And on we go, after a small break, with a recent batch of 15 randomly chosen Norwegian shares. This time, the random quantity generator chosen all kinds of companies in comparison with the ususal “Fsih & Ships”. 3 shares made it onto the watch listing, one in all them had been in my portfolio prior to now. Take pleasure in !!

121. HAV Group AS

HAV Group is a 32 mn EUR market cap provider to the maritime trade. Wanting on the web site, they appear to give attention to at the least optically on “Inexperienced” applied sciences, as an illustration electrical ships and hydrogen options.

That every one sounds superb on paper and for 2021 has translated into first rate earnings, however 2022 appears very totally different, with declining gross sales and disappearing earnings. This autumn 2022 was particularly dangerous with an EBIT margin of -16%.

Wanting on the chart, we are able to see that the timing of the IPO in March 2021 appears to have been excellent….for individuals who had been promoting:

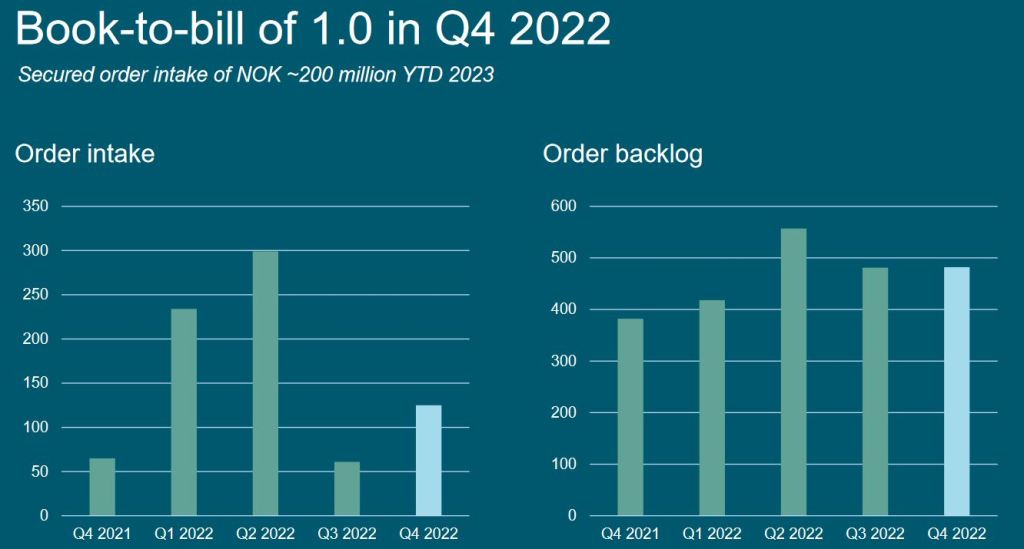

Wanting on the order e book, issues should not actually booming both:

The corporate does give an optimistic outlook for 2025 however nothing actually for 2023. In idea, the enterprise appears like an amazing alternative however for some purpose issues should not actually improing. On the plus aspect, they don’t have monetary debt as of the tip of 2022.

I’ll put them onto the “watch” listing however it’s not a really sturdy candidate.

122. Nordic Halibut

Nordic Halibut is, because the identify says, a 60 mn EUR market cap fish farmer that specialices on Halibut. Once more, a 2021 IPO, the corporate trades round -20% vs the IPO value. The corporate does have gross sales, however losses are nearly as excessive as gross sales and the enterprise mannequin appears to be nonetheless in a comparatively early section. Though I do like Halibut on a plate greater than Salmon, I’ll “move”.

123. Built-in Wind Options ASA

Built-in Wind is a 113 mn EUR market cap firm that owns 6 ships that service the offshore wind trade. The corporate was integrated in 2020, IPOed in 2021 and trades ~15% beneath the IPO value.

