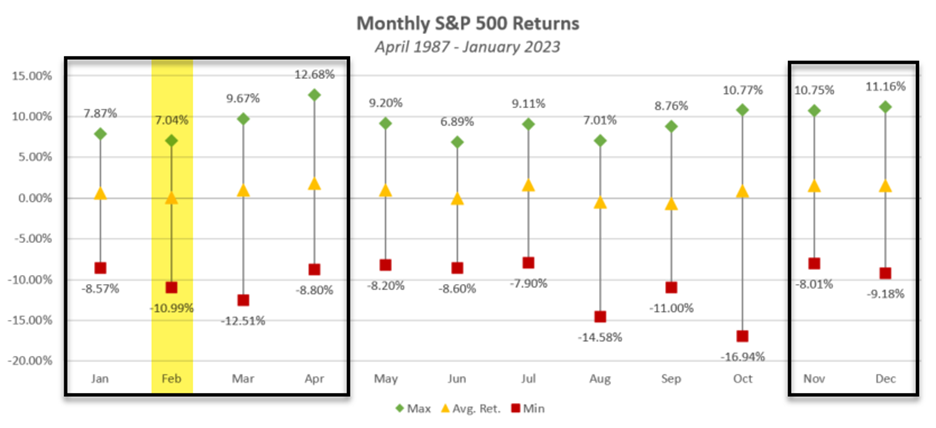

Going again to 1987, February has had the bottom most return and second-worst detrimental return among the many six months (Nov-April) which can be historically robust.

(Supply: Dorsey Wright & Associates – “DWA”)

Why does it matter?

Regardless of what you would possibly naturally guess, a powerful January tends to enhance the February return profile.

For February, the S&P 500 (SPX) is up proper round 1.5% (MTD) as of this writing.

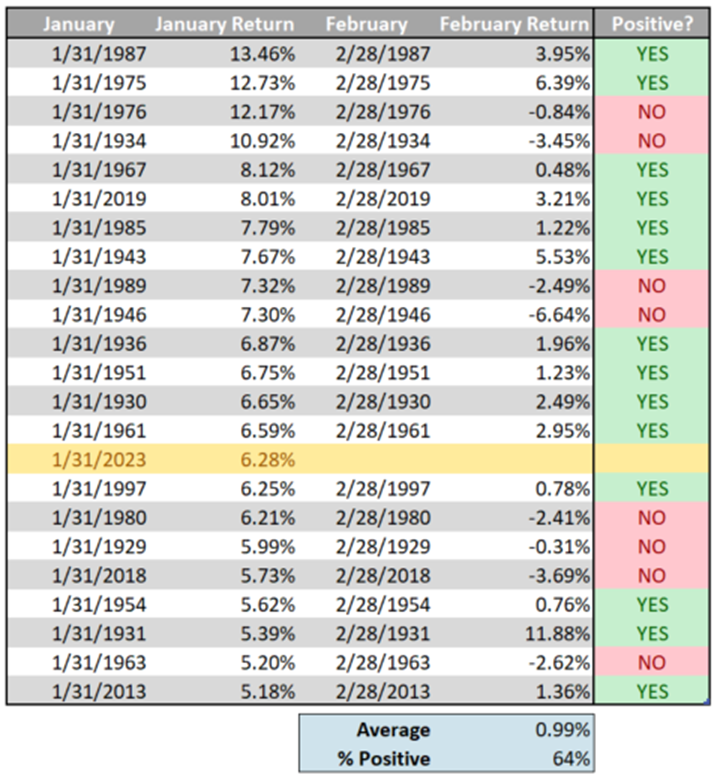

Beneath you will note yearly the S&P 500 gained at the very least 5% in January since 1928 together with the market efficiency for the next month (Feb). (Supply: DWA)

You’ll additionally see that these Februarys reported a return common (and in addition a median, btw) of just about 1%. That is considerably larger than the typical return of 0.17% for “all Februarys” and was optimistic 64% of the time.

In fact, there are some vital outliers. Check out 1946 when the market gained greater than 7% in January earlier than dropping virtually -7% in February. Additionally have a look at 1934, when the market returned 11% in January earlier than dropping virtually -3.5% the next month.

The percentages are on the aspect of the investor.

No assure however nonetheless, not a darkish cloud by any stretch of the creativeness.

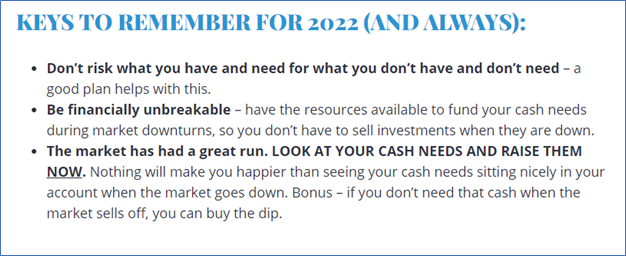

I’ll conclude with the recommendation I gave heading into 2022 (graphic beneath) from a weblog I wrote in December of 2021 which could be discovered right here.

I’m not making an attempt to rub it in. I’m simply highlighting that generally one of the best recommendation is simply good basic decision-making and getting the large issues proper.

In case you are feeling like shit proper now, PLEASE keep in mind this sense in order that when the market will get again to the degrees we noticed in January 2021 (and we are going to…sometime), you’ll be able to tune up your plan, reallocate your portfolio, and lift the money you would like you have been residing out of proper now.

Try our most up-to-date episode of the Off the Wall Podcast: What’s Direct Indexing and How Does it Work? On this episode, we talked to Pat McStay at OSAM about an strategy to investing that’s gaining reputation as a consequence of its potential to construct allocations which can be personalized to an investor’s preferences, in addition to harvest tax losses. We hope you’ll tune in.

Maintain trying ahead,