Securing an amazing financial savings account rate of interest is without doubt one of the best methods to earn revenue in your money deposits. Nonetheless, with so many banks and financial savings accounts to select from, the method could be time-consuming.

Raisin is a comparatively new financial savings account platform that may simplify the analysis course of as a result of they companion with FDIC-insured banks, usually regional and smaller ones, to supply high-interest charges on a wide range of deposit merchandise. The high-yield financial savings and CD charges you get via Raisin are sometimes increased than what’s obtainable to most people on that financial institution’s web site.

On this Raisin overview, I analyze their provides, let you know the way good the financial savings charges are, and if the platform is legit.

💡 SaveBetter goes via a rebranding and is altering their identify to Raisin, the identify of their father or mother firm. Reasonably than being known as SaveBetter by Raisin, they’ll merely go by Raisin. That is solely going to be a rebranding identify change, nothing in regards to the service has modified. We will likely be updating this publish with up to date graphics, adopted by naming and different adjustments.

Desk of Contents

- What’s Raisin?

- How Does a Custodial Financial institution Account Work?

- Financial savings Account Promotions

- Who Can Use Raisin?

- Who Ought to Use Raisin?

- How Can Raisin Provide Such Excessive Charges?

- Deposit Account Choices

- What if a companion financial institution fails?

- What if Raisin fails?

- What are Raisin Charges?

- Raisin Associate Banks

- How Does Raisin Work?

- First, Create an Account

- Then Evaluate Gives

- Hyperlink & Fund New Account

- Managing Accounts

- Transferring Funds

- Simply One Yr-Finish Tax Doc (1099-INT)

- Is Raisin Legit?

- Raisin Execs and Cons

- Alternate options to Raisin

- 5% Financial savings Accounts

- UFB Premier Cash Market – 4.81% APY

- Uncover Financial institution

- Ally Financial institution

- Raisin FAQs

- Raisin Evaluate: Closing Ideas

🔃Up to date June 2023 with extra data on how Raisin works, what occurs if it or a companion financial institution fails, up to date screenshots, the pooled deposit program, and different up to date particulars plus information of the rebranding.

What’s Raisin?

Raisin is an internet platform that companions with over ten banks and credit score unions to supply aggressive charges on high-yield financial savings accounts, cash market accounts, and CDs (certificates of deposit).

Raisin GmbH is Raisin’s father or mother firm (based 1973) they usually’ve been doing this in Europe for years. Raisin works with roughly 400 banks in additional than 30 international locations. They solely not too long ago expanded into the USA with Raisin.

At Raisin, you will see that banking provides from regional banks and mid-sized establishments that don’t seem in most financial savings account searches. Consequently, you could have extra banking choices to select from and may earn a doubtlessly higher price in your financial savings.

For example, Raisin will allow you to open a high-interest account from Sallie Mae Financial institution, Ponce Financial institution, or The State Trade Financial institution. You gained’t see nationwide names like Axos Financial institution, Capital One 360, or Uncover Financial institution.

Once you use Raisin, you may put your cash with one financial institution however you don’t get a separate checking account. Your cash is pooled with different Raisin clients on the financial institution in a custodial account. You gained’t be capable to switch cash into and out of the companion financial institution straight and also you gained’t get an account quantity on the financial institution, it has to undergo Raisin.

Sadly, the platform doesn’t supply checking accounts or on-line invoice pay companies. So, you’ll solely be capable to open financial savings accounts, MMA, and CDs to maximise your money reserves.

It’s not unusual to make use of a separate financial institution for high-yield financial savings, so this limitation isn’t a deal-breaker for a lot of.

How Does a Custodial Financial institution Account Work?

Once you “open an account” with a companion financial institution via Raisin (comparable to Sallie Mae), you aren’t actually opening a brand new account on the companion financial institution. Once you switch funds out of your present financial institution to the brand new Raisin-linked account, you might be transferring funds to a custodial account held by Lewis and Clark Financial institution.

You get FDIC or NCUA insurance coverage via the companion financial institution (pass-through insurance coverage), not Lewis and Clark Financial institution. Lewis and Clark Financial institution are the custodian financial institution. Your funds is not going to be in your identify on the companion financial institution however there are authorized information indicating how a lot you could have there – you might be absolutely insured by FDIC or NCUA insurance coverage.

