A reader asks:

I’m a 34-year-old with a excessive danger tolerance. All of my funding accounts are 100% invested in shares. The one factor I’ve a tough time discovering a tried and true reply on after I do analysis is the right way to finest allocate my inventory investments amongst large-cap, mid-cap, worldwide, rising markets, and many others. I’m not trying to get the best return attainable per se (though that might be good), reasonably, I’m trying to have a well-diversified portfolio that provides me publicity to the varied elements of the inventory market in order that my long-term return is 7%-10%. I’ve all the time utilized the next allocation for no different cause than it appears affordable and is nicely diversified:

-

- 33% U.S. giant cap

- 17% U.S. mid cap

- 16% U.S. small cap

- 20% developed worldwide

- 14% rising markets

Does this appear about proper to you? Would like to know the way you concentrate on your inventory allocation and what you make the most of as a superb benchmark.

I can’t promise something on the subject of future returns for the inventory market however a world benchmark for the inventory market is pretty simple.

The world inventory market is an efficient place to begin to match your 100% inventory portfolio to as a result of that’s the investable universe.

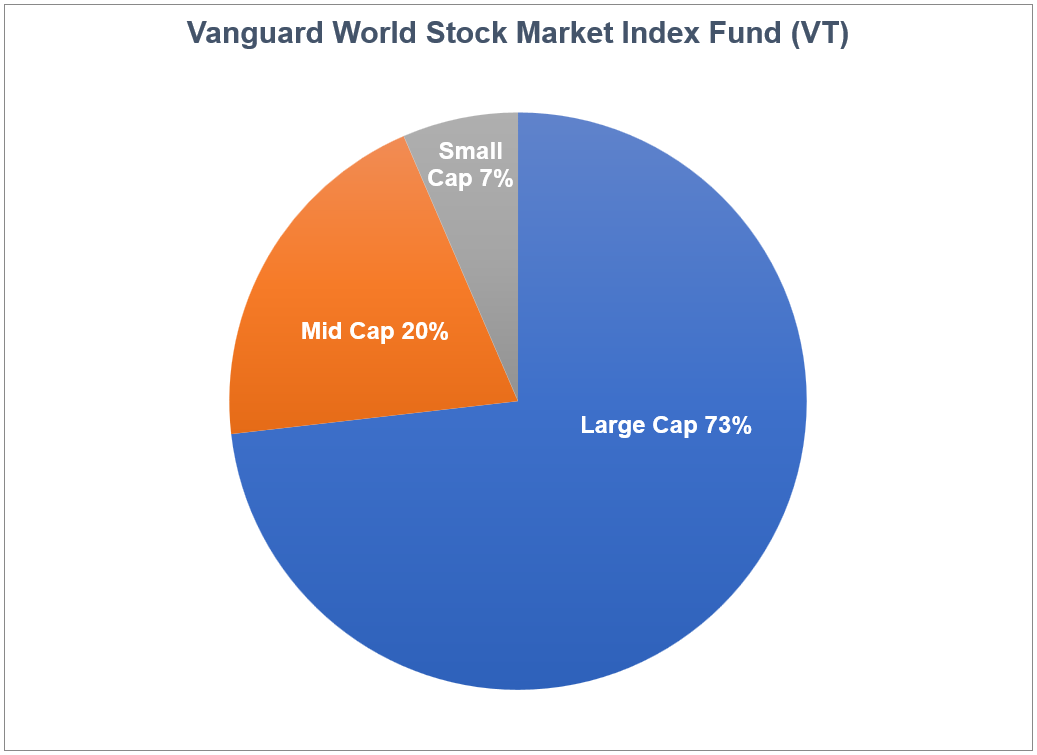

Right here’s the present breakdown primarily based on the Vanguard World Inventory Market ETF (VT):

That’s almost 60% in U.S. shares, one-third in international developed shares and just below 10% in rising markets.

