RBL Financial institution launched its standalone Signature+ debit card someday again. Because the identify suggests, it is available in Visa Signature variant.

Apparently by default this debit card will not be issued with any of its financial savings account or relationship banking program.

Moderately you may open any RBL financial savings account (even digital financial savings account having minimal 5K AMB will suffice) and apply for improve to Signature+ debit card through any RBL department and even RBL MoBank app.

On this case default debit card issued along with your newly opened financial savings account will get closed put up the issuance of Signature+ debit card.

Keep in mind this debit card is to not be confused with RBL Signature debit card, which is issued as part of RBL’s premium banking program.

Price Construction

- Becoming a member of Price: 5000+GST = 5900/- (No Waiver Standards)

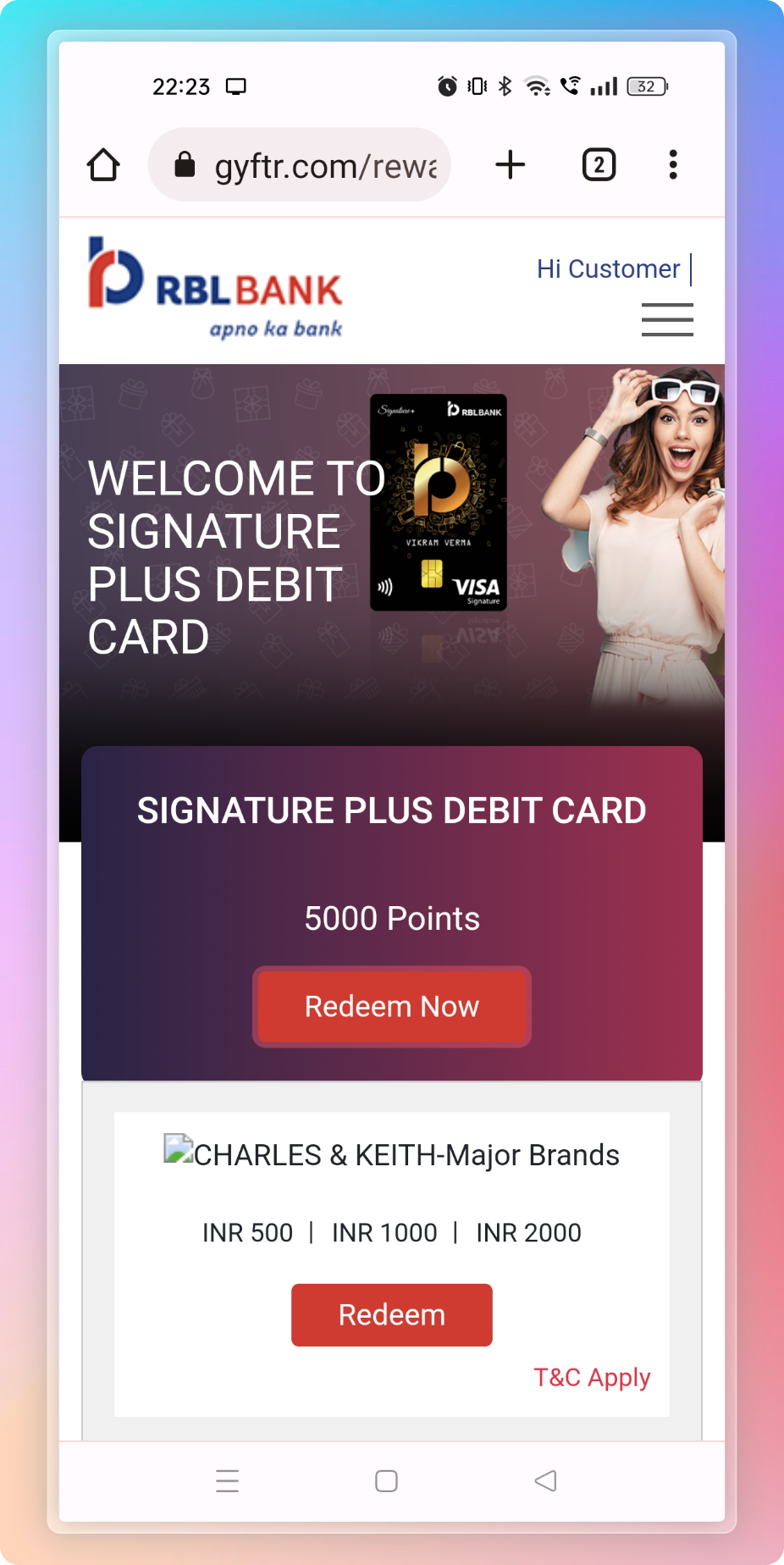

- Welcome Profit: 5000 price GV

- Renewal Price: 1500+GST = 1770/-

- Renewal Price Waiver Standards: Spend 3L+ in earlier yr

Logical query:

Why would anyone pay such a excessive becoming a member of charge together with tapered down renewal charge, when you will get Premium to even Tremendous Premium bank cards with that form of charge.

Resolve your self put up going by the Options part of this in-depth assessment.

Be aware: As I didn’t obtain any e mail for claiming the Welcome voucher, saved on checking the identical virtually each day through a hyperlink that will likely be shared with you over e mail.

One high-quality day it went by efficiently. As per my expertise I can say that– Welcome voucher of 5000 GV is accessible after ~ 1 month of paying the becoming a member of charge

Fingers-on Expertise

Opened RBL digital financial savings account (5K AMB) through an all app digital expertise. VKYC was performed inside 1 hour of opening the account through Aadhaar authentication and PAN picture seize as standard. Funded the account with 6000+, protecting in thoughts 5000+ GST becoming a member of charge.

Similar day requested for Signature+ debit card improve and was processed immediately. Signature+ debit card becoming a member of charge charged instantly to account. Debit card seen in app inside 48 hours, bodily supply took ~ 6-7 days although.

Card Look & Really feel

Card appears to be like are respectable. Its a traditional card with under common print & plastic high quality. Identify is in entrance whereas all card particulars are on the again. Envelope containing the cardboard was easy as effectively.

Milestone Advantages

Spend wherever on POS/On-line through RBL Signature+ debit card and get 1% value-back upto 1000 as GV.

Legitimate transactions at present embody all types of On-line/ Offline funds performed through any cost platform. Can double dip through different invoice cost apps too e.g. Paytm/Mobikwik/CheQ and so on.

Disclaimer: Above cost apps/platforms is only for info function & not a suggestion in anyway.

Complete spends in a month have to be greater than 10K to be eligible for this month-to-month USP profit.

Easy methods to declare– You’ll obtain an e mail with a hyperlink to assert the month-to-month profit on 15-Seventeenth of the subsequent month (For spends made in present month). Else above talked about hyperlink is legitimate for claiming month-to-month advantages as effectively.

Annual Milestone: Spend above 5L in a yr and get 5000 price GV individually

Return on Spend

Return Ratio: When you max. out the spends, i.e. 1L per thirty days X 12= 12L in a yr, you obtain:

- 1000 GV per thirty days X 12 = 12K factors

- 5000 GV per yr X 1 = 5K factors

Complete= 17K on an efficient becoming a member of charge of (5900-5000)= 900 INR. Renewal charge anyway will likely be Zero from subsequent yr upon spending 3L+ in earlier yr.

- Return Proportion for 1st yr= (17K-900)/12L ~ 1.34%

- Return share subsequent yr onwards= 17K/12L ~ 1.41%

Finest Worth: In case your spends aren’t that top, hitting 5L in a yr is the candy spot.

In 1st yr You get 5K Month-to-month + 5K Annual profit = (10K-900)/5L ~ 1.82%

And subsequent yr onwards you get (5K + 5K)/5L ~ 2%

When you spend greater than 12L in a yr, return worth goes downwards. As you may see, this card holds good until annual spends of 12L max solely (ideally 1L per thirty days spend with minimal 10K in a month to earn cashbacks as GV)

