Ever because the Fed began to boost rates of interest, many people have been shuffling our money between varied choices – together with fastened deposits, treasury payments and short-term endowment plans – as we hunt down greater returns with out risking our capital within the inventory market. What’s the present local weather for savers? Right here’s a fast look.

The newest inflation numbers for Singapore got here in at over 5%, and many people have already began to see our payments and glued bills rise within the final yr.

The query is, is your revenue rising quick sufficient to maintain up?

Are your money financial savings rising quick sufficient to outpace inflation?

When you’re nonetheless sitting on the fence and ready for inflation to come back down, right here’s the dangerous information: greater costs at the moment are the brand new regular. As a substitute of ready round whereas inflation erodes the worth of your {dollars}, listed here are some choices the place you may wish to put your cash in as a substitute.

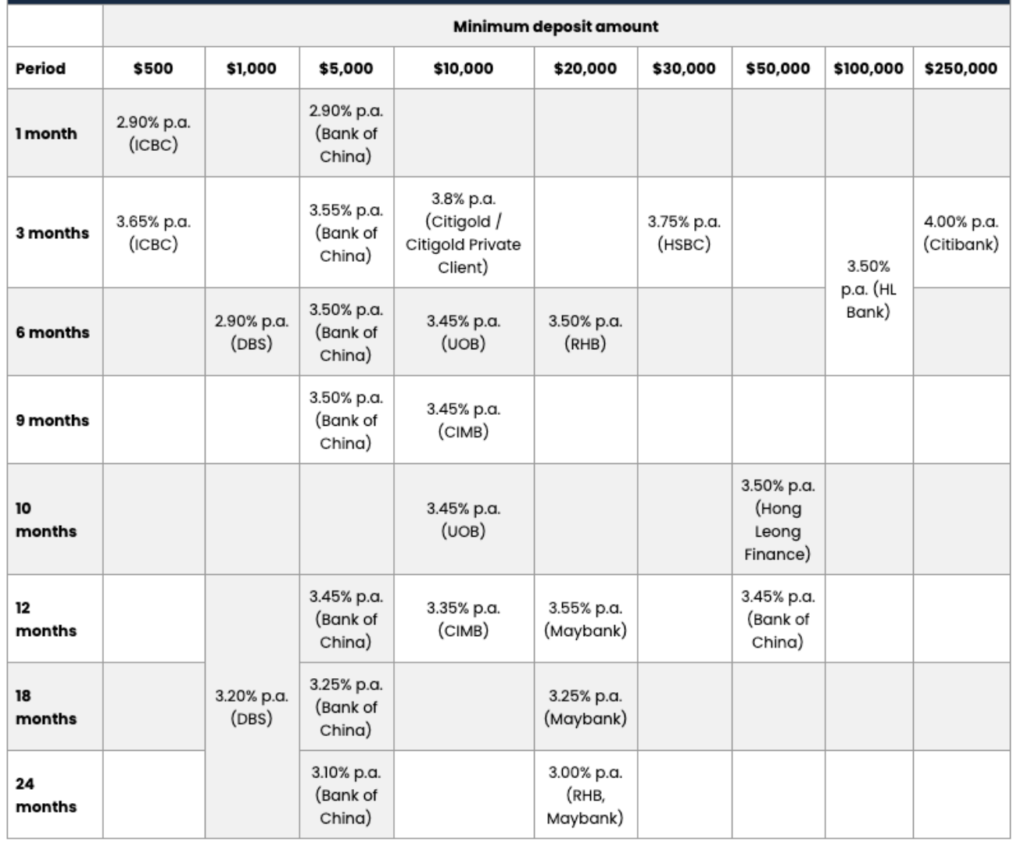

Mounted deposits

The benefit of fastened deposits is that they’re pretty nimble – most include brief lock-in intervals and could be utilized on-line, at a financial institution department and even in your cell.

Simply final yr, the shortest lock-in interval for fastened deposits was at the least a yr, however at the moment, even the banks have decreased that to as little as 1 – 3 months.

For somebody with $10,000 however lower than $100,000, you’ll be able to anticipate to get wherever between 3.35% – 3.75% within the present local weather.

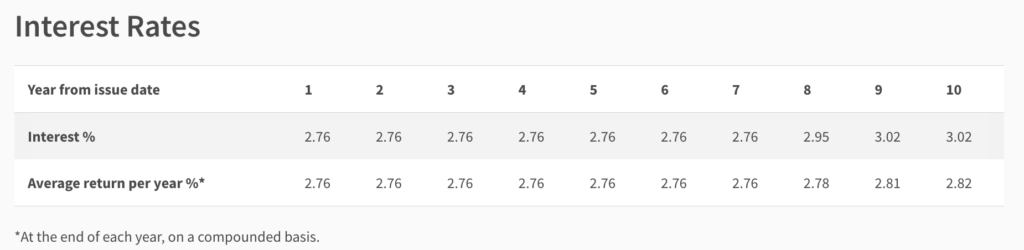

Singapore Financial savings Bonds

The newest Singapore Financial savings Bonds (SSBs) this month gives you 2.76% p.a. in your first yr, with the common 10-year return at 2.82% if you happen to had been to carry for a full decade.

Savers preferring placing their cash in SSBs over fastened deposits are sometimes those that wish to keep excessive liquidity i.e. the power to terminate early and withdraw your funds throughout the following month. Nonetheless, the return on SSBs have dropped in latest months; it wasn’t too way back when it was yielding over 3% p.a.

MAS T-bills

MAS Treasury Payments (T-bills) have turn into a well-liked short-term instrument for many individuals, together with amongst savers, people utilizing it for stashing apart their emergency funds, in addition to buyers placing apart their money conflict chest whereas ready for market alternatives.