As promised an image from the ships:

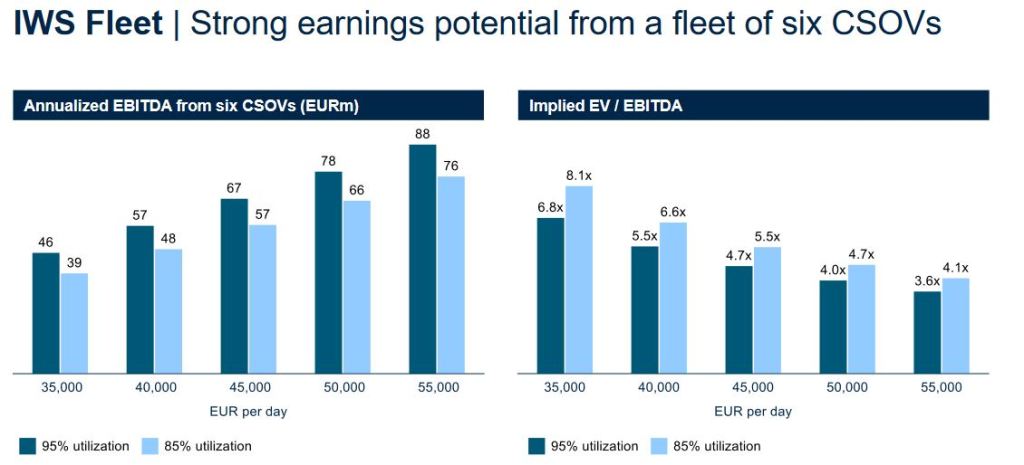

The corporate has been dropping cash in 2022, nonetheless based mostly on their presentation, the long run appears (in fact) fairly good. That is hwo they see their valuation based mostly on costs to be achieved:

I’ve to say that that is the primary Delivery firm that I discover remotely attention-grabbing, subsequently I’ll put them on “watch” however once more a weaker one.

124. Sparebanken 1 SMN

Sparebanken 1 SMN is a 1,5 bn EUR market cap savigs financial institution headquartered in Norway. Apparently, wanting on the share value, shareholders of this financial institution may be the happiest banking shareholders in Europe, making 7x over the previous 20 years. At round 9x earnings and 5% dividend yield, th inventory doesn’t look costly. I do not know what these guys did in a different way to another financial institution in Europe, possibly is hould attempt to discover out at a while, however on the time being I’ll “move”.

125. Grong Sparebank

With 50 mn EUR market cap, Grong is clearly one of many small financial savings banks and surprisingly situated in a Metropolis known as Grong. Nothing to see right here for me, “move”.

126. Sparebank 1 Nord-Norge

The random generatr is tormenting me with Sparebanken. This one has a a market cap of 820 mn EUR, operates from Tromsoe and concentrates on Northern Norway. The inventory has additionally an honest long run efficiency, however much less spectacular than SMN. Valuation is comparable, with a barely larger dividend yield. “Go”.

127. Airthings

Airthings is a 43 mn EUR market cap firm that’s in pricnple lively in an attention-grabbing space, coping with “air high quality sensors and hardware-enabled software program merchandise for air high quality, radon measurement, and power effectivity options worldwide.”

As an opportunistic, finish of 2020 IPO, the share misplaced ~-70% from the IPO value. 2022 confirmed solely little development after a giant bounce in 2021, however losses are growing and stock is piling up. The corporate issued shares early in 2023 and lowered their 2024 outlook. General, regardless of an attention-grabbing enterprise, this appears slightly bit too shaky for my style. “Go”.

128. ELMERA Group SA

ELMERA is a 173 mn market cap electrical energy distributor and cell phone supplier that doesn’t personal a grid/tework and doesn’t produce electrical energy. As such, the principally purchase wholsale and promote retail. So it’s not a giant shock, that 2022 was robust for them. Wanting on the chart, we are able to see nonetheless that issues appear to have worsened already earlier in 2020:

The corporate grew so much prior to now few years, however margins are razor skinny and debt is substantial. “Go”.

