Finance is like style.

Wait lengthy sufficient and the identical arguments come again in model.

We’ve the identical quarrels about finance subjects each few years.

The dying of the 60/40 portfolio.

Is that this the highest (or backside)?

One other one which’s cropped up once more this yr is are the market’s positive aspects too concentrated?

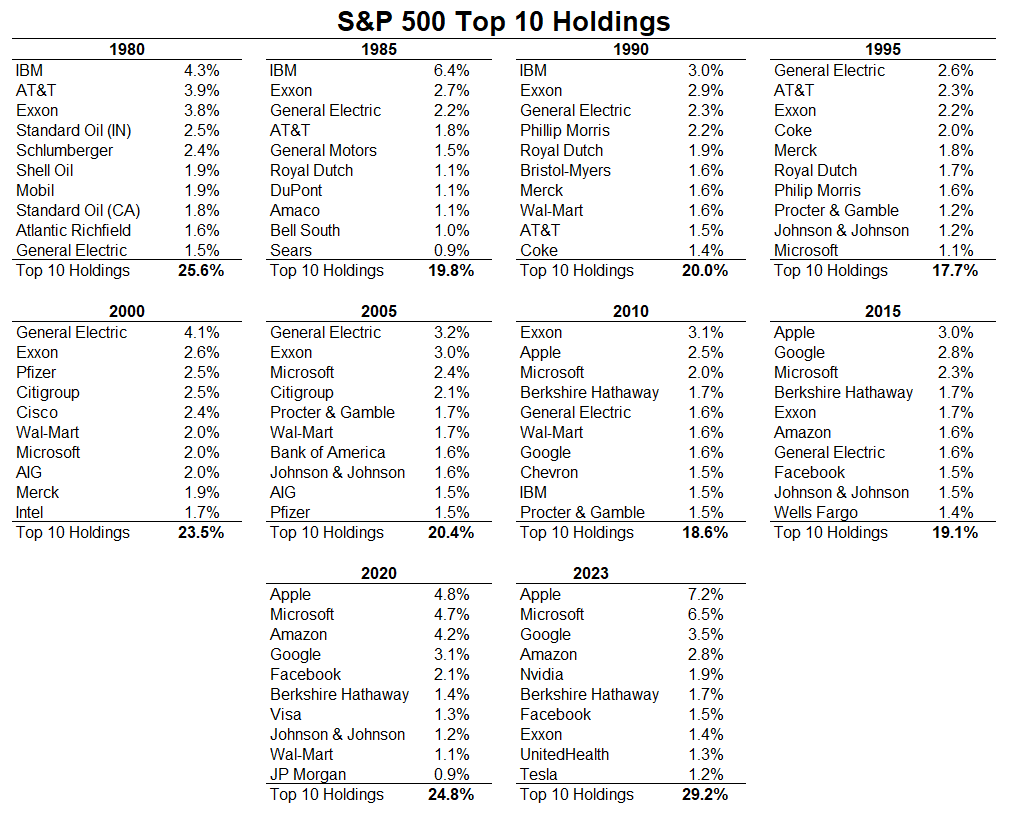

Right here’s a take a look at the outsized affect of mega cap tech shares within the first quarter courtesy of JP Morgan:

The ten largest shares had been chargeable for greater than 70% of the positive aspects by way of the primary three months of the yr.

Ought to this fear you as an investor?

Are this yr’s positive aspects a home of playing cards?

Is that this regular?

All reputable questions.

The S&P 500 has definitely develop into extra top-heavy over time.

