The Financial Trendy Household has opened its loving arms to the bulls and to us after our 2 weeks away.

Starting with Granddad Russell 2000 (IWM), Monday started with a spot up over the 50-DMA (blue). We’ll look ahead to a section change affirmation. Moreover, the month-to-month chart reveals IWM again above the 80-month MA (inexperienced). Resistance at 191 space is on faucet if IWM holds above 174.

Granny Retail XRT gave us the clutch maintain earlier than we left by by no means breaking down below the 80-month shifting common (inexperienced). Now, XRT has extra to show and must be watched rigorously. You possibly can see the resistance on the 200-DMA (inexperienced), however, extra importantly, preserve watching the month-to-month chart.

XRT has not cleared the 23 -month MA (blue) but in 2023. Each IWM and XRT are proper into resistance on the momentum or Actual Movement charts.

One other shiny spot potential is within the Management chart, with IWM now outperforming the SPY. This may very well be a sport changer if it continues.

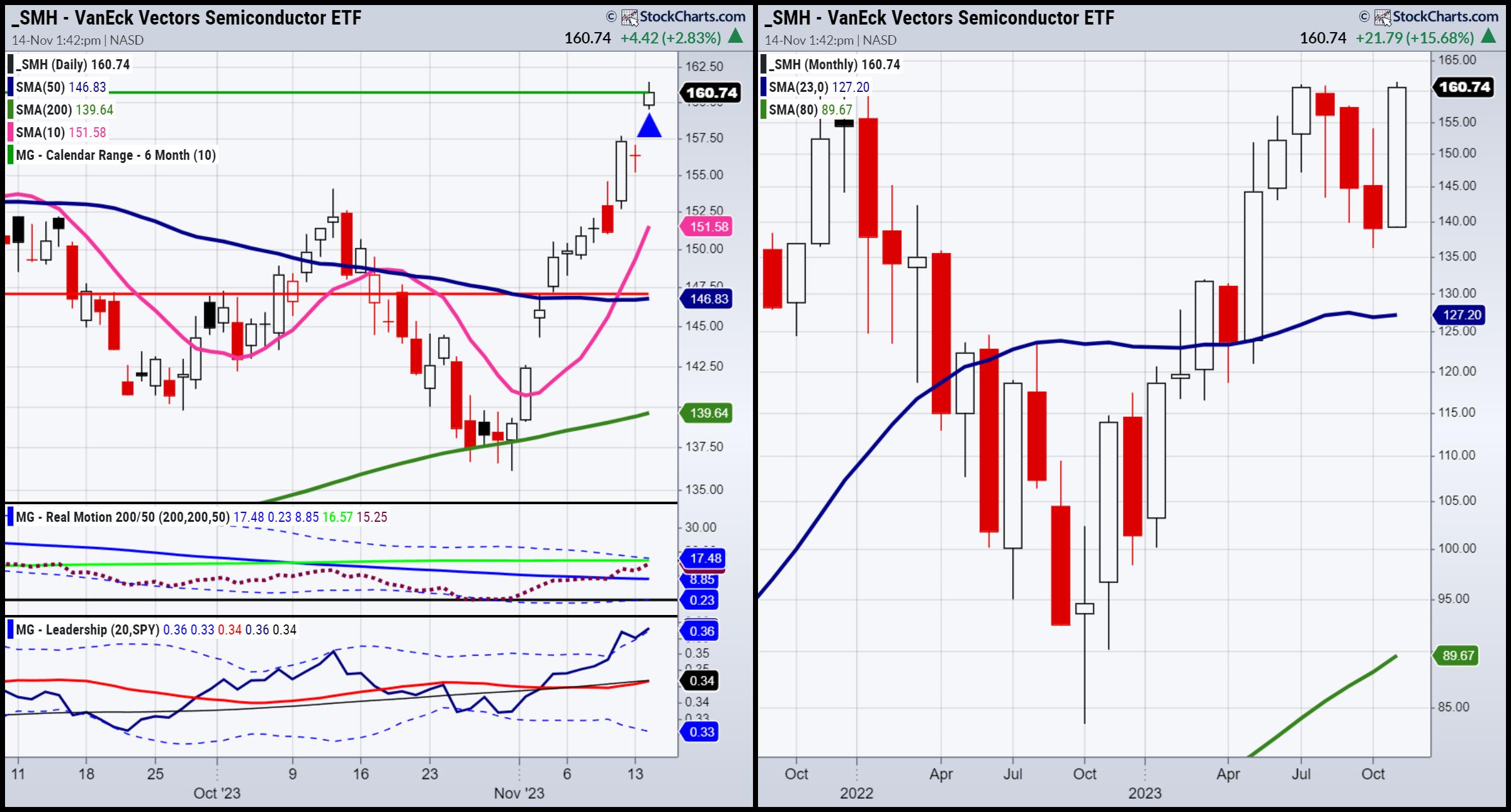

Semiconductors (SMH), together with development shares, lead. Fascinating that SMH touched the July 6-month calendar vary excessive (inexperienced horizontal line) in the present day. The momentum indicator additionally hit resistance. The month-to-month calendar by no means broke down. Now, we’re awaiting SMH to clear (or not) the 160-161 stage with quantity.

Transportation (IYT) is again to final month’s highs. IYT is definitely underperforming in momentum, whereas it cleared previous the SPY in management. Marginally surpassing the 23-month proper now, IYT should maintain over 230 now to remain within the sport.

The within sectors of the economic system, as represented by IWM, XRT, and IYT, nonetheless have loads to show, regardless of being spectacular on this run. Semiconductors after all, are method stronger, however are additionally going into some headwinds.

These month-to-month charts have been extraordinarily dependable in serving to us gauge the main help and resistance. Seasonally, the market might stay sturdy. Nonetheless, this has been a 12 months of #squarepegroundhole.

That is for instructional functions solely. Buying and selling comes with danger.