128. Induct

Induct is a ten mn EUR market cap firm that gives some form of mission collaboration plartform. The inventory is thinly traded, the corporate is loss making for the final 6 years or so and all in all doesn’t look very attention-grabbing. “move”.

129. Aker Horizons

Aker Horizons is a inventory that truly had been in my portfolio however I exited it a couple of months in the past as I lowered my Renewables publicity. Aker Horizon has a market cap of 540 mn EUR and covers all the pieces throughout the wider Aker Group that’s associated to Local weather and Vitality transition.

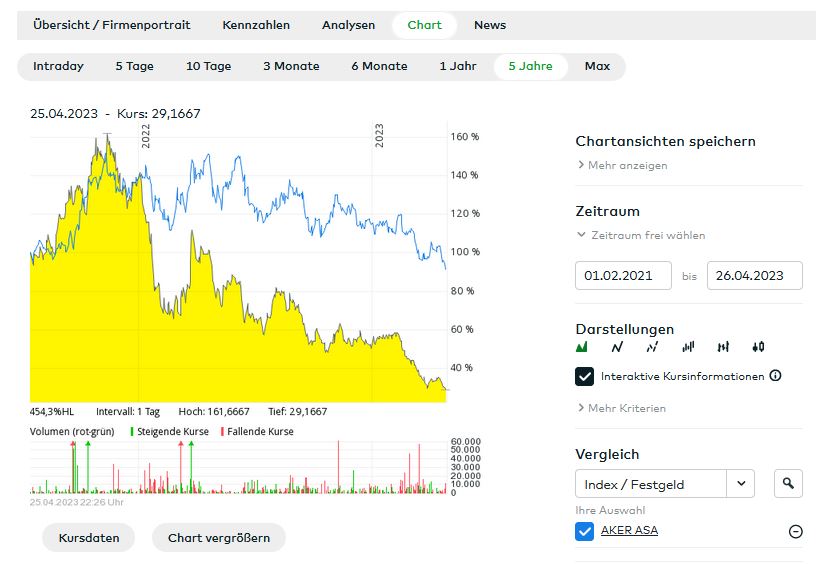

As we are able to see within the inventory chart nonetheless, after in preliminary bounce, the inventory value is on a great distance down since its IPO in Ferbuary 2021:

One purpose for the declining share value is clearly the frantic reorganization. Initially, Aker listed 3 extra subsidiaries, Aker Carbon Seize, Aker Offshore Renewables and Aker Hydrogen. Nevertheless, Aker Offshore and Aker Hydrogen have been taken non-public in 2022 with important losses for the shareholders with solely Aker Cabon Seize remaining listed.

The P&L of Aker Horizon is de facto laborious to investigate at it’s principally a improvement firm with a number of bills upfront and little operational income and/or earnings.

From the This autumn presentation, probably the most attention-grabbing slide is how they report their NAV :

Their NAV of ~1,3 bn EUR is considerably above the market cap, put partially depends on historic valuation (Mainstream). General, I nonetheless discover it very attention-grabbing and Aker Horizon stays on the “watch” listing with a excessive precedence.

130. AMSC ASA

AMSC is a 255 mn EUR market transport firm that “operates as a ship proudly owning and lease finance firm in america. The corporate is concerned within the buy and bareboat chartering of product tankers, shuttle tankers, and different vessels to operators and finish customers within the Jones Act market. It operates a fleet of 9 product tankers and one shuttle tanker.”

The Jones Act is a US legislation that solely permits US based mostly ships to function inside a sure distance of the US coast and subsequently protects these ships from any overseas competitors.

As many transport shares, the inventory appears low cost however they carry a number of debt and the inventory did nothing for the final 10 years. I’m additionally unsure if proudly owning ships as such is a very good enterprise, even when protected by the Jones Act. “Go”.

