Put up Views:

7,399

“There

are a long time the place nothing occurs; and there

are weeks the place a long time occur” – Vladimir Ilyich Lenin.

The primary Roman empire rule started in 27 BC and helmed by the emperor Caesar Augustus. Roman Empire at its peak conquered an enormous a part of Europe and important a part of the African continent. The empire constructed 50,000 miles of roads, amphitheaters, bridges and infrastructures which can be nonetheless in use at present. Even at present lots of western nations’ alphabet, calendar, languages, literature, and structure is impressed a lot from the Romans. How may such a mighty empire collapse?

Commerce was essential to the Roman financial system and it generated

huge wealth for the residents of Rome. The main forex utilized in first 220

years within the Roman empire was Denarius. In the course of the early days of the empire,

Denarius was of excessive purity, holding about 4.5 grams of pure silver. The coin was

value a day’s wage for a craftsman or a talented labourer.

Nevertheless, because of the finite provide of silver and gold, the spending was restricted by the variety of Denarii that might be minted. However the greed for increased progress and energy was then additionally. So, what ought to the emperors do to extend their spending on wars, pet tasks and different purchases? Officers discovered a inventive strategy to work round this drawback – scale back the silver content material within the coin. Thus, by debasement of the forex, they have been capable of make extra cash which led to increased spending by the Authorities. This concept resulted in additional dropping of the silver content material within the cash through the years.

Low value of forex began displaying its impact over some time period. Including extra cash in circulation didn’t improve prosperity however resulted in inflation as extra cash have been wanted for buy of products and companies. By the point silver content material was lowered to lower than 5%, the costs skyrocketed by 1000%.

With rising prices and finite provide of valuable metals, the

Roman Govt. levied increased taxes on individuals to generate income for expenditure.

Rome’s commerce by severely hit by triangular issues of hyperinflation, excessive

taxes and nugatory forex. The financial system was in shambles and commerce was majorly

localized and was completed utilizing barter strategies. Roman empire was in free-fall.

Commerce networks perished. Barbarian invasions from totally different instructions plundered

the livelihood additional. Inside a century, greater than 50 emperors have been murdered

or killed in battle.

Hyperinflation brought on by debasement of forex helped lead

to the demise of western Roman Empire which might stop to exist by 476 AD.

Are you able to draw any parallels from the story with the current

occasions?

A lot of the developed world used to observe gold requirements the place

a rustic’s forex or paper cash has a worth immediately linked to gold. With

the gold commonplace, a set quantity of gold was given in change of paper

cash.

Quick ahead to the current occasions, the gold commonplace will not be

utilized by any authorities now. Britain abolished the gold commonplace in 1931. US

stopped following the gold commonplace in 1933 and deserted the remnants of the

system in 1973. The gold commonplace was utterly changed by fiat cash

like US Greenback. Apparently, the time period fiat is derived from the Latin phrase

fieri which implies an arbitrary act or decree.

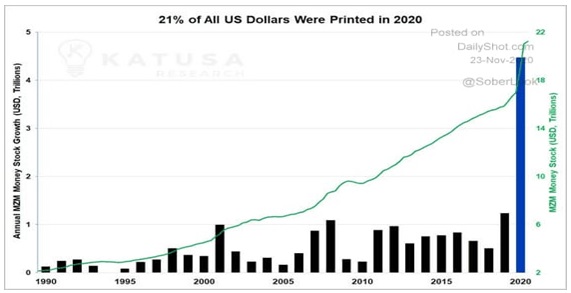

Over the previous few years, the tempo of printing the fiat cash has risen sharply.

US Fed’s steadiness sheet is increasing by 2.5 occasions in FY21 over FY20 i.e. from ~4 trillion USD to ~10 trillion USD.

Cash is accessible low-cost and in abundance. After the speedy decline in Federal reserve key rate of interest, it’s now accessible at 0.25%.

Bonds value 17 trillion USD are buying and selling at unfavorable yield. Greater than 80% of the bonds on the planet when it comes to worth are buying and selling at yields lower than 2%.

Vital debasement of cash has occurred and can

proceed to occur as per the guarantees made by the Central banks throughout the

world.

