This submit presents an up to date estimate of inflation persistence, following the discharge of non-public consumption expenditure (PCE) worth information for March 2023. The estimates are obtained by the Multivariate Core Development (MCT), a mannequin we launched on Liberty Avenue Economics final yr and coated most just lately in a March submit. The MCT is a dynamic issue mannequin estimated on month-to-month information for the seventeen main sectors of the PCE worth index. It decomposes every sector’s inflation because the sum of a standard development, a sector-specific development, a standard transitory shock, and a sector-specific transitory shock. The development in PCE inflation is constructed because the sum of the widespread and the sector-specific tendencies weighted by the expenditure shares.

MCT Declined in March

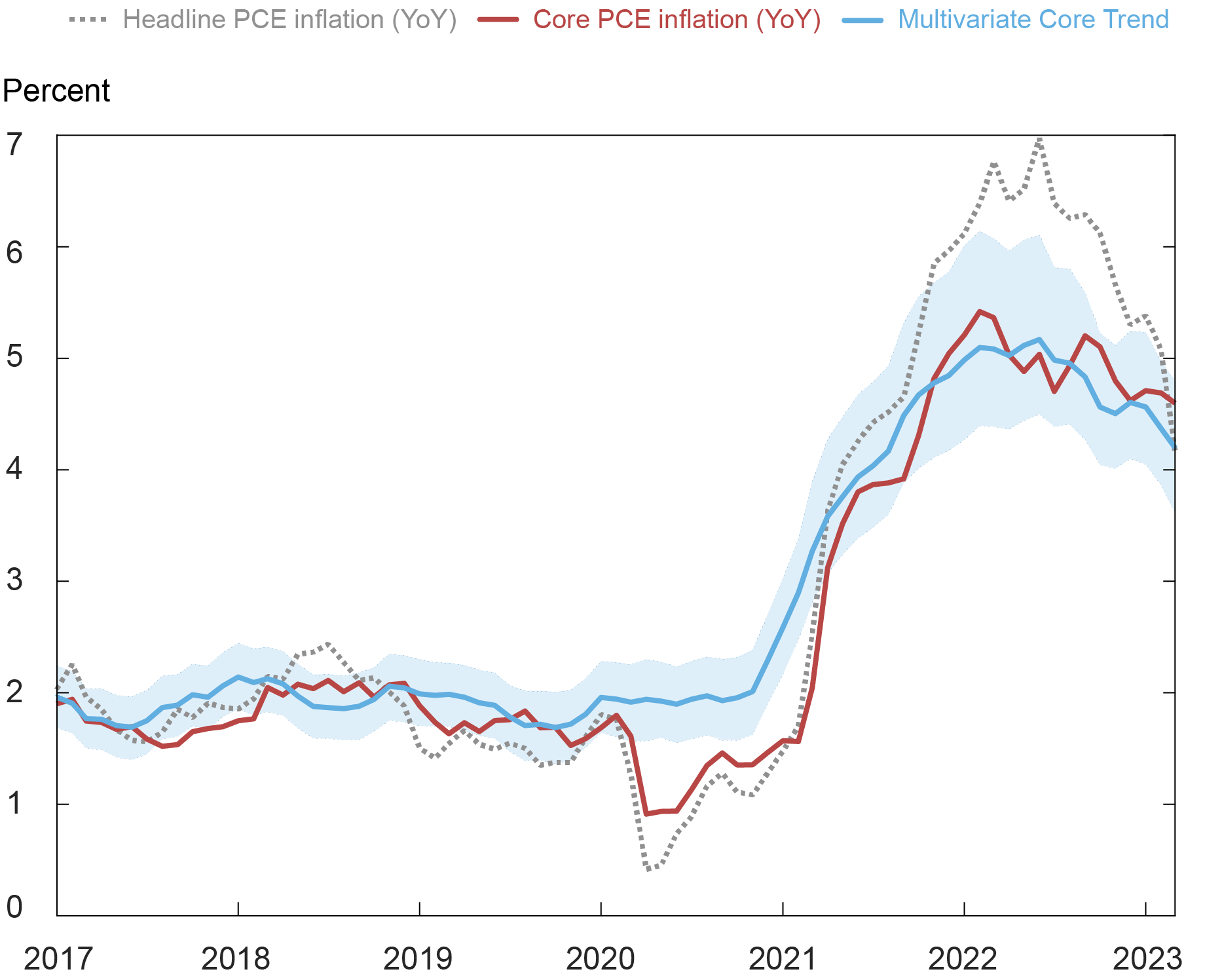

The MCT declined to 4.2 % in March from 4.4 % in February (the worth for February was itself revised down from 4.5 %), as illustrated within the chart beneath. Uncertainty is excessive as mirrored within the 68 % chance band (shaded space) of (3.6, 4.8) %. By comparability, the usual twelve-month core PCE measure declined from 4.7 % in February to 4.6 % in March following month-to-month readings of 0.6 % in January and 0.3 % in February.

PCE and Multivariate Core Development

Notes: PCE is private consumption expenditure. The shaded space is a 68 % chance band.

