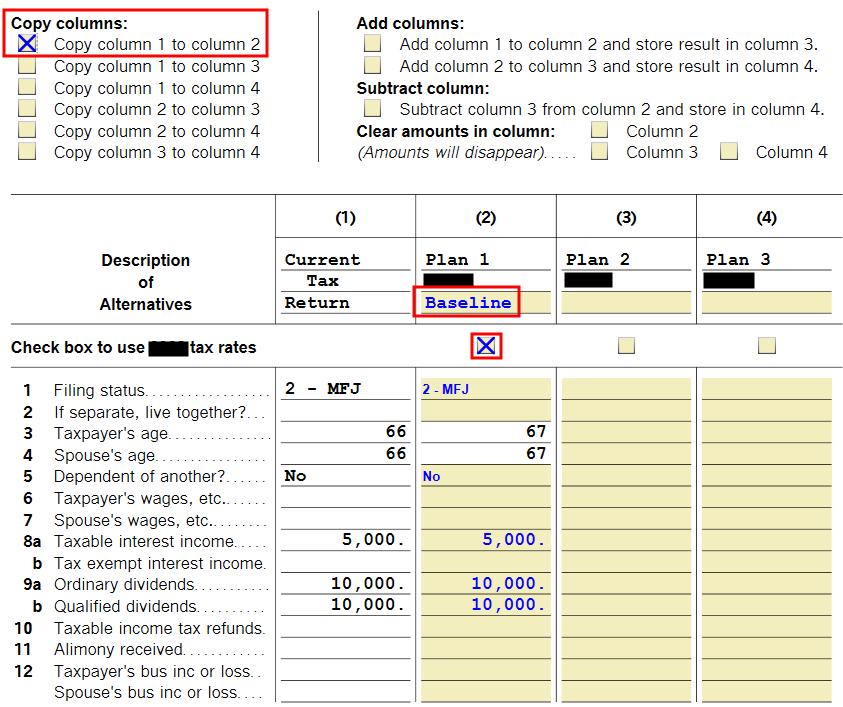

After you create baseline for the present yr, suppose you wish to see how changing $20,000 out of your Conventional IRA to Roth will have an effect on your taxes.

Copy Column 2 to Column 3 by checking the field beneath “Copy columns.” Verify the field to make use of the present yr’s tax brackets once more. Give it a brief description equivalent to “Convert $20k.”

Scroll all the way down to the road for taxable IRA distribution and lift the quantity by $20,000 from the baseline in Column 2 to your various state of affairs in Column 3.

The What-If Worksheet reveals this extra earnings will enhance the taxable quantity of the Social Safety advantages for this couple within the instance by $17,000. Along with the $20,000 Roth conversion, the AGI will enhance by $37,000.

Scroll down additional. The What-If Worksheet reveals that changing $20,000 to Roth will enhance the full tax from $2,138 within the baseline to $6,565. That’s a distinction of $4,427, which interprets into $4,427 / $20,000 = 22% common marginal tax fee on changing $20k.

Now you’ll be able to resolve whether or not paying a 22% tax to transform $20,000 is value it. Do it in case you suppose your future tax fee can be increased than 22%. Don’t do it in case you suppose your future tax fee can be decrease than 22%.

If you happen to’d like to check one other various, equivalent to changing $50k, repeat the above to repeat the baseline in Column 2 to Column 4 and enhance the IRA withdrawal by $50k in Column 4. Calculate the distinction in whole tax and the common marginal tax fee once you convert $50k.

Case Research Spreadsheet

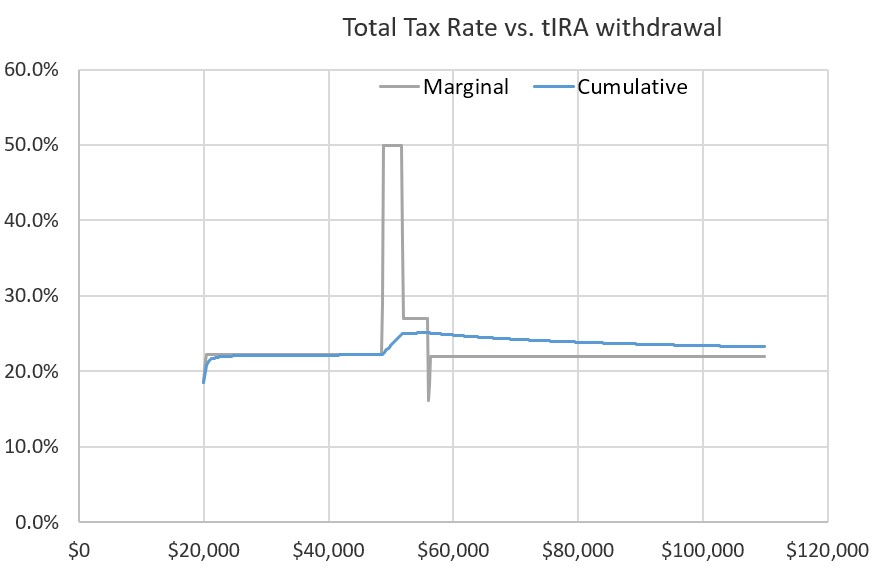

The Case Research Spreadsheet within the earlier submit reveals the identical impact for changing $20k on this identical instance.

The chart from the Case Research Spreadsheet reveals that rising the IRA withdrawal from $20k to $40k produces a 22% marginal tax fee. It additionally reveals that this identical marginal tax fee continues earlier than hitting a spike when the IRA withdrawal reaches $45k (changing $25k to Roth on high of a $20k withdrawal).

The What-If Worksheet in TurboTax doesn’t present the marginal tax fee instantly. You must calculate it your self by dividing the distinction in whole tax by the conversion quantity. Nor does it present the marginal tax fee for various conversion quantities in a chart. You don’t know the place it could hit a spike. You’d must do trial-and-error with totally different inputs: $20k is OK, what about $30k; $50k is just too excessive, what about $40k, …

It additionally solely reveals the distinction in federal earnings tax. It doesn’t embody the impact on state earnings tax or Medicare IRMAA. The Case Research Worksheet contains each the state earnings tax and Medicare IRMAA.

The What-If Worksheet in TurboTax is simpler to make use of although. TurboTax already has your tax information. You don’t have to search out the suitable locations to enter them in a spreadsheet. You don’t must learn to use a spreadsheet if that sounds intimidating.

Skilled Software program

I’ve heard nice reward for knowledgeable tax planning software program known as Holistiplan. Many monetary advisors use it to do tax planning for his or her purchasers. I watched a demo of Holistiplan on YouTube:

Holistiplan makes use of the identical method because the What-If Worksheet in TurboTax.

- Copy information from the tax return for the earlier yr to the present yr.

- Make recognized modifications to create a baseline.

- Copy the baseline to an alternate state of affairs.

- Make modifications to the choice state of affairs and evaluate it with the baseline.

It additionally produces a chart of the marginal tax fee much like the Case Research Spreadsheet.

If you happen to go to a monetary advisor for the sort of planning, it could value you $1,000 or extra. After you utilize TurboTax downloaded software program to file your taxes, you have already got the What-If Worksheet in TurboTax for tax planning estimates. It doesn’t present a chart or embody the impact on state tax or Medicare IRMAA however it will get you 80% there. Use the Case Research Spreadsheet if you wish to get near 100%.

Say No To Administration Charges

In case you are paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Discover ways to discover an unbiased advisor, pay for recommendation, and solely the recommendation.