Inflation continues to be a hot-button subject. We (and plenty of others) have written about TIPS, TIPS funds, and Sequence I Bonds. This text just isn’t about including or altering suggestions. As a substitute, we let the information do the speaking. As a substitute of prescribing an funding thesis, I wish to see how market contributors are behaving by watching their actions. Some gentle commentary will attempt to join the pictures and tables right into a narrative. You might be forgiven should you detect an underlying theme that feels like “a rational flight from irrational complexity”!

1. The Shopper Worth Index – City Reference Index

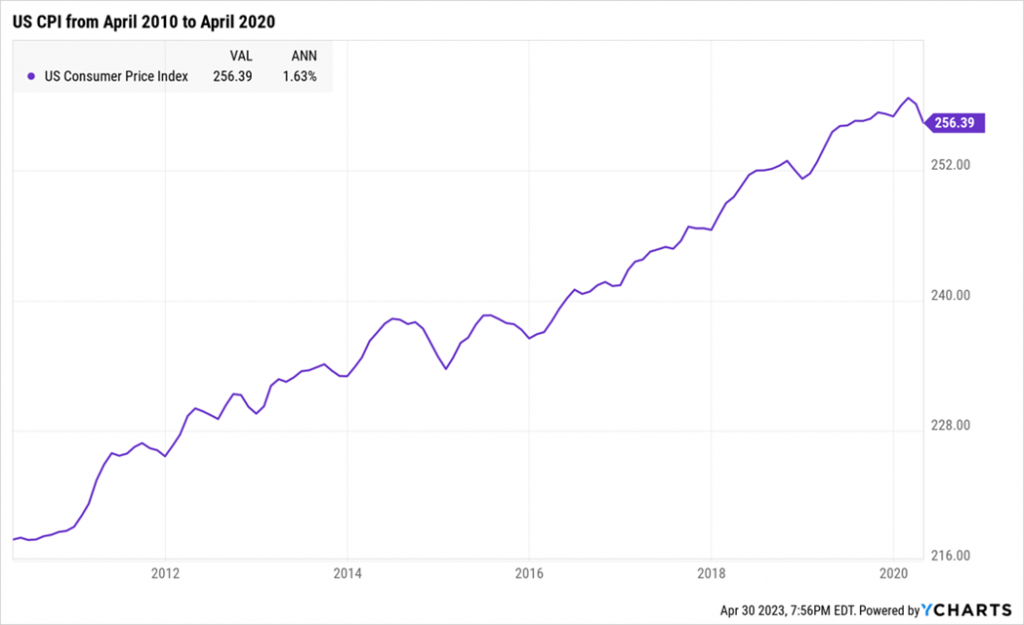

Inflation from April 2010 to April 2020 annualized at 1.63% a yr:

However from April 2020 to April 2023, the speed of inflation soared to five.62% a yr:

Annual Accrued CPI Charge

| Calendar 12 months | Annual Accrued Inflation Charge |

| 2010 | 1.50% |

| 2011 | 2.96% |

| 2012 | 1.74% |

| 2013 | 1.50% |

| 2014 | 0.76% |

| 2015 | 0.73% |

| 2016 | 2.07% |

| 2017 | 2.11% |

| 2018 | 1.91% |

| 2019 | 2.29% |

| 2020 | 1.36% |

| 2021 | 7.04% |

| 2022 | 6.45% |

| 2023 to April | 1.70% |

(Information from Y-Charts)

Projected inflation for the entire of 2023 is between 3.5% and 4.5% at this level.

