Trace: You gained’t must strive too arduous, so long as you learn to leverage your innate feminine traits that has been confirmed to result in higher investing outcomes over time.

Again in 2017, I first wrote about how girls make for higher buyers than males, as lengthy you study to leverage your innate female traits and instincts that make for outperformance.

This isn’t simply me making daring claims – quite a few analysis research and surveys have since confirmed that the girls certainly do make higher buyers. Contemplate these:

In fact, all of us – no matter our age and gender – are weak to creating unhealthy funding choices. However the important thing lies in recognizing who we’re as an investor, and organising processes to beat our weaknesses.

As an illustration, overconfident buyers typically really feel a stronger urge to purchase extra in good occasions to seize positive aspects, or promote extra in tough occasions to stop future losses. In case you too, discovered your self exhibiting these tendencies within the final 3 years, you might need to verify in on what you are able to do otherwise subsequent time.

Within the final 3 years alone, buyers lived by way of a rollercoaster journey because the markets dropped sharply in early 2020 because of the pandemic, earlier than going into an enormous bull market fuelled by cash printing and a hype over development shares. That lasted till early 2022 when rates of interest began rising, inflicting valuations to drop and the inventory markets crashed.

The Problem of Being Feminine

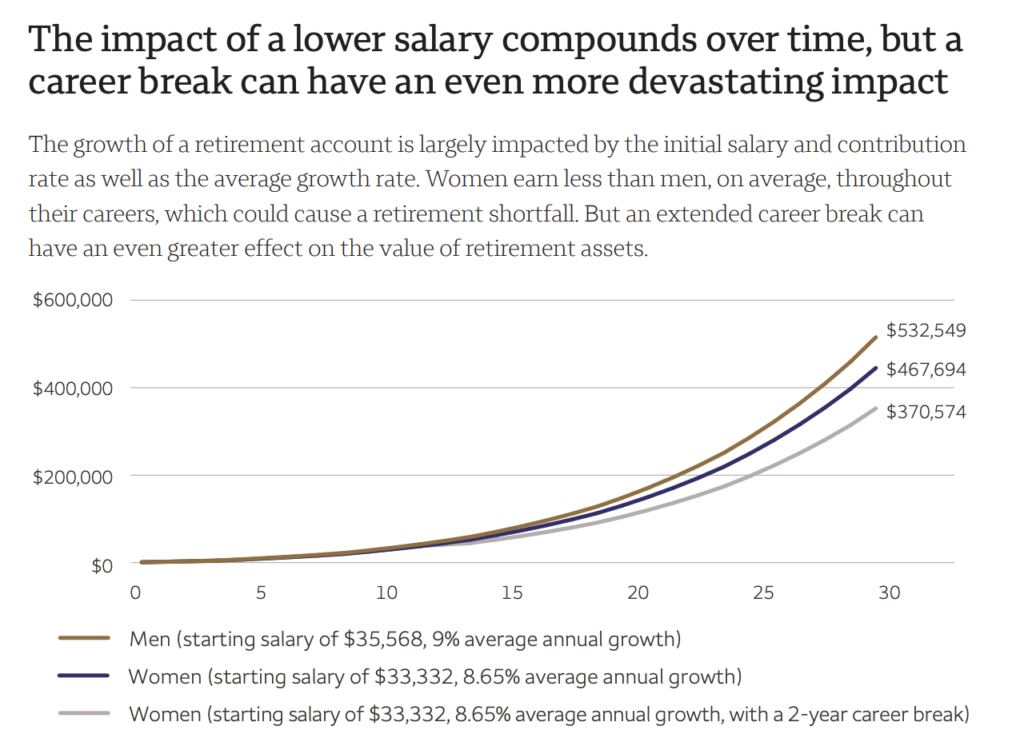

Sadly, being a girl isn’t simple. Not solely do girls earn much less on account of wage disparities (a male colleague in the identical function and a smaller portfolio was paid 25% larger than me), we additionally have longer lifespans.

As well as, girls are typically the default caregiver for his or her households, which generally result in having to take break day work – a limitation acknowledged even by our very personal Prime Minister. These breaks not solely hinders their profession development, but additionally signifies that for a lot of females who keep residence to care for his or her youngsters or aged dad and mom, they’ve much less private funds going right into a retirement plan, inflicting an enormous monetary drawback for them afterward in outdated age.