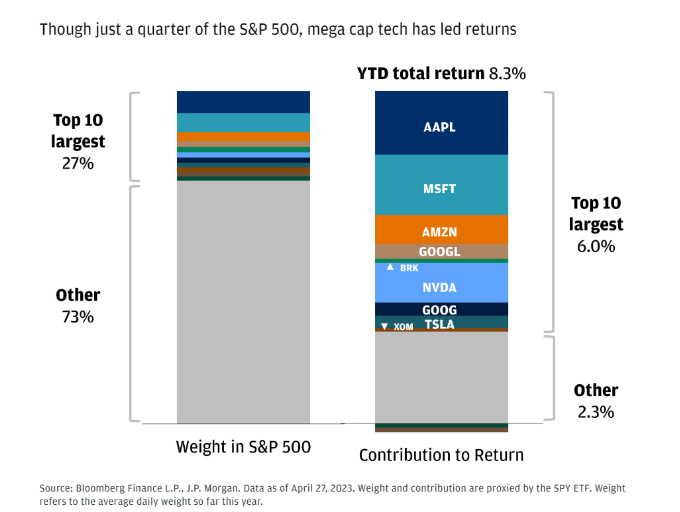

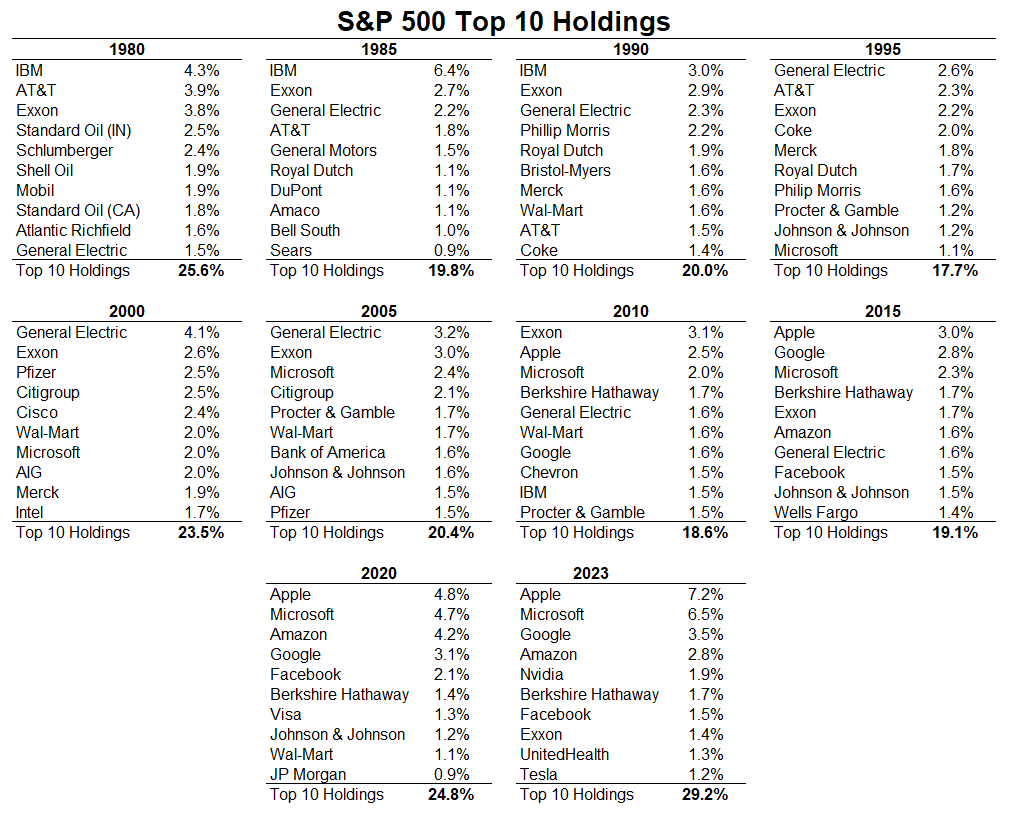

Listed here are the highest 10 shares by market cap each 5 years beginning in 1980 together with an replace with the present weightings:

This stuff ebb and circulate over time however practically 30% within the prime 10 holdings proper now’s as excessive because it’s been over the past 40+ years.

