Are you unknowingly being nurtured to domesticate extra reckless spending habits?

Just a few years in the past, when Purchase Now Pay Later (BNPL) providers have been first launched, plenty of of us questioned why the authorities have been so involved and stepping in, arguing that it was hindering innovation within the scene.

However 2 years on, and after watching this video from CNA on how the younger are utilizing BNPL providers, absolutely we are able to all perceive their issues.

Extra shoppers at the moment are spending greater than what they will afford and making impulsive buys, largely resulting from a false notion of elevated buying energy because of BNPL providers.

The power to say no to purchases and to tell apart between paying for what you need vs. what you actually want is a talent to be cultivated over time.

And should you’re not cautious, permitting your self to make use of providers that are aimed to boring this potential…goes to set you up for greater bother later down the street.

How utilizing BNPL on smaller purchases can mess with our minds

We are inclined to assume twice about shopping for one thing when now we have to pay for it in full. However if you break up the sum up into smaller quantities, our thoughts tends to “justify” the acquisition as one thing that we are able to afford.

That $76 basis is now inside my means as a result of it solely prices me $25 per thirty days to personal it.

Except for surprising, large-ticket gadgets that we have to get (akin to when the fridge breaks down), utilizing BNPL providers to pay to your Shein clothes purchases, Sephora make-up and even meals…isn’t precisely the wisest alternative.

And as BNPL retailers have confirmed, cart abandonment charges have gone down once they provide BNPL cost choices. The CNA video additionally pointed to how a lot greater shoppers are spending by way of BNPL providers:

What this implies is that fewer shoppers are pondering twice about their purchases, vs. the previous the place we might add an merchandise into our cart and mull over the choice for a couple of days earlier than deciding whether or not to purchase. Whereas that is good for the retailers, it’s much less so for us and our pockets.

Don’t rely on the retailers or advertisers that can assist you domesticate higher monetary habits; it’s of their curiosity to make sure that you spend extra and purchase extra of their merchandise.

SG Price range Babe

In the event you’re making an attempt to domesticate higher monetary habits, it is perhaps higher to keep away from BNPL providers and spend solely when you may pay in full inside that month itself.

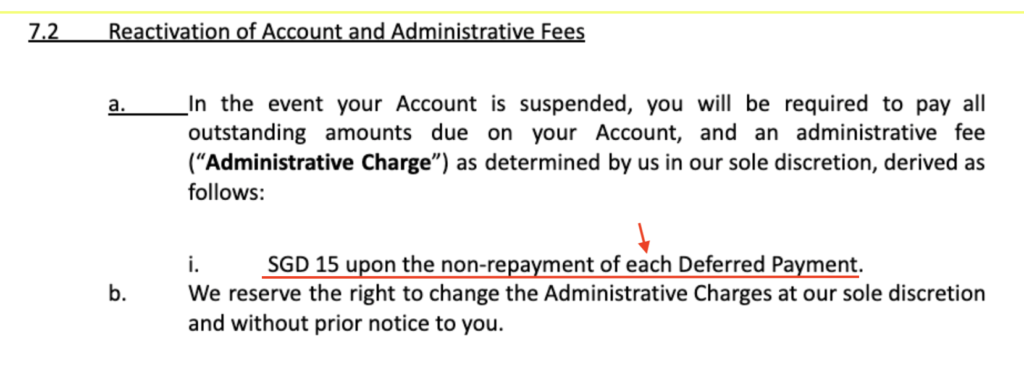

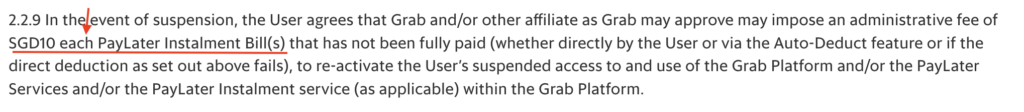

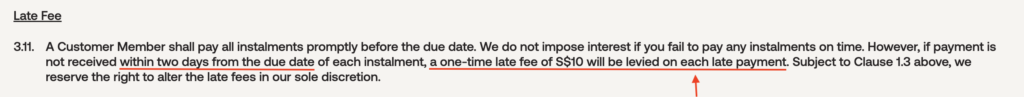

Watch out for late charges

Most BNPL customers have a tendency to have a look at the late price caps and assume, “I can deal with that”. However little do they realise that the price is utilized per instalment cost, which implies it may very simply snowball into a lot greater charges than bank card costs if one just isn’t cautious.

