Dreaming of an even bigger earnings? It is a shut take a look at what a six determine wage truly seems to be like and what you are able to do to construct wealth. Constructing wealth is the important thing to monetary safety.

What’s the American dream? Many individuals would say it’s to graduate school, personal your individual residence, and make 6 figures a 12 months. Is that this actually the dream that everybody thinks it’s? What does 6 figures a 12 months truly get you?

On this information, I’m going to look carefully at what this earnings provides you. Then, I’ll clarify clearly tips on how to stay a lifetime of abundance even when your wage isn’t 6 figures.

What Is A Six-Determine Earnings?

A wage between $100,000 – $999,999 is taken into account a 6-figure earnings. Something over $200,000 could be thought-about a a number of six-figure earnings. Simply because somebody earns 6 figures doesn’t imply they’re rich. A lot of things play an element in wealth. Let’s dig into these components!

What A Six-Determine Wage Will get You

Are you one of many people who has dreamed about incomes sufficient cash so that you don’t have to fret about your funds ever once more?

Numerous folks assume {that a} increased wage is the reply. They preserve six figures because the excessive and lofty objective for which they all the time intention. If that’s the goal, let’s take a look at what precisely this wage gives you.

If you happen to break it down, a wage of $100,000 per 12 months comes out to a minimal of $8,333 per thirty days. Here’s what that month-to-month and annual wage will get you.

Jobs That Earn Six Figures

The very first thing {that a} six-figure wage will get you is a full-time job. This may grow to be your life – so what sorts of jobs pay this effectively?

Most of these jobs are normally going to incorporate positions like docs, legal professionals, and different specialised careers. They require coaching and schooling.

Listed below are a few of the commonest six-figure careers and the typical earnings they generally pay.

- Anesthesiologist – $292,000

- Dentist – $150,000

- Monetary Supervisor with MBA – $127,000

- Petroleum Engineer – $138,000

- Software program Developer – $105,000

What about jobs that don’t require a university diploma? Sure, you’ll be able to nonetheless earn 6 figures with out scholar mortgage debt!

These are just some of the high-paying jobs that don’t require a level:

- Crane Operator – $500,000 a 12 months in NYC

- Actual Property Dealer — $120,000 a 12 months

- Air Site visitors Controller – $159,000 a 12 months

- Internet Developer – $100,000 per 12 months

- Industrial Pilot – $110,000 per 12 months

Some jobs that pay rather well in some areas (like dental hygienists) don’t require 4-year levels, however they do require an Associates.