It’s additionally value mentioning how a lot turnover there was over time. There are a choose few shares that keep atop the leaderboard for a number of a long time (GE, Microsoft, Exxon, Wal-Mart) however change is the one fixed.

The truth that Apple makes up greater than 7% of the index with a market cap stands out as properly.

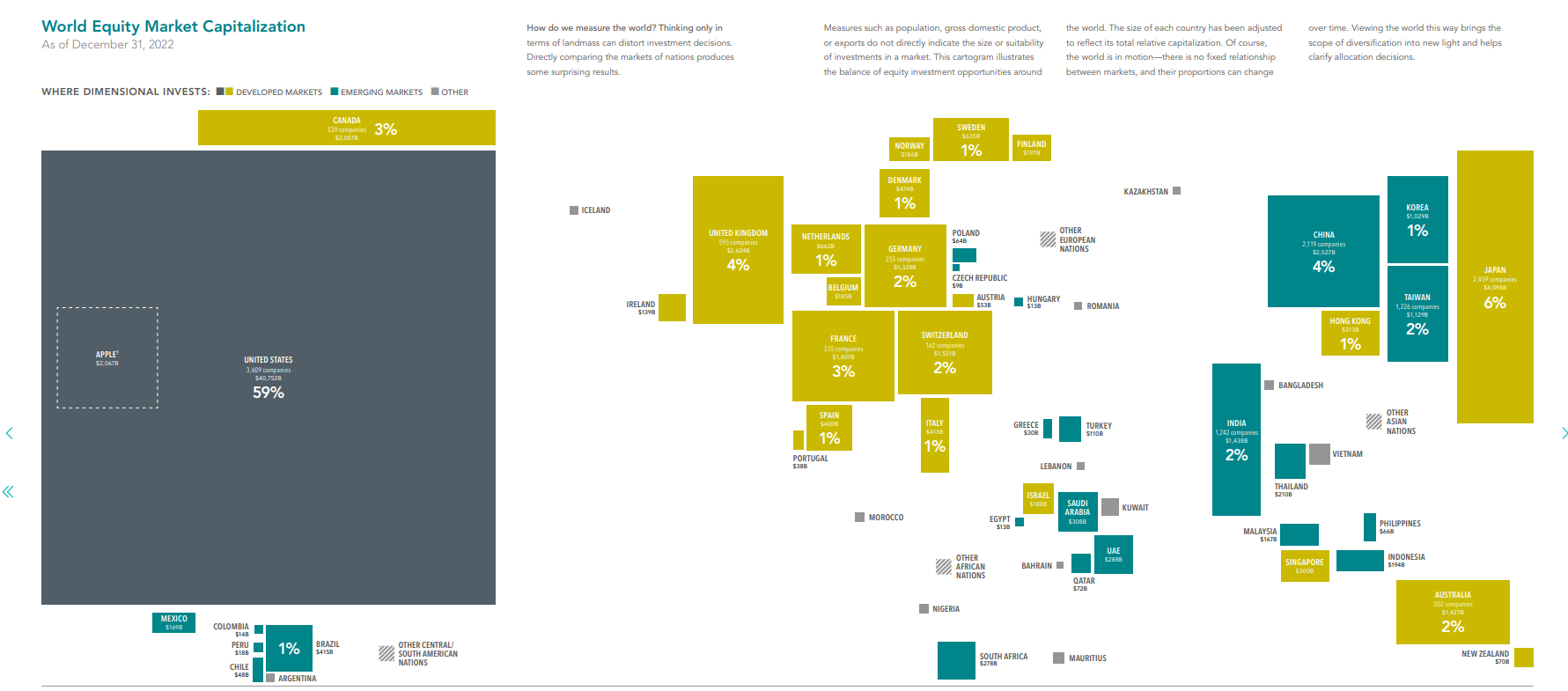

The annual DFA Matrix guide takes a take a look at the market caps of nation inventory markets across the globe:

To place Apple’s dimension in perspective, the corporate’s $2.6 trillion market cap is identical dimension as your entire UK inventory market, which is comprised of 595 corporations. Apple has a much bigger market cap than Germany’s inventory market and is 65% of Japan’s market cap.