How so? Properly, take into account these 2 situations:

- You notice fraudulent transactions in your bank card, so that you instantly name your financial institution to cancel it, however you forgot that you’ve got 8 BNPL instalments tagged to that card throughout Atome, Tempo and Seize. The late charges get utilized the next month, and also you instantly incur 8 x $10 of costs ($15 on Atome) Congratulations.

- You run into monetary points that month (maybe a consumer paid you late, as a gig employee) and thus have difficulties paying your bank card invoice, so that you assume, I’ll simply incur the $100 late price and 26% rolling curiosity for a month. However you overlook that you’ve got your BNPL instalments too, and that you just’re additionally being charged a late price on every of them.

These are very actual – and customary – situations that would occur to any of us.

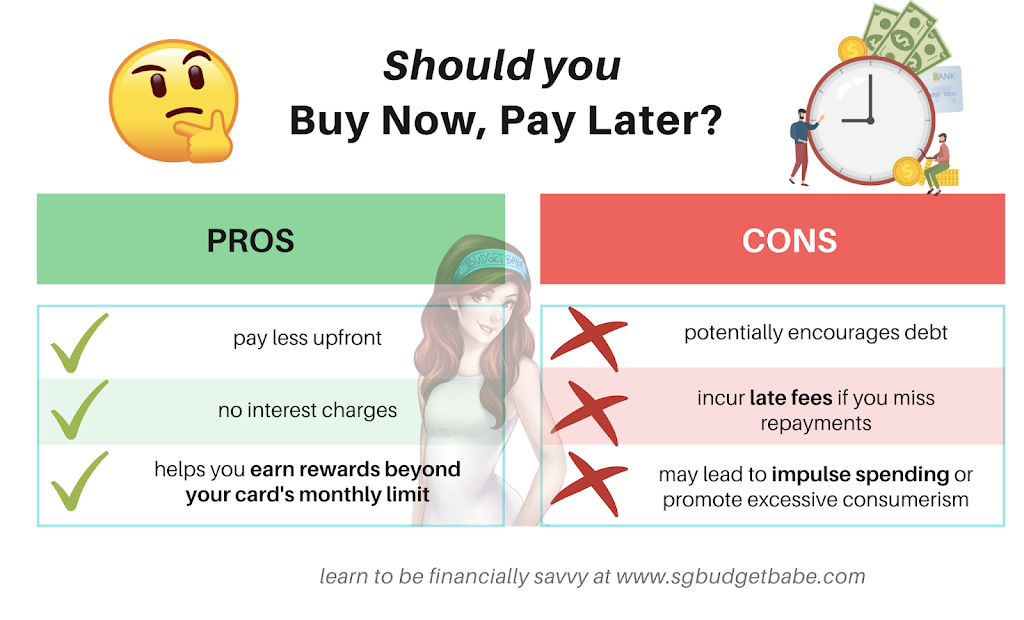

Now, I’m not saying that BNPL providers are evil. Quite the opposite, there are large advantages you may reap from utilizing BNPL – examine them right here.

However the issue is, the software cuts each methods. And because it presently stands, younger individuals make up a big portion of BNPL customers, regardless that not all of them are financially savvy sufficient to deal with it.

Nonetheless pondering of utilizing BNPL providers? Learn this primary.

Use the 10X spending rule as an alternative

One useful guideline can be to purchase provided that you earn greater than 10 occasions of what the merchandise prices you.

As an example, should you’re pondering of shopping for a $700 Dyson hairdryer, you may wish to first examine should you’re incomes at the least $7,000 a month in order that the acquisition takes up a smaller portion of what you labored exhausting to earn.

In the event you’re incomes $10 / hour and also you need that $700 Dyson hairdryer, ask your self, are you keen to trade 70 hours of your life for that buy?

It’s as much as you whether or not you wish to apply this 10x rule primarily based in your month-to-month or annual earnings. Personally, I exploit annual limits for bigger-ticket gadgets (i.e. something above $1,000) and use month-to-month limits for smaller purchases like my skincare merchandise or clothes.

Measure by utility and never worth

I additionally desire to use the 10x rule along with the idea of utility value – which measures how a lot worth I can get out of the product – and ask myself, what number of occasions will I be utilizing this?

Like many females, I get tempted by the newest season of vogue put on as nicely, particularly when it’s repeatedly proven to me as adverts on social media, as posts by the model and its ambassadors / influencers, or extra. However utilizing this idea of utility has helped me to stroll away from many purchases the place I’ve not been capable of justify carrying the outfit sufficient occasions to spend that a lot on it.

That method, I do know my cash is simply going in the direction of issues that might be helpful to me, as an alternative of an impulsive buy that can solely find yourself sitting at house as a white elephant.

Bonus: this isn’t simply useful to your pockets, but additionally higher for the setting 😉

With love,

Price range Babe