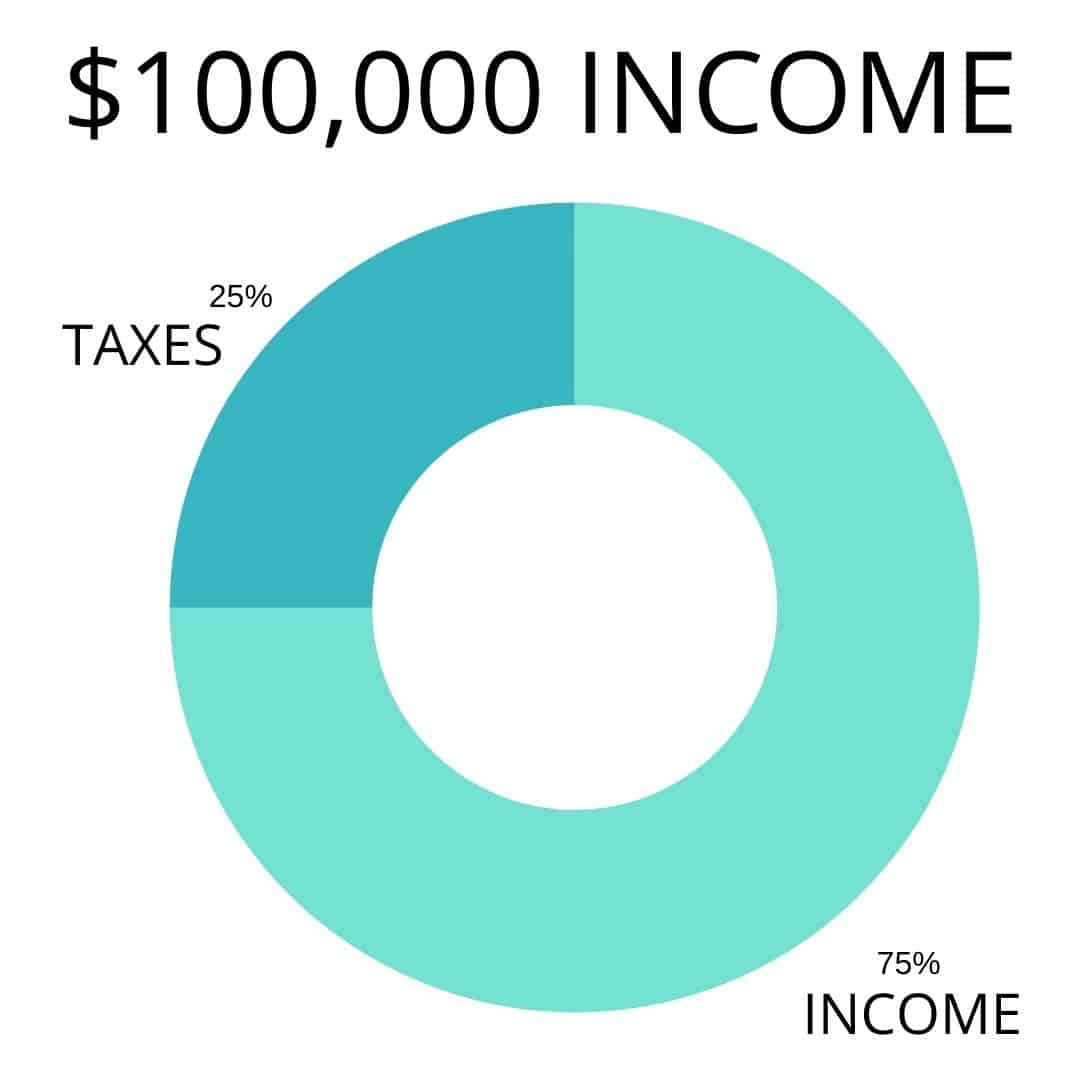

Taxes On Six Determine Wage

One other factor six figures gives you is increased taxes since you’ll be in the next tax bracket now.

Let’s take a look at it nearer. In case your wage is $100,000, then you’re within the 25% tax bracket. Which means your take residence pay is simply $75,000.

This is the reason so many individuals intention for a lot increased than simply $100,000 per 12 months. Primarily, they’ll be capable of truly deliver residence extra money every month after taxes.

The Six Determine Way of life

The life-style is what everybody desires of – and it actually could be enjoyable. With the fitting budgeting, this earnings might offer you entry to completely different houses, automobiles, and journeys.

As enjoyable as this may be, it’s additionally harmful. “Maintaining with the Joneses” is an actual wrestle for some folks.

Attempting to stay in a bigger home, drive a more recent automobile, and purchase the garments that everybody admires all prices cash and will rapidly eat away at your earnings.

This is likely one of the issues that causes even well-paid professionals to stay paycheck to paycheck.

Price Of Dwelling In Effectively-Paying Cities

A superb variety of the roles that pay effectively are situated in large cities. This additionally implies that the price of dwelling in these cities is far increased, in order that earnings will dwindle a lot quicker. You’ll pay increased taxes, a bigger hire or mortgage fee, and extra for meals and different facilities.

Let’s take a look at this nearer.

These are the cities that pay one of the best, together with the typical worth of hire for a 2-bedroom residence.

- Chicago, Illinois – $2,243

- Portland, Oregon – $1,761

- Philadelphia, Pennsylvania – $2,241

- Baltimore, Maryland – $1,812

- Los Angeles, California – $3,091

- Denver, Colorado – $1,867

- Seattle, Washington – $2,950

- New York Metropolis – $3,092

- Washington D.C. – $2,672

What about proudly owning a house? If you happen to purchase a house for round $500,000, you’ll pay about $2,387 per thirty days for the mortgage. This doesn’t even embody property taxes or insurance coverage on the home!

As you’ll be able to see, hire and even mortgages in these cities (and within the suburbs round them) will have an effect on how a lot of your earnings you even have out there to make use of.

Scholar Mortgage Debt

A variety of the roles that may pay you six figures require a university diploma. This school diploma would possibly include scholar mortgage funds each month.

Scholar mortgage debt is likely one of the worst for anybody to disregard. If you happen to don’t pay it, they will garnish your wages and take what you owe out of your earnings tax refund.

How a lot is a scholar mortgage fee? The common American pays about $400 per thirty days for his or her scholar loans. These with grasp’s levels are likely to pay much more towards scholar loans. This quantity is dependent upon the quantity of the loans. Personal schools will go away folks with extra debt than public universities or neighborhood schools.

Investments

Even people who make six figures need to make and follow a price range. In the event that they follow a price range and make investments their extra cash properly, it will probably repay in the long term.

Sensible investments will earn compound curiosity the longer it stays within the account. In truth, some investments even pay out dividends whilst you have them.

Time

Historically, people who earn six-figures find yourself spending extra time working every week and 12 months. With solely 24 hours in a day, all of us have a selection in terms of how we are going to spend that point.

