If you happen to’re in search of a Tremendous Premium Credit score Card that offers rewards on “any” sort of spend, then you definately’ve landed on the proper place. Within the present state of affairs the place most bank card issuers impose limitations on spending classes, Customary Chartered Final Credit score Card involves rescue not just for these sorts of spends but additionally past.

Right here’s the whole lot you should learn about this infinitely rewarding bank card,

Overview

| Kind | Tremendous Premium Credit score Card |

| Reward Fee | 3.3% |

| Annual Charge | 5,000 INR+GST |

| Greatest for | Voucher redemptions |

| USP | Rewards on all sort of spends |

With a reward charge that matches HDFC Infinia and with none redemption limitations, Customary Chartered Final Credit score Card is likely one of the most suitable choice for prime spenders.

Charges

| Becoming a member of Charge | 5,000 INR + GST |

| Welcome Profit | 6,000 factors |

| Renewal Charge | 5,000 INR + GST |

| Renewal Profit | 5,000 factors |

| Renewal Charge waiver | Nil |

The welcome rewards you get is equal to the becoming a member of payment you pay. It even covers the GST half for that matter for first 12 months however sadly not on renewal, as you’ll be wanting 1K factors.

Anyway, reward factors as welcome profit is an effective transfer in comparison with the earlier welcome profit that used to offer MMT voucher.

Card Design

The cardboard seems to be fairly good with these golden parts shining on a black background. It seems to be premium for positive in actuality. Furthermore, the Mastercard emblem provides a pleasant contact to the general design.

Rewards

- Reward Fee: 3.3% on most spends

- Rewards expire in: 3 years

As talked about beforehand, the USP of the Final card is that it provides rewards on all sorts of spends no matter whether or not it’s on-line (or) offline spend. There isn’t any cap in any way each for incomes and redeeming.

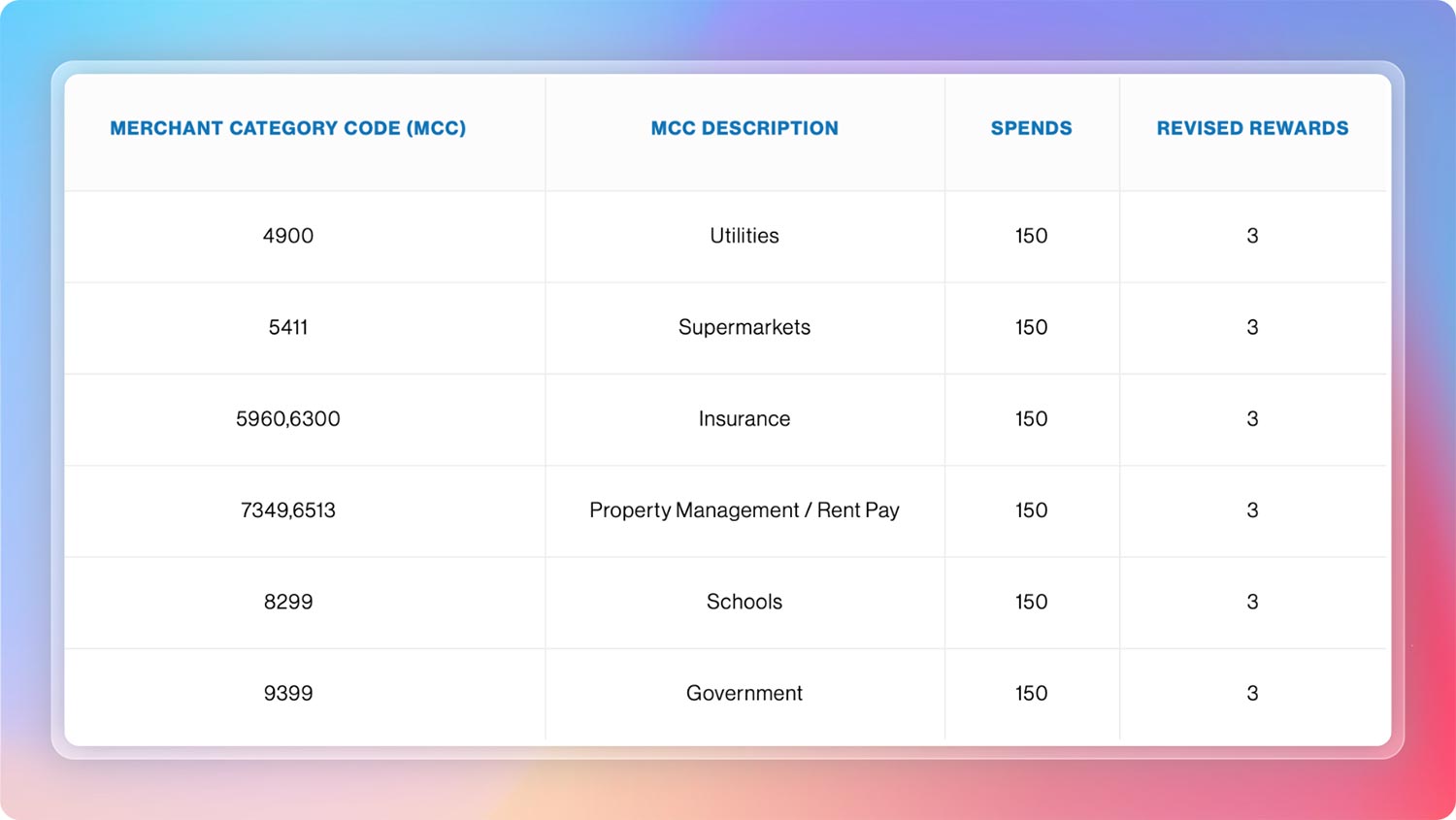

Nonetheless, SCB has lastly provide you with revision of rewards on choose classes (as beneath) which is able to solely earn ~2% rewards going ahead (eff. 2nd April 2023).

