I used to be honored to spend time on Making Cash with Charles Payne, which airs on Fox Enterprise, and provides a quick glimpse into why I’m not as bearish proper now based mostly on the macro. (hyperlink under)

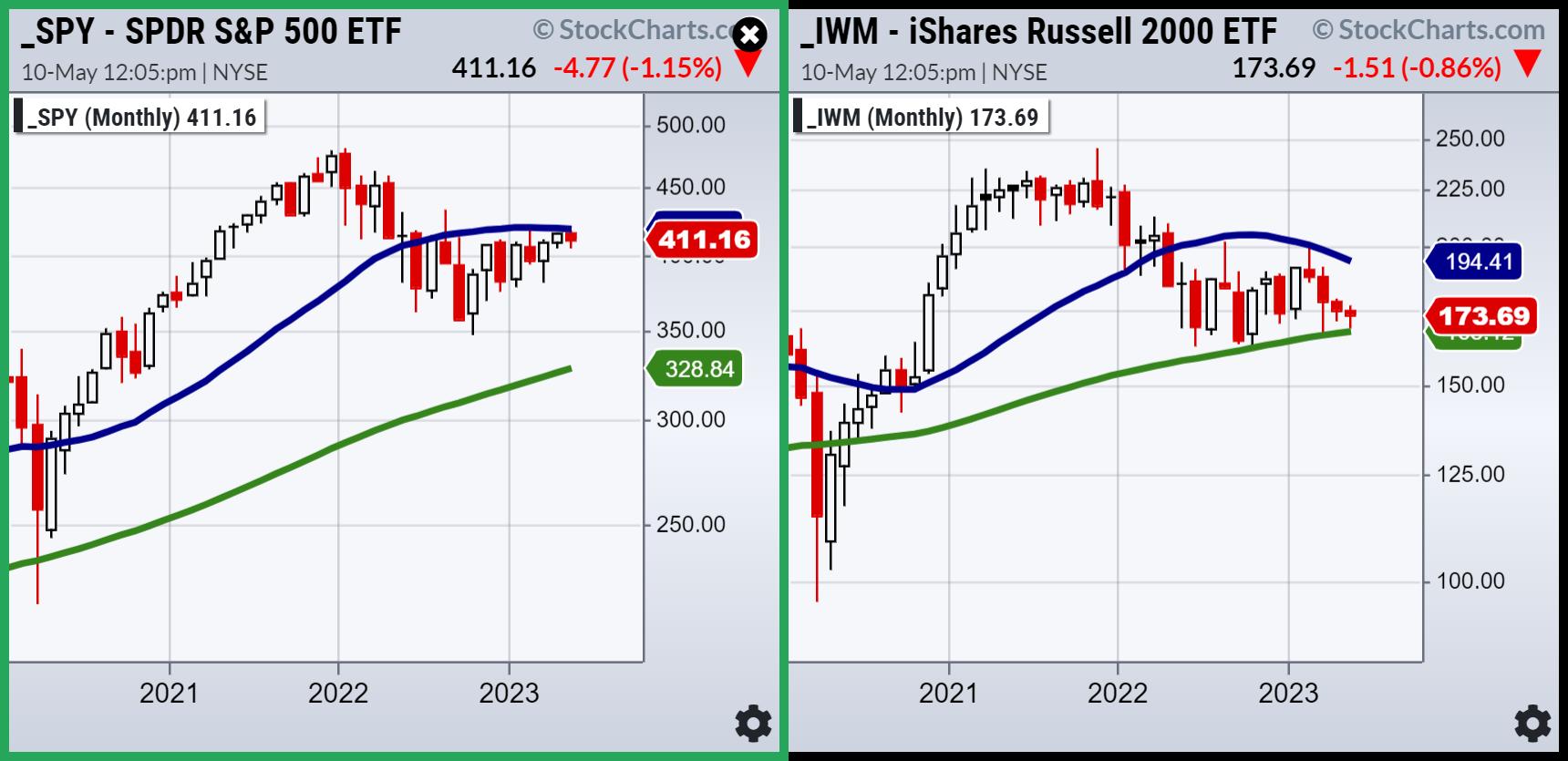

My macro take based mostly on enterprise cycles and zooming out on the charts? The financial contraction based mostly on longer enterprise cycle timeframe or 6-8 years, is perhaps executed. The 80-month transferring common (inexperienced line) held in small caps (IWM) retail (XRT) and transportation (IYT). That does not imply we begin increasing, although; it simply means the market wanting ahead, would possibly commerce to the higher areas of the buying and selling vary. That’s the Stagnate a part of stagflation.

