Axis Financial institution not solely has so many entry-level and tremendous premium bank cards but in addition has a reasonably good set of Premium Credit score Playing cards like Axis Privilege Credit score Card focused for the cardholders who’re evolving from the entry-level phase.

Axis Privilege Credit score Card was once the key sauce for a lot of again in time when Axis Magnus wasn’t this aggressive. However even now it continues to be a card to carry because it’s being issued as First Yr FREE for a restricted interval (thirty first March).

Overview

| Sort | Premium Credit score Card |

| Reward Price | 1% to 2% |

| Annual Payment | |

| Finest for | Procuring Voucher Redemptions |

| USP | Multi-brand Voucher redemption |

Axis Privilege Credit score Card is a premium bank card that offers reward fee of two% simply with none advanced incomes/redemption guidelines.

And now that it’s being issued totally free, it is sensible to carry one, so long as you’ve a free slot with Axis, as Axis permits solely 3 bank cards per particular person.

Charges

| Becoming a member of Payment | – Paid Card: – FREE Card: for Precedence A/c holders |

| Welcome Profit | – 12,500 Factors on PAID playing cards (5,000 INR price) – 6,250 Factors on FREE playing cards (2,500 INR price) |

| Renewal Payment | 1,500 INR+GST |

| Renewal Profit | 3,000 Edge Rewards |

| Renewal Payment waiver | on spends of two.5L in earlier 12 months |

The welcome profit is wonderful even on paid playing cards, as you simply pay 1.5K INR and get 5K INR price of vouchers.

The worth of factors are assumed as 40ps/level (in above calculation) due to the power to redeem for multi-brand vouchers. We’ll see different choices later under.

*** Restricted Interval Supply: First Yr FREE ***

Design

The design appears neat and easy however I proceed to surprise why they didn’t refresh Axis privilege bank card’s design whereas they refreshed the design of just about each different bank card.

Perhaps they wish to discontinue? I assumed so, however now after seeing them going aggressive with Zero Becoming a member of Payment supply on this card, it’s solely stunning!

Rewards

- 10 Factors per Rs.200 Spend (Home & worldwide)

The earn fee is easy and easy. To make the mathematics easy, you earn about 5000 Edge Rewards on each 1L spend, which is fairly good due to the redemption choices, as you may see under.

It’s possible you’ll as nicely use Axis Privilege Card on Axis Reward Edge (or) Axis Seize Offers portals to earn 5X/10X rewards.

Redemption

There are a number of choices to redeem edge rewards, broadly divined into two (+1), as under:

| Redemption Sort | Product Sort | Level Worth (Per Level) |

Reward Price |

|---|---|---|---|

| Edge Rewards | Catalog Vouchers | 20Ps | 1% |

| Edge Rewards | Multi-Model Vouchers | 40Ps | 2% |

As you may see above, the purpose worth is fairly good with multi-brand voucher redemption. Listed here are the multi-brand redemption choices:

- 6250 Factors price 2500 INR multi-brand voucher

- 12500 Factors price 5000 INR multi-brand voucher

In case you’re questioning concerning the manufacturers which are redeemable below Multi-brand voucher, right here is the listing of obtainable manufacturers as seen few months in the past. The listing may hold altering infrequently.

However do not forget that you’ll must have both 6.25K/12.5K factors to have the ability to redeem for these choices as this behaves extra like Amex Gold Assortment.

That mentioned, should you’ve different Axis tremendous premium playing cards like Axis Magnus, you might as nicely switch these factors to number of factors switch companions to extend the worth even additional.

Airport Lounge Entry

- Complimentary Entry: 2 per Quarter (home solely)

The complimentary lounge entry profit on Axis Privilege Credit score Card is proscribed to solely home lounges with above limits.

Whereas it doesn’t give entry to iconic lounges like Bangalore 080 lounge, the cardboard is accepted at throughout 29 lounges throughout the nation, which is fairly nice given the payment level at which it’s issued.

My Expertise

I used to be utilizing the Axis Privilege Credit score Card for fairly someday till the launch of Axis Factors Switch program and I did get fairly good worth out of it.