Which means that you get $250,000 of protection at every financial institution. In the event you open accounts at two companion banks, you get $250,000 from every financial institution for a complete of $500,000 (although it’s nonetheless $250,000 at every financial institution, the quantities don’t pool collectively so you may’t get $300,000 at one and $200,000 on the different). Keep in mind, the protection isn’t from Raisin however the companion financial institution (to not belabor the purpose however this may get complicated).

That is the very same mechanism utilized by many fintech firms who supply bank-like companies however are themselves not a financial institution.

Additionally, that is how almost all particular person inventory market holdings are managed. The shares of inventory you “personal” at any brokerage should not actually in your identify. They’re held by a custodian who retains monitor of who owns what (referred to as “road identify). This makes it simpler to transact on the shares.

Financial savings Account Promotions

The attraction of Raisin is that they’ve negotiated increased rates of interest with their companion banks. You’ll often see a decrease price in case you go on to the financial institution web site.

Banks could use above-average charges to draw new clients that will not dwell inside their native service space. For instance, you may be a part of a Florida-based neighborhood financial institution even in case you dwell in California (you may full the account opening course of on-line).

In the event you at present financial institution with companion establishments, you could be eligible for higher charges as they’re obtainable to all Raisin customers. The one distinction is that this account gained’t present in your financial institution dashboard.

Moreover, these ongoing above-average charges are sometimes superior to financial institution promotions, which often supply a one-time money bonus.

Who Can Use Raisin?

You have to be 18 years outdated, dwell in the USA, and have a Social Safety quantity (SSN) to open deposit accounts. It’s no completely different than the necessities of an everyday checking account.

Better of all, you don’t have to create an account to match the most recent rate of interest provides. They publish them on the web site!

Who Ought to Use Raisin?

Think about using Raisin in case you’re in search of the very best charges for financial savings accounts, time period CDs, and no-penalty CDs. The provides could be higher than these from well-known nationwide banks, though you have to be comfy utilizing a neighborhood financial institution with a smaller buyer base.

Regardless of being online-only, the banking expertise could be completely different than opening an account straight with a companion financial institution or credit score union. You schedule deposits and withdrawals via your Raisin account as a substitute of visiting the financial institution web site that you could be use for different companies.

How Can Raisin Provide Such Excessive Charges?

A typical industrial financial institution spends a LOT of cash on promoting and advertising. I’m certain you’ve seen radio and TV adverts on your native financial institution, to not point out journal and print adverts. Heck, M&T Financial institution pays $5 million a yr to sponsor the Baltimore Raven’s stadium.

I’ve seen experiences that they pay not less than $400 in promoting charges for a private checking account and twice that for a enterprise account. For this reason financial institution bonuses are sometimes within the a whole bunch of {dollars} – they’d slightly pay you than an promoting firm. (and also you’re happier when YOU get the cash!)

However smaller regional banks can’t compete on that degree so that they companion with Raisin to extend their deposits. As an alternative of paying an enormous bonus, they simply supply increased rates of interest. They’re FDIC insured so this can be a risk-free price and infrequently beats what you will get elsewhere.

Deposit Account Choices

You’ll be able to open these federally-insured financial savings merchandise and earn passive revenue.

It’s at present potential to open a person or joint account. The platform plans on providing IRA banking companies sooner or later to attenuate your taxable curiosity, however proper now you may select between:

- Excessive-yield financial savings & cash market accounts

- Excessive-yield Certificates of Deposit

- No Penalty CDs

Excessive-Yield Financial savings Accounts

You’ll be able to open a high-yield financial savings account or a cash market deposit account with a minimal $1 stability. This financial savings product is on-line solely and sometimes permits as much as six month-to-month withdrawals.

Contemplate this account in case you don’t need your cash locked up for a number of years or face potential early redemption insurance policies as financial institution CDs require.

The rates of interest are variable, however the Raisin provides can yield greater than most of the finest high-yield financial savings account charges.

Excessive-Yield CDs

Now that we’re again in a rising charges setting, financial institution CDs have gotten a horny choice to earn enticing yields in case you’re searching for a hard and fast revenue.

