On the AEI fiscal principle occasion final Tuesday Tom Sargent and Eric Leeper made some key factors in regards to the present scenario, with regards to classes of historical past.

Tom’s feedback up to date his wonderful paper with George Corridor “Three World Wars” (at pnas, abstract essay within the Hoover Convention quantity). Tom and George liken covid to a warfare: a big emergency requiring immense expenditure. We will quibble about “require” however not the expenditure.

(2008 was a bit of warfare on this sense as properly.) Since outlays are properly forward of receipts, these enormous non permanent expenditures are financed by issuing debt and printing cash, as optimum tax principle says they need to be.

In all three circumstances, you see a ratcheting up of outlays after the warfare. That is taking place now, and in 2008, simply as in WWI and WWII.

After WWI and WWII, there’s a interval of major surpluses — tax receipts better than spending — which helps to pay again the debt. This time is notable for the absence of that impact.

We see that the majority clearly by plotting the first deficits straight. The information replace since Tom and George’s authentic paper (dots) makes that clear. To a fiscal theorist, this can be a worrisome distinction. We’re not following historic custom of normal, full employment, peacetime surpluses.

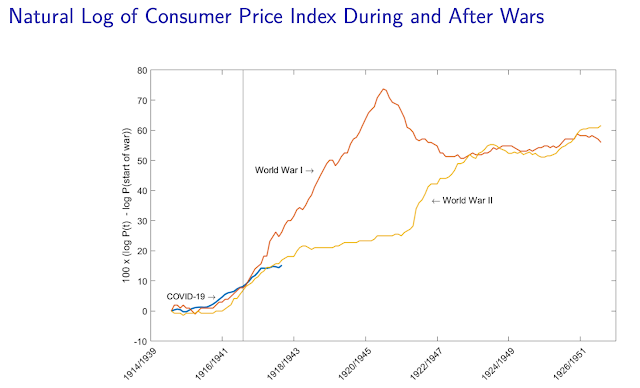

The 2 world wars have been additionally financed by a substantial inflation. The necessary consequence of inflation is that it inflates away authorities debt. Basically, we pay for a part of the warfare by a default on debt, engineered through inflation.

1947 is an fascinating case. As now, inflation broke out, the Fed left rates of interest alone, and the inflation went away as soon as it had inflated away sufficient debt. That too is an fascinating episode within the debate whether or not the Fed should transfer charges multiple for one to maintain inflation from spiraling away.

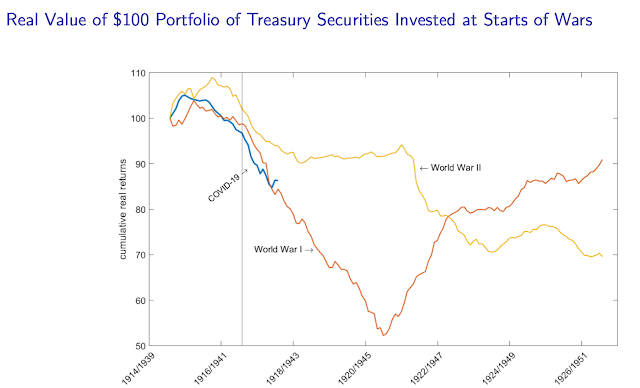

The impact of inflation is clearer within the subsequent graph, which plots the true return on authorities bonds:

Sure, the inflation of 1920 did inflate away a whole lot of the WWI debt, although the deflation of 1921 introduced a whole lot of that again. (That is an episode we might do properly to recollect extra! The worth stage doubled from 1916 by way of 1920. It then retreated by a 3rd in 1920-1921. There was a pointy recession, however the financial system recovered in a short time with no stimulus or heroic measures. The traditional knowledge that wringing out WWI inflation brought on the UK Twenties doldrums wants to contemplate this counterexample. However again to our level)

That is additionally in line with normal optimum tax principle, which says that within the occasion of a catastrophe that occurs as soon as each 50 years or so, it’s proper to execute a “state contingent default” (Lucas and Stokey), and inflation is a pure strategy to do it.

However… “state contingent default” is meant to occur on the starting of a warfare. These inflations occurred on the finish of the warfare. How did governments promote bonds to individuals who ought to have anticipated them to be inflated away? Sure, there have been some worth controls and monetary repression, however it’s nonetheless an necessary puzzle to straightforward public finance principle.

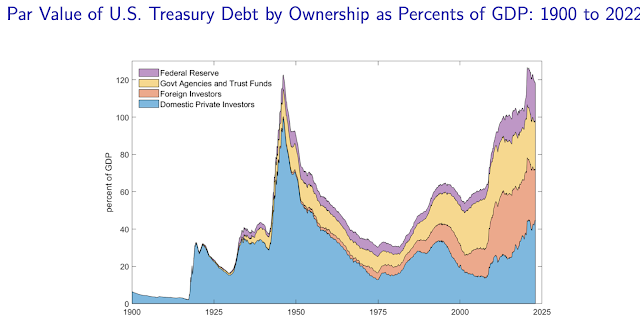

My concern, in fact, is that we have had two as soon as in 100 yr occasions in a row (2008, 2020), I can consider heaps extra that may come quickly, and you may solely do that often. Hit folks over the top a couple of too many instances they usually begin to duck. We’ll head to the subsequent disaster with no historical past of regular surpluses in good instances, 100% debt to GDP ratio, and a painful reminder of what occurs should you lend to the US proper within the rear view mirror.

We begin the H5N1/Taiwan warfare disaster with the identical debt we had on the finish of WWII. And who owns the debt results in some fascinating hypothesis which I am going to allow you to fill in together with your chat GPT.

In 1933, we had a disastrous deflation. The gold normal is a stunning fiscal dedication gadget to attempt to include inflation, however it has an Achilles heel. If there’s a deflation, the federal government has to lift taxes to pay an surprising actual windfall to bondholders. In 1933, the Roosevelt Administration abrogated the gold normal. It was a default on the authorized phrases of the bonds. And look what occurred to inflation!

Eric additionally introduced up a second central level of his 1933 paper: The Roosevelt Administration separated the price range right into a “common” price range, through which we must always anticipate deficits to be paid again, and an “emergency” price range, unbacked (in our language) by anticipated surpluses. That cleverly allowed inflationary finance in 1933, however as soon as the “emergency” was over in 1941, it preserved the US repute for repaying wartime money owed with subsequent surpluses, and allowed it to borrow for WWII. This lack of “again to regular,” of expectations that we at the moment are in “common” not “emergency” finance is worrisome right this moment.

Lastly, Eric introduced some good proof to bear on the query, why 2020 however not 2008? Effectively, partly, we will have a look at statements of public officers. In 2008, they explicitly mentioned, deficit now, reimbursement later. In 2020 they explicitly mentioned the other.

(“Offsets” is Washington-speak for “taxes” or later spending cuts.) Do not learn a pejorative on this evaluation. If you wish to borrow, finance disaster expenditures and never create inflation, you “preserve the norm.” If you wish to create a “state contingent default” and pay for disaster expenditures by inflating away debt, you need to “violate the norm.” That’s darn onerous — ask the Japanese. How do you persuade folks you are not going to repay some a part of the debt, regardless of a great repute, however just a few half, and if WWII comes alongside you are good for added money owed? Effectively, asserting your intentions helps!

And it labored. We in a short time inflated away the debt. Making a state contingent default through inflation will not be simple. Nonetheless to be seen although is whether or not we will return to “regular” “Hamilton norm” as soon as it is over.

Robert Barro additionally had nice feedback, however extra directed on the ebook and with no nice graphs to move alongside. Thanks anyway!