Microsoft, at $2.3 trillion, isn’t too far behind.

The market is extra concentrated now than it’s been in a while however it’s not out of the extraordinary for the largest corporations to dominate the inventory market at instances.

Jason Zweig as soon as shared that AT&T made up 13% of the U.S. inventory market within the early-Thirties. Basic Motors was 8% of the market in 1928 and IBM had a 7% weighting in 1970 (it was near that once more by 1985).

So this occurs.

A variety of this depends upon the way you take a look at threat.

Is it actually dangerous to have a number of the greatest, greatest corporations on this planet carrying the inventory market?

Would you like the smallest, junkiest corporations prepared the ground?

It’s additionally true that the remainder of the inventory market continues to be holding up even if the largest shares are doing so properly.

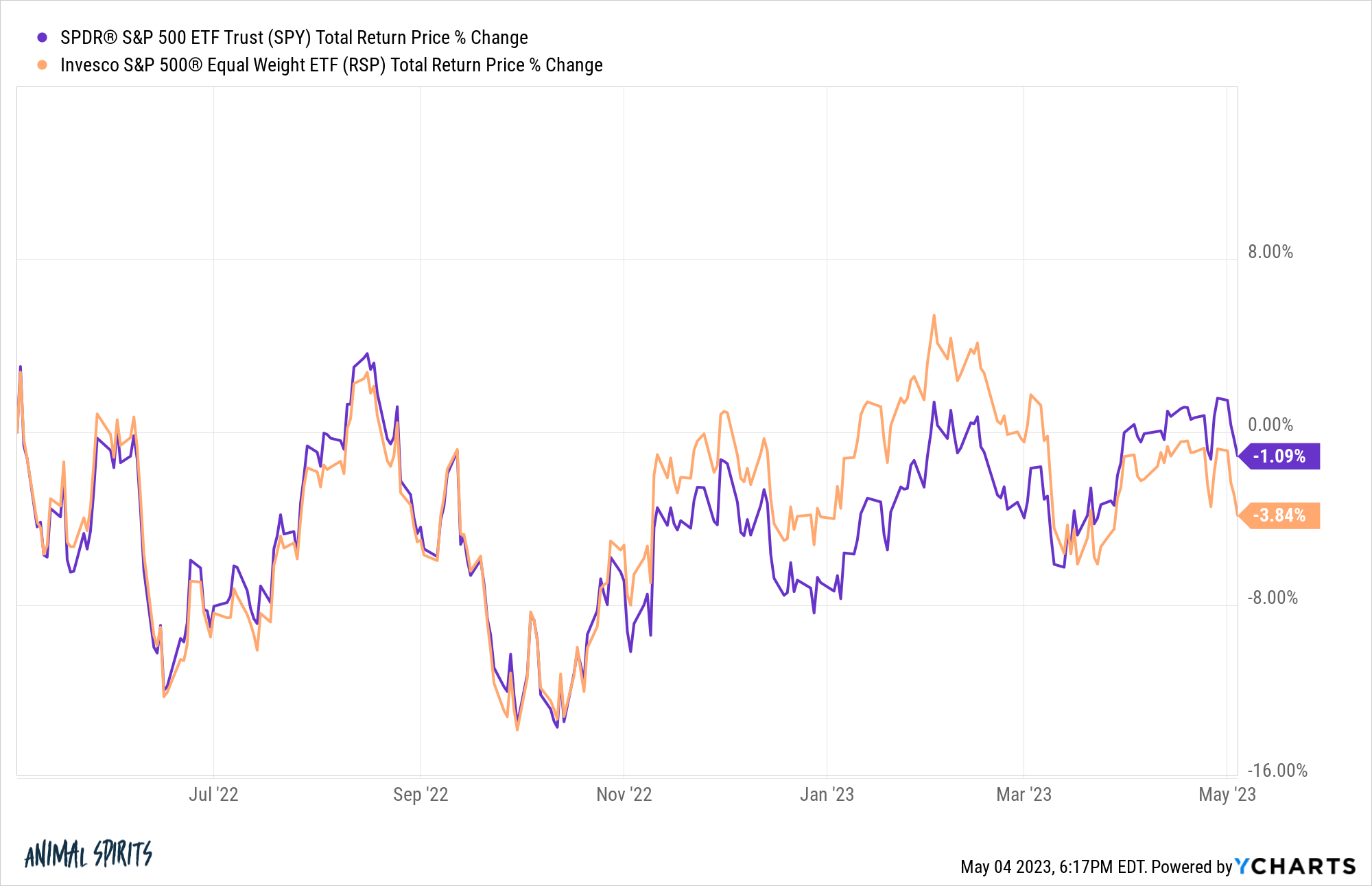

This can be a take a look at the equal-weighted S&P 500 versus the market-cap-weighted S&P over the previous yr:

The largest shares are serving to the S&P 500 however it’s not an enormous distinction.

