Disclaimer: This isn’t Funding recommendation. PLEASE DO YOUR OWN RESEARCH !!

Abstract:

When you would ask me about probably the most boring inventory of my typically very boring portfolio, I may identify Schaffner Group. I had purchased a primary place again in 2021 throughout my “All Swiss Shares” collection.

Nevertheless, I’ve by no means written a extra detailed write-up despit my annual summaries (2021/2022 , 2022/2023), perhaps becasue I at all times bought bored after I began writing about it ? Over time I added to the place and after the newest 6 months numbers, I made a decision to extend right into a full place. Time to clarify the funding case somewhat bit higher.

- The Firm – Transformation

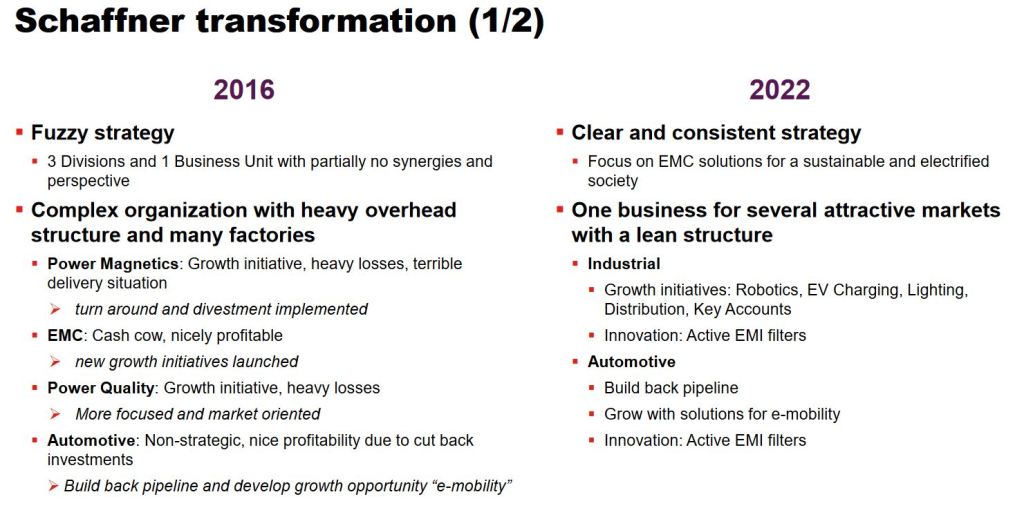

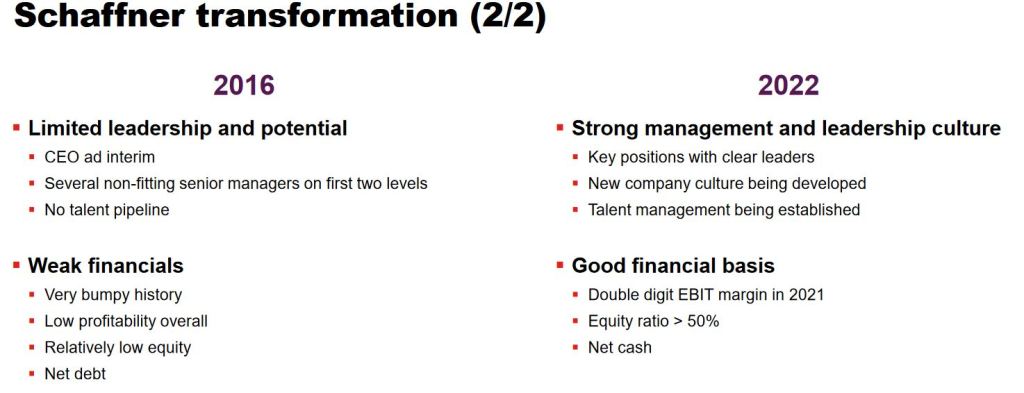

Schaffner Group is a Swiss firm that underwent a major tranformation over the previous few years. Most significantly, they managed to dispose their second largest division “Energy Magnetics” which was loss making in 2021 and give attention to 2 divisions: EMI Filters and Automotive. That is how Schaffner describes their tranformation in a 2022 investor presentation:

For some causes, the final 2 years nonetheless have been “noisy”. In 2020/2021 (Monetary 12 months goes from 01.04 to 31.3.), they needed to guide a (non money) loss for the ability magenitics disposal, in 2021/2022, the Automotive division suffered from the availability chain points within the vehicle trade.

Nevertheless, below this noise, the core division, EMI filters grew steadily. Now, in FY 2022/2023, with a sure restoration of the Automotive section, the true high quality of the enterprise begins to emerge. However extra on this laters.