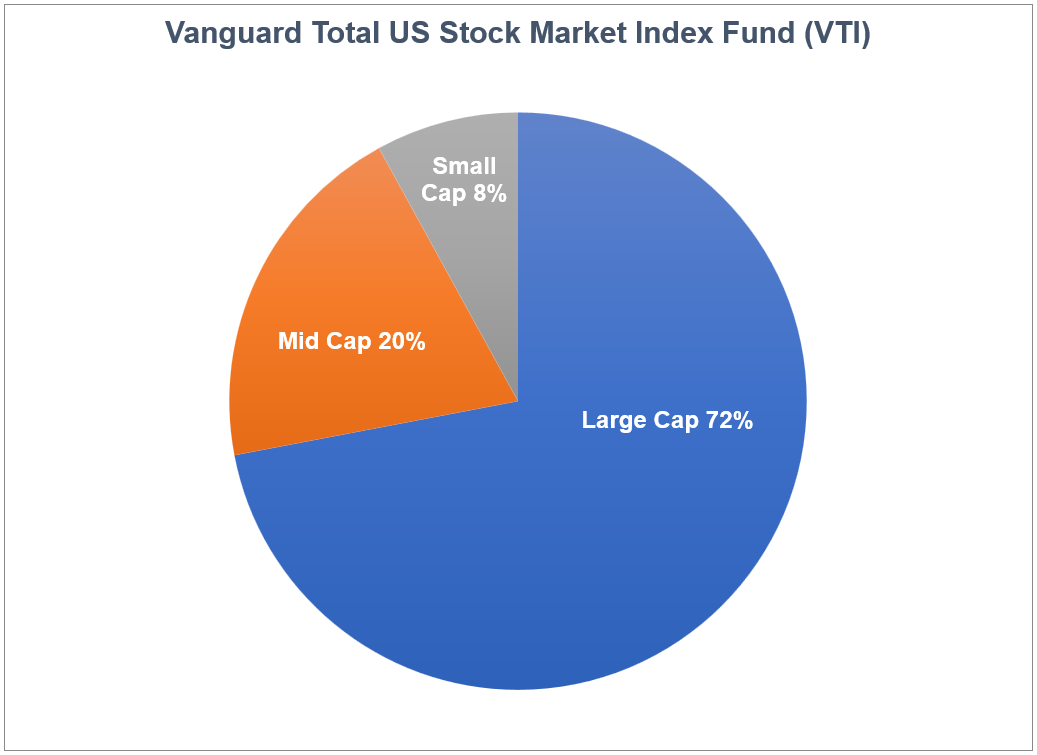

That is market cap breakdown on a world foundation:

The big, mid and small weightings globally are principally the identical as they’re in the USA:

I’m not saying it’s important to observe international weightings (really the portfolio in query is fairly shut). I simply assume the worldwide market cap is an efficient jumping-off level to see the place you differ from the precise market.

If nothing else, you should use the world inventory market as a benchmark for efficiency attribution and perceive the place your bets are being made.

Many traders in all probability assume the S&P 500 or a complete U.S. inventory market index fund must be the benchmark of alternative. With the USA making up 60% of the overall pie and getting the entire publicity on the subject of the monetary media, I perceive why this is able to be the case.

The truth is, out of the highest 25 holdings for the Vanguard World Inventory Market Index Fund, simply 4 are international firms:

America dominates the inventory market.

I do, nonetheless, nonetheless assume there’s room for diversification should you’re going to speculate your whole portfolio in shares.

I do know it looks like the S&P 500 all the time outperforms small caps, mid caps, worldwide developed markets and rising markets however you don’t have to return that far to discover a time when the largest firms in America underperformed.