131. Kongsberg Gruppen

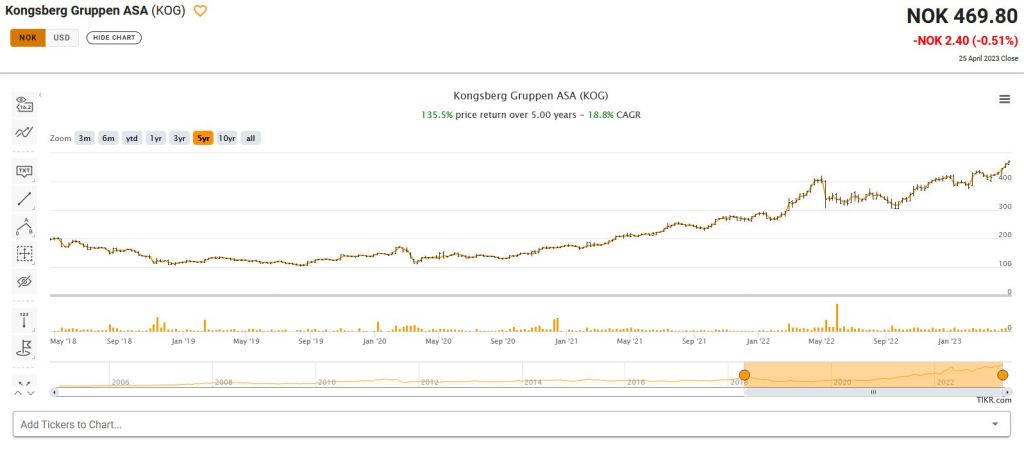

Kongsberg Gruppen is a 7,3 bn EUR market cap Know-how Group that’s lively throughout a variety of sectors equivalent to marine and aerospace with a give attention to protection and navy applied sciences. The inventory has been performing effectively, doing 19% CAGR during the last 5 years:

That is supported by a powerful improve in working revenue and EPS after a hunch in 2017 and 2018. It appears that evidently as a protection inventory, a number of issues at the moment go into their instructions.

Nevertheless the inventory now additionally appears fairly costly at 30x P/E and 25x EV/EBIT. The Norwegian Authorities owns 50% of the shares. As I’ve no actual angle on this, I’ll “move”.

132. PGS ASA

PGS aka Petroleum Geo Companies, is a 626 mn EUR market cap firm that’s lively within the assortment of Geological surveys for the Oil & Fuel trade. In distinction to competitor TGS Nopec (which I woned some years in the past), PGS nonetheless owns its personal ships which makes it a capital intensive, leveraged and subsequently susceptible cyclical enterprise.

PGS needed to elevate steadily capital and the share value is tremendous risky. Not my space of curiosity, “move”.

133. Norsk Titanium

This 73 mn EUR market cap firm is, because the identify signifies a “producer of aerospace-grade, additively manufactured, structural titanium parts for business aerospace tier one suppliers”.

Sadly, the manufacturing appears very small, with revenues lower than 100K EUR for 2022 and now development however growing losses. As lots of its peer 2021 IPOs, this appears to be extra a enterprise funding. “Go”.

134. Quantafuel

Quantafuel is a 92 mn EUR market cap “Cleantech” firm that goals to recycle plastics into helpful uncooked supplies by chemical processes. Quantafuel was IPOed really simply earlier than Covid hit and the inventory participated within the “Covid hype” earlier than than declining far beneath the IPO value:

In February 2023, Quantafuel obtained a take-over (or take-under) from KKR at a value of 6,38 NOks per share and the 2 largest shareholders have alreay agreed, representing greater than 40% of the shareholders.

Wanting on the present value, evidently the probability of the deal going by is sort of excessive, subsequently I’ll “move” though the house as such is attention-grabbing.

135. Nordic Mining

Because the identify says, Nordic mining appears to be lively in mining operations within the Nordic. The corporate has a market cap of 105 mn EUR. So far as I perceive, they’re at a comparatively early stage and began growing the websites, however needed to do a capital elevate in March in orther to finance the subsequent step. Mining is clearly not my circle of competence, subsequently I’ll “move”.