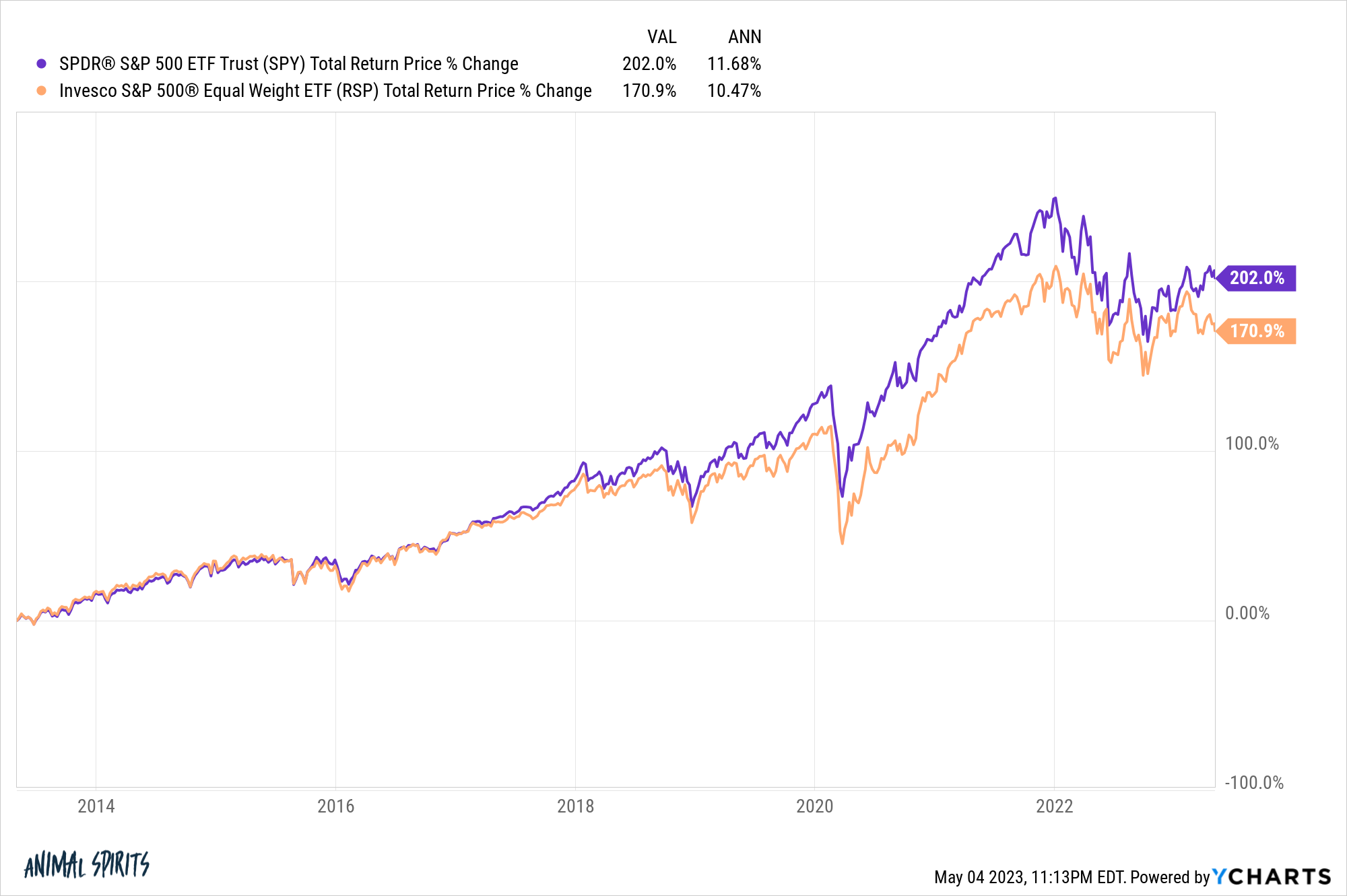

Returns over the previous 10 years issues are just a little extra pronounced however nonetheless not egregious:

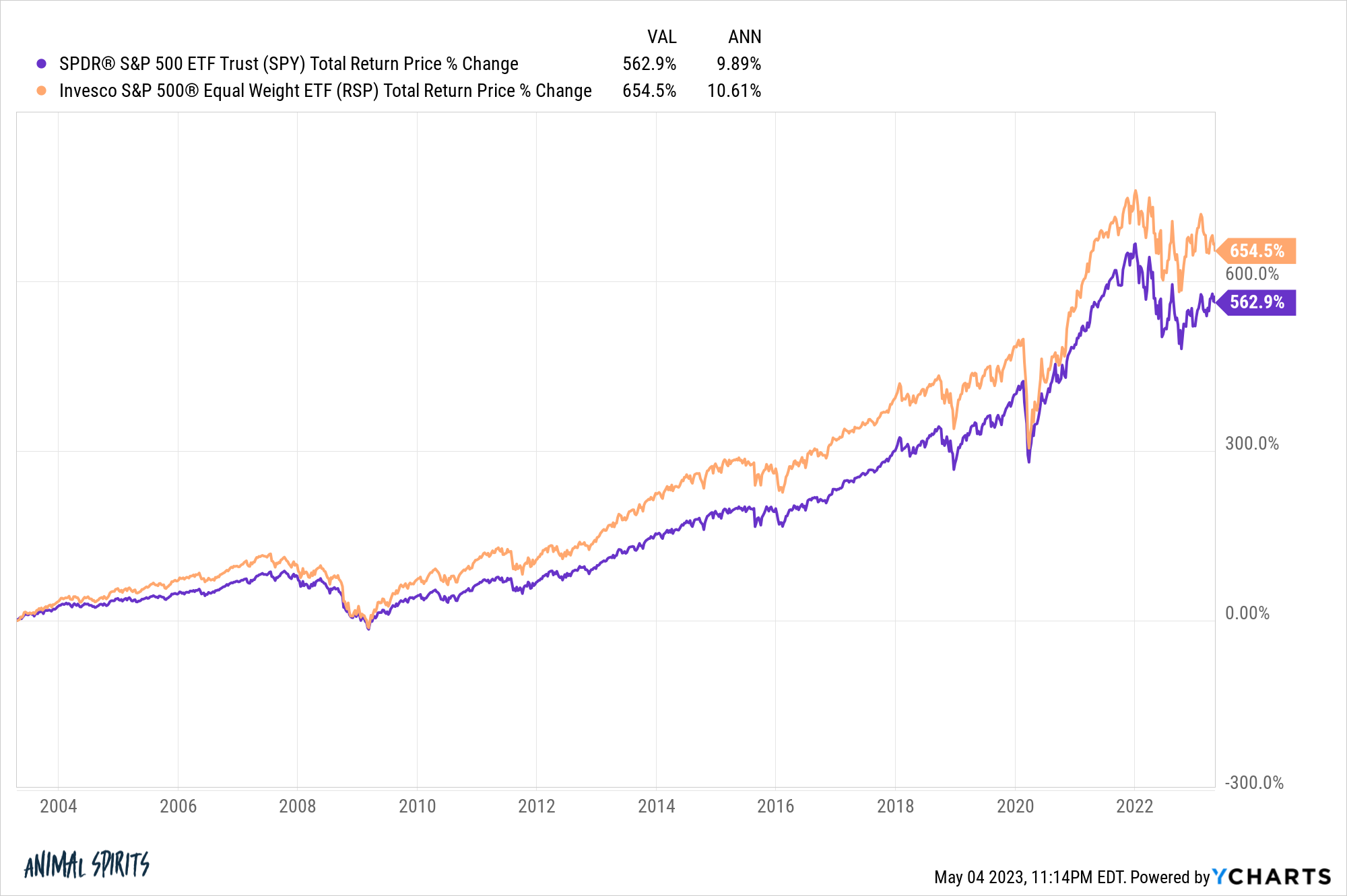

However because the mid-2000s the equal-weighted model has really finished higher:

This can be a good reminder that you may win nearly any argument concerning the markets by altering your begin or finish dates however the level is usually the largest shares carry the day and generally it’s a extra balanced market.

There’s an enormous distinction between a market-cap-weighted index just like the S&P 500 that may all the time be just a little top-heavy and an precise concentrated portfolio.

Gunjan Banerji on the Wall Road Journal profiled a handful of particular person traders to select up some classes folks have discovered from this bear market.

This one stood out essentially the most to me:

Do Kim, a 46-year-old accountant in Bucks County, Pa., was all-in on shares equivalent to Nvidia Corp. and Tesla, build up a mixed place within the two corporations of greater than $2 million, he says. He loved monitoring the businesses and held on the whole lot Elon Musk and Nvidia Chief Government Jensen Huang stated. He dove into different shares, together with these of the insurer Lemonade Inc. and Palantir Applied sciences Inc., whereas buying and selling choices in a bid to juice his returns.

He watched his portfolio skyrocket—till 2022, that’s. All year long, he says he was hit with calls from his brokerage agency to publish additional cash to cowl trades he had placed on with borrowed cash, or choices trades that had soured.

Mr. Kim says he ended up shedding all the cash he made because the begin of the pandemic, accumulating losses of greater than $1 million in his brokerage account that even ate into his preliminary funding. The losses had been demanding. At instances, he skipped holidays with household to spend time buying and selling and maintaining a tally of his portfolio.

“I really feel like I misplaced a few years of my life,” Mr. Kim says. “I had so many sleepless nights.”

That is the type of factor you may’t get from a Warren Buffett or Charlie Munger quote.

Going all-in on a few shares sounds great till you might be pressured to stay with the volatility inherent in focus.

Positive, a concentrated funding stance offers you a greater probability of trying completely different than the index however that works in each instructions.

I’m undecided I’ve ever heard of anybody skipping household holidays due to investments in index funds.

The S&P 500 nonetheless has greater than 70% of its shares exterior of the highest 10 holdings.

And the excellent news is it’s by no means been simpler to diversify past the S&P 500 if you’re apprehensive about Apple and Microsoft making up practically 14% of the index.

Michael and I talked about concentrated positions and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Are 5 Shares Actually Carrying the Complete Inventory Market?