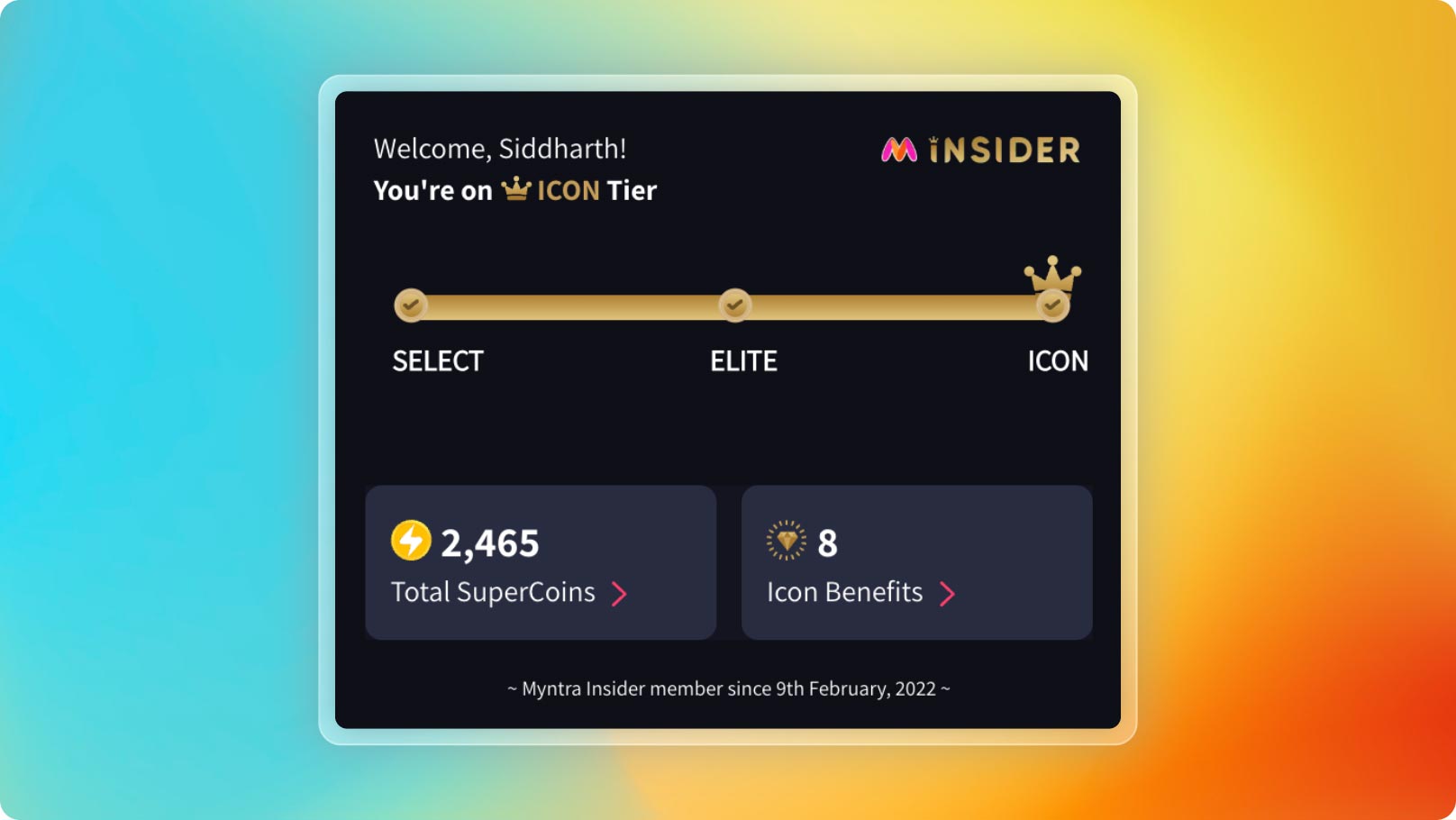

For instance, I used to redeem edge rewards for Myntra Vouchers (Multi-brand voucher possibility) and get to Myntra Icon tier quicker, which has respectable advantages.

This additional helped me to earn much more “tremendous cash” and redeem them for vouchers & memberships.