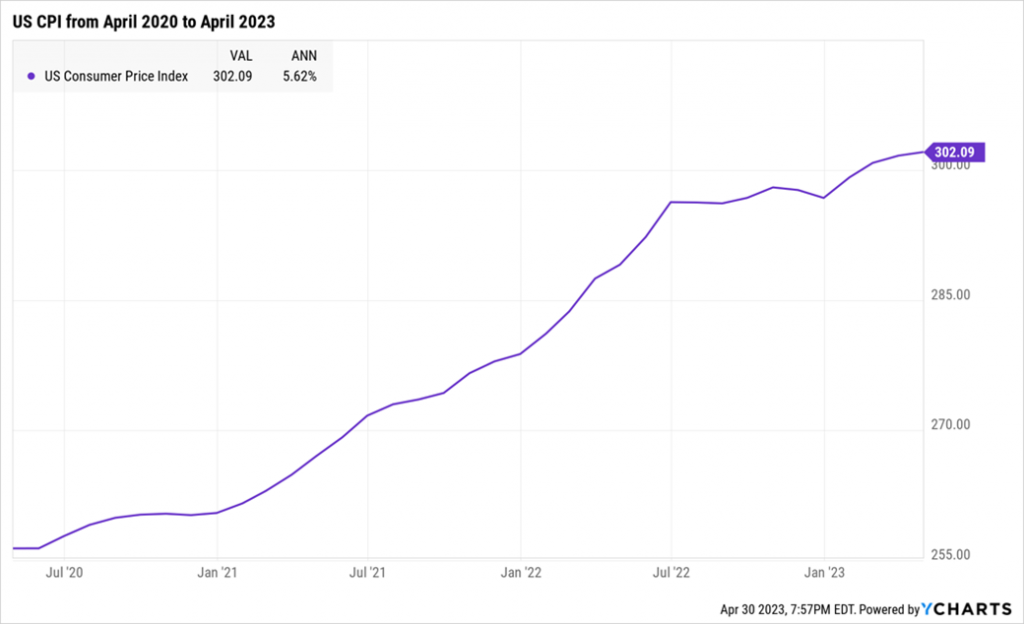

2. Federal Reserve Financial institution Selections on Charges (and not directly Treasury Payments)

In response to this sharp enhance in inflation, the Federal Reserve has elevated its in a single day goal rate of interest:

Enhance in Fed Funds Charge led to a predictable enhance in short-term Treasury Payments:

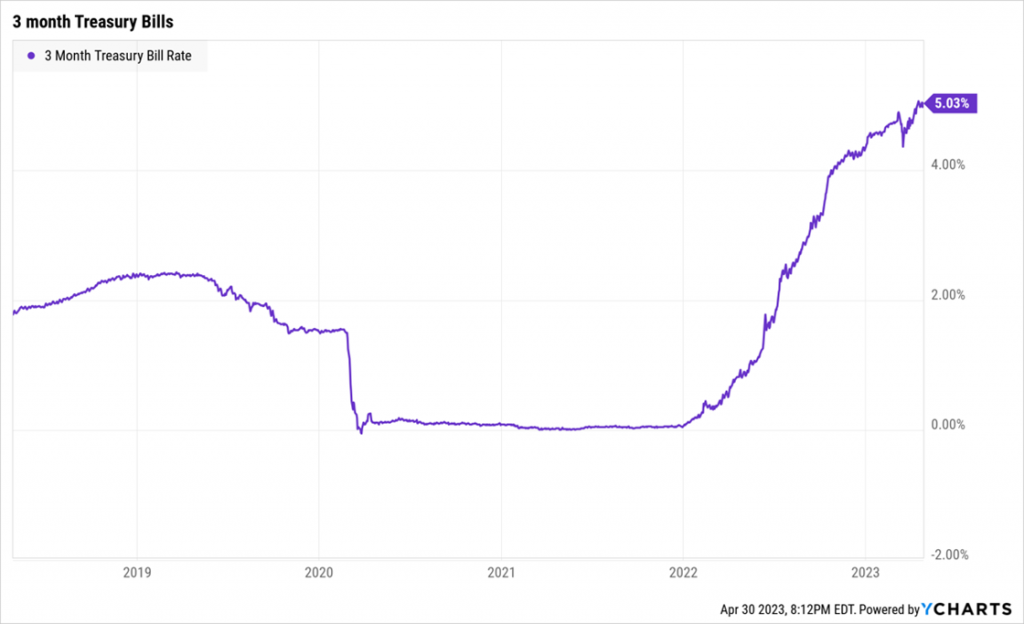

3. Cash Market Funds.

Many cash market funds maintain short-term US Authorities Treasury Payments, payments like those above that yield over 5% every year. Market contributors are sharp. Individuals withdrew deposits from banks and invested in cash market funds. MFO Premium has 29 funds within the Cash Market class with a class AUM of $638 Billion. Here’s a subsection of these funds and the information from Y-Charts.