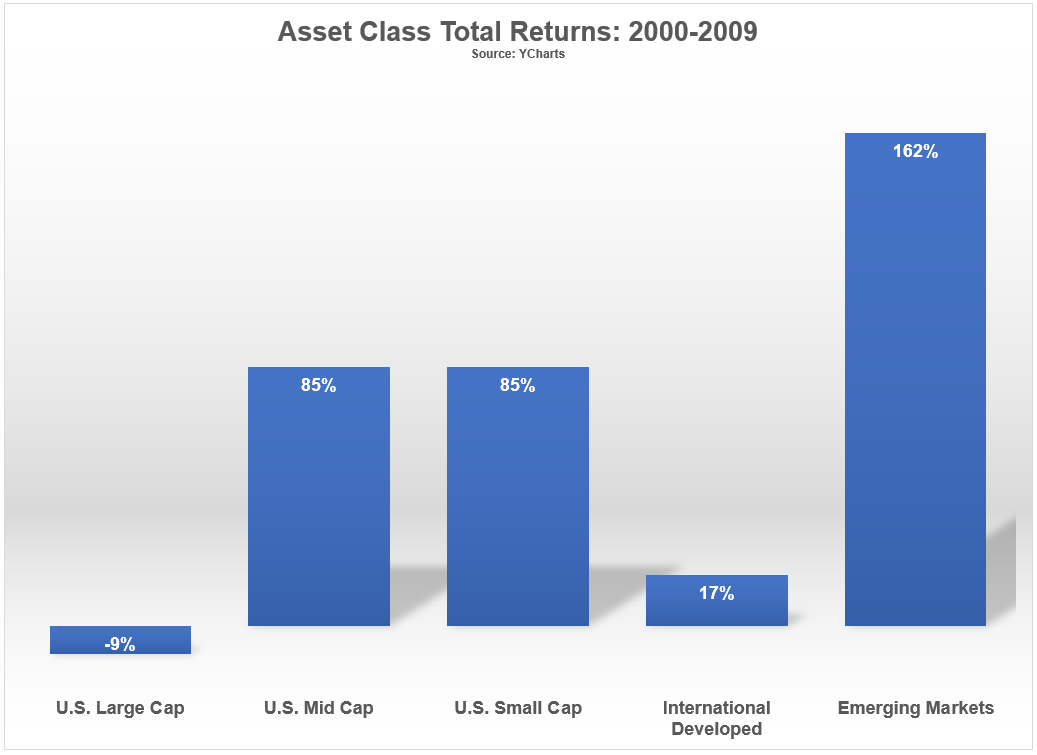

There are the overall returns1 within the first decade of the twenty first century:

It was a misplaced decade for the S&P 500. And diversification saved the day should you unfold your bets amongst these different areas of the market.