The charges are increased than an internet financial savings account, however the funding time period is often from 9 months to 24 months. Nonetheless, they do have a suggestion of a 60-month (5-year) CD, although it’s not the very best price in the meanwhile.

Not like most CDs which require depositing not less than $500 or $1,000, the minimal deposit is barely $1 via Raisin.

This low minimal funding makes it straightforward to construct a CD ladder and earns a better yield on the money you gained’t want for instant bills.

Moreover, the charges are aggressive with different platforms. As a fast instance, you may earn 5.00% on a 12-month CD time period via Raisin however solely 2.75% straight from a financial institution.

The finest CD charges fluctuate repeatedly, however you may often get one of the best returns with an 18-month or 24-month time period.

No-Penalty CDs

A no penalty CD can stability the advantages of high-yield financial savings accounts and conventional fixed-term CDs.

This product can earn a doubtlessly increased rate of interest than a financial savings account as you’re pledging your funds for a particular period. Nonetheless, you may often make penalty-free withdrawals seven enterprise days after account opening.

Most no-penalty CD phrases are from 10 months to 17 months. Though some banks supply a 36-month time period.

The charges should not as enticing as a time period CD, and you need to take into account locking your cash in case you’re assured you gained’t have to faucet it. But when there’s an inexpensive chance that you’ll want the funds, take into account this feature or persist with a high-yield financial savings account for peace of thoughts.

What if a companion financial institution fails?

In case you have money at a companion financial institution and that financial institution fails, your cash remains to be protected by FDIC insurance coverage – as in case you had your cash within the financial institution straight.

The method for a financial institution failure is identical whether or not you could have an account straight with the financial institution or via Raisin. Your funds could be frozen whereas the method resolved itself (usually over a weekend) and your cash could be returned to you or transferred to an buying financial institution.

What if Raisin fails?

Raisin isn’t a financial institution so there’s no danger that they might “fail,” but when Raisin goes bankrupt or in any other case not operates as an organization – your cash remains to be protected in an FDIC-insured financial institution.

If, in some uncommon scenario, Raisin utterly disappeared and all of its knowledge have been erased, the companion financial institution nonetheless has details about your account. Raisin shares a day by day file with the companion financial institution that features all clients’ positions and balances.

What are Raisin Charges?

There are zero charges for utilizing Raisin. You retain 100% of your curiosity revenue. You additionally keep away from the hidden charge of excessive minimal stability necessities because you solely have to deposit $1 per account.

The one potential charge is an early redemption penalty for time period CDs in case you withdraw your funds earlier than the CD maturity date – that is true at any financial institution. You’ll be able to keep away from this by opening a financial savings account or no penalty CD.

Whilst you gained’t pay a charge, Raisin makes cash by amassing advertising charges from companion banks and credit score unions. However because you usually can get a better rate of interest than going to the financial institution straight, it’s a win win.

Raisin Associate Banks

As of June 2023, yow will discover provides from these banks and credit score unions:

These establishments sometimes present brick-and-mortar banking companies to non-public and enterprise accounts. Membership is open nationwide due to the Raisin relationship to enhance your banking wants.

How Does Raisin Work?

The service acts as a center man making it potential to open interest-bearing accounts with a number of banks however handle your balances with a single platform. You solely work together with Raisin, however the companion financial institution holds your funds in a custodian account and pays curiosity.

In the event you like chasing yield and shifting your funds to the financial institution with the very best rate of interest, this streamlined strategy could make it simpler to handle your accounts.

First, Create an Account

Step one is making a Raisin account by offering your identify, electronic mail deal with, and password. When you open an account with a selected financial institution, you’ll submit the same old authorized particulars to confirm your identification.

Then Evaluate Gives

You’ll be able to examine charges for these banking merchandise:

- Excessive-yield financial savings accounts

- Cash market deposit accounts

- Fastened Time period CDs

- No Penalty CDs

Tapping a suggestion helps you to overview the product phrases and take a look at very important particulars such because the yield, minimal deposit, and withdrawal limits.

Hyperlink & Fund New Account

You’ll fund your Raisin accounts by linking an present checking or financial savings account via the third-party app Yodlee or manually submitting your routing and account quantity.