The newest 1-year T-bill got here in at a median yield of three.27% p.a., whereas the latest 6-month tranche (8th June) offered a median yield of three.36% p.a.

There are typically 2 – 3 tranches of 6-month T-bills launched every month. When you favor an extended period, you’ll have to attend for the subsequent 1-year T-bill utility on 20 July.

Brief-term endowment plans

These are quickly catching on among the many normal public as nicely, as a number of insurance coverage firms have launched short-term endowment plans.

The draw back is that these plans aren’t all the time out there for lengthy – they sometimes have brief utility intervals attributable to recognition and tranche dimension out there from the insurers.

To make it into considered one of such enticing short-term endowment plans, it is best to in all probability remind your monetary consultant to maintain a lookout for you or stalk the insurer’s web site and social media updates since most of those plans can now be purchased on-line.

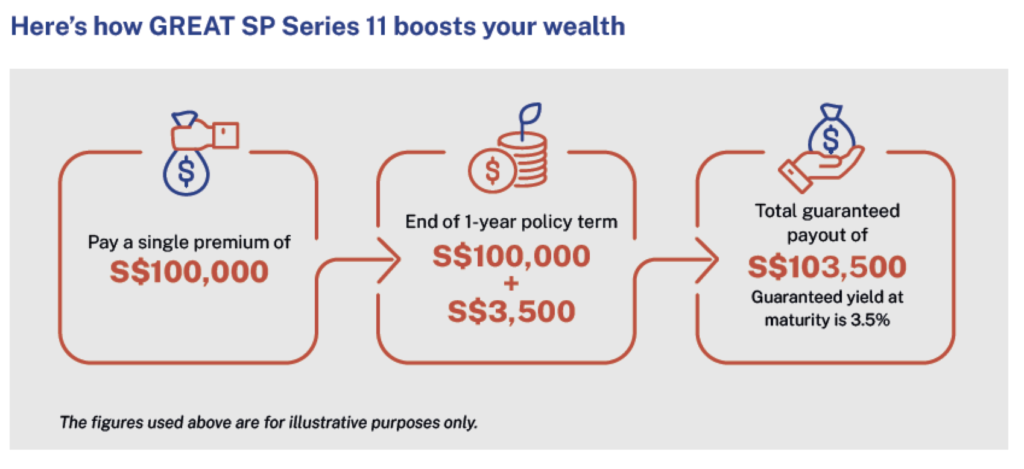

When you haven’t already heard, Nice Jap is bringing again their newest GREAT SP Collection 11 on 21 June 2023.

Disclosure: The Nice Jap Life Assurance Firm Restricted ("Nice Jap") has kindly invited me to do a evaluate and rationalization of their newest providing, and the next part is sponsored by them.

Listed here are some key detalis:

- 1-year single premium non-participating endowment plan

- Assured return of 3.5% p.a*. upon maturity

- Minimal S$10,000^ to use

- Can use money or SRS

This plan additionally gives insurance coverage protection in opposition to loss of life and whole and everlasting incapacity on the similar time.

You’ll be able to both apply right here or get entry by way of your most well-liked Nice Jap monetary consultant.

Conclusion

As inflation charges stay excessive, we’ve to start out being nimble with our money. On this article, I’ve chosen to cowl solely the lower-risk choices that are typically capital assured i.e. you received’t have to fret about shedding cash even when the market turns.

I personally use a wide range of devices, together with a number of high-yield financial savings accounts supplied by the banks, to get greater returns on my emergency funds and idle money that aren’t being invested in any belongings or shares.

However some folks aren’t a fan of such accounts, both as a result of they don’t meet the necessities…or they discover it an excessive amount of of a problem to maintain leaping by way of hoops to “earn” further curiosity every month. And woe betide the saver who forgot to fulfill a sure standards (like clocking a minimal spend on their bank cards) and missed out on the bonus curiosity that month.

Whereas I beforehand stashed a few of my money into the Singapore Saving Bonds, I’ve uncared for them previously one yr as a result of Treasury Payments and a few 6-8 month fastened deposits had been providing me a a lot greater yield as a substitute. And now, with the upcoming GREAT SP Collection 11 being launched, I like the truth that it is going to give me a 3.5% p.a.* yield on my cash for the easy act of holding it for 1 yr till maturity, which is why I’ll be making use of for it myself.

Whereas this isn’t any indication so that you can comply with swimsuit, I hope my evaluate offers you a good suggestion of what it’s and the opposite choices that you simply also needs to weigh earlier than you resolve whether or not it’s appropriate for you.

Relying on how a lot money you could have, you might wish to use one, and even a number of of the instruments coated on this article to earn the next fee in your idle money.

Disclaimer: This publish is dropped at you in collaboration with Nice Jap, who fact-checked the offered product details about GREAT SP Collection 11. All opinions on this publish are mine, together with the choice to take a position into it.

Notes: *Assured survival profit of three.5% of the only premium will probably be payable on survival of the life assured on the finish of the coverage time period. ^The minimal single premium quantity will depend upon the entry age (as of subsequent birthday) of the life assured and the cost methodology.

The data introduced is for normal info solely and doesn't have regard to the precise funding targets, monetary state of affairs or specific wants of any specific individual. As shopping for a life insurance coverage coverage is a long-term dedication, an early termination of the coverage normally includes excessive prices and the give up worth, if any, that's payable to you might be zero or lower than the overall premiums paid. Chances are you'll want to search recommendation from a monetary adviser earlier than making a dedication to buy this product. When you select to not search recommendation from a monetary adviser, it is best to take into account whether or not this product is appropriate for you. Protected as much as specified limits by SDIC. Info appropriate as 21 June 2023. This commercial has not been reviewed by the Financial Authority of Singapore.