This 12 months’s World Trade Classification Requirements (GICS) adjustments will embrace a number of reclassifications which can have a big influence on the weighting of a number of totally different broad sectors together with funding methods.

Why the 2023 GICS Modifications Matter

Whereas there are a number of small adjustments happening, there are some key reclassifications that may materially influence the broad sector weightings and presumably traders’ funding methods.

Listed here are the fabric adjustments:

- Each Visa (V) and MasterCard (MA) will probably be moved out of the Expertise sector and into the Monetary sector.

- ADP (ADP) may also be moved out of Expertise and into the Industrial sector.

- Goal (TGT) will probably be moved out of the Shopper Cyclical sector, and into the Shopper Staples sector.

These reclassifications are materials as a result of every of these 4 corporations sit within the prime ten of their present sectors by market cap.

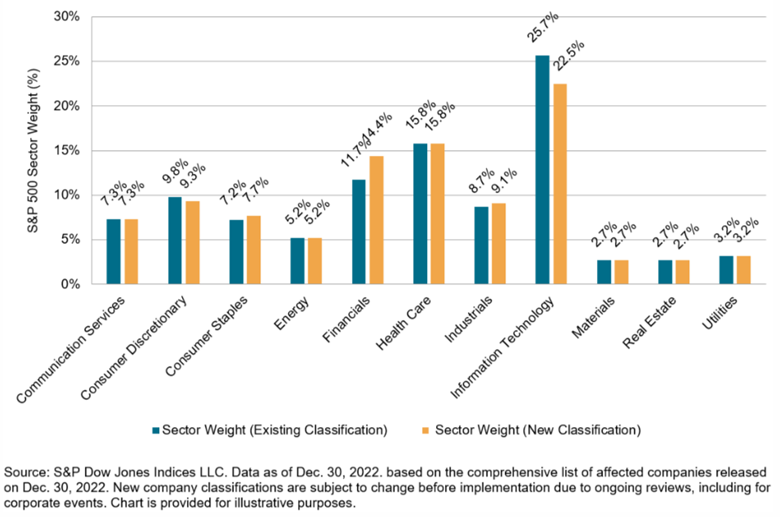

With the Monetary sector selecting up each Visa and MasterCard, it turns into the most important gainer of all 11 sectors and can set up itself in third place behind Info Expertise (#1) and Well being Care (#2).

Info Expertise will nonetheless keep its place as the most important sector, however it’s dropping over 3% of its whole weighting throughout the whole S&P 500 – essentially the most of some other sector within the reclassification.

With ADP transferring into the Industrial sector, it is going to deliver that sector S&P 500 weighting as much as 9.1%, which is simply barely decrease than the Shopper Discretionary sector which misplaced Goal to the Shopper Staples sector. All different sectors stay unchanged. The graph beneath exhibits the distinction between the present classification (blue) and the brand new upcoming classification (yellow).

When you keep an funding technique that focuses on ETF sector choice, this transformation is one thing to remain conscious of.

When you’re a MONUMENT CLIENT IN THE MWM ETF STRATEGY, see extra beneath.

Going Deeper on the GICS Rankings

The GICS rankings try to supply a framework for corporations to be broadly labeled and grouped collectively for analysis and technique functions. What it’s actually attempting to do is to take note of how the market perceives these corporations to supply each complete and clear groupings.

If you consider GICS as a hierarchy, the segmentations look one thing like this (from largest to smallest):

- 11 Sectors

- 24 Trade Teams

- 69 Industries

- 158 Sub Industries.

Right now I’m simply sticking with the 11 giant sectors for this dialogue. As a reminder, these eleven are:

- Vitality

- Supplies

- Industrials

- Shopper Discretionary

- Shopper Staples

- Healthcare

- Financials

- Info Expertise

- Communication Companies

- Utilities

- Actual Property

The groupings are reviewed yearly with the intent of creating certain basic market segments replicate actuality as corporations shift technique and merchandise. Whereas small updates occur yearly, there are particular years the place there are dramatic impacts on how the sectors are constructed and labeled.

For instance, one of many extra impactful adjustments happened in 2018, which included shifting a number of corporations out of the Info Expertise house and the Shopper Discretionary house and right into a brand-new Communications sector. That change noticed a few of the huge big tech names equivalent to Fb, Google, and Netflix consolidated into this new sector.

One other change happened in 2016 when the Actual Property sector was launched as its personal standalone sector.

The Backside Line

Each few years we see materials adjustments that reclassify how markets and sectors are outlined. This upcoming reclassification is a kind of materials adjustments. Since these 4 sectors are being reorganized, it’s significantly necessary to concentrate on any present investments you’ve gotten in sector ETF funds and be certain that they’re nonetheless in a correct weight given your portfolio technique.

The Monument Wealth Administration Asset Administration Staff will probably be having a look at sector publicity in our MWM ETF Portfolio and making some adjustments this quarter. Please name us if in case you have any issues about upcoming adjustments in your ETF portfolio and the way it could influence your tax image.

Our ETF portfolio is arising on its 20-year anniversary and is considered one of our longest-standing methods. Modifications to this technique invariably contain capturing long-term capital features. And whereas we’re at all times attempting to be tax-sensitive, we consider that it’s extra necessary to handle the portfolio for future progress than it’s for tax avoidance.

Hold wanting ahead,