Deliberate Liquidation and Dissolution

Because of the deliberate discontinuation of CYT-0851 improvement, and the beforehand introduced discontinuation of Cyteir’s discovery pipeline, the Firm’s Board of Administrators intends to approve a Plan of Liquidation and Dissolution (“Plan of Dissolution”) that will, topic to shareholder approval, embody the distribution of remaining money to shareholders following an orderly wind down of the Firm’s operations, together with the proceeds, if any, from the sale of its belongings. Previous to winding down operations, the Firm intends to finish regulatory and affected person obligations from the continued medical trial. The Firm will interact impartial advisors, who’re skilled within the dissolution and liquidation of firms, to help within the Firm’s dissolution and liquidation. The Firm additionally intends to name a particular assembly of its shareholders within the second half of 2023 to hunt approval of the Plan of Dissolution and can file proxy supplies regarding the particular assembly with the Securities and Alternate Fee (the “SEC”). If the Firm’s shareholders approve the Plan of Dissolution, the Firm would then file a certificates of dissolution, delist its shares of widespread inventory from The Nasdaq International Choose Market, fulfill or resolve its remaining liabilities, obligations and prices related to the dissolution and liquidation, make affordable provisions for unknown claims and liabilities, try and convert all of its remaining belongings into money or money equivalents, together with via a possible sale of CYT-0851, and return remaining money to its shareholders. The Firm will present an estimate of any such quantity which may be distributed to shareholders within the proxy supplies to be filed with the SEC. Nonetheless, the quantity of money really distributable to shareholders could differ considerably from any estimate supplied by the Firm based mostly on plenty of components.

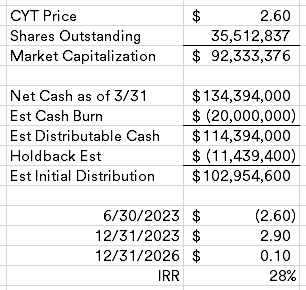

Here is my fast, probably fallacious, swag at a liquidation situation:

I am estimating $20MM of money burn, which is likely to be too excessive, particularly throughout a interval the place cash market funds are returning 5%, serving to to offset some G&A. I am assuming a 12 months finish preliminary distribution of 90% of the money, after which simply 30% of the holdback quantity in 3 years when the liquidating belief winds down.

Disclosure: I personal shares of CYT