In the event you choose to log into your account, make sure that to show off any adblocking extensions you’ll have on your browser. It’s going to mess up the widget for logging in when you’ve got an adblocker on.

All deposits take as much as three enterprise days to finish, and you start incomes curiosity when the financial institution custodian receives your deposit.

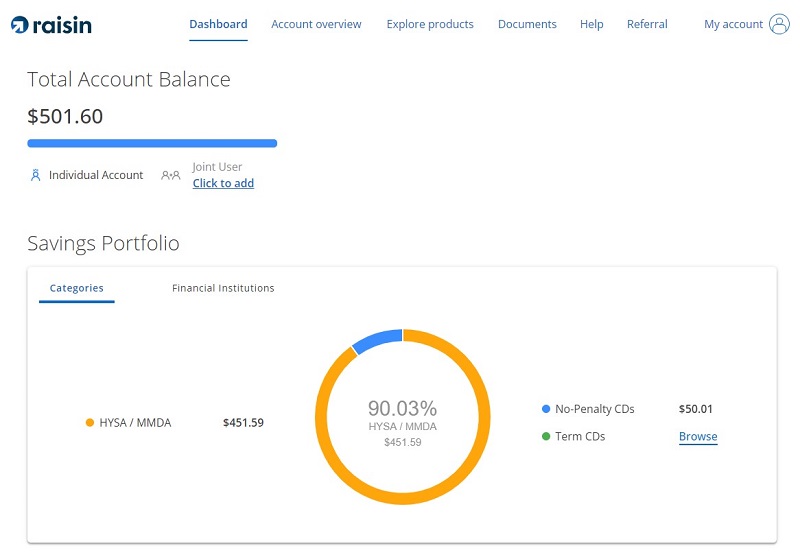

Managing Accounts

Managing your account is as intuitive as you assume.

You’ll be able to log into your Raisin account to view your present stability, rate of interest, and earnings.

This dashboard additionally helps you to schedule deposits or withdrawals. Your month-to-month statements and tax paperwork are within the “Paperwork” part.

Curiosity compounds day by day and deposits month-to-month on your numerous accounts.

Transferring Funds

With Raisin, there isn’t a “Raisin account.” Once you switch funds, they’re at all times between the companion financial institution’s account and your individual externally linked account.

For instance, if you open any new account, the funds have to come back from the exterior account. You’ll be able to’t switch from one other account inside Raisin.

If you wish to transfer funds from one Raisin companion financial institution to a different, it has to undergo your exterior account first.

For instance, when you’ve got funds in a Western Alliance Checking account and wish to open a brand new CD at Wex Financial institution, you need to switch your funds to an exterior account first. Then, as soon as it has made it there, you may switch them into a brand new Wex Checking account.

Simply One Yr-Finish Tax Doc (1099-INT)

Apart from a better rate of interest, this is without doubt one of the finest advantages of utilizing Raisin – you solely get a single Kind 1099-INT on the finish of the yr!

In the event you chase charges from financial institution to financial institution, you’ll get a Kind 1099-INT from each financial institution the place you earned $10 or extra in curiosity (although you continue to owe taxes on any curiosity you earn, even with no kind).

With Raisin, you solely obtain one 1099-INT tax doc, even when you’ve got money in a number of accounts!

Only one one kind, regardless of coping with a number of banks, means much less paperwork when submitting your taxes. This may prevent a number of time. You additionally keep away from the annoying scenario of forgetting to report a kind and having to submit an amended return.

Is Raisin Legit?

Raisin is a legit platform to search out one of the best financial savings account and financial institution CD rates of interest. There aren’t any service charges, and the minimal deposit is barely $1.

You might be hesitant to make use of Raisin as a result of it’s a comparatively new expertise firm and never an precise financial institution. They’re an additional layer between you and your cash saved in a pooled account. Nonetheless, it companions with FDIC-insured banks and NCUA-insured credit score unions. You might be absolutely insured. They ship experiences of balances day by day so every part is reconciled.

Moreover, the financial savings account provides on Raisin should not marketed on the banking companion web sites. This exclusivity generally is a pink flag for a possible rip-off because the rates of interest sound “too good to be true.”

