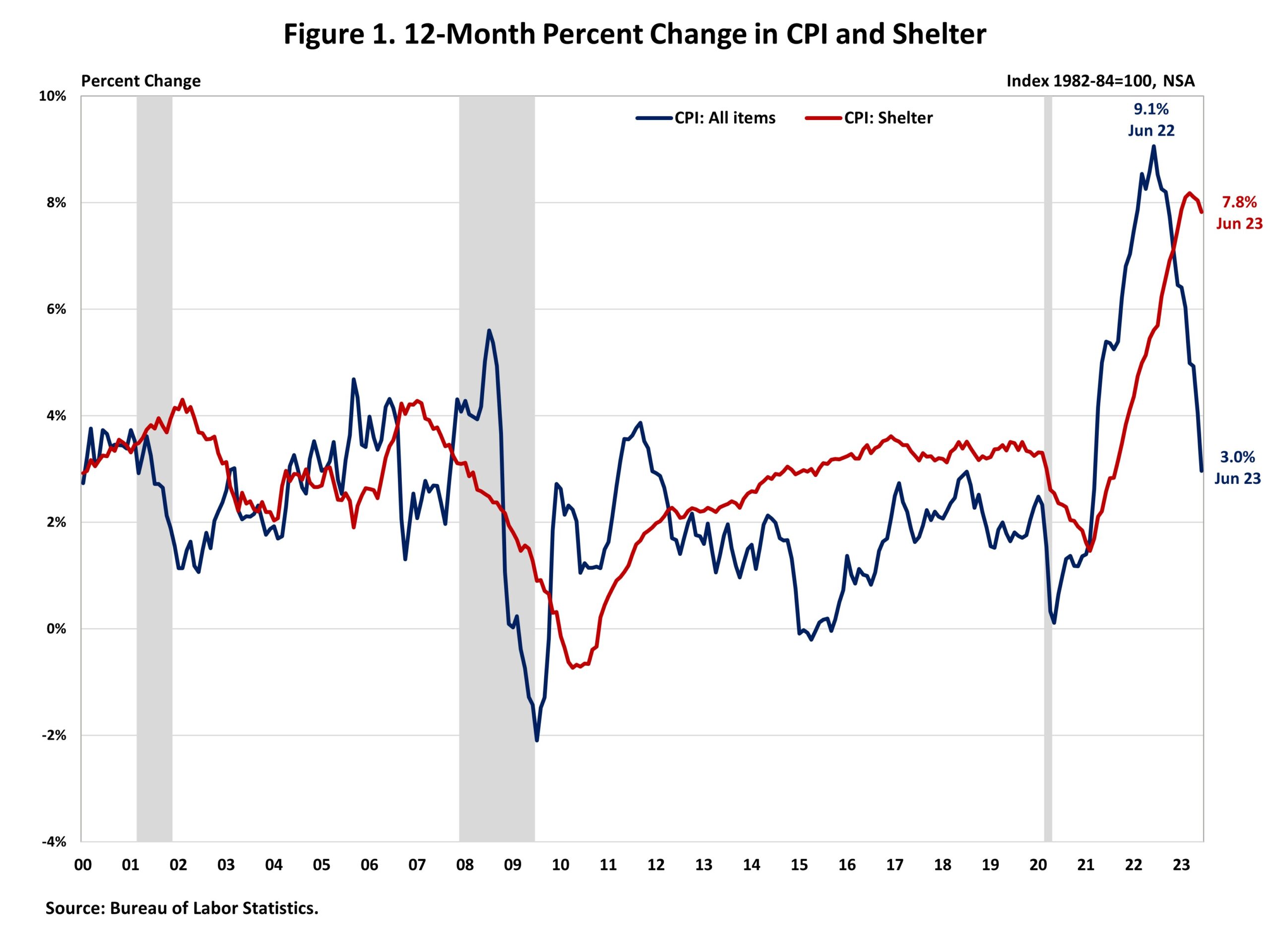

Client costs in June noticed a continued deceleration, with the smallest year-over-year acquire since March 2021. Over the previous twelve months, inflation has been persistently decelerating. Regardless of a slowdown in comparison with the earlier month, the shelter index (housing inflation) continued to be the most important contributor to each headline and core inflation, accounting for over 70% of the rise in headline inflation.

The Fed’s skill to handle rising housing prices is proscribed as shelter price will increase are pushed by a scarcity of reasonably priced provide and growing growth prices. Further housing provide is the first answer to tame housing inflation. The Fed’s instruments for selling housing provide are at greatest restricted. In reality, additional tightening of financial coverage will harm housing provide by growing the price of AD&C financing. This may be seen on the graph beneath, as shelter prices proceed to rise regardless of Fed coverage tightening. Nonetheless, the NAHB forecast expects to see shelter prices decline additional later in 2023, supported by real-time knowledge from personal knowledge suppliers that point out a cooling in hire progress.

The Bureau of Labor Statistics (BLS) reported that the Client Worth Index (CPI) rose by 0.2% in June on a seasonally adjusted foundation, following a rise of 0.1% in Might. The worth index for a broad set of vitality sources rose by 0.6% in June as the rise in gasoline index (+1.0%) and electrical energy index (+0.9%) greater than offset the declines in pure gasoline index (-1.7%) and gas oil index (-0.4%). Excluding the unstable meals and vitality parts, the “core” CPI rose by 0.2% in June, following a rise of 0.4% over the previous three months. In the meantime, the meals index elevated by 0.1% in June with the meals at residence index remained unchanged.

In June, the indexes for shelter (+0.4%), motorcar insurance coverage (1.7%) and attire (0.3%) have been the most important contributors to the rise within the headline CPI. In the meantime, the indexes for airline fares (-8.1%), communication (-0.5%) in addition to family furnishings and operations (-0.1%) declined in June.

The index for shelter, which makes up greater than 40% of the “core” CPI, rose by 0.4% in June, following a rise of 0.6% in Might. The indexes for homeowners’ equal hire (OER) elevated by 0.4% and hire of major residence (RPR) elevated by 0.5% over the month. Month-to-month will increase in OER have averaged 0.6% over the past six months. These features have been the most important contributors to headline inflation in latest months.

Through the previous twelve months, on a not seasonally adjusted foundation, the CPI rose by 3.0% in June, following a 4.0% enhance in Might. This was the slowest annual acquire since March 2021. The “core” CPI elevated by 4.8% over the previous twelve months, following a 5.3% enhance in Might. The meals index rose by 5.7% whereas the vitality index fell by 16.7% over the previous twelve months.

NAHB constructs a “actual” hire index to point whether or not inflation in rents is quicker or slower than general inflation. It gives perception into the provision and demand situations for rental housing. When inflation in rents is rising quicker (slower) than general inflation, the true hire index rises (declines). The true hire index is calculated by dividing the value index for hire by the core CPI (to exclude the unstable meals and vitality parts). The Actual Lease Index rose by 0.3% in June.

Associated