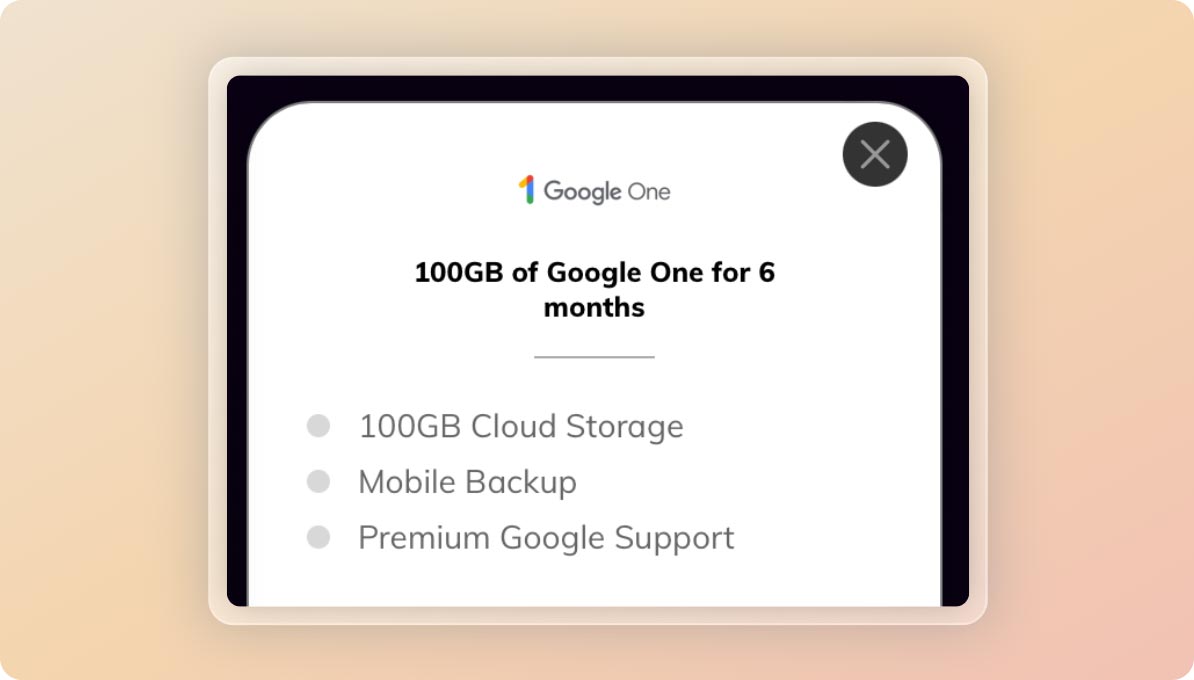

For instance, I redeemed among the Tremendous Cash for “Instances Prime membership” which gave me entry to a complimentary 6 months “Google One” subscription plan, which provides 100 GB house on Gmail.

That’s a terrific worth to me as I used to be in want of further house.

Whereas these could not sound like a lot worth in entrance of in the present day’s Magnus Credit score Card advantages, it was certainly enjoyable again in time to make use of Axis Privilege Credit score Card.

That mentioned, the advantages are nonetheless there and would proceed to make sense to those that don’t wish to pay a payment to carry tremendous premium bank cards or don’t desire journey redemptions.

Eligibility

- Eligibility by way of ITR: >6L INR revenue p.a. (or)

- Eligibility by way of different financial institution bank card: Credit score restrict >1L INR

In case you’re going through any points (or) should you desire to have a easy experience into Axis Credit score Card Ecosystem, do take a look at this inexperienced persons information to Axis Financial institution Credit score Playing cards: Maximizing Axis Financial institution Credit score Playing cards.

