Saving cash doesn’t must really feel boring or troublesome! If you’re on the lookout for a money-saving problem, that is probably the most full information you will see that. These 20-plus cash challenges for 2022 will assist you save large!

One thing I discovered once I was a child is that while you make one thing a recreation, even probably the most mundane job will be enjoyable. That’s what’s so magical about these money-saving challenges.

As an alternative of needing to create a brand new behavior or self-discipline, doing a problem makes saving your cash a lot extra enjoyable.

21 Cash-Saving Challenges To Attempt in 2022

If you wish to kick your financial savings into excessive gear, these challenges are the place that you must begin. Learn via all of them and select those that sound probably the most pleasurable to you.

You’ll be much more profitable when you do these challenges with your loved ones and pals. Invite them to save cash together with you.

The excellent news is that it’s by no means too late to get your funds so as!

1. No-Spend Problem

The No-Spend Problem is among the hottest cash saving challenges you will see that. I wrote a information to the No-Spend Problem that lays out tips on how to do it and get probably the most out of it.

On the most simple degree, a no-spend problem is the place you go for a set period of time and don’t spend any extra cash. I’m speaking about cash past the fundamentals of meals/home/fuel.

It’s like fasting, however along with your spending habits.

You are able to do this for as lengthy or as wanting a time interval as you need. Attempt it for a month or begin out with only a week.

2. 52-Week Cash Problem Backwards

The everyday 52-week cash problem is the place you save $1 the primary week, $2, the second week, and so forth. By the tip of the 12 months, you’d have saved $1,378.

Flip this problem the other way up and do it backward. That is the way it will look:

- $52 into financial savings: week 1

- $51 into financial savings: week 2

- $50 into financial savings: week 3

- $49 into financial savings: week 4

Proceed that sample and reduce the quantity you place away by a greenback every week. It is a smart way to save cash as a result of by the point the vacations hit, you’ll be capable to pay for Christmas presents!

3. 8-Week Trip Financial savings Plan

You possibly can full this problem in simply two months – speak about immediate gratification. With this problem, you’ll save $1,000 in 8 weeks as an alternative of all 12 months lengthy.

The Soccer Mother Weblog has all the small print – and it has two elements. It’s important to put a set quantity into financial savings every week. You even have to chop again on spending a specific amount over this time-frame too.

4. Vacation Helper Fund

It is a approach to get forward of the massive bills of the vacations. Beginning January 1, put aside $20 from every week’s funds and put it into financial savings.

You need to use this for vacation present shopping for, or use it to save lots of up for a trip or one other main expense. By the tip of November, you’ll save an additional $960 on a bi-weekly funds.

You possibly can even put aside your cash in a Christmas Money Envelope. Seize yours free of charge right here.

5. 52-Week Financial savings Problem

That is in all probability one of the common financial savings challenges on this listing. In case you observe this accurately, on the finish of a 12 months, you’ll have saved a further $1,378.

Right here’s the way it work:

- $1 into financial savings: week 1

- $2 into financial savings: week 2

- $3 into financial savings: week 3

- $4 into financial savings: week 4

Hold doing this till week 52, when you’ll put $52 into financial savings!

In order for you a free printable, A Helicopter Mother has one that’s straightforward to observe and can assist you keep on observe.

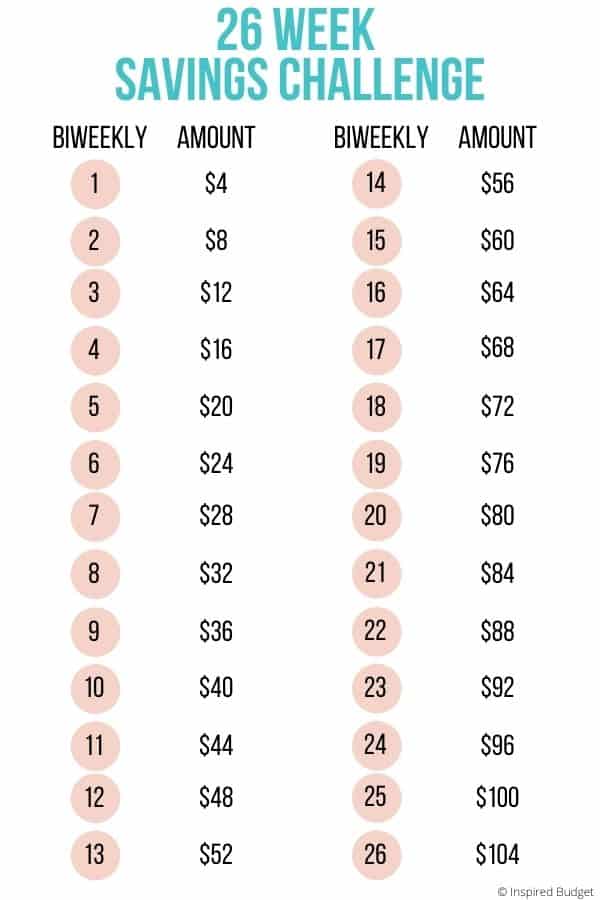

6. 26-Week Bi-Weekly Financial savings Plan

As an alternative of a weekly problem, this one challenges you to save cash every-other week.