The funds right here have an AUM of $616.9 billion. Observe that YTD, these funds have had a web influx of $49.8 Billion, and during the last yr, the web fund inflows have been $324 billion. Greater than half of all property in cash market funds have been added within the final 1 yr!

Apart from these funds, we all know that traders have purchased T-Payments and CDs instantly as properly. These numbers aren’t captured within the exhibit above. What emerges is one method persons are utilizing to cope with excessive inflation:

Federal Reserve raised rates of interest to combat inflation >> Quick-term Treasury Payments providing greater yield >> Traders shifting cash into Cash Market Funds, CDs, and T-Payments.

4. Sequence I Bonds

We have now talked about Sequence I Bonds when discussing inflation methods:

Ideas on Inflation Safety (Feb 2022), I want I may offer you some TIPS on beating inflation (August 2022), Sequence I Bonds: A Ray of Hope (October 2022), and Lengthy-dated TIPS Bonds: A Margin of Security (Jan 2023)

I made a YouTube video from just a few years in the past: US Authorities Financial savings Bonds An Distinctive Deal for the Small Saver Video 39 at https://youtu.be/fW9nfh0JE2Y

Briefly talking, Sequence I Bonds are US Authorities Financial savings Bonds. They are often purchased solely by US taxpayers as much as the restrict of $10,000 every calendar yr. (NB: Tax refunds may be utilized for a further $5000.)

Sequence I Bonds are neat as a result of the principal can by no means go down (even in deflation), there isn’t a worth fluctuation (the bonds don’t commerce within the secondary market), and the bonds aren’t topic to modifications in actual charges (not like TIPS they neither profit nor lose from modifications in actual charges). In different phrases, Sequence I Bonds are easy methods to profit from excessive inflation.

In case you can inform an American a easy story, and if rings true, they may act with drive.

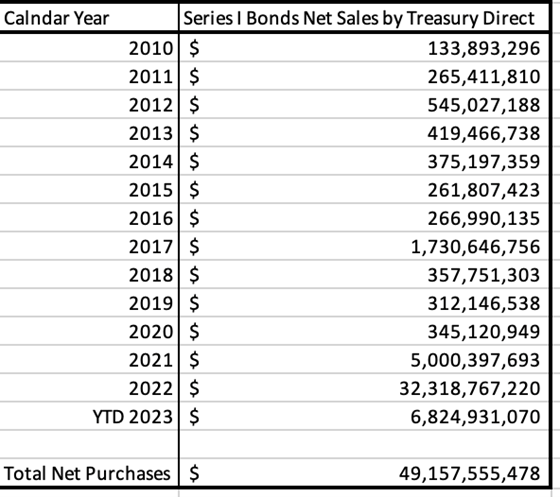

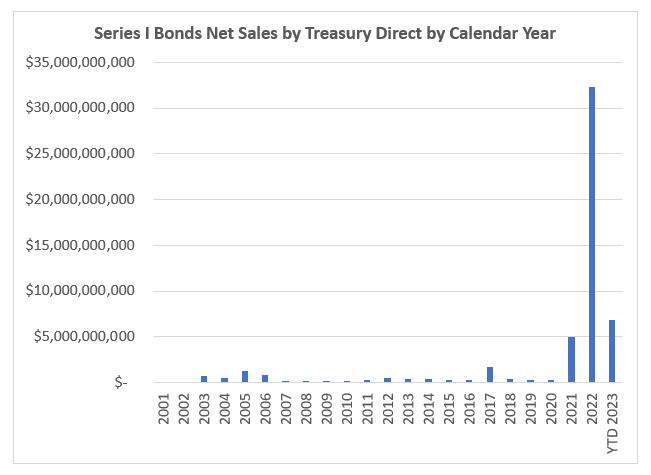

Beginning sooner or later in 2021, traders found Sequence I Bonds. From investing solely $345 million in 2020, traders purchased $5 billion in 2021, $32.3 billion in 2022, and for the primary 4 months of 2023, $6.8 billion in these bonds. Why? The yields have been excessive.

