My Two-for-Tuesday morning prepare WFH reads:

• What would U.S. default really seem like? ‘Monetary Armageddon.’ The worldwide monetary system is like an upside-down pyramid, and the tip of that pyramid is the U.S. Treasury market. “All the things else rests upon it.” (Washington Submit) however see additionally Can Biden Name the G.O.P.’s Bluff on Debt and Shield the Financial system? Some Republicans, whether or not critical or bluffing, appear able to go to the brink of default — if not really default on the U.S. nationwide debt. Debate has intensified. (New York Instances)

• Vanguard’s Trillion-Greenback Man Leads a Mounted-Earnings Revolution: Lively bond funds bleed report money as passive lures billions; Josh Barrickman leads rise of latest fixed-income market giants. (Bloomberg)

• Your boss is obsessive about productiveness with out understanding what it means: That’s poor floor to face on when making an attempt to revoke distant work. (Vox) see additionally The Decline of the 5-Day Commute Is a Boon to Suburban Retail: Difficult time for city downtowns presents alternatives in different areas. (Wall Road Journal)

• The Lies We Inform Ourselves About Multitasking: Our brains aren’t wired to juggle duties. (Wall Road Journal)

• The Repo Man Returns as Extra Individuals Fall Behind on Automotive Funds: Pandemic reduction measures shielded many individuals from repossession, however that’s altering as rates of interest and auto costs soar. (Businessweek) see additionally Repo Males Haggle With Harley-Davidson Over Restoration Charges: Motorbike maker cites increased credit score loss, lack of repossession brokers; corporations say Harley doesn’t pay sufficient for troublesome, harmful work. (Wall Road Journal)

• Why Launch Rockets When You Can Simply Fling Them Into Area? California startup SpinLaunch says its system will be capable to full 2,000 launches a yr. (Businessweek)

• Jack Dorsey Has a Lot to Say, Together with About Elon Musk and Twitter: The Twitter co-founder has posted prolifically on two new social networks, Nostr and Bluesky, which he additionally backed financially. (New York Instances) see additionally The Life and Demise of the Blue Verify Mark: Twitter’s verification course of was historic. Then got here Elon Musk. (Slate)

• Having a Identify Twin at Work Is Exhausting, Simply Ask Chris Smith. And Chris Smith. You’re getting a promotion! Or are you? Work doppelgängers are all over the place.. (Wall Road Journal)

• How Ron DeSantis remodeled into an anti-public well being crusader: DeSantis’s surgeon common is accused of manipulating knowledge to justify an anti-vaccine agenda. How did we get right here? (Vox) see additionally These ten books are thought-about pornography in Ron DeSantis’ Florida: Few of the books faraway from Florida college libraries had been deemed pornographic or sexually express. And plenty of books that did obtain that label don’t meet the definition of pornography — or something shut — below state or federal regulation. (Common Info)

• The Sport NBA Defenders Hate to Play: See Steph Run: Stephen Curry’s long-range 3-pointers make the spotlight reels. The distances he travels earlier than he shoots them are what actually destroy NBA defenses. (Wall Road Journal)

Make sure you take a look at our Masters in Enterprise interview this weekend with Julian Salisbury, Chief Funding Officer of Goldman Sachs Asset & Wealth Administration, with $737 billion in property below administration. He’s a member of the Administration Committee and Co-Chair of the Asset Administration Funding Committees, (personal fairness, infrastructure, development fairness, credit score, and actual property).

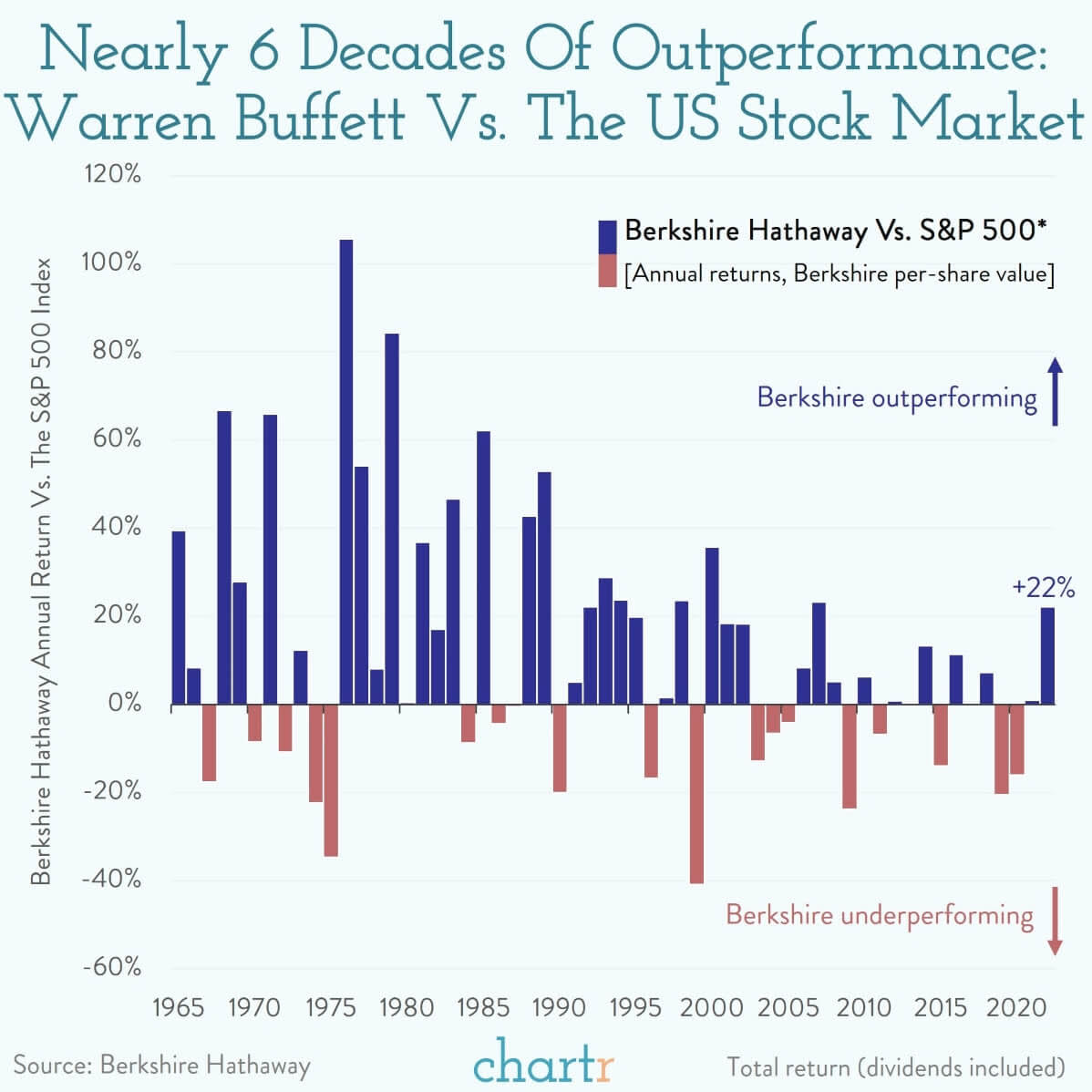

Buffett vs. the market: Charting 58 years of Berkshire Hathaway’s returns

Supply: Chartr

The submit 10 Tuesday AM Reads appeared first on The Large Image.