A reader asks:

I’m discovering it extremely onerous to take a position my extra money, even in my children’ school funds, with the S&P 500 closing in on new highs. Objectively, I do know I’m supposed to only grit my tooth and make investments, not attempt to predict the market, take consolation in realizing that time-in-the-market is greatest consider my long-term funding success…however IT IS SO DAMN HARD for me to do it psychologically in these seemingly overbought circumstances. I’m not an fool: I do mechanically max out my 401k. I’ve swallowed onerous and contributed a good quantity to 529s, and even a bit to my brokerage account. However I’ve cash increase on the sidelines that I do know I ought to do one thing with, and each day the market hits a brand new excessive, I really feel extra paralyzed. Would like to see you sort out this “downside” as a result of I do know I’m not the one one affected by this unusual — and sure, enviably — illness.

For some buyers it will at all times be an issue.

Market timing is difficult. And when you do it, market timing can result in a money dependancy.

When markets are falling you assume they may fall even additional. Money turns into a security blanket.

When markets are rising you assume they’re too costly and can right sooner or later. Once more, money turns into a security blanket.

I heard from an investor quite a lot of years in the past who went to money in 1999. That was fairly good timing, contemplating it was the peak of the tech bubble, which was the costliest the U.S. inventory market has ever been.

Sadly, he was nonetheless sitting in money 15 years later.

He informed me it was some mixture of concern, conceitedness and macro doom and gloom that saved him within the funding fetal place for a decade-and-a-half.

Market timing is difficult not simply because that you must be proper twice for it to work — if you get out and if you get again in. It additionally requires the braveness to get again in if you don’t need to.

There are a couple of methods round these fears.

I’ll begin with the spreadsheet methods after which transfer on to the behavioral approaches.

Diversification and asset allocation are danger mitigation methods. You wouldn’t need to unfold your bets if the long run was identified with certainty.

The entire concept behind setting an asset allocation within the first place is that it helps you stability your varied dangers and time horizons as an investor. You don’t have one asset allocation for bull markets and one other for bear market or one for inflationary environments and one other for deflation and so forth.

You must have a mixture of shares, bonds, money and different belongings that’s sturdy sufficient so that you can maintain throughout any market surroundings. That must be true of each present belongings in your portfolio and any future contributions.

And for those who’re that nervous about valuations for giant cap U.S. shares it’s best to look into diversifying into different asset courses — bonds (which lastly have some yield), worldwide shares (less expensive), worth shares (identical), small cap shares (additionally cheap), top quality shares, dividend shares, REITs, and so forth.

There are such a lot of completely different methods obtainable right this moment so that you can diversify into.

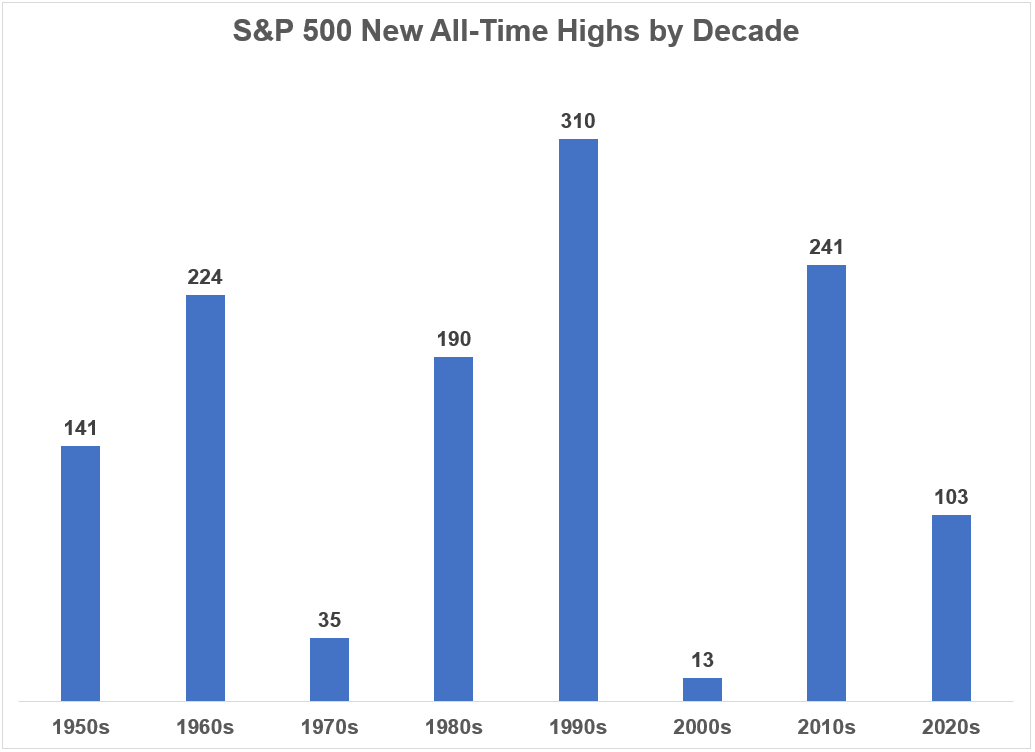

It’s additionally price mentioning new highs within the inventory market are nothing to be afraid of. They occur lots:

A handful of those new highs will happen at a peak proper earlier than a bear market. However most of them merely result in extra new highs down the street.

The opposite huge piece right here is defining your objectives. Why are you investing this money within the first place?

Retirement? A visit to Hawaii? Renovations? Child’s wedding ceremony? Seaside home? Healthcare wants? Normal wet day financial savings?

The only real purpose of investing just isn’t discovering the best returns you may or creating essentially the most optimized Sharpe ratio portfolio or outperforming some benchmark. You make investments cash now within the hopes that it grows to a bigger quantity for future use.

You simply need to outline these future makes use of and when they may happen.

Your cash is multi function huge bucket however you may separate your portfolio into completely different buckets if that helps. One bucket might be for development. One other might be for earnings or volatility discount. One other bucket could possibly be for capital preservation or security.

That security bucket can and doubtless ought to embody money (short-term bonds, CDs, cash market funds, on-line financial savings accounts, and so forth.). However I like the thought of placing a restrict on the money piece of your portfolio.

That could possibly be a proportion of the general allocation or an absolute degree.

My money bucket has a ceiling on it. As soon as a pre-defined degree is breached, I transfer something over and above that quantity into my funding accounts. It doesn’t need to be set in stone however it’s best to set that quantity upfront so that you’re not guessing on a regular basis or slowly turning into hooked on a rising money place.

The purpose is every bit of your portfolio ought to have a job. And people jobs must be outlined upfront together with the sources essential to finish them.

After all, the plan is the straightforward half. Anybody can do this.

The onerous half is implementing your plan.

Your solely selection right here is automation.

Automate your contributions. Automate your asset allocation. Automate your rebalancing schedule.

After which cease your portfolio a lot.

One of the simplest ways to keep away from errors in your portfolio is to make a handful of fine choices forward of time and get out of your personal method.

We spoke about this query on this week’s Ask the Compound:

Barry Ritholtz joined me once more this week to cowl questions concerning the state of the economic system, bond yields, investing an inheritance and collectibles.

Additional Studying:

The Psychology of Sitting in Money