As we speak, I’ve received a handful of bullish inventory charts on your ChartLists subsequent week, the significance of which begins with the above desk. Yow will discover this Sector Abstract desk up to date day by day at www.marketgauge.com/sectors.

For those who had been watching the market final week, it in all probability did not really feel cal or uneventful. Nonetheless, as you may see from the “5-day” column highlighted within the Sector Abstract desk above, the outcome was comparatively unchanged in most sectors.

One notable sample, additionally highlighted, is that the highest three sectors primarily based on six-month p.c change had been additionally the higher performers for the week and on Friday. Likewise, the worst-performing sectors for the week are additionally the worst performers over the past six months and year-to-date. This sample of the comparatively strongest teams or shares persevering with to outperform whereas the laggards proceed to lag is a well known tendency of the market that we exploit in a number of of our buying and selling techniques.

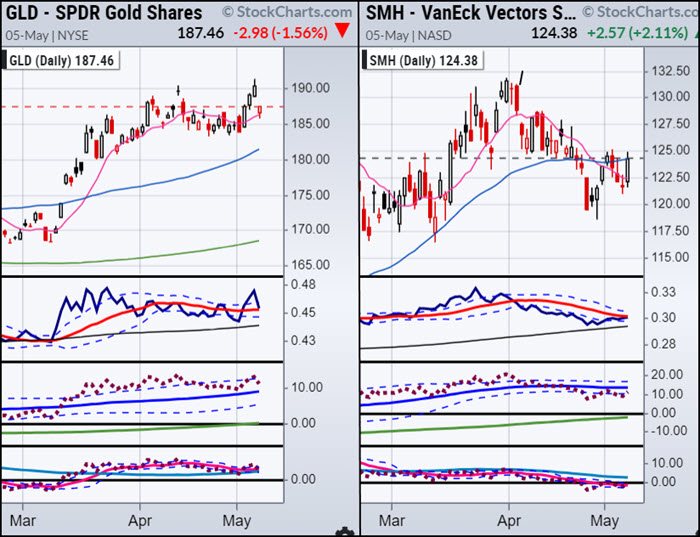

In latest Mish’s Day by day articles, I’ve instructed that gold was poised to maneuver larger, and the VanEck Vectors Semiconductor ETF (SMH) was weak and more likely to break beneath its 50-day transferring common and decline.

Main as much as the employment report on Friday, SPDR Gold Shares ETF (GLD) was rallying, and SMH was rolling over. Nonetheless, the report instructed that the financial system was stronger than anticipated, which pushed the inventory indexes and the semiconductor sector (SMH) larger. If it trades again over $125, its sample will flip bullish.

On the identical time, GLD gapped down on Friday, then rallied although out the day. Is the hole down in gold a dip to purchase or a major high? Will SMH break larger?

In each instances, a transfer over Friday’s excessive could be a superb purpose to have a look at lengthy trades within the ETFs or in main shares of their respective teams.

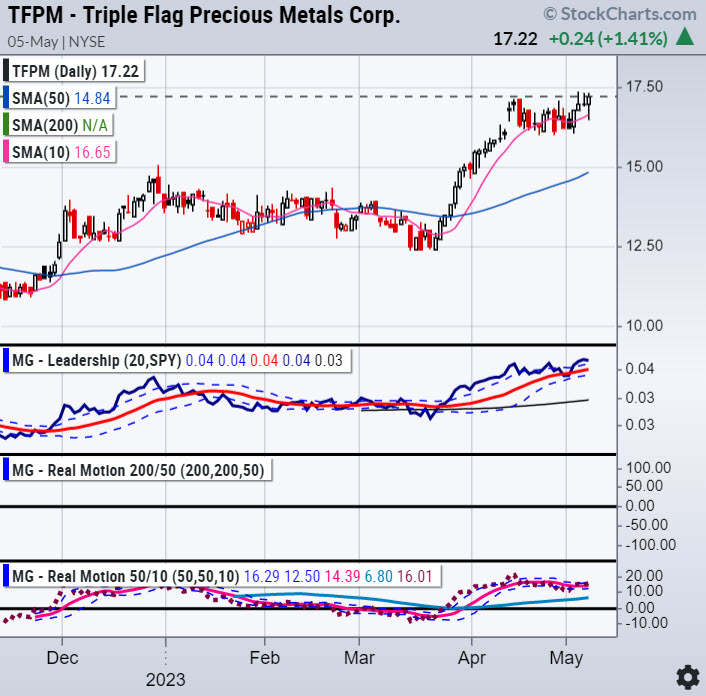

Listed below are a number of gold shares which have bullish patterns.