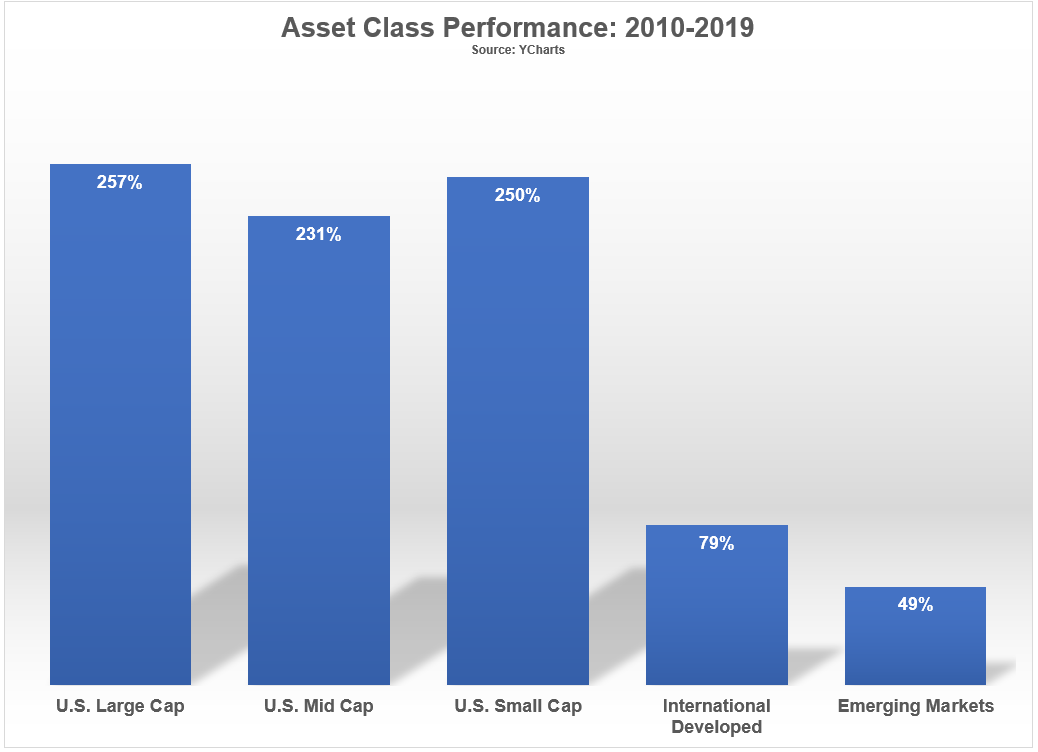

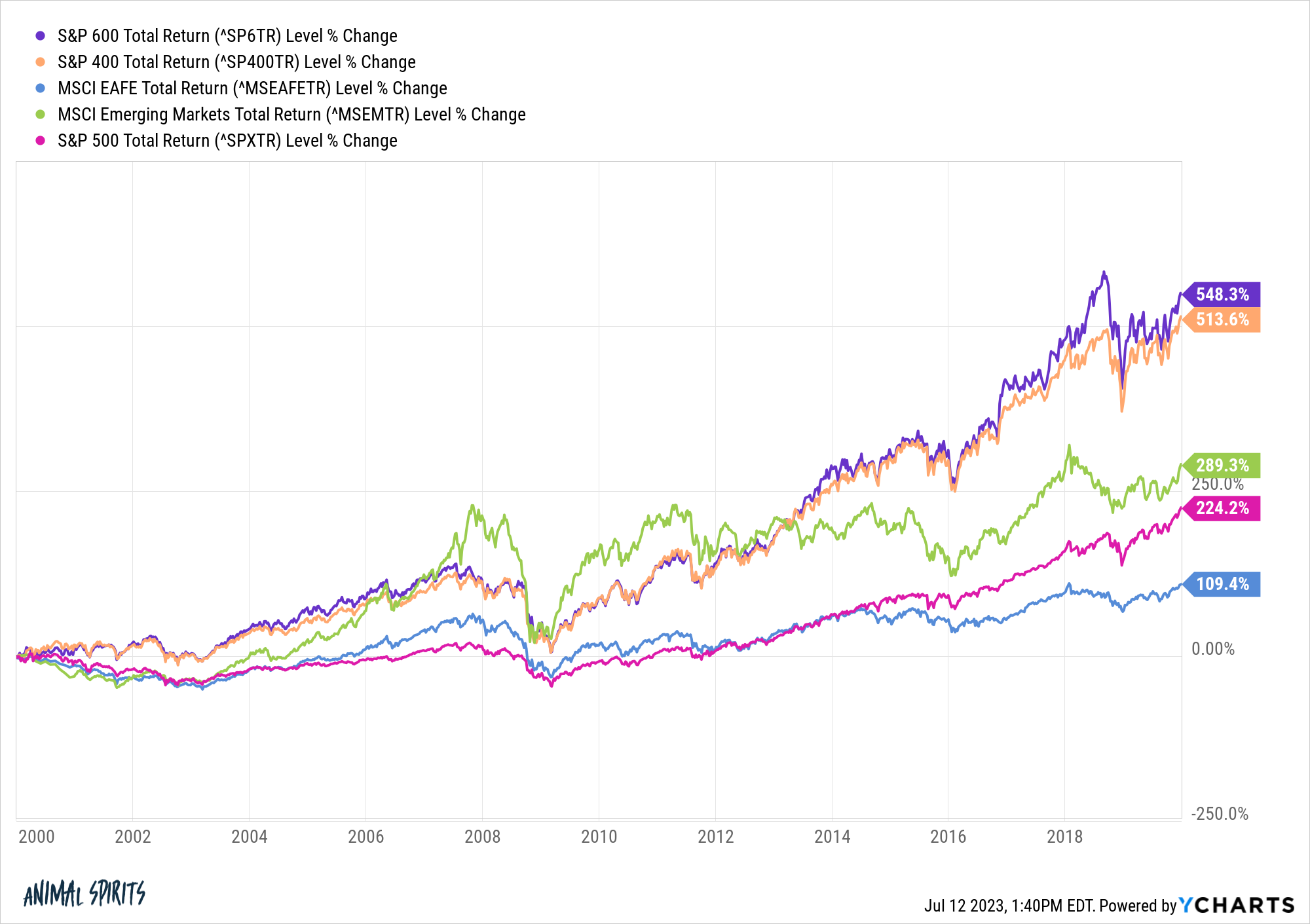

Now right here’s what occurred within the ensuing decade:

The S&P 500 got here again with a vengeance whereas rising markets went from first place to final place.

Now right here’s what it seems like if we put all of it collectively for each many years:

Surprisingly, the S&P 500 ranks second to final by way of whole efficiency from 2000-2019.

A few of this has to do with the beginning and finish dates chosen right here. The yr 2000 was doubtless the worst entry level in fashionable U.S. inventory market historical past.2 I might change the beginning date and the S&P would take a look at lot higher than this.

However perhaps that’s my level.

You simply by no means know when sure markets, geographies, market caps or danger components are going to knock the quilt off the ball or strike out.

That’s why I believe diversification is vital, even should you plan on investing 100% of your cash within the inventory market.

We talked about this query on this week’s Ask the Compound:

Doug Boneparth joined me on the present this week to debate questions on managing your funds in center age, budgeting for RSUs, monetary planning for households and the right way to allocate between investments and money.

1Right here’s what I used for every asset class right here: S&P 500, S&P 600, S&P 400, MSCI EAFE and MSCI EM.

2September 1929 wasn’t nice both.