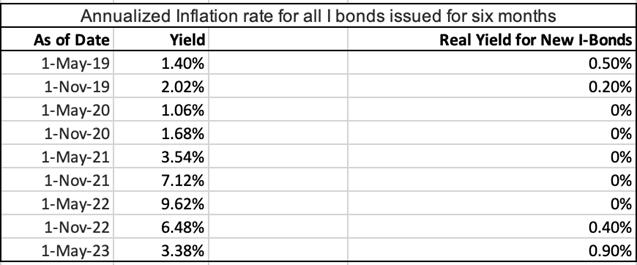

Juicy coupons from the US Authorities: On an annual foundation, the composite yield on Sequence I Bonds went from a boring 1-2% zone in 2019 and 2020, to as a lot as 9.62% in 2022, earlier than declining to six.48% and most not too long ago to three.38%

New consumers, as of Might 2023, additionally obtain a further 0.9% actual fee along with the three.38% yield for the following 6 months, for a composite fee of 4.28%.

The identify is Bond, I Bond.

Treasury Direct knowledge

As we are able to see from the chart above, American savers know a great deal when it’s on provide. Within the final 12 months, Individuals have web purchased $30.3 Billion in bonds. Maintain on to these numbers, as we’ll discover it attention-grabbing within the context of TIPS funds web flows in the identical interval.

5. TIPS Mutual Funds

Within the class of Inflation-Protected Bonds, MFO Premium stories 85 separate funds, with a mixed class AUM of $256 Billion. A few of these funds carry worldwide bonds and floating-rate bonds, and a few others use choices and hedges. I’ve tried to tidy the information to maintain it largely TIPS funds.

Right here is my YouTube Video hyperlink that explains TIPS:

US Authorities Inflation Linked Bonds An Overview Video 37 @ https://youtu.be/dOyHoiNChjw and US Authorities TIPS Technical Particulars: Video 38 @ https://youtu.be/V5bYdfe0syU

I’ve learnt by way of the final yr that TIPS are something however straightforward to know for all however probably the most refined bond traders. I can not change that proper now. Anyhow, this text just isn’t a few advice. It’s about observing what the market is doing. Information that follows is from Y-Charts.

So, what’s the market doing?

I’ve sorted the TIPS universe into three classes:

Quick Dated TIPS (Lower than 5 years to maturity), Intermediate TIPS (Between 0 and 10 years to maturity), and Lengthy Dated TIPS (5 to 30 years in maturity)

Let’s take every class by itself:

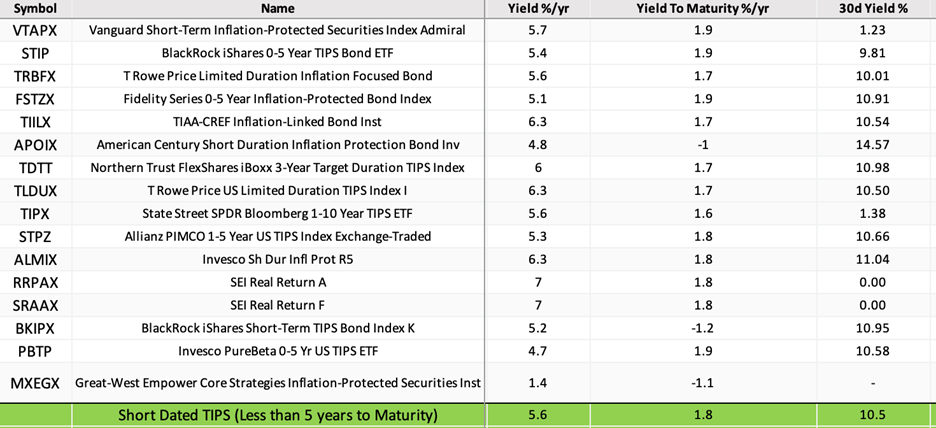

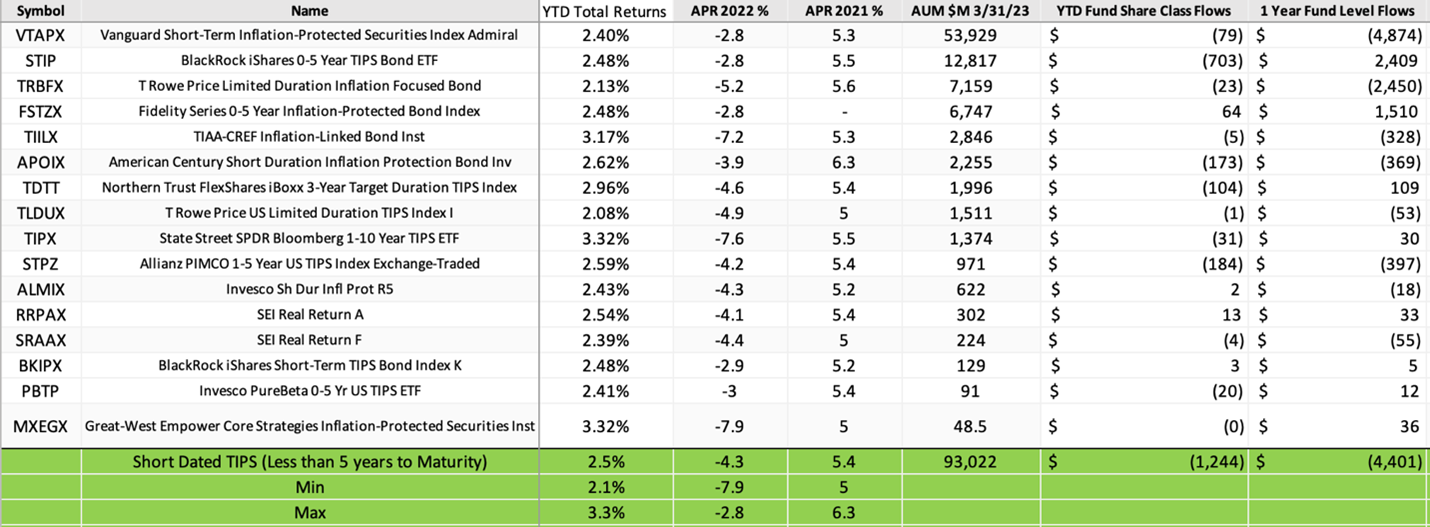

Quick Dated TIPS (Lower than 5 years to maturity)

Quick-dated TIPS funds have an AUM of about $93 Billion. The median fund is up 2.5% in 2023, with complete returns being as little as 2.1% and as excessive as 3.3% for the yr. In 2022, the median fund was down 4.3%, and in 2021, the median fund was up 5.4% for the yr.

2022’s detrimental return was an enormous put-off for traders. Thus, YTD in 2023, short-dated funds have misplaced $1.2 Billion in property, and during the last yr, the funds have misplaced $4.4 Billion in AUM.

Take a look at the assorted Yields related to these funds in keeping with MFO Premium’s Lipper Information:

Which quantity to have a look at and why? Oh, it may be so complicated! Who cares. Simply promote, traders stated. Too difficult to hassle to know. The investor votes along with her ft, explaining the one-year outflows of $4.4 billion. Sequence I Bonds are less complicated to know and put money into.