So usually high-earners spend greater than 40 hours every week to earn their six-figure earnings. This time away from residence and household may cause a pressure on somebody’s psychological well being and relationships.

Many individuals who earn six-figures are keen to commerce time for cash by hiring outdoors assist with family duties. Though this would possibly give again private time, it’s additionally growing their month-to-month bills.

How To Construct Wealth With out 6 Figures

The excellent news is, it’s potential to stay the identical sort of financially free life that you just dream of even with out a 6-figure wage. It’s potential to construct wealth and have extra cash for issues like journeys and new purchases in your present earnings.

Right here’s tips on how to make your present life your dream life.

Pay Off Debt

The very first solution to preserve extra of your earnings is to repay your debt as rapidly as potential. The debt snowball technique is the simplest approach to do that.

The debt snowball seems to be like this: you repay your smallest debt first. Then, you are taking the funds you have been making and apply them to your subsequent largest debt. When that’s paid off, you are taking this complete fee and apply it to the following one.

Earlier than you understand it, your debt can be paid off and you’ll have a lot extra money in your price range each month.

It’s a magical and thrilling expertise.

After you repay your money owed, make a plan to not get again into this place once more.

Construct Up Financial savings

One other factor that may show you how to construct wealth is making a wet day financial savings account. That is one thing that you just’ll use to pay for shock bills like a brand new air conditioner or massive engine repairs.

Attempt to save up 2-3 month’s hire. This fashion, if one thing occurs to your job, you’ll nonetheless have cash to pay your payments whilst you search for one other job.

This financial savings account will fund bills that may in any other case derail your funds. You possibly can’t predict the issues that may go unsuitable, however you could be ready to pay for them.