However, the enterprise cycle inside the longer cycle or 2 years as measured by the 23-month transferring common (blue-line) has but to pierce to the upside, besides in a few sectors like semiconductors (SMH). Thus, progress shares may develop additional whereas the “inside” components of the US financial system stay sideways for longer. Therefore, we have now unhealthy information and excellent news.

The unhealthy information is the indices, and lots of sectors, are rangebound and will stay so for a very long time.

The excellent news is the indices, and lots of sectors, are rangebound and will stay so for a very long time.

We nonetheless imagine that the SPY may clear over the 23-month transferring common. Finally although, the small-caps (IWM) should observe. Two eventualities can spoil the occasion:

- If IWM fails the 80-month transferring common going into extra of a recessionary cycle-worst affect are the Regional Banks. That will power SPY to rethink the rally.

- IWM holds but can’t get above 190-200. In that case the SPY might be at 240 and nonetheless reverse course.

Clearly, you possibly can see the distinction between the small caps and the S&P 500 on the each day timeframe as nicely.

A primary step could be for IWM to rally above the 50-DMA or blue line. Then, possibly, we’re on the way in which to extra upside. Shorter-time body after all, however begin if it could actually occur.

Actual Movement Momentum is meh within the SPY and about to enter a bear section within the IWM. Momentum must clear again over each transferring averages in IWM to get much more fascinating.

Extra macro:

Excessive grade company bonds (LQD) and excessive yield excessive debt junk bonds are each in buying and selling ranges. Nevertheless, seasonally, and traditionally, yields are likely to peak in Could. Contemplating the CPI numbers, that’s potential.

The US Greenback is holding main help, testing the lows of its 2 yr enterprise cycle growth. That could be a good line within the sand. Moreover, gold and silver are additionally now vary bound- albeit at increased ranges. Copper and Platinum are robust. Smooth commodities, particularly sugar and cocoa, are robust. Meals costs stay the stickiest a part of inflation.

That’s the Flation a part of stagflation.

The CPI numbers exclude meals and power. Plus, international inflation nonetheless excessive.

For extra detailed buying and selling details about our blended fashions, instruments and dealer schooling programs, contact Rob Quinn, our Chief Technique Guide, to be taught extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-Guide in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

On this look on Fox Enterprise’s Making Cash with Charles Payne, Mish and Charles talk about if financial system has contracted sufficient with help in place, and current 3 inventory picks.

Mish covers the buying and selling vary and some of her current inventory picks on Enterprise First AM.

In this look on Actual Imaginative and prescient, Maggie Lake and Mish talk about present state of the market, from small caps to tech to gold.

In the Q2 version of StockCharts TV’s Charting Ahead 2023, hosted by David Keller, Mish joins RRG Analysis’s Julius de Kempenaer and Less complicated Buying and selling’s TG Watkins for an roundtable dialogue in regards to the issues they’re seeing in, and listening to about, the markets.

Mish and Dave Keller talk about why Mish believes that yields will peak in Could, what to anticipate subsequent in gold, and extra in this in-studio look on StockCharts TV’s The Remaining Bar!

Mish explains why Grandma Retail (XRT) could change into our new main indicator on the Could 4th version of Your Every day 5.

Mish discusses the FOMC and which inventory she’s shopping for, and when on Enterprise First AM.

Mish covers technique for SPY, QQQ, and IWM.

Coming Up:

Could eleventh: Mario Nawfal, Twitter Areas at 8am ET & Jim Pupluva, Monetary Sense Podcast

Could 18th: Presentation for Orios VC Fund, India

Could nineteenth: Actual Imaginative and prescient Evaluation

Could twenty second: TD Ameritrade

Could thirty first: Singapore Radio with Kai Ting 6:05pm ET MoneyFM 89.3.

- S&P 500 (SPY): 23-month MA 420

- Russell 2000 (IWM): 170 help – 180 resistance

- Dow (DIA): Dancing on the 23-month MA

- Nasdaq (QQQ): 329 the 23-month MA

- Regional banks (KRE): 42 now pivotal resistance-holding final Thurs low

- Semiconductors (SMH): 23-month MA at 124

- Transportation (IYT): 202-240 largest vary to look at

- Biotechnology (IBB): 121-135 vary to look at from month-to-month charts

- Retail (XRT): 56-75 buying and selling vary to interrupt a method or one other

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For almost 20 years, MarketGauge.com has offered monetary info and schooling to 1000’s of people, in addition to to giant monetary establishments and publications equivalent to Barron’s, Constancy, ILX Programs, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to observe on Twitter. In 2018, Mish was the winner of the Prime Inventory Choose of the yr for RealVision.