Bitcoin (BTC), the most important cryptocurrency out there, has demonstrated a robust shift in investor sentiment. Over the previous 24 hours, BTC has surged by a formidable 9%, at the moment buying and selling at $29,300.

Nonetheless, Bitcoin nonetheless faces important hurdles, with a resistance line positioned at $29,500, in addition to a key psychological stage at $30,000 that has not been reached since April nineteenth.

BTC’s Second Of Reality

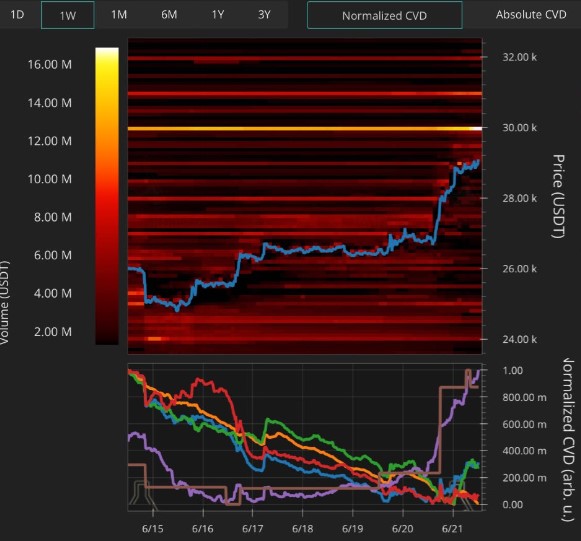

Materials Indicators, a cryptocurrency knowledge evaluation agency, has recognized a considerable resistance stage for BTC at $30,000. This resistance stage has been constructing and should impede the cryptocurrency’s upward momentum, doubtlessly inflicting it to develop into range-bound, as has occurred a number of occasions this yr.

Associated Studying: US Bitcoin Investor Buying and selling Quantity Rises, Stage Set For One other Large Rally?

If BTC fails to interrupt by way of this resistance stage, it might develop into trapped in a slim buying and selling vary, limiting its potential for additional development. Nonetheless, if it manages to beat this hurdle, it might present a robust bullish sign for buyers and doubtlessly result in additional value will increase.

One key issue that Materials Indicators is watching is bid liquidity within the lively buying and selling vary. Bid liquidity refers back to the quantity of shopping for energy out there and is a vital indicator of investor sentiment and confidence in a specific asset. The corporate is carefully monitoring how a lot bid liquidity strikes into the lively buying and selling vary to function assist for BTC.

As well as, Materials Indicators is anticipating the testimony of Federal Reserve Chair Jerome Powell, which might impression the cryptocurrency markets. Whereas the corporate doesn’t count on any main surprises from Powell’s testimony, they acknowledge that these occasions can typically result in elevated volatility and uncertainty within the markets.

Nonetheless, Bitcoin wants to keep up its bullish momentum and overcome the closest resistance stage of $29,500 to have an opportunity at breaching the essential $30,000 line.

Alternatively, if this try fails, will probably be essential for BTC to consolidate above $29,000 and forestall any additional draw back actions.

Bitcoin Set For Main Rally?

Ted Talks Macro, a widely known cryptocurrency dealer and host of a preferred podcast has lately up to date his macro view for BTC, highlighting a number of bullish components that would drive the cryptocurrency’s value increased within the coming months.

In response to Ted, the market has now accepted above February’s highs and is forming the next low on the weekly timeframe. It is a bullish sign that implies BTC is on monitor for additional beneficial properties.

In March, Ted famous that the high-timeframe bull thought can be invalidated if BTC dropped again into the vary under $24,500. Nonetheless, this didn’t occur, and the bulls confirmed as much as assist the worth of BTC.

Along with these technical components, Ted recognized a number of narratives that would drive sentiment over the approaching quarters. These embrace the upcoming BTC halving, the launch of the Blackrock spot ETF (and different related merchandise), the Federal Reserve’s pause on rate of interest hikes, and the launch of crypto exchanges by conventional finance giants.

Primarily based on these components, Ted Talks Macro has set a goal of $35,000 for BTC, which is now in play. This goal represents a big improve from BTC’s present value and means that the cryptocurrency market might be poised for a serious rally within the months forward.

Featured picture from iStock, chart from TradingView.com