Nonetheless, there are a number of buyer evaluations of account holders depositing funds, incomes curiosity, and making profitable withdrawals to their linked funding account.

Raisin Execs and Cons

Right here’s my checklist of positives and negatives of utilizing Raisin to discover a higher checking account.

Execs

- A number of account choices and companion banks

- Above-average rates of interest

- No service charges

- $1 minimal deposit

- One dashboard to handle a number of accounts

Cons

- No checking or on-line invoice pay companies

- They companion with smaller banks and credit score unions with much less identify recognition

- Your account is in a pooled account at companion banks

- Private banking solely (no enterprise accounts)

Alternate options to Raisin

Maybe you’ll slightly deal straight with the monetary establishment, or Raisin’s checklist of companions doesn’t curiosity you; there are different methods to safe an amazing financial savings price. Listed here are a couple of Raisin alternate options to contemplate.

5% Financial savings Accounts

Excessive-interest financial savings accounts that may aid you earn roughly 5% curiosity. You’ll sometimes want to finish a particular variety of transactions and preserve a minimal stability to earn the very best price.

These platforms additionally present checking accounts that you should utilize to pay payments and handle your day-to-day transactions.

UFB Premier Cash Market – 4.81% APY

UFB Premier Cash Market is obtainable by ufb Direct, which is a companion of Axos Financial institution. It’s technically a cash market account, slightly than a financial savings account, however provides a price of 4.81% APY.

The good thing about this account, past the upper price, is you can pay your pals by way of peer-to-peer funds and your payments utilizing Invoice Pay. Most financial savings accounts don’t supply that, they’ve to make use of their checking account. This MMA additionally comes with a debit card too, so there’s some versatility right here.

👉 Be taught extra about UFB Premier Cash Market

Uncover Financial institution

You’ll be able to earn a money bonus in case you qualify for a Uncover Financial institution promotion. It’s potential to obtain the bonus after satisfying the deposit necessities. Uncover Financial institution provides a aggressive rate of interest that will rival the Raisin provides. This on-line platform additionally offers rewards checking

Our in-depth overview of Uncover On-line Financial savings Financial institution offers extra particulars.

Ally Financial institution

Ally Financial institution provides high-yield financial savings accounts and CDs with aggressive charges and an easy-to-use platform. You may also open interest-bearing checking accounts and tax-advantaged IRA financial savings accounts.

There can also be Ally Financial institution promotions value contemplating.

Raisin FAQs

No, Raisin is a monetary expertise (FinTech) platform that companions with banks. Nonetheless, you may deposit funds with federally-insured banks and credit score unions. As much as $250,000 of balances are eligible for pass-through FDIC Insurance coverage and NCUA Insurance coverage.

These banks maintain your cash in a custodian account and award curiosity. Whereas the banks retailer your wealth, Raisin manages deposits and withdrawals as requested.

Your deposits are protected with as much as $250,000 in federal insurance coverage – both FDIC for industrial banks or NCUA for credit score unions. For knowledge safety, Raisin makes use of a number of practices, together with Yodlee, to hyperlink to your financial institution accounts and guard your privateness. The platform is SOC 2 verified and makes use of exterior auditors to confirm the safety protocols to safeguard buyer knowledge.

You’ll be able to contact Raisin from 9 am to 4 pm EST Monday-Friday when you could have questions on banking companies. Dwell chat and electronic mail help can also be obtainable to add screenshots. A web based data library additionally solutions generally requested questions.

Raisin Evaluate: Closing Ideas

Raisin is a singular platform that helps you get pleasure from a number of the highest financial savings account and CD charges. As well as, you solely should deposit $1 and gained’t encounter any service charges.

Whereas banking with FDIC-insured banks, you should still unfold out your financial savings and use better-known high-yield financial savings accounts to deal straight with the financial institution if you need assistance.

Raisin

Strengths

- A number of account choices and companion banks

- Above-average rates of interest

- No service charges

- $1 minimal deposit

- One dashboard to handle a number of accounts

Weaknesses

- No checking or on-line invoice pay companies

- They companion with smaller banks and credit score unions with much less identify recognition

- You don’t work straight with the companion banks

- Restricted customer support hours

- No enterprise banking provides