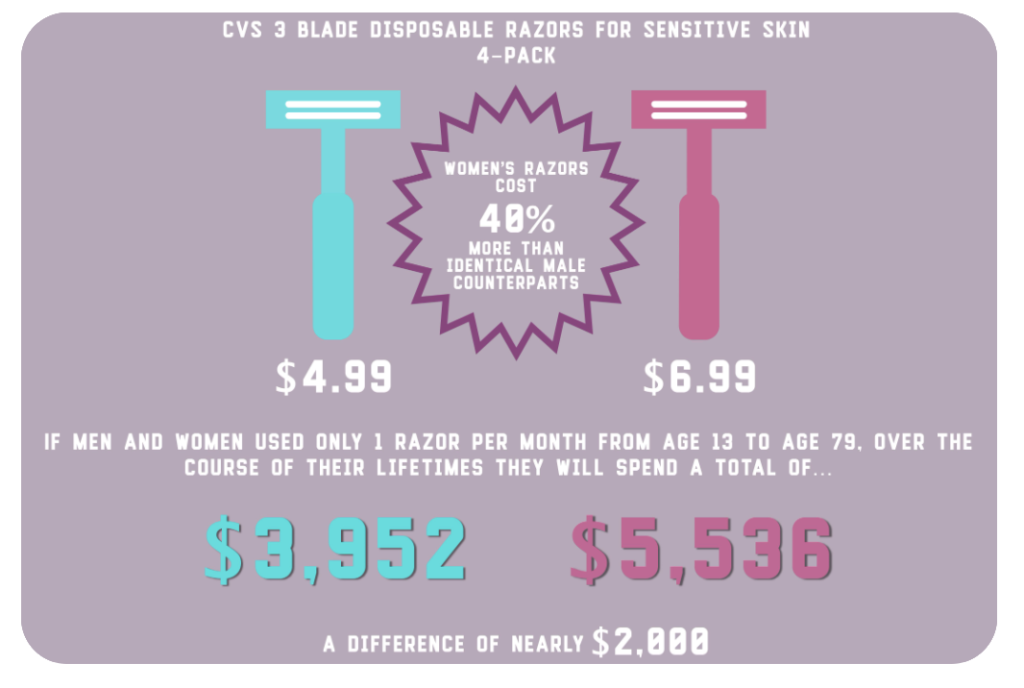

We haven’t even talked about the way it usually prices extra to stay as a girl than a person in as we speak’s society. Simply have a look at the price of skincare, haircuts, make-up and even clothes – these often value extra for females, a phenomenon termed as “the pink tax”. Month-to-month menstrual prices additionally add up, whereas the males don’t have such issues.

Put all of that collectively and also you primarily get much less lifetime earnings however larger bills (and for longer).

If we girls don’t do something about it, we’ll discover ourselves in a worse monetary state than our male counterparts.

Investing as a Girl

By now, you already know that investing is the easiest way to develop and compound your cash over time.

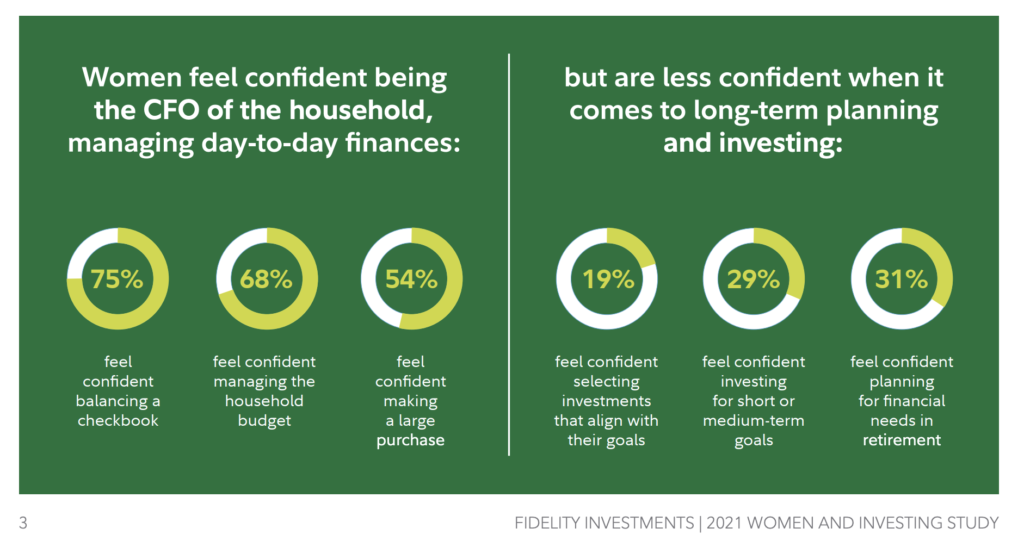

The excellent news is, girls may simply be primed for higher funding success. And for many of us who’re already accountable for the family funds, we’ve it in us to succeed.