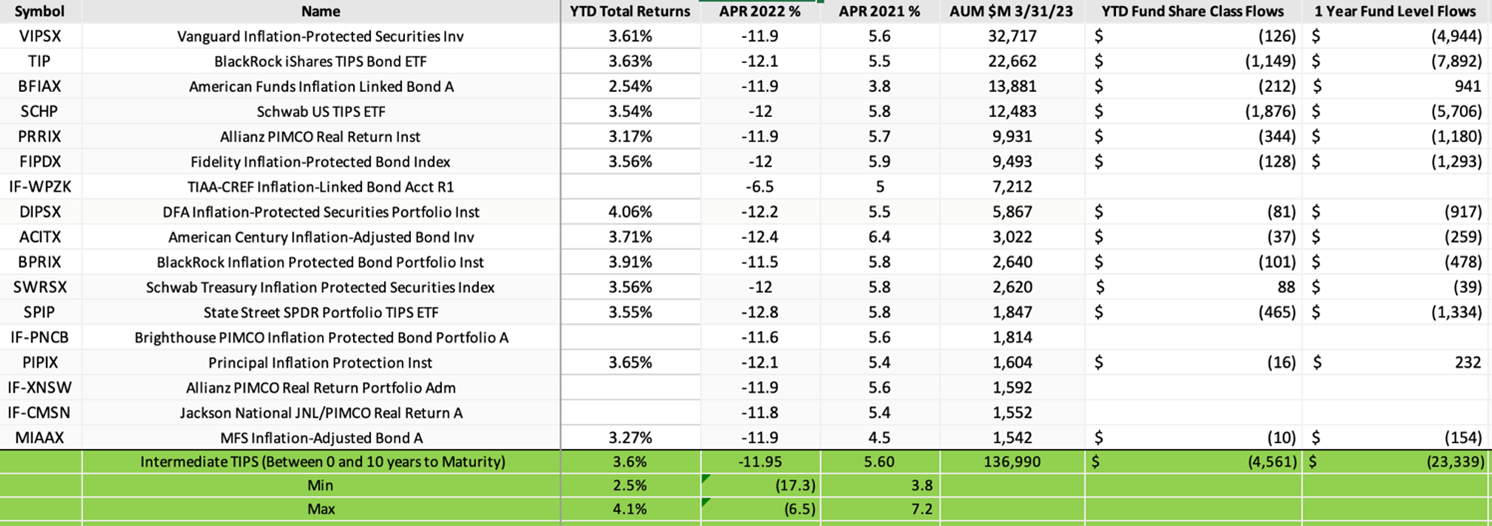

Intermediate TIPS (Between 0 and 10 years to Maturity)

TIPS Funds which have bonds between 0 and 10 years to Maturity have an AUM of about $137 Billion.

The median fund has a complete return of +3.6% in 2023. In 2022, the median return for this maturity class was -11.95%, and in 2021, it was up +5.6% for the yr. As soon as once more, traders voted with their ft. YTD, they’ve pulled $4.5 billion from these funds, and during the last yr, these funds have misplaced $23 billion in property. That’s a considerable share of the prevailing AUM in intermediate TIPS funds.

Although, with nice endurance, one can clarify to the investor why the cumulative return for these funds between 2021 and 2023 is detrimental (it’s all about actual yields), traders don’t care. A greenback quick and a yr late.

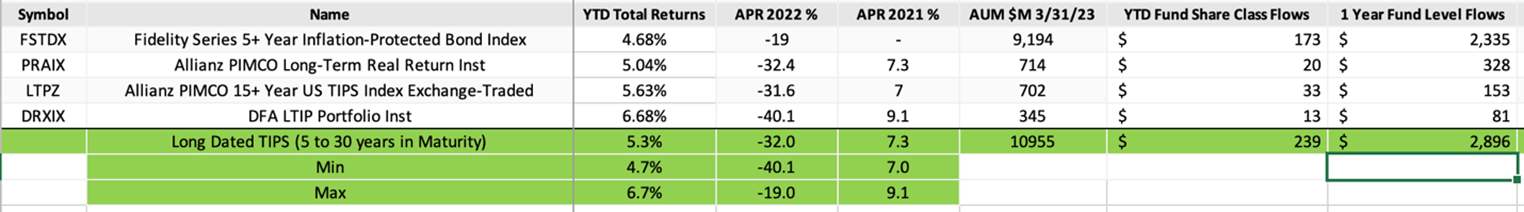

Lengthy Dated TIPS (5 to 30 years in Maturity)

Lengthy-dated TIPS Funds maintain about $10.9 billion in AUM.

The median fund has gained about 5.3% complete return in 2023 thus far, after a disastrous 2022 the place the median fund misplaced 32% for the yr!

Curiously, each YTD and one-year fund flows have been optimistic, including $239 million and $2.9 Billion, respectively.

What explains this transfer on the a part of traders? Possibly, a really small fraction of traders have reached into the longest-dated TIPS bonds as a worth or length play?