It is a higher thought when you desire to deposit cash into financial savings on the identical schedule as your paycheck.

By the tip of this problem, you could possibly save $1,404 – it takes a 12 months, similar to the 52-week problem.

That is the way it will look:

- 1st week: put $4 into financial savings

- third week: put $8 into financial savings

- fifth week: put $12 into financial savings

- seventh week: put $16 into financial savings

You merely improve the quantity by $4 each two weeks, then you may get pleasure from watching your financial savings account develop.

7. 365-Day Nickel-Saving Problem

This problem is for anybody that feels overwhelmed making weekly or bi-weekly deposits – and you find yourself saving much more cash with it.

This publish explains tips on how to do the problem intimately.

Right here is how this problem works:

- 1st day, deposit $0.05 into financial savings

- 2nd day, deposit $0.10 into financial savings

- third day, deposit $0.15 into financial savings

Mainly, you add a nickel to the day past’s financial savings each single day. Then by the final day, you’ll deposit $18.40.

Whenever you have a look at these numbers, they appear so doable! One of the best factor is that while you add all of it up, the entire you’ll put into financial savings might be a whopping $3,300!

8. $1 Invoice Save

The $1 invoice problem is tremendous self-explanatory. Each time you get a one greenback invoice as change, put it in your financial savings envelope.

This problem works greatest when you already use the envelope system. In case your envelope turns into too massive, then contemplate including all of your$1 payments to a big jar. Depend it out on the finish of the 12 months and apply it to one thing FUN. You’ll be stunned simply how a lot cash it can save you!

9. Climate Financial savings Problem

It is a actually enjoyable problem that’s actually random! This blogger in Arizona got here up with this concept. As soon as every week, you deposit cash into financial savings that matches the excessive temperature that day.

In case you dwell someplace gentle, this might be straightforward. Dwelling in Arizona, this blogger deposited as a lot as $105 some weeks.

Don’t wish to make weekly deposits? Then look again on the finish of the month for the typical excessive temperature every week. Multiply it by 4 and deposit that a lot into your account!

10. 31-Days To Enhance Your Monetary Life

Need one thing that’s much more difficult? Comply with this problem from Half-Time Cash. It is going to take you step-by-step via a whole month of monetary habits that can fully change the way you save and spend your cash.

They provide you a model new job or problem every day, after which provide the instruments and sources to do them. That is the right 31-Day problem for freshmen!

11. 3-Month Financial savings Cash Problem

This problem solely lasts for 3 months, so when you don’t wish to decide to one thing all 12 months lengthy, that is the one for you.

In case you observe this problem, it can save you as much as $1,000 in these three months.

You’ll do that by saving precisely $84 per week. Sound robust? Browse our saving cash suggestions for insights and inspiration.

12. Spare Change

A number of individuals have used this problem as a method to save cash. Bear in mind the opening clip within the film Up? They did it too.

Everytime you get unfastened change, you place it in a jar or piggy financial institution. When that jar fills up, take it to the financial institution and put it in your financial savings account.

When you’ve got by no means tried to save lots of your unfastened change, it would shock you the way a lot you may accumulate.

The one draw back to this problem is that it received’t work that effectively when you by no means pay with money.

13. Expense Monitoring Problem

Have you ever ever tracked your bills earlier than? It’s a very efficient approach to visually see the place your cash goes and tips on how to save extra.

In case you haven’t tracked bills, use this as a chance to begin. Problem your self to jot down and categorize each single buy for a whole month.

You is likely to be shocked at how a lot you spend on sure issues!