This creates a major danger of rising inflation in

future as quickly because the pandemic is curbed and even earlier than that. There isn’t a worth

for guessing that gold as an asset class can defend towards the danger created

by the actions of our coverage makers. That’s why we’ve been including at the least

10% of Gold publicity in our shopper’s portfolio since 2018.

Flood of low-cost cash is discovering its strategy to the inventory markets

all over the world. In India, overseas institutional traders have been franticly

shopping for into equities whereas home institutional traders like mutual

funds, insurance coverage, and so on. are internet sellers of fairness over the previous few months.

Abundance of liquidity backed by the Central banks promise of doing no matter it takes has been encouraging speculative behaviour by market contributors. This has resulted in skyrocketing valuations of the inventory markets. Nifty at present is buying and selling at a multi-year’s excessive valuation.

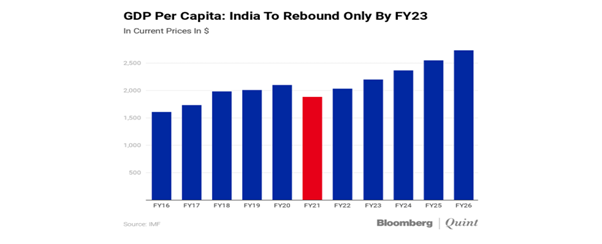

Whereas, the whole financial restoration continues to be distant and unsure when it comes to its timing and construction. Ok-shape restoration?

Rising variety of instances in Europe has been affecting the financial restoration.

Though, inventory markets are exhibiting the feelings of

euphoria, we’re nonetheless not out of the woods and definitely have misplaced just a few years

of progress made by humanity.

Liquidity has inflated asset costs not simply in fairness however of long-term bond additionally (bond worth has an inverse relationship with rates of interest), that are frequent asset lessons in any investor’s portfolio. Each time such state of affairs has arisen up to now, the long run returns haven’t been good for a conventional portfolio composition of 60:40 Fairness/Debt portfolio.

Investing at very excessive PE ratios have delivered poor returns even over the subsequent 10 years of funding interval. Within the chart under, black circles symbolize durations of Sensex PE ratios a lot above the long-term common of 20x. The corresponding 10 years returns as mirrored by white line has been very poor, even falling under 5% in few instances. Quite the opposite investing in yellow circles – low PE ratio have delivered respectable returns over the subsequent 10 years. At present Sensex is buying and selling at a PE ratio of round 30x on normalized earnings per share.

Funding Technique

We stay underweight on fairness as a result of valuation issues;

obese on quick time period debt as a result of danger of rising rates of interest and sustaining

some publicity to gold to hedge the portfolio towards international uncertainties due

to danger arising from attainable errors made by coverage makers over the subsequent 5-10

years.

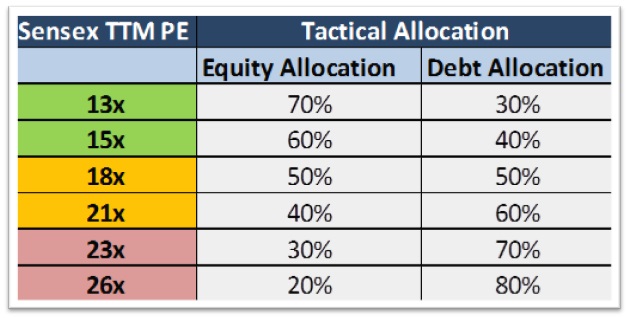

Amid excessive uncertainty of financial restoration and sky-high valuations of assorted asset lessons, the one dependable funding technique (after finding out varied methods over the lengthy time period) to our thoughts is tactical asset allocation. A pattern tactical allocation for a reasonable danger profile investor could be one thing like this:

The above picture is for illustration function solely. Each investor has a novel asset allocation plan primarily based on their danger profile, funding horizon and liquidity necessities.

When you have a tactical asset allocation plan in place and have self-discipline to execute the identical by eradicating feelings out of your funding determination making, you’ll do significantly better than others by minimizing the draw back danger whereas enhancing the upside potential of your portfolio.

Truemind Capital is a SEBI Registered Funding Administration & Private Finance Advisory platform. You’ll be able to write to us at join@truemindcapital.com or name us on 9999505324.