In line with our newest estimates, the development as measured by the MCT has held regular at a degree beneath 5 % since October 2022 after exceeding 5 % throughout most of 2022. The sectoral composition exhibits that the decline within the development since October 2022 is defined in equal elements by core items and non-housing companies whereas the decline in housing contributed solely barely to the general development.

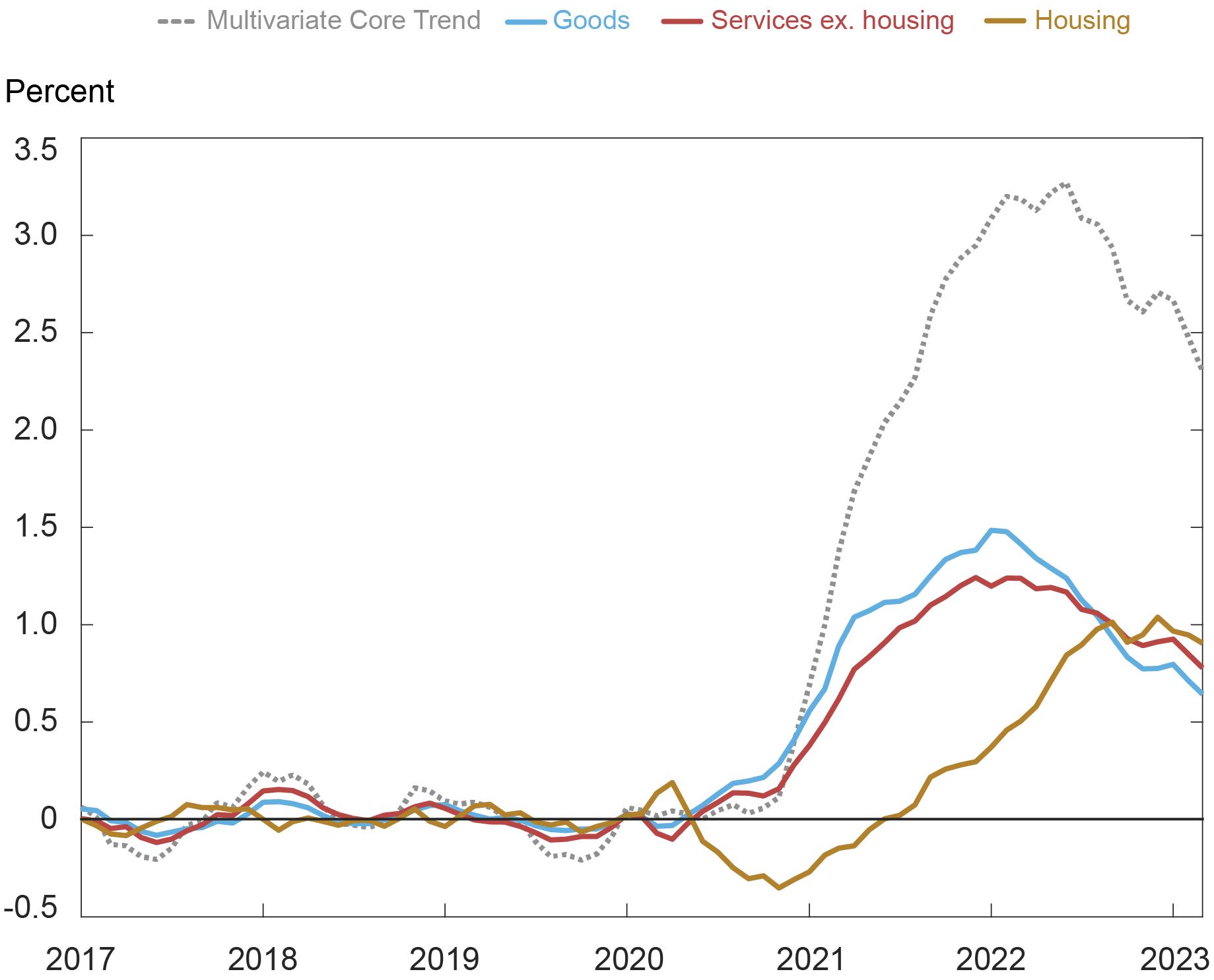

To be extra exact concerning the sectoral particulars, the development in housing inflation declined to eight.5 % in March from the 8.8 % recorded in February as the information confirmed month-to-month housing inflation reducing to 0.5 % in March from 0.8 % on common between July 2022 and February 2023. The tendencies in items and companies continued to say no over the month. The contribution of housing inflation to the rise within the persistent element of inflation from the onset of the pandemic, at about 0.9 proportion level (ppt), is similar to the cumulative contribution of companies ex-housing (0.8 ppt) and above that of products (0.6 ppt), as proven within the following chart.

Inflation Development Decomposition: Sector Aggregates

Notice: The bottom for the calculations of the contributions to the change within the Multivariate Core Development is the typical over the interval January 2017-December 2019.