2. The enterprise & Merchandise

Schaffner has a pleasant graph in one among theri presentation how their merchandise seem like:

These merchandise at first sight are clearly not “horny shopper” merchandise that you simply discover within the grocery store however fairly small, however essential elements for different producers (B2B).

The primary product line of Schaffner are EMI Filters. You will discover an in depth description of those Filters and why they’re wanted as an illustration right here. In a nutshell, {most electrical} equipement requires these filters to be able to forestall electro magnetic interference (EMI) between totally different digital circuits. Though these elements are usually comparatively low worth objects, they normally should be customized made to straight match the particular goal and there are sometimes trade norms that require using these filters.

It appears to be that it is a small however rising trade with just a few gamers and Schaffner appears to have a world market share of round 20-30%. So on this small pond, it’s a fairly huge fish.

Schaffner’s enterprise mannequin is to largely desgin the elements in Switzerland however manufacture them in China and Thailand, in order that they appear to be very competitve on worth.

What I discover most fascinating is the very fact, that there’s structural development on this trade because the elevated electrification means structurally greater calls for for his or her elements. EV charging, semi-conductor manufacturing and heatpumps are just a few areas that Schaffner mentios that at the moment drive development and can so for the foreseeable future.

3. How have issues progressed ?

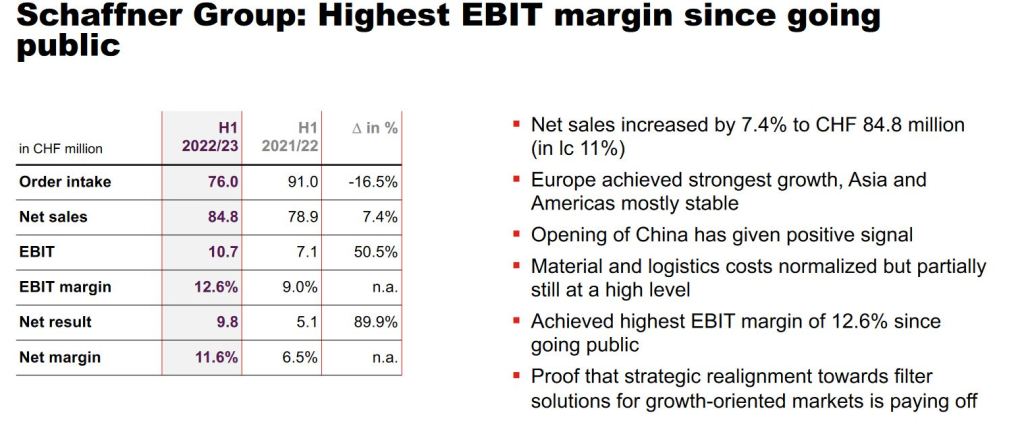

Since I’ve purchased the primary shares, the Industrial division has grown steadily, however as talked about, the Automotive division had some issues. Within the curren monetary 12 months nevertheless issues look good and Schaffner, which communicates usually fairly undertsated bought nearly euphoric:

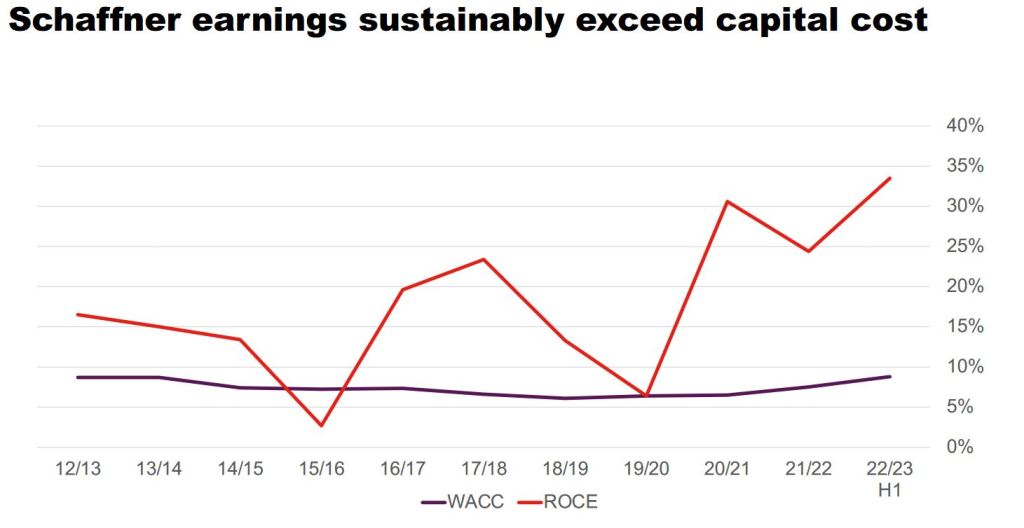

Schaffner had intitially guided mid time period goal of an EBIT-Margin of 10-12% and an natural development charge of 5% p.a., each targets have been surpassed they usually appear to be fairly optimistic for the complete 12 months. That is supported by a really capital environment friendly bsuiness mannequin with reaching 33% ROCE within the first 6M:

4. Valuation

With 631‚069 excellent shares and a share worth of 285 mn CHF, the corporate is valued at ~180 mn CHF. Schaffner has round 8 mn in internet money at 31.03 so this interprets, if we simply double 6M numbers. into an anticipated P/E of 9,2x and EV/EBIT of 8,0 for the present 12 months. Not dangerous for a double digit EBIT margin enterprise with a excessive ROCE and a great probability of first rate development and a rock strong stability sheet. Particularly when considerung {that a} regular Siwss enterprise with this KPIs would simply commerce 50% or dearer.

5. Why is the inventory low-cost ?

I feel there are just a few apparent causes, the primary being a really weak long run observe file which is mirrored in an extremly unispiring long run share worth:

Schaffner right this moment is buying and selling under its IPO worth of 1998 and has oscillated between 100 and 300 CHF for the final 15 years or so. So clearly, buyers don’t appear to be satisfied but, that Schaffner can be on a long run success path.

As well as, the final 2 years have been noisy and just one analyst appears to cowl Schaffner. Liquidity is simply modest, it’s not straightforward for a fund or bigger investor to get out and in rapidly. Schaffner additionally experiences solely twice a 12 months and doesn’t present quarterly updates. Not everybody likes this, i do.

Schaffner additionally has some China publicity and appears to make use of round 300 individuals in China. The bigger manufacturing hub nevertheless appears to be Thailand with 1000 staff.

Final however not least, the enterprise mannequin at first sight shouldn’t be very horny and in addition not straightforward to know.

6. Administration, shareholder construction, different stuff

The most important investor is a monetary investor known as BURU Holding who additionally owns a 20% stake in Kardex, one other prime quality Swiss producer. BURU Holing is run by Philipp Buhofer, a Swiss Investor who appears to play the lengthy recreation and appears to be fairly energetic. Marc Buhofer, clearly a relative, owns one other 3% of Schaffner.

CEO Aeschliman was appointed in 2017. He owns round 2100 shares which is somewhat bit lower than his annual wage, however quantity is rising as a consequence of incentive applications. The incentives are primarily based on EBIT margins, free cashflow and particular person targets, Total I’d charge the mixture of shareholder & Managment nearly as good.

As talked about above, stability sheet high quality is excessive, with 8 mn internet money and no goodwill.

Capital allocation is comparatively clear: They pay out round 40-50% of the revenue in dividends and the remaining will go in the direction of selective M&A.

Possibly one comment with regard to a possible catalyst: I feel there may be none or solely a really small one. The one potential “smooth catalyst” might be a potetnial dividend improve. In the event that they stick with their 40-50% pay out rule, 40% of a possible 20 mn internet revenue in 2022/2023 can be round 12,50 CHF per share, a major improve in comparison with the 9 CHF paid in for the earlier 12 months.

Abstract:

The general case for Schaffner will be summarized fairly simply: One can get a great firm with an excellent enterprise at a wonderful worth.

The mix of a double digit EBIT margin (12%) , double digit natural development, ROCE within the 20-30% and a valuation of ~9x 2023 P/,E for me is an honest wager on the expectation, that the way forward for Schaffner appears higher than the previous.

For me, Schaffner is among the most fascinating circumstances of a standard enterprise that may doubtlessly profit from an extended development pattern in the direction of electrification. Sure, it’s a trunaround, however in contrast as an illustration to Meier & Tobler on the time of the funding, the flip round has already occurred they usually now “solely” have to proof that this was not a one-off.

Even when this journey is bumpy, I feel over the following 3-4 years, the shares may supply an honest return. On high of an anticipated dividend yield of as much as 5% p.a. I may simply think about one other 10% pa. as a mix of development and a slight a number of enlargement kind the present low ranges. In the very best case, this might even change into a “Meier & Tobler 2.0” if the inventory trades at “Swiss High quality multiples”.

I’ve due to this fact elevated the place additional to a 6% weight and financed this largely by an extra lower in Meier & tobler which is not so low-cost anymore.

One ought to point out that the share shouldn’t be overly liquid, on common, 300-400 shares are traded every day on the Swiss trade.