- Choose Classes: 2% as rewards

- Hire Fee payment: 1% + GST will likely be levied moreover

Redemptions

- Redemption sort: Vouchers

- Redemption Charge: 99 INR +GST

Whereas we don’t have any “airline/resort” switch companions with SC Final bank card as of now, we are able to redeem factors for a protracted record of vouchers at 1:1 ratio.

Listed here are among the vouchers you’ll be able to count on to redeem utilizing reward factors on Customary Chartered Final Credit score Card.

- Procuring: Myntra, Nykaa, Pantaloons, Levis, and so on

- Electronics: Croma

- OTA: MakeMyTrip, EaseMyTrip

- Motels: Marriott Motels, Taj Motels, ITC Motels

- Cabs: Uber

- Airline: Vistara Voucher

- Luxurious manufacturers like Luxe, Armani, and so on.

Word: the voucher manufacturers retains altering every now and then.

Usually, cardholders redeem factors for Croma vouchers, as that is most likely the one card that offers fairly good worth for procuring electronics. However in the event you’re into journey, you’ll be able to discover entire lot of choices.

Foreign exchange Markup Charge

- Foreign exchange Markup Charge: 2%+GST = 2.36%

- Internet acquire: 0.94%

Whereas its not an impressive acquire, it’s nonetheless superb for individuals who doesn’t have HDFC Infinia or Axis Reserve Credit score Playing cards, as you don’t free something for doing international foreign money spends on Customary Chartered Final bank card.

Airport Lounge Entry

| ACCESS TYPE | VIA | LIMIT |

|---|---|---|

| Home (Major) | Visa / Mastercard | 4/Qtr |

| Worldwide (Major) | Precedence Move | 1/month |

- Spend standards for Intl lounge entry: 20,000 INR spend in earlier month

A real Tremendous Premium Credit score Card often comes with a limiteless lounge entry profit throughout the globe not just for major but additionally for add-on cardholders.

Nonetheless, with Customary Chartered Final it’s fairly restricted in terms of lounge entry. Furthermore, to benefit from the complimentary worldwide lounge entry, a minimal spending requirement needs to be met, as talked about above.

Golf Profit

Whereas above is the inbuilt Golf profit obtainable on Customary Chartered Final Credit score Card, you can even avail further video games & classes in the event you’re holding the Mastercard variant of SC Final.

Mastercard World Golf profit provides you further 4 golf video games per 12 months and 1 golf lesson per thirty days.

Different Advantages

- Responsibility Free Spends: Get 5% cashback on duty-free transactions at over 1000+ airports the world over, with a max. cashback of 1,000 INR per thirty days.

- Film Profit: You may get the Buy1 Get 1 Visa Infinite Provide in the event you’re holding Visa variant of the SC Final Credit score Card.

- Gasoline surcharge waiver: 1% waiver & no rewards on gasoline spends (eff. 2nd April 2023).

Eligibility

- ITR: 24L p.a.

- Different Financial institution Credit score Card: ~5L Credit score Restrict

- Current SC Credit score Card: ~4L Credit score Restrict

The eligibility standards for the Customary Chartered Final Credit score Card could differ every now and then. Nonetheless, the data above can offer you an thought of what Customary Chartered financial institution is usually in search of from a potential buyer.

The right way to Apply?

Chances are you’ll apply on-line on Customary Chartered financial institution web site, however probabilities of rejection is excessive lately.

So the simplest method to get Customary Chartered Final Credit score Card is to first get Customary Chartered Sensible Credit score Card after which apply for SC Final utilizing the prevailing bank card relationship with the financial institution.

You’ll simply must authenticate your present SC bank card to get 2nd card from Customary Chartered and its only a matter of few clicks.

You’ll nevertheless must be permitted for a superb credit score restrict for this to work, which may be very a lot potential in the event you’ve greater limits on different bank cards.

If the appliance is caught and never responding past some extent, fear not, you’ll probably get a name from backend in per week or two.

If the whole lot fails, the one possibility left is to open Customary Chartered Precedence Financial savings Account (30L steadiness) and apply for the cardboard based mostly on the banking relationship.

Bottomline

Customary Chartered Final Credit score Card has been one of many greatest bank cards in India for a few years in a row and it continues to shine in 2023 as properly.

It definitely stays as a really Final Bank card within the tremendous premium phase, particularly for individuals who are primarily in search of non-travel reward redemption choices on ongoing spends.

Acquired queries? Get solutions to all of your questions round bank cards, rewards, airmiles, and so on with the One-on-One Credit score Card session service.

Do you maintain Customary Chartered Final Credit score Card? Be at liberty to share your experiences within the feedback beneath.