MarketGauge has rocked it this 12 months. Our blends, fashions, methods, instruments and training is like no different. In the event you discover it troublesome to execute the MarketGauge methods or wish to discover how we are able to do it for you, please e mail Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Gross sales. Cell: 612-518-2482.

For extra detailed buying and selling details about our blended fashions, instruments and dealer training programs, contact Rob Quinn, our Chief Technique Marketing consultant, to be taught extra.

Merchants World Fintech Awards

Get your copy of Plant Your Cash Tree: A Information to Rising Your Wealth.

Develop your wealth in the present day and plant your cash tree!

“I grew my cash tree and so are you able to!” – Mish Schneider

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

Mish talks about Tencent Music Leisure on Enterprise First AM.

Mish talks bonds with Charles Payne on this clip from October 27, recorded dwell in-studio at Fox Enterprise.

Stay in-studio at Yahoo! Finance on October 26, Mish does a chart deep dive with Jared Blikre.

Mish talks 401(okay)s on the NYSE in this October 26 video from Cheddar TV.

Mish covers the bond rally and the way customers might save the day on this October 24 video from Enterprise First AM.

Coming Up:

November 14: X Areas with Hedgeye

November 16: CNBC Asia

November 17: BNN Bloomberg

November 20: Yahoo! Finance

November 28: Your Day by day 5, StockCharts TV

November 30: Stay Teaching

December 3-December 13: Cash Present Webinar-at-Sea

Weekly: Enterprise First AM, CMC Markets

- S&P 500 (SPY): 450 clears see 465. Beneath 450, 435 help.

- Russell 2000 (IWM): 181 resistance, 174 help.

- Dow (DIA): 360 resistance, 346 help.

- Nasdaq (QQQ): 388 should clear and 370 should maintain.

- Regional banks (KRE): 45 huge resistance.

- Semiconductors (SMH): 160-161 now pivotal help.

- Transportation (IYT): 230 key help.

- Biotechnology (IBB): 120 pivotal.

- Retail (XRT): 63 resistance and 60 pivotal help.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For practically 20 years, MarketGauge.com has offered monetary info and training to 1000’s of people, in addition to to massive monetary establishments and publications resembling Barron’s, Constancy, ILX Programs, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary individuals to comply with on Twitter. In 2018, Mish was the winner of the Prime Inventory Choose of the 12 months for RealVision.