Publish Views:

15,720

Don’t battle the forces, use them. – R. Buckminster Fuller

Everybody thinks that as a result of current occasions brought on by Coronavirus we’re in unsure occasions. I imagine we’re at all times in unsure occasions. The emergence of any occasion has a number of co-dependent components and nothing will get created out of a vacuum. Since we can not know and management all of the components that result in the manifestation of any scenario; we can’t be 100% sure about any occasion. Thus, we’re at all times in unsure occasions, solely the diploma varies in our thoughts based mostly on how we understand the newest set of knowledge which has identified ‘knowns & unknowns’ and nonetheless lacking out on unknown ‘knowns & unknowns’.

The very best buyers I do know are those that imagine that the longer term is at all times unsure they usually plan and account for such a scenario of their funding administration framework. The buyers who do poorly are those that are at all times very certain of the longer term occasions. On this weblog, I’m going to present you insights on the necessary features of funding administration employed by the most effective buyers and the way we will use them to maximise our portfolio returns moreover minimizing the danger.

1. Be Cautiously Optimistic

Everyone knows that to have the ability to achieve success in life, we should be optimistic about our future. Nevertheless, together with that optimism, warning must also be hooked up on account of unknown ‘knowns & unknowns’ sooner or later. The very best buyers are cautiously optimistic in regards to the future. In truth, Warren Buffet who’s the 4th richest man on the planet has two guidelines for investing:

Rule No 1: By no means lose cash

Rule No 2: Always remember rule no. 1

The above assertion doesn’t imply that one won’t ever have funding

losses however following the above two guidelines will make you assume in a path to

construct methods and approaches that reduce your losses.

Do you know lots of the world’s greatest buyers have been already

ready for the crash? Warren Buffet is sitting on greater than USD 120 billion

of money

from many months, Howard Marks has been speaking

about being defensive because the final two years and so

was Seth Klarman. It’s not that they knew the time of the market crash, however

their funding methods ensured that their portfolios have been ready for any

such eventualities.

They perceive that inventory markets undergo a cycle and the priceless classes from historical past taught them to learn indicators and keep cautiously optimistic. They don’t battle the forces, they use them.

2. Use tactical allocation to make your portfolio future-ready

Sensible buyers are very cautious about market valuations (costs) and investor behaviour. They know that human behaviour results in excessive costs within the inventory market – each on the upside and draw back, and they’re ready to reap the benefits of such follies. The chart beneath illustrates that the sensible cash enters when valuations are low and nearly all of the buyers aren’t that asset class or safety.

How are they ready for that? They use the precept of margin of security.

It means they purchase any enterprise or inventory when its buying and selling value is decrease than

their self-assessed truthful worth (often known as intrinsic worth) of that

enterprise. Decrease the buying and selling value than

truthful worth, decrease is the draw back danger and better is the margin of security and

upside potential. Equally, the sensible buyers cease making new investments

and bought the one they have been holding once they notice that market valuations are

too costly which leads to larger draw back danger, low margin of security, and decrease

return potential. This offers them

sufficient liquidity to take a position once more at cheaper costs when the tide goes out.

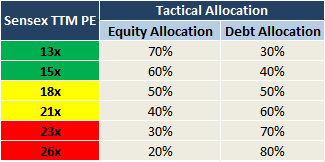

For frequent buyers, arriving at a good worth of any inventory could possibly be very difficult. Therefore, they’ll use a easy valuation parameter of 10-15 years common value per incomes (PE) ratio. For instance, the 15 years common twelve months trailing (TTM) PE ratio of benchmark Sensex is 18-19x. In earlier market cycles, the TTM PE of Sensex has touched 28-30x on the market peak and 10-12x on the marker trough. So a mutual fund investor targeted on giant caps ought to progressively begin lowering fairness allocation from the portfolio because it retains rising above 21x PE. Quite the opposite, one ought to progressively add up fairness allocation because the Sensex PE retains falling beneath 18x PE ratio. A pattern tactical allocation plan for an investor with a average danger profile could possibly be like this:

Please notice, we’ve got simplified the above case for understanding functions. In actuality, truthful valuation of the Sensex is dependent upon many components and it retains on altering however taking long run common (of a minimum of 10-15 years) is an effective strategy to begin. The necessary takeaway is that there ought to be an allocation plan ready for asset class volatility and it shouldn’t be simply an ad-hoc emotional shopping for or promoting. One can put together a custom-made plan relying upon their funding liking and understanding of various asset courses, sub-categories, and their very own danger profile. Having a way of market/asset class cycles and at which stage we could possibly be in that cycle helps tremendously.