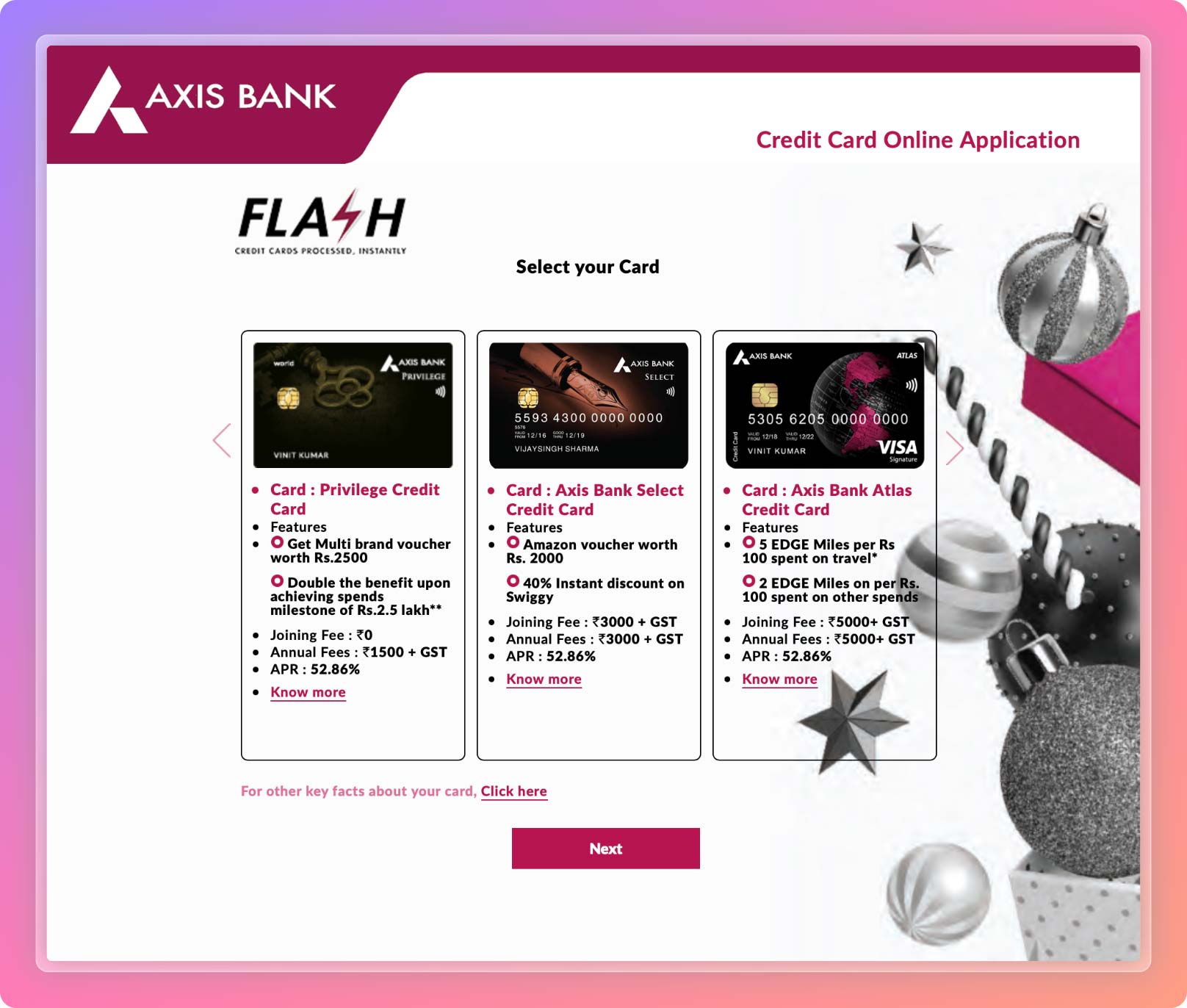

Easy methods to Apply?

It’s possible you’ll apply on-line on Axis Financial institution web site in a matter of few clicks. Axis Financial institution is lately identified for processing recent bank card purposes fairly quick.

The cardboard is at present supplied as first 12 months free, however whether or not you’ll get 6,250 factors as welcome profit is a thriller. More than likely you’ll get, as that’s the way it’s ideally designed.

However the “First Yr Free” (until thirty first March 2023) profit is a confirmed one, as I can see it displaying on the web site as nicely, as under:

Typically Axis Financial institution takes a few week to approve the appliance. If the profile has wholesome credit score report, you might as nicely get the cardboard in hand in below every week, as some profiles could undergo VKYC and quicker processing.

*** Restricted Interval Supply: First Yr FREE ***

In case you’re new to financial institution, to not fear, you don’t must open a recent Axis Financial institution Financial savings A/c to get an Axis Financial institution Credit score Card.

Backside line

General Axis Privilege Credit score Card is certainly a decently rewarding bank card for individuals who desire purchasing vouchers over journey redemptions.

However should you’re into Axis journey edge redemptions and already maintain Tremendous Premium Credit score Playing cards from Axis Financial institution, then it’s no surprise that Privilege does add an excellent worth with it’s welcome profit.

Have you ever ever held an Axis Privilege Credit score Card? Be at liberty to share your experiences within the feedback under.