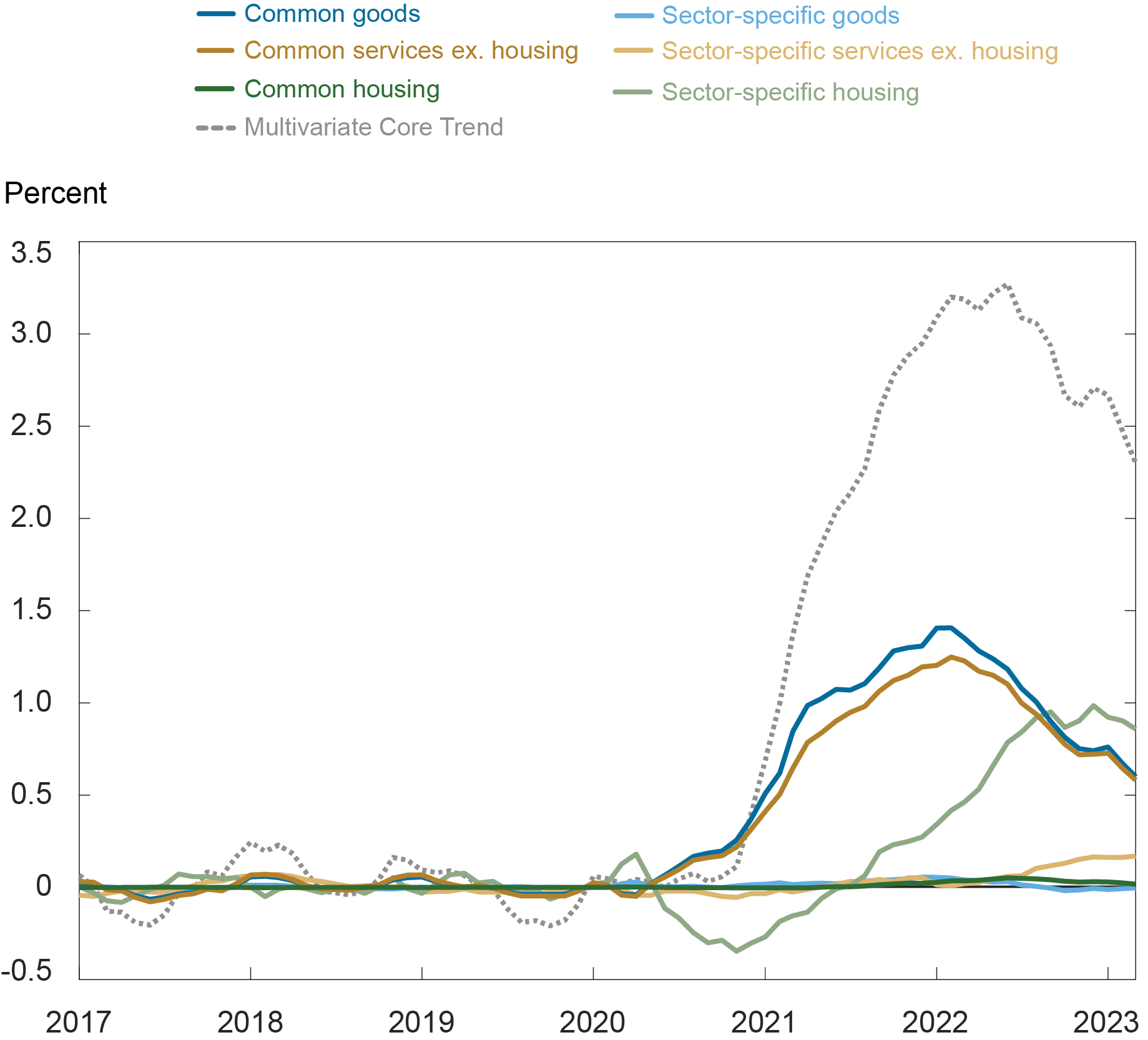

As we documented in our earlier posts, an necessary distinction throughout sectors is the supply of the persistence: within the housing sector, the persistence has a powerful sector-specific element, whereas core items and companies ex-housing are dominated by their widespread element, as seen within the subsequent chart displaying a finer decomposition utilizing the MCT mannequin.

Finer Inflation Development Decomposition

Notice: The bottom for the calculations of the contributions to the change within the Multivariate Core Development is the typical over the interval January 2017-December 2019.

We are going to present a brand new replace of the MCT and its sectoral insights after the discharge of April PCE information.

Martín Almuzara is a analysis economist in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Babur Kocaoglu is a senior analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Argia Sbordone is the top of Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

The best way to cite this submit:

Martin Almuzara, Babur Kocaoglu, and Argia Sbordone, “MCT Replace: Inflation Persistence Continued to Decline in March,” Federal Reserve Financial institution of New York Liberty Avenue Economics, Could 5, 2023, https://libertystreeteconomics.newyorkfed.org/2023/05/mct-update-inflation-persistence-continued-to-decline-in-march/.

Disclaimer

The views expressed on this submit are these of the writer(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the writer(s).