These shares are in bullish patterns so long as they keep over their 10-day transferring common (purple line).

Listed below are some bullish semiconductor shares.

Warning: The semiconductor group is dangerous. It nonetheless must commerce larger to substantiate the resumption of its bullish development. If any of those shares or the SMH commerce beneath final week’s low, it might be very bearish. Nonetheless, if QQQ breaks out and SMH breaks over $125, these shares could possibly be market leaders.

For extra detailed buying and selling details about our blended fashions, instruments and dealer schooling programs, contact Rob Quinn, our Chief Technique Guide, to be taught extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-Guide in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for day by day morning movies. To see up to date media clips, click on right here.

Mish explains why Grandma Retail (XRT) might develop into our new main indicator on the Might 4th version of Your Day by day 5.

Mish and Dave Keller talk about why Mish believes that yields will peak in Might, what to anticipate subsequent in gold, and extra in this in-studio look on StockCharts TV’s The Closing Bar!

Mish discusses the FOMC and which inventory she’s shopping for, and when on Enterprise First AM.

Mish covers technique for SPY, QQQ, and IWM.

Mish and Nicole Petallides talk about cycles, stagflation, commodities and a few inventory picks on this look on TD Ameritrade.

Mish talks motion pictures and streaming shares with Angela Miles on Enterprise First AM.

Mish and Charles talk about zooming out, stagflation and picks outperforming shares on this look on Making Cash with Charles Payne.

Everyone knows at this level how tough the market has been with the entire various opinions concerning recession, inflation, stagflation, the market’s going to come back again, the market’s going to break down – advert nauseam. What concerning the folks caught in the midst of a spread certain market? Mish presents her high decisions for shorts and longs on the Friday, April 21 version of StockCharts TV’s Your Day by day 5.

Mish and Benzinga talk about the present buying and selling ranges and what would possibly break them.

Mish discusses what she’ll be speaking about at The Cash Present, from April 24-26!

Mish walks you thru technical evaluation of TSLA and market circumstances and presents an motion plan on CMC Markets.

Mish presents two shares to have a look at on this look on Enterprise First AM — one bullish, one bearish.

Mish joins David Keller on the Thursday, Might 13 version of StockCharts TV’s The Closing Bar, the place she shares her charts of excessive yield bonds, semiconductors, gold, and regional banks.

Mish joins Wolf Monetary for this Twitter Areas occasion, the place she and others talk about their experiences as former pit merchants.

Mish shares her views on pure gasoline, crude oil and a collection of ETFs in this look on CMC Markets.

Mish talks what’s subsequent for the financial system on Yahoo! Finance.

Mish joins Bob Lang of Explosive Choices for a particular webinar on what merchants can anticipate in 2023!

Rosanna Prestia of The RO Present chats with Mish about commodities, macro and markets.

- S&P 500 (SPY): 23-month MA 420.

- Russell 2000 (IWM): 170 assist, 180 resistance.

- Dow (DIA): Over the 23-month MA-only index.

- Nasdaq (QQQ): 329 the 23-month MA.

- Regional banks (KRE): 43 now pivotal resistance.

- Semiconductors (SMH): 246 the 23-month MA.

- Transportation (IYT): 202-240 greatest vary to observe.

- Biotechnology (IBB): 121-135 vary to observe from month-to-month charts.

- Retail (XRT): 56-75 buying and selling vary to interrupt a technique or one other.

Geoff Bysshe

MarketGauge.com

President

Geoff Bysshe is the co-founder and President of MarketGauge.com. For practically 20 years, he is developed buying and selling merchandise, providers, methods and techniques whereas additionally serving as a buying and selling mentor for MarketGauge prospects. He additionally offers common commentary and buying and selling instruction within the MarketGauge weblog. Geoff is a former floor-trader who was a member of the FINEX buying and selling the U.S.

Be taught Extra