Ought to we change to hybrid funds from debt funds to keep away from tax? What are the dangers concerned in hybrid funds? Allow us to talk about this matter on this submit.

After the current surprising taxation guidelines of debt fund taxation, many are eagerly on the lookout for avenues for his or her debt merchandise that are in a roundabout way tax environment friendly additionally. Few are on the lookout for varied classes of hybrid funds like balanced benefit funds or fairness financial savings funds as an alternative choice to debt funds. Nonetheless, is it value contemplating these classes?

Ought to we change to hybrid funds from debt funds to keep away from tax?

In the event you take a look at the SEBI’s categorization and rationalization of Mutual Fund Schemes notification, one can find that there are seven funds listed within the hybrid class. They’re as under.

a) Conservative Hybrid Fund – Funding in fairness and equity-related devices – between 10% to 25% of whole property. Funding in debt devices – 75% to 90% of the overall property.

b) Balanced Hybrid Fund – Fairness and equity-related devices – between 40% to 60% of the overall property. Debt devices – 40% to 60% of the overall property. No arbitrage could be permitted on this class.

c) Aggressive Hybrid Fund – Fairness and equity-related devices between 65% and 80% of whole property; Debt instruments-between 20% to 35% of whole property.

d) Dynamic Asset Allocation or Balanced Benefit – Funding in fairness/debt that’s managed dynamically.

e) Multi Asset Allocation – Invests in not less than three asset courses with a minimal allocation of not less than 10% every in all three asset courses.

f) Arbitrage Fund – Scheme following arbitrage technique. Minimal funding in fairness & fairness associated instruments-65% of whole property.

g) Fairness Financial savings – Minimal funding in fairness & fairness associated instruments-65% of whole property and minimal funding in debt-10% of whole property. Minimal hedged & unhedged to be acknowledged within the SID. Asset Allocation underneath defensive concerns may be acknowledged within the Supply Doc.

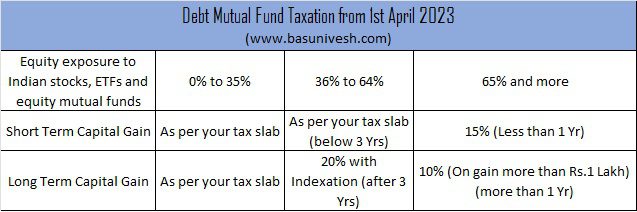

Now allow us to return to the modifications that occurred for debt fund taxation from 1st April 2023.

In the event you intently watch the above out there hybrid classes and likewise the above new tax guidelines, you observed that conservative hybrid funds are out of the query. As a result of as per the definition, the fairness publicity of this class needs to be between 10% to 25%. Therefore, obliviously they’re taxed as per your tax slab. Subsequently this class is dominated out utterly.

Similar manner, balanced hybrid funds the place the fairness allocation is to the utmost of 40% to 60% means they’re taxed as debt funds however with indexation advantages.

However the remainder of the hybrid fund classes like Aggressive Hybrid Funds (Fairness between 65% and 80%), Dynamic Asset Allocation or Balanced Benefit Funds (Fairness 0% to 100%), Multi-Asset Allocation (if we assume the fund invests in three property solely as it’s the minimal standards to fall on this class, then the fairness might go between 10% to 80%), Arbitrage Funds (Fairness or equity-related 65%) and Fairness Financial savings (Fairness minimal 65%) have a better vary of fairness (exception is Balanced Benefit Funds and Multi-Asset).

Nonetheless, to draw buyers due to this new taxation rule, these funds might preserve the fairness publicity all the time on or above 65%.

Therefore, the danger is of upper fairness publicity and the generic definitions of those funds pressure us to consider whether or not they’re really an alternative choice to debt funds. The classification is simply based mostly on what % needs to be in fairness and debt. Past that, it’s utterly unknown to us the place the fund managers make investments.

In such a situation, despite the fact that in plain it appears to be like like allocation to debt and fairness (moderately than 100% in fairness) is protected, because the definition isn’t clear and a whole freedom for fund managers, they could take the undue danger both in fairness (by allocating to thematic, small cap or mid cap) or debt (by allocating in direction of low rated bonds) to generate greater returns.

I settle for that you may run away from the brand new tax rule which is harsh in nature. However simply due to saving the tax, you’re taking another undue danger which is extra harmful.

Do keep in mind that all debt funds aren’t protected and on the similar time all fairness funds aren’t the identical. It’s all the time higher to put money into mutual funds the place there’s a clear mandate of funding moderately than generic categorization.

For instance, within the aggressive hybrid fund, if the fund is investing round 65% in fairness then by no means assume that your 35% is protected. If you’re keen on such funds, then it’s a must to intently watch the portfolio of not solely fairness however debt additionally. Sooner or later, if the fund supervisor takes some undue danger, then the price of shifting away from such funds is heavy.

Yet one more unknown danger that many people are conscious of is INTER SCHEME TRANSFER danger of those hybrid funds. Despite the fact that after the 2020 liquidity crunch and few situations of IST by few AMCs, SEBI laid down the foundations for such IST (Seek advice from this SEBI round on this regard), we will’t outrightly assume that such issues is not going to repeat sooner or later.

SEBI clearly laid down that IST isn’t attainable within the case of FMPs (Mounted Maturity Plans). Nonetheless, it’s attainable within the case of debt funds if there’s a actual liquidity crunch (after the fund supervisor pays from its money, borrows to pay cash (borrowing can also be restricted), or makes an attempt to promote illiquid securities first).

Sure different restrictions laid down by SEBI on this matter are as under.

- Fund managers needs to be penalized in the event that they switch a bond from a credit score danger fund to a different scheme, after which the bond defaults inside a yr. However what if default occurs after a yr?

- If there’s detrimental information about an organization, even “rumors”, then an inter-scheme switch isn’t allowed.

- If safety will get downgraded following ISTs, inside a interval of 4 months, the Fund Supervisor of shopping for scheme has to offer detailed justification /rationale to the trustees for getting such safety. However what if the safety is downgraded after 4 months?

These are sure unanswered dangers or uncontrolled dangers for widespread buyers. Nonetheless, why I’m bringing this inter-scheme switch solely in direction of hybrid funds moderately than the debt funds is that the definition of hybrid funds and particularly with respect to the debt a part of hybrid funds are unclear. Therefore, inter-scheme switch danger is extra to hybrid funds than debt funds.

Therefore, contemplating all these features, I strongly counsel you not use hybrid funds as an alternative choice to your debt funds (only for saving tax).

You don’t have any selection however to pay tax and simply to keep away from the tax, don’t take the undue danger of identified unknown.