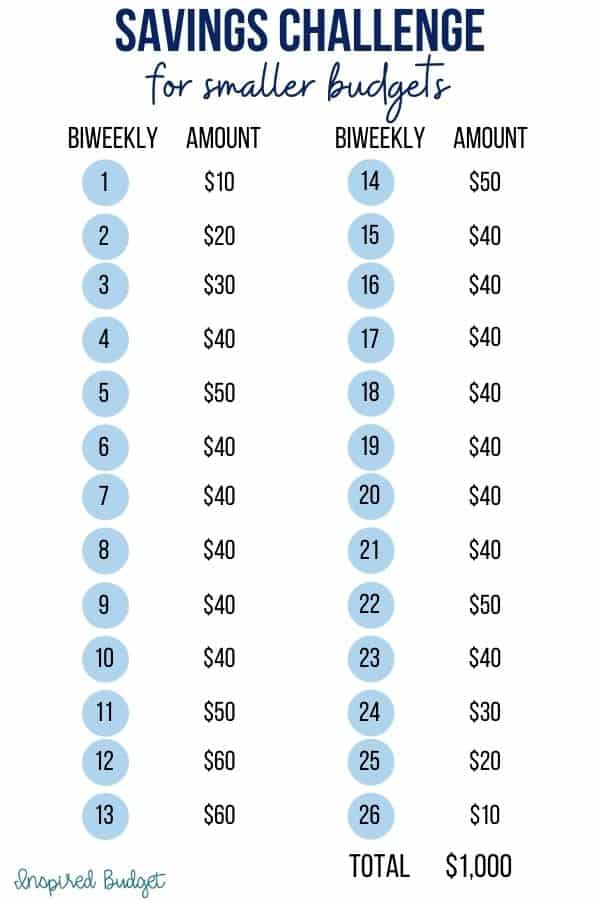

14. 26 Paycheck Problem For Smaller Budgets

This problem is for anybody that budgets each paycheck – which is lots of people!

You improve the quantity you place into financial savings by $10 every week. The primary week you deposit $10 and the 2nd week you deposit $20.

The cool factor about this problem is that it caps at $60 which is ideal for these with smaller budgets.

On the finish of 26 paychecks (which is a couple of 12 months), you’ll have an additional $1,000 in financial savings!

15. No Consuming Out Problem

This problem is for anybody that wants one thing with a quick-win! If saving up cash appears too intimidating, attempt to simply cease consuming out for a whole month.

This one behavior may assist you save more cash than you notice. That’s the enjoyable factor about these little challenges.

You possibly can even select 3 months out of the 12 months for this financial savings problem. You’ll be shocked by how a lot cash it can save you while you lower out eating places. Plus, you may pair this problem with one other straightforward one just like the $1 invoice problem and save much more.

16. The Penny Problem

This problem is quite a bit just like the spare change problem. The one distinction is that you’re saving your whole pennies, not the entire unfastened change.

It’s fairly stunning to take a big jar of pennies to the financial institution and uncover how a lot you could have.

Put all of this cash immediately into financial savings as quickly as your jar fills up.

17. Cancellation Problem

The cancellation problem is simply so simple as the “no consuming out” problem.

Sit down along with your partner and have a look at your whole subscriptions. Cancel as many as potential.

Then, take it a step farther. What about different locations you spend cash? Do you spend cash every month in apps? What about reloading playing cards like a Starbucks account?

Cancel as many issues as potential and put the cash you’d spend on them immediately into financial savings.

18. Little Vices Financial savings Problem

The little vices problem will take just a little extra time and effort. You’ll have to consider each single buy and determine whether or not it’s a vice or a needed one.

Vice purchases are issues you may dwell with out. This contains impulse buys on the register or espresso while you’re out doing errands.

You’ve gotten a couple of choices with this problem. You possibly can both lower out all vices for a whole month or lower out sure vices for a fair longer time frame.

Do what works for you and decide a technique that it is possible for you to to observe.

19. Spherical-Up Cash Saving Problem

Some banks can help you spherical up purchases to the closest greenback after which deposit the change right into a related financial savings account.

In case your financial institution doesn’t supply this, decide from one in every of these apps that may do it for you.

20. 1% Problem

That is one other problem that you are able to do with out even lifting a finger. Go into your office and improve your 401(okay) contribution by 1%.

Then, in 2 months, go in and improve it by one other 1%.

In case you don’t have a retirement account or wish to do that problem with out utilizing one, simply calculate 1% of your gross pay. Then, divide that by your complete paychecks for the 12 months, and put that quantity right into a financial savings account after your first paycheck.

Comply with the identical course of while you improve your financial savings to the next proportion, then get pleasure from watching your nest egg get greater and greater.

21. Cash Throwdown

This one is quite a lot of enjoyable! Problem a buddy or member of the family and see who can save probably the most cash in a month.

You’ll simply must work out the principles and the way you’ll consider how a lot you saved.

Keep Motivated Throughout A Cash Saving Problem

Smaller and faster challenges can help you make progress with out shedding motivation. However what concerning the challenges that final all 12 months?

One of the best ways to remain motivated all through a cash saving problem is to visually observe your progress.

Seize the free printable beneath to trace your progress. Merely shade in a field every time you save $100. Put up this web page someplace you’ll see it usually to remain motivated!

Closing Ideas

Typically, doing a problem is a very enjoyable approach to kickstart a brand new way of life of budgeting and saving cash. Pick a couple of of those challenges and uncover how a lot it can save you!