Time will inform. My articles and my very own portfolio as I’ve written level to some hope right here.

The difficulty with a few of these longer-dated TIPS and TIPS funds is their excessive volatility and illiquidity. Many traders, and rightly so, aren’t snug with the concept of their “protected” fixed-income bucket being a unstable addition to their portfolio. Till this volatility persists in long-duration bonds, flows is not going to are available.

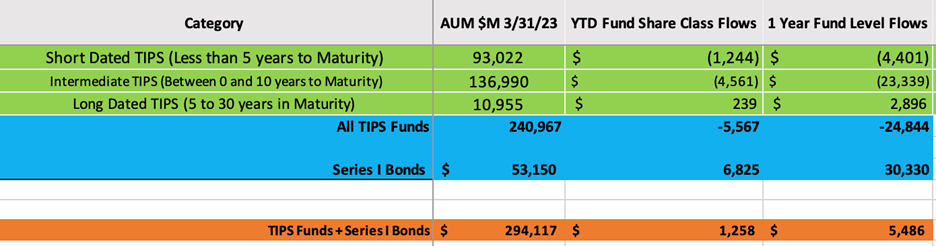

6. Conclusion: TIPS Funds + Sequence I Bonds Web Flows + Cash Market Funds

If our numbers are roughly appropriate, it appears to be like like now we have $240 billion in AUM in varied TIPS funds and $53 billion in Sequence I Bonds. That’s a complete funding of about $294 billion in Inflation merchandise excluding direct investments into TIPS.

YTD, traders have bought $5.8 billion in brief and intermediate TIPS. In the meantime, they’ve purchased $239 million in long-dated TIPS and $6.8 Billion in Sequence I Bonds.

Over the past yr, traders have bought $27.8 Billion in brief and intermediate TIPS funds to purchase $30.3 Billion in Sequence I Bonds and $2.9 Billion in long-dated TIPS funds.

From these numbers, it appears traders have bought length in Inflation Merchandise. Promoting quick and intermediate TIPS funds and shopping for Sequence I bonds is decreasing length. Modifications in Lengthy-dated TIPS are minimal.

We are able to say that traders have usually traded out of complexity and into simplicity. Out of difficult-to-understand TIPS funds and into easy US Authorities saving bonds. Out of difficult-to-understand inflation-linked dividend funds from TIPS funds and into the absolutely comprehensible Sequence I Bonds.

Traders have surprisingly traded out of a product they’ll purchase and promote any day (ETFs and mutual funds) and right into a product that requires moderately long-term holding (Sequence I Bonds). That could be a stunning transfer by traders who are sometimes chided for his or her trigger-happy conduct in day buying and selling. Good.

Allow us to additionally recall that traders added $324 billion within the final yr to cash market funds.

All in all, the “market,” as I’ve narrowly outlined by funds and Sequence I Bonds, prefers to reside in very short-dated bonds (nominal and inflation-protected) with nearly zero length. In fact, there are different merchandise, and this text is pretty confined in its evaluation to a small set of merchandise.

7. Message for fund builders and traders

Traders like to purchase issues they’ll perceive which can be easy and predictable. There may be advantage in holding it easy. Generally, and in some locations, life is complicated. If you’re a fortunate investor with important property, Sequence I Bonds is not going to do due to their $10,000 per yr funding cap. One might want to study the complexities of Actual Yields and Period to put money into TIPS and TIPS funds.

For a fund developer, the message is to keep on with the message. By some means, traders anticipate yield from mounted earnings. If now we have informed traders that TIPS will accrue primarily based on (lagged) CPI, then perhaps the funds ought to pay month-to-month earnings primarily based on that CPI. Although that might be unnatural for TIPS – as a result of the principal accrues, the curiosity doesn’t stroll in – higher to pay a floating coupon by promoting some TIPS to fund the curiosity. Traders may be keen to disregard the volatility of the TIPS if they are often sure they may get the realized inflation as anticipated each month. It’s counterintuitive, however predictability is extra necessary within the case of fixed-income traders.

[NB: I welcome perspectives from readers about how to read the market flows in a different way or if we have some of the numbers or assumptions incorrect. Drop me a note!]