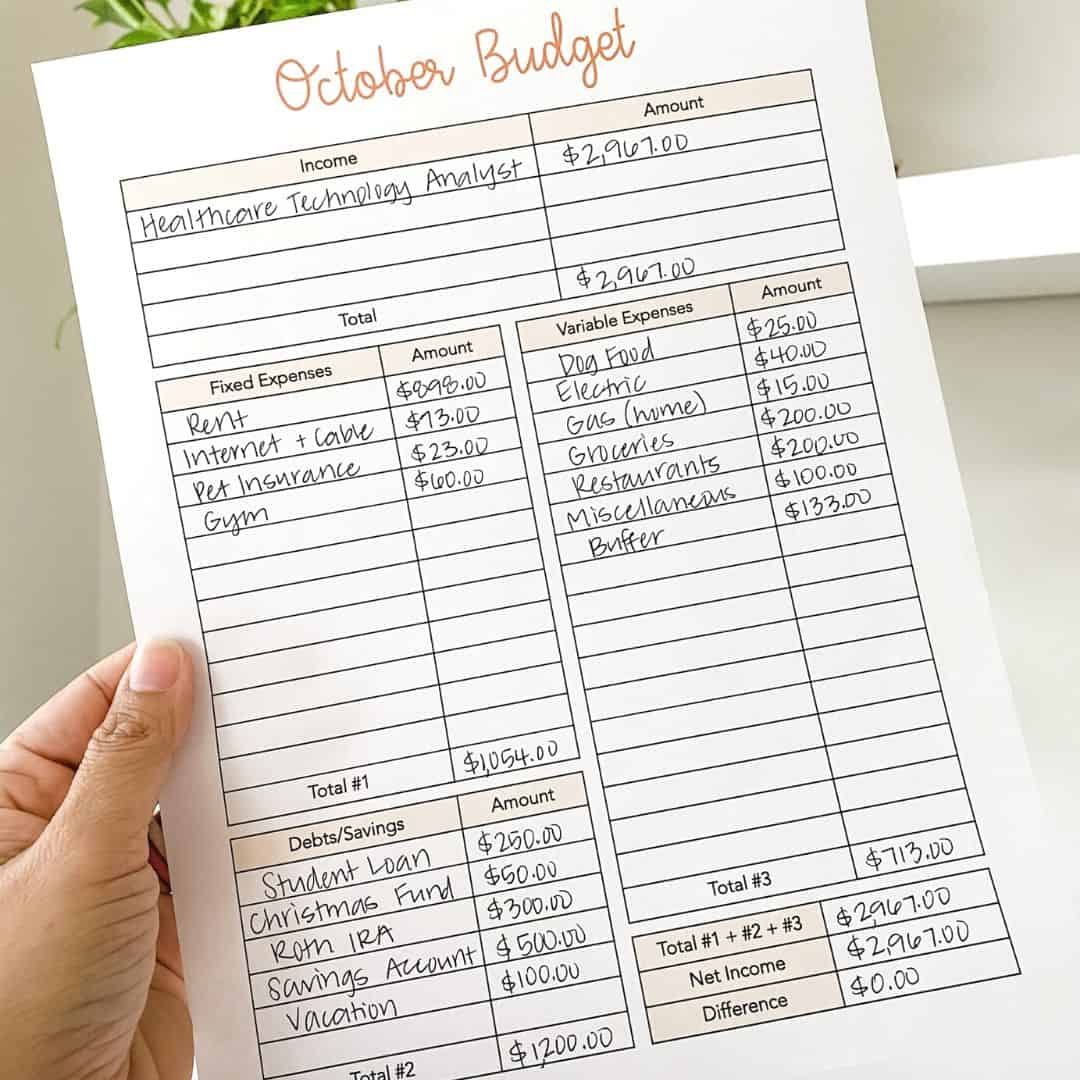

Create A Price range

Everybody, it doesn’t matter what their wage is, advantages from a well-planned price range. While you create a price range, you’re setting your self up for achievement.

This may be so simple as the money envelope system or as advanced as one thing with a price range software program – simply be certain that it suits the best way you take a look at cash.

You’ll know precisely what your bills are and also you’ll be capable of see the place you’ll be able to reduce and make smarter decisions.

A price range will even provide the freedom to know forward of time how lengthy it would take you to avoid wasting up for that enormous dream buy.

If you wish to construct wealth, all of it begins with a price range.

Make investments Correctly

You don’t need to make $200,000 a 12 months to have investments. Speak to an funding skilled and discover good methods to take a position your cash that may repay if you retire.

Investments that earn compounding curiosity are among the best methods to construct wealth. Some folks recommend investing in actual property, others within the inventory market. There are execs and cons to each sort of funding, so it’s essential to speak to somebody you’ll be able to belief.

Even merely investing in your 401K or retirement account is a good way to get began with investing. Don’t wait till you’re older to take a position. Begin younger and begin early!

Get On The Similar Web page With Your Associate

Cash issues are sometimes listed as causes behind divorce in America. It’s no secret that cash seeps into our on a regular basis lives. Merging funds with one other particular person could be very irritating.

By getting on the identical web page along with your partner or accomplice, you’re extra probably to save cash and write a price range that really works. This may show you how to in the long term in terms of paying off debt and constructing wealth.

In case your accomplice is hesitant to get on board with a price range, then begin by merely discussing your loved ones’s targets and desires. What age do you wish to retire? What would you like to have the ability to do or see sooner or later? Would you like to have the ability to take your grandkids or associates on a visit?

Begin the dialog early on in your relationship as a result of it will probably actually prevent cash.

Downsize

Lastly, check out the place you reside and what you drive. Typically by merely downsizing, it can save you some huge cash.

Promoting your own home and shifting right into a smaller one in a distinct neighborhood might imply an enormous distinction in mortgage funds.

Don’t simply downsize your home or automobile, however take a look at your spending habits too. Are there any spending habits that you might curtail a bit?

Each little bit helps. The much less you spend, the extra you’ll save and preserve.

Take Up A Momentary Aspect Hustle

Lastly, if you wish to construct your wealth, take up a brief aspect hustle. Pour the earnings from this aspect hustle into paying off your money owed and build up your financial savings account.

When you find yourself snug financially, you’ll be able to stop this aspect hustle. You’ll have extra time in your arms and sufficient cash constructed up that you just gained’t really feel like it’s a must to work a lot.

Examples of aspect hustles embody:

- Freelance writing

- Canine strolling or Babysitting

- Instacart or Door Sprint

- Digital Assistant

- Freelance Graphic Design

To be taught extra about turning into a digital assistant and making GREAT cash in your spare time, checkout this free guidelines from my pal Abbey to see if it’s best for you.

Be taught To Price range No Matter Your Earnings

Simply since you make six figures doesn’t imply you shouldn’t write a price range. Likewise, in case you don’t make six figures then a price range is for you as effectively!

Studying tips on how to write a price range that may be just right for you and your loved ones could be overwhelming. By signing up for the Free Budgeting and Debt Payoff Cheat Sheet, you’ll be taught step-by-step tips on how to write a price range that may be just right for you so you’ll be able to payoff your debt for good.

Ultimately, you’ll discover ways to get monetary savings, handle your funds higher, and get began on paying off debt. Able to get began? Join under.

Ultimate Ideas on the Six Determine Wage

That dream of incomes six figures a 12 months is a highly regarded one for folks in America. You would possibly assume that with all that cash, you’ll by no means have to fret about budgeting or monetary stress once more.

What would possibly shock you is that even people who earn this wage have to observe their price range. In the event that they don’t, they will even stay paycheck to paycheck.

Be taught to stay inside your means and construct wealth at your present earnings stage. It’s positively potential!