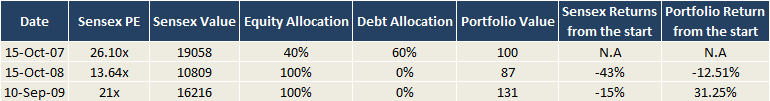

Now let’s see how tactical asset allocation could make an enormous distinction in your portfolio efficiency. Take into account an investor with a high-risk profile who chooses to take fairness publicity in her portfolio by investing in an index fund monitoring Sensex and the remaining quantity in a debt mutual fund. She had a plan to scale back fairness publicity to 40% of the portfolio when the Sensex TTM PE reaches 26x and improve it again to 100% when the Sensex TTM PE reaches 13x. If she had executed her plan with perfection in two years interval from Oct 2007 to Oct 2009, her portfolio returns would have been constructive 31% (46% greater than Sensex returns) over the subsequent two years in comparison with damaging 15% returns if she had continued to remain 100% invested in fairness.

Pardon me for utilizing an ideal case state of affairs for a brief interval of two years to drive throughout my level for the sake of calculation simplicity. In actuality, the most effective technique is to progressively improve fairness allocation because the market continues to slip down because you by no means know if the market will actually backside at 13x or 14x or every other PE ratio. You’d have nonetheless ended up making 20-25% larger returns over the Sensex returns in two years by making staggered investments through the down cycle. Sequence of such profitable tactical asset allocation calls leads to long run compounding returns and outperformance over the benchmark returns by 5-15% each year which is simply wonderful!

There are numerous research which clarify that asset allocation accounts for 80-85% of portfolio returns whereas scheme choice contributes to solely 15-20%. Regardless of that, many buyers find yourself spending a majority of their time and vitality to find the most effective scheme and infrequently on discovering the most effective asset allocation.

Nevertheless, having a plan will not be the certain shot strategy to funding success should you shouldn’t have the proper temperament and braveness to execute the identical. This brings us to the final however an important high quality of profitable buyers.

3. Endurance, Braveness, and Conviction

Since persistence and

braveness are uncommon traits, so is the uncommon membership of profitable buyers. I’ve

seen many disciplined and skilled buyers who resisted investing in

fairness for a very long time on account of costly valuations however lastly gave in to the

psychological strain of seeing their friends earn money. They ran out of

persistence and ended up investing on the market peak. They discover some causes to

justify the extreme valuation by assuming that the components which can be driving the

market to excesses will proceed to remain perpetually. By the best way, bears turning

bulls can be a robust sign of market reaching to its peak.

Having conviction to observe a method and persistence to stay

to a plan (normally by going in opposition to the herd)

for so long as it requires, wants a fantastic power of braveness and tranquil temperament.

One can develop and strengthen these qualities by meditation

and working towards mindfulness.

Draw back

of following a disciplined worth investing strategy is that you could be find yourself being

too early typically. However it’s at all times higher to be early than late.

Being early can value you some missed-upside however being late could be very harmful to

your portfolio well being.

The proof of the pudding is within the consuming. Following the above three qualities of profitable buyers, we at Truemind Capital have been in a position to ship respectable outcomes. As talked about in our earlier weblog, we have been underweight on fairness earlier than the market correction on account of overvaluation and had taken respectable publicity to Gold a yr in the past. We elevated a few of our fairness publicity within the month of March when markets corrected considerably from its peak. This helped us generate constructive return of three%-8% on our portfolios underneath administration within the final one yr in comparison with -17% YoY decline within the Sensex worth. This means an outperformance of 20-25% over the benchmark Sensex. Nevertheless, we proceed to remain cautiously optimistic.

We hope this piece helps in understanding on formulate an funding technique on your portfolio. You need to work on a plan instantly even when your portfolio has losses. Failing to plan would lay floor for future disappointments. In case you are having issue in organising a strategic funding plan that fits your distinctive necessities, be at liberty to debate with us.

Truemind Capital is a SEBI Registered Funding Administration & Private Finance Advisory platform. You’ll be able to write to us at join@truemindcapital.com or name us on 9999505324.