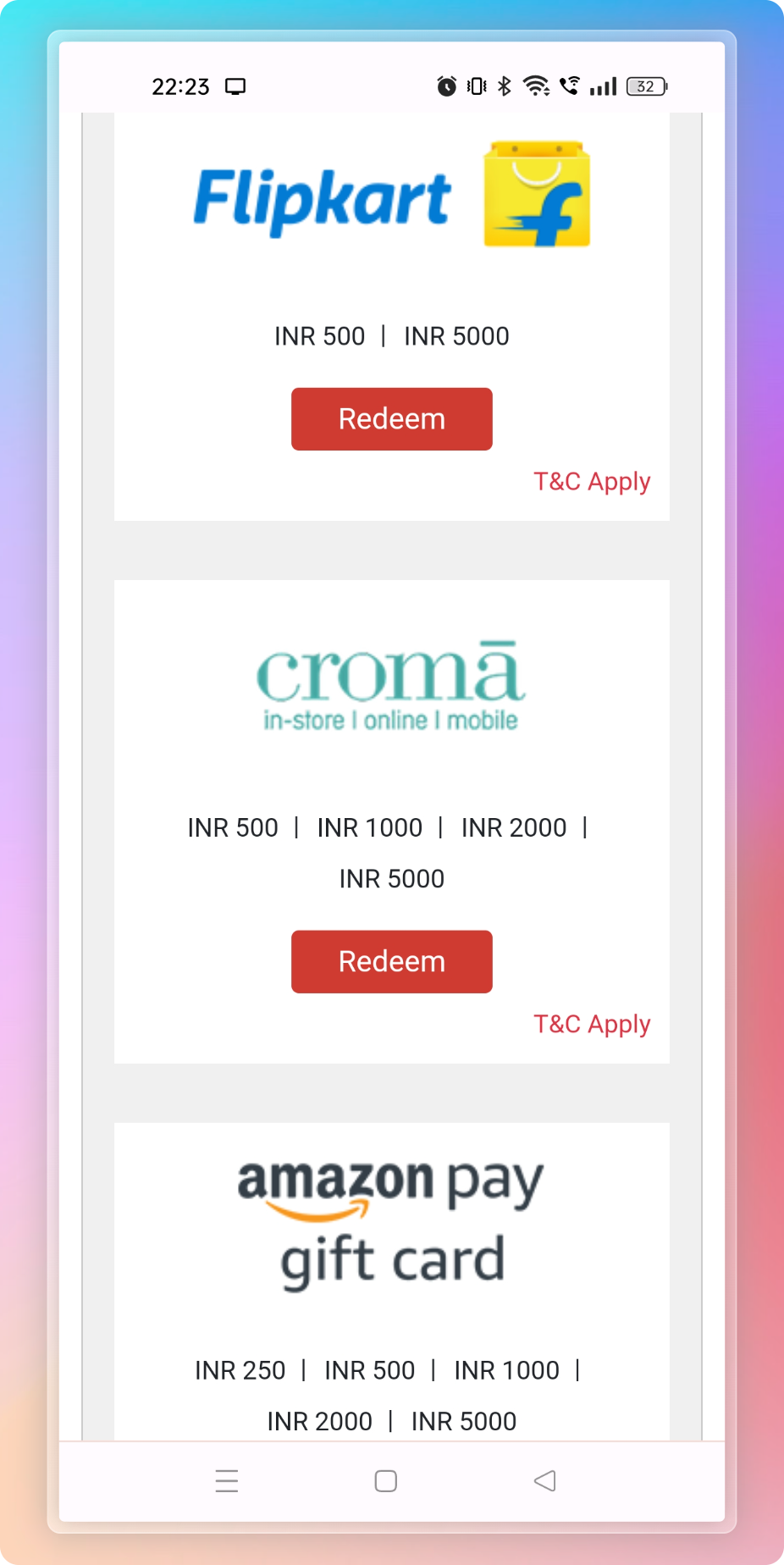

GVs out there: Big selection of GVs with a number of value factors can be found for redemption in opposition to each Welcome/ Month-to-month advantages. Notable ones are Amazon, Flipkart, Croma, Bigbasket and so on.

0% Foreign exchange Markup

Zero markup on International foreign money transactions is one other very helpful good thing about this card (3.5% markup relevant for ATM money withdrawals performed in UAE through Signature+ debit card)

Different Options

Lounge Entry: 2 Complimentary home airport lounge entry per quarter (Massive variety of home lounges are coated)

Insurance coverage Cowl: Air accident & different covers out there, akin to different Premium bank cards in India.

Bottomline

Other than the excessive becoming a member of charge, which is sufficiently compensated with equal GV worth apart from the GST half, this debit card ticks virtually all of the containers.

Kudos to RBL financial institution for launching such a debit card, which might be termed as probably finest rewarding debit card in India at present.