The abilities that include managing a family finances are just like what it takes to achieve the funding markets: discover bargains, allocate your money properly, and make investments for a much bigger payoff down the street.

Whenever you pay on your baby’s meals and nutritional vitamins, you’re investing of their bodily development and well being. Whenever you pay for his or her schooling, you’re investing of their future. The identical goes for investing – whenever you spend money on a diversified monetary portfolio, you’re placing your cash to work and safe your retirement.

Now you simply must translate that into your private funds.

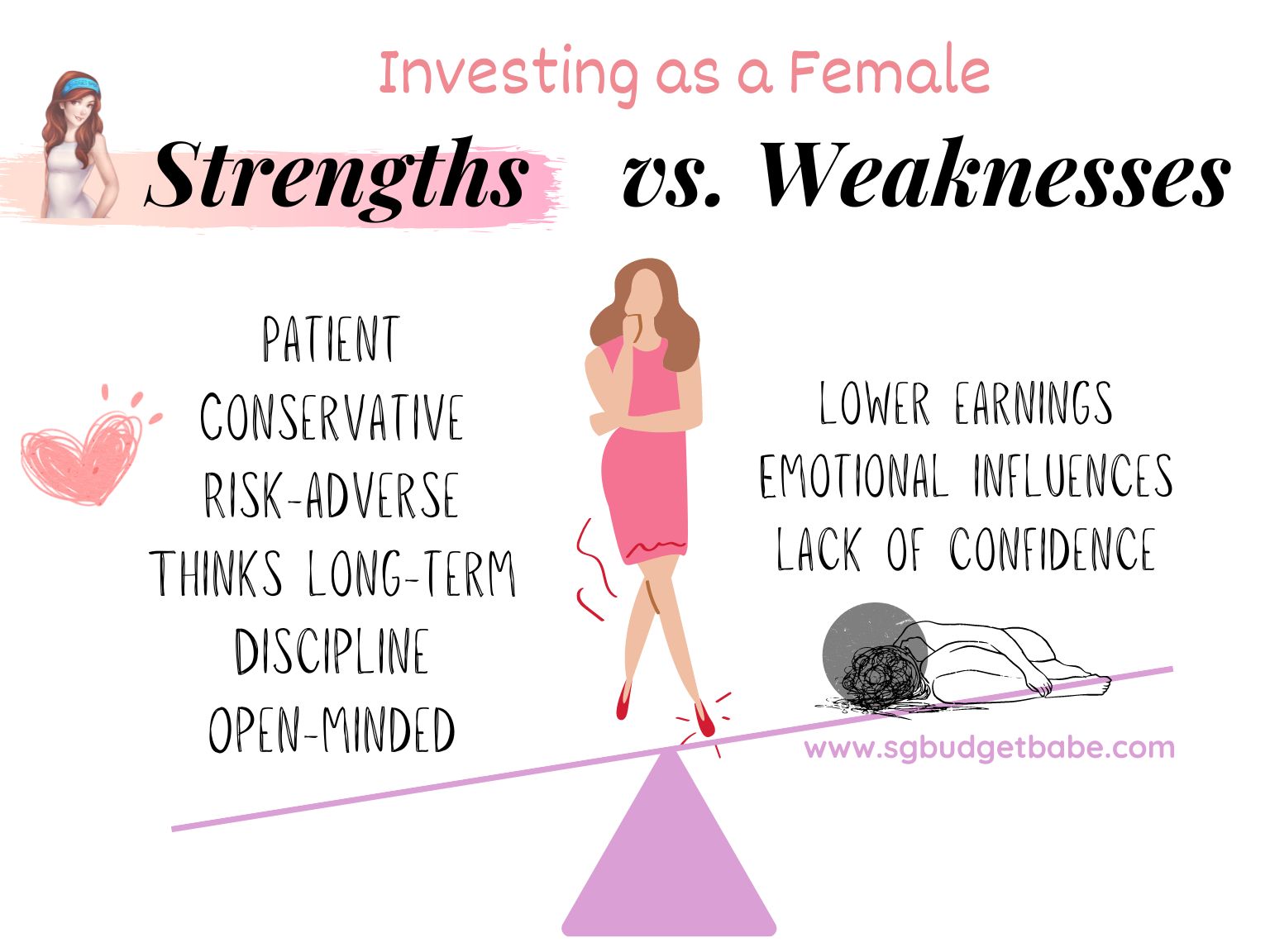

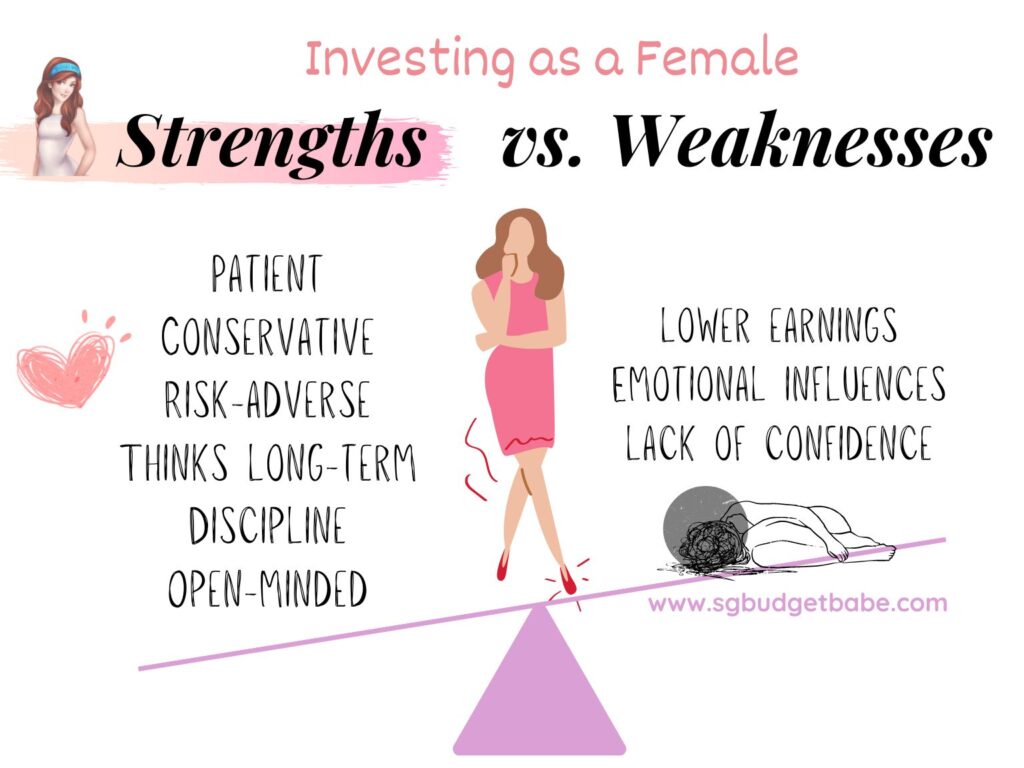

Within the above-mentioned research, the widespread traits recognized that made girls outperform their male counterparts have been:

- Persistence: girls usually tend to be affected person in ready for returns, and are much less prone to be swayed by short-term market fluctuations.

- Conservative: girls have a tendency to contemplate the potential draw back of investments first, and be extra thorough of their analysis and evaluation when making funding choices.

- Danger-adverse: researchers consider that as a result of many ladies typically make investments with their household and family members in thoughts, they’re much less inclined to take pointless threat.

- Thinks long-term: girls typically make investments with an extended time horizon in thoughts.

- Disciplined: females usually tend to keep on with a long-term funding plan and resist the temptation to make impulsive choices primarily based on short-term market fluctuations.

- Open-minded: girls usually tend to search out recommendation and think about quite a lot of views, which frequently results in extra knowledgeable and well-thought out funding choices.

In fact, we aren’t with out our weaknesses both. However listed here are some methods to beat them:

- Decrease earnings: you may make up for a decrease capital whenever you make investments earlier and in a disciplined method.

- Emotional affect: as a lot as I’d hate to confess that girls are usually extra emotional, we’re extra vulnerable to changing into fearful – particularly since we make investments with our family members in thoughts – and performing on it irrationally. One approach to scale back that is to give you “funding guidelines” or a guidelines to information you on every determination that you simply make.

- Insecurity: don’t let ignorance and unfamiliarity maintain you again. Investing is a ability, and it begins from first studying the vocabulary earlier than you observe it and change into competent over time. To study the language and instruments of the commerce, you’ll be able to additionally try programs that I’ve curated right here.

As a feminine myself, I discover that the most important problem I face is with my time and a scarcity of like-minded friends whom I can focus on funding concepts and philosophies with. That’s why I sought out new buddies (albeit principally males) once I began investing, and you may simply try this on-line as we speak too (together with on communities discovered on moomoo).

However time will at all times stay a valuable commodity, and that is maybe my latest and largest problem ever since changing into a mom. With two younger youngsters demanding my fixed consideration, it may be arduous to focus, however I’ve labored round that by scheduling in pockets of time to do my analysis and replace my portfolio each week.

Conclusion

In my discussions with many feminine readers, I typically discover that the most important weak point they’ve is their very own mistaken perception that they aren’t good buyers. So I hope the above proof – each anecdotal and academic-based – convinces you that hey, you DO have what it takes to succeed whenever you make investments.

What’s extra, whereas most females readily discuss make-up, magnificence, their OOTDs or meals, we seldom open up about our personal private funds. We will begin altering this from our technology onwards, so our daughters of tomorrow can develop up in a tradition the place having open conversations about one’s monetary state and how one can enhance it with out concern of judgment.

After I first began this weblog virtually a decade in the past, I acquired a lot criticism from fellow girls who referred to as me “stingy”, “miserly” and “money-minded” each time I talked about saving cash. However 10 years on, that has modified. Speaking about cash is not as taboo because it was once, and changing into “financially woke” is now deemed as cool.

And in case your “interior auntie” loves purchasing for bargains as a lot as I do, let me inform you that it’s much more rewarding whenever you discover bargains within the inventory market vs. on the grocery store or division retailer.

Plus, with instruments like automated dollar-cost averaging, robo-advisory platforms, a variety of exchange-traded funds as we speak and even money administration merchandise, it has change into a lot simpler for us girls to create a portfolio that may cater to our degree of ability and time. Whether or not you’re a younger 20-something feminine with restricted capital or a 40-something mom juggling your profession and caregiving, you’ll undoubtedly be capable of put collectively a portfolio that works for you.

As we rejoice Worldwide Ladies’s Day this yr and replicate on the essential function that females play in society and at residence, let’s additionally not overlook to do one thing for ourselves – and make investments to safe our personal monetary future.

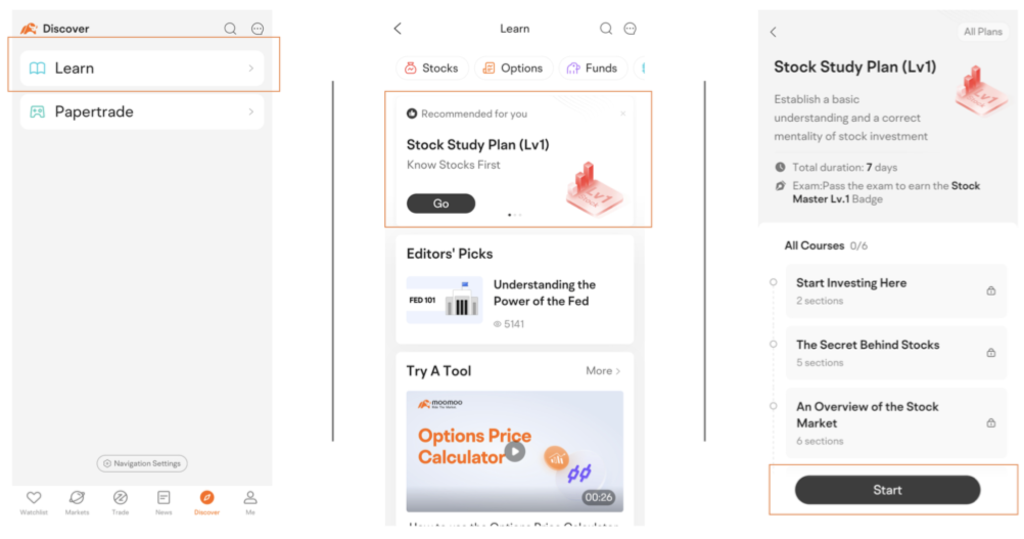

Sponsored Message moomoo is a good way for ladies to speculate on the go. With bite-sized funding articles and monetary evaluation, you'll be able to simply overview an organization’s monetary well being and valuations on the cell app. I personally use moomoo to do quite a lot of my preliminary inventory screens and 5-minute analysis whereas commuting in between my appointments, and even as I sit and supervise my baby for his homework. What’s extra, you too can park your spare funds right into a money administration fund to give you the results you want when you patiently await alternatives within the markets. Signal as much as begin your funding journey right here as we speak!

In case you're new to investing, you too can discover numerous fundamental investing programs on moomoo to assist females begin their investing journey. Test the free programs out right here!

Disclaimer: All views expressed on this article are the unbiased opinions of SG Price range Babe. Neither moomoo Singapore or its associates shall be chargeable for the content material of the knowledge supplied. This commercial has not been reviewed by the Financial Authority of Singapore.