CIMB not too long ago introduced a hike of their rates of interest for bank cards, which is able to come into impact subsequent month. Right here’s a have a look at the adjustments, in addition to the prevailing late charges and rates of interest proper now on the different banks and bank card issuers.

I shared this on my Instagram and lots of of you DM-ed me to complain in regards to the greater charges. Whereas it can be crucial that we customers pay attention to the adjustments, additionally it is value highlighting that we don’t have to fret about them until we miss or neglect any funds.

With this, I made a decision to take a look at the place the most recent rates of interest and late price expenses by different banks are at proper now, and a few tips about the best way to keep away from being charged these charges.

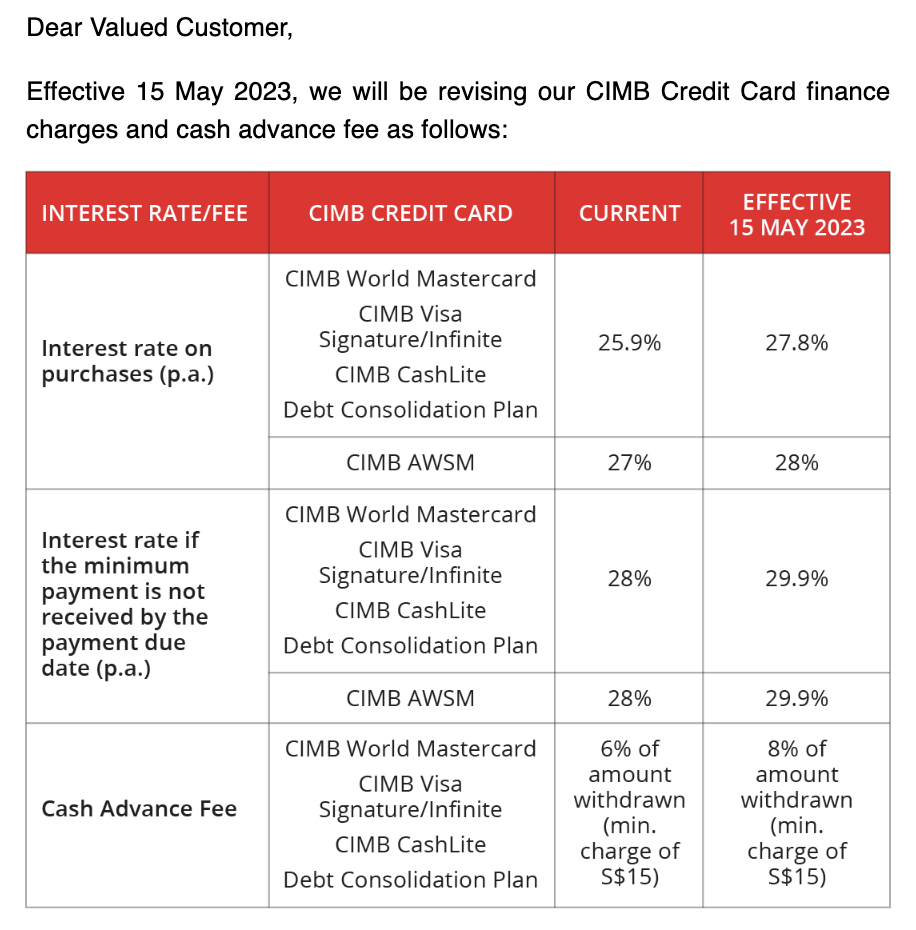

The CIMB announcement that got here out earlier immediately:

At a look, it looks like CIMB is the primary to alter their charges (thus far in 2023). We’ll should regulate whether or not this prompts any of the opposite banks or issuers to observe swimsuit, so I’ll replace this text if that adjustments in a while.

Late charges

This refers back to the rapid cost you get slapped with when you miss a bank card cost. For each month that you simply’re late, you get charged one other $100 / month.

The scary half is if you don’t even notice you’re in arrears, and unknowingly get charged $100 each month (even whether it is simply 1 cent that you simply owe). And guess what? This $100 price additionally incurs curiosity expenses!

Curiosity Charges

You get charged an rate of interest for any excellent quantity that you simply’ve not but paid to the financial institution or bank card issuer (a.ok.a. the price of borrowing). Sure, which means even in case you’ve made the minimal cost and nonetheless have $800 excellent, the financial institution will levy curiosity in your $800 remaining sum till all the things has been paid off in full.

CIMB stands out as the financial institution with the very best rate of interest proper now, however I gained’t be stunned if we see extra banks increase their rates of interest quickly within the coming months.

Why bank card charges could be so insidious

Like most monetary devices, bank cards could be good or unhealthy, relying on how you utilize them. So long as you’re disciplined about paying off in full every month, you’ll not have to fret about any expenses and may totally benefit from the perks e.g. cashback / miles earned / rewards / service provider reductions / additional curiosity in your financial savings account.

Nevertheless, the difficulty begins if you neglect, or fail, to pay your bank card payments in full earlier than the due date. And when you’ve a number of bank cards – every with totally different billing cycles – it may be simple to miss the cost for one or two playing cards.

Supply: MoneySense

What occurs then?

- You’ll be charged curiosity on a day by day foundation on your excellent quantity

- Any curiosity not settled by the subsequent cost due date may also appeal to curiosity within the subsequent assertion, on high of a $100 late price

In brief, any unpaid quantity shall be rolled over to the subsequent invoice, and also you’ll be charged curiosity on high of your curiosity and capital. That’s how bank card debt can simply snowball in case you’re not cautious / not paying consideration!

Methods to keep away from bank card charges

Personally, I take advantage of 2 strategies to assist me keep away from unwittingly being charged these late cost charges:

1. Test your payments twice a month

Set a calendar reminder within the first and final week of each month to verify in your billing cycles. Why twice a month? That’s as a result of bank card funds are due on the finish of a billing cycle, however the size of a billing cycle differs between banks.

For some, it begins from the time you activate the cardboard, whereas some banks set it primarily based on if you made the primary cost or buy in your card.

Therefore, the fail-proof methodology could be to verify close to the beginning and the top of each month, as a result of that just about covers you for all cycles.

2. Sync your bank card billing cycles

Ideally, you’d wish to sync all of your bank card billing cycles to coincide with one another so that you could merely log in as soon as, verify all the things at one go, and clear all funds in a single occasion.

Nevertheless, that’s simpler stated than performed. What’s extra, some banks have billing cycles of 25 days, whereas others have 30 – 40 days, so even in case you name in to set the identical begin date for every bank card, you should still obtain totally different statements on totally different dates and should cope with totally different cost due dates, which get additional and additional aside because the months go on.

Truthfully, so long as you’ve a number of bank cards throughout totally different banks (which many people do), it may be onerous to maintain observe! Therefore, whilst you do your greatest to sync up all of the respective billing cycles, don’t neglect to maintain up with Tip #1 so that you simply by no means threat falling behind in funds.

Conclusion: Repay your bank cards in full each month

I’m an advocate of bank cards and I nearly by no means spend something in money / debit, as a result of doing so means I lose out on the cashback and miles that I can get for every greenback spent. Not value it, particularly after I’ve to spend the identical quantity regardless.

However utilizing bank cards correctly additionally requires monetary self-discipline, as a result of as you may see, the late charges ($100 per 30 days!!!!) and rolling rates of interest are merely NOT value it.

Be a savvy bank card consumer by milking all the advantages and rewards, whereas NEVER paying for any late or curiosity charges in case you might help it.

With love,

Price range Babe