MBIA Inc (MBI) ($680MM market cap) is now a shadow of its former self, previous to the 2007-2009 monetary disaster, MBIA was the main monetary assure insurer within the U.S., the place MBIA would lend out its AAA score to debtors for an upfront price. This enterprise mannequin most likely by no means made sense, it assumed the market was persistently mispricing default danger, the price MBIA charged needed to make it economical to remodel a decrease rated bond to the next rated one.

Within the early-to-mid 2000s, MBIA was leveraged over 100 occasions, they assured the well timed cost of principal and curiosity on bonds that have been 100+x that of their fairness, solely a small variety of defaults would blow a gap into their steadiness sheet. When the enterprise was first based, MBIA targeted on municipal debt by way of their subsidiary Nationwide Public Finance Assure Corp (“Nationwide”), with the thesis being that even when some municipal bonds weren’t formally backed by taxpayers, there was an implied assure or a authorities entity up the meals chain that may bail out a municipal borrower. That has largely proved true (minus the latest quasi-bankruptcy in Puerto Rico), nevertheless MBIA was grasping and grew into guaranteeing securitized automobiles (through subsidiary MBIA Corp) previous to the GFC. MBIA and others (notably AIG Monetary Merchandise) acquired caught, discovering themselves on the hook for beforehand AAA senior tranches of ABS CDOs and subprime-RMBS that went on to endure materials principal losses. There was nobody up the chain to bail out a Cayman Islands particular function automobile with a P.O. field as a company handle. Lots has occurred within the 15 years since 2008, MBIA Corp stopped writing new enterprise nearly instantly, Nationwide continued to jot down new enterprise on municipal issuance however stopped in 2017 after Puerto Rico went additional into misery, Nationwide had vital publicity to island. The enterprise has been in full runoff since then.

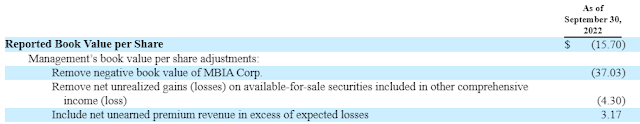

The excellence between Nationwide (municipal bonds) and MBIA Corp (asset backed securities) is vital, MBIA Corp and Nationwide are legally separate entities which are non-recourse to the holding firm, MBIA Inc. MBIA Corp’s fairness is approach out of the cash, fully nugatory to MBIA Inc, the entity is being run for the good thing about its former policyholders. Nationwide however has optimistic fairness worth, however when consolidated with MBIA Corp on MBIA Inc’s steadiness sheet, leads to an general unfavorable ebook worth. However once more, these are two separate insurance coverage firms which are non-recourse to the mother or father. The SEC slapped MBIA Inc’s wrist for reporting an adjusted ebook worth primarily based on the belief that MBIA Corp’s unfavorable ebook worth was now not related to the mother or father, as some compromise, MBIA Inc stopped offering the tip consequence, however nonetheless supplies the parts of their adjusted ebook worth (unsure how that is considerably totally different, however no matter). Listed here are the changes for Q3:

By making these changes, MBI’s adjusted ebook worth is roughly $28.80/share, at this time it trades for $12.50/share. The final two objects within the adjusted ebook worth bridge are extra runoff-like ideas, these are the values that MBIA Inc would theoretically earn over time because the bonds mature of their funding portfolio and erase any mark-to-market losses (largely pushed by charges final yr) after which any unearned premiums assuming their anticipated losses assumptions are correct.

I’ve type of ignored Puerto Rico, I’ve passively adopted it over time through Reorg’s podcasts, it’s an excessive amount of to enter right here, however MBIA Inc’s (through Nationwide) publicity is basically remediated at this level (asserting in December that they settled with PREPA, Puerto Rico’s electrical utility that was destroyed in Hurricane Maria), clearing the best way to promote itself. From the Q3 earnings press launch:

Invoice Fallon, MBIA’s Chief Government Officer famous, “Given the substantial restructuring of our Puerto Rico credit, we now have retained Barclays as an advisor and have been working with them to discover strategic options, together with a potential sale of the corporate.”

Basically the entire bond insurance coverage firms have stopped writing new enterprise, the one one in every of any actual measurement remaining out there is Assured Warranty (AGO) ($3.7B market cap). Assured has vital overlap with Nationwide that may drive practical synergies. Road Insider reported that AGO and one other firm are in superior talks with MBIA. They’re the one true strategic purchaser (possibly a few of the insurers that bid on runoff operations could be too), AGO additionally trades low-cost at roughly 0.75x GAAP ebook worth. AGO would wish to justify a purchase order to their shareholders that may no less than be on par with repurchasing their very own inventory (which they do consistently).

In my again of the envelope math, I am solely pulling out the unfavorable ebook worth related to MBIA Corp from the adjusted ebook worth, then slapping a 0.75x adjusted ebook worth a number of on it. Once more, the opposite two objects in MBI’s adjusted ebook bridge appear extra like market dangers a purchaser can be assuming and needs to be compensated for bearing the chance of finally reaching. AGO ought to be capable to justify paying the identical a number of for MBIA Inc since it would embrace vital synergies. I provide you with a deal goal value of roughly $16/share, or 28% upside from at this time’s costs.

I purchased some shares not too long ago (I do know, one other speculative arb